1. What is Ether.fi?

Ether.fi is a Liquid Restaking protocol on Ethereum, where users can deposit their ETH into the protocol to receive eETH. It is one of the first native liquid restaking tokens with various applications in DeFi.

2. Product

2.1 Liquid Restaking

As one of the pioneers in the Liquid Restaking space, on November 17, 2023, Ether.fi collaborated with Eigenlayer to launch its own Points farming program. By simply minting eETH and utilizing them in various DeFi activities, users automatically receive the following 'rewards':

-

Profits from staked ETH

-

Ether.fi Points - a quantity of points to exchange for Ether.fi tokens during the TGE token project

-

Eigenlayer Points

-

Profits from DeFi strategies

With notable technologies, Etherfi effortlessly dominates the Liquid Restaking segment. At the current moment, despite the project having launched its token, it still leads and attracts over $4.5 billion in Total Value Locked (TVL).

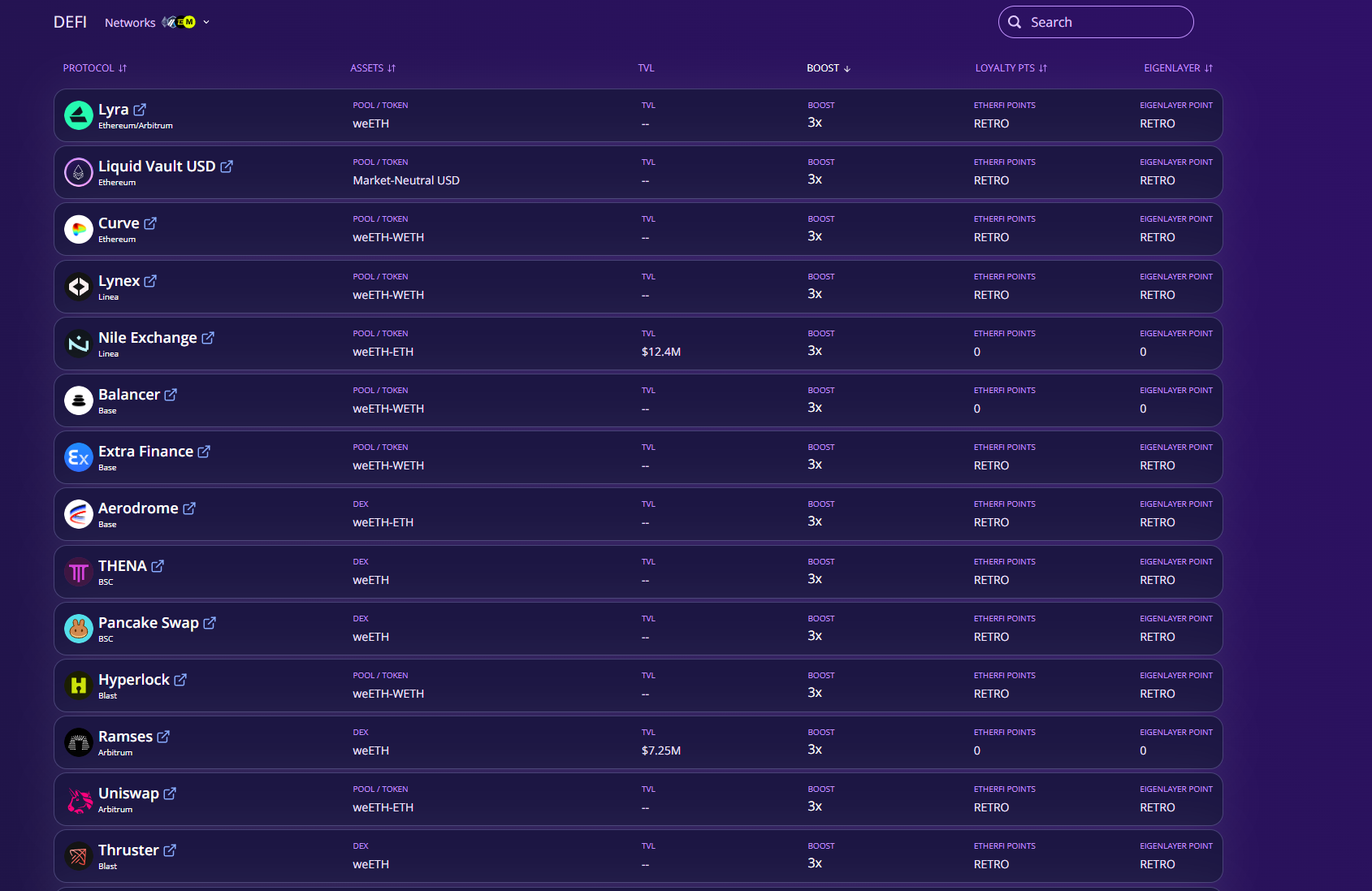

2.2 Application of eETH in Defi

Ether.fi has collaborated with numerous DeFi protocols to bring forth a plethora of applications for its holders. As of now, eETH remains one of the most versatile Liquid Restaking Tokens in terms of participation in DeFi. This opens up countless opportunities for profit enhancement.

-

eETH has been integrated with protocols such as Maverick, Gravita, Balancer, Curve, Pendle…

-

Etherfi has also expanded cross-chain and integrated its LRT into many protocols on prominent Layer 2 blockchains such as Base, Linea, Blast...

Moreover, the majority of users providing liquidity to these protocols with eETH can receive both Ether.fi Points and Eigenlayer Points - both projects have publicly announced upcoming second airdrop rounds.

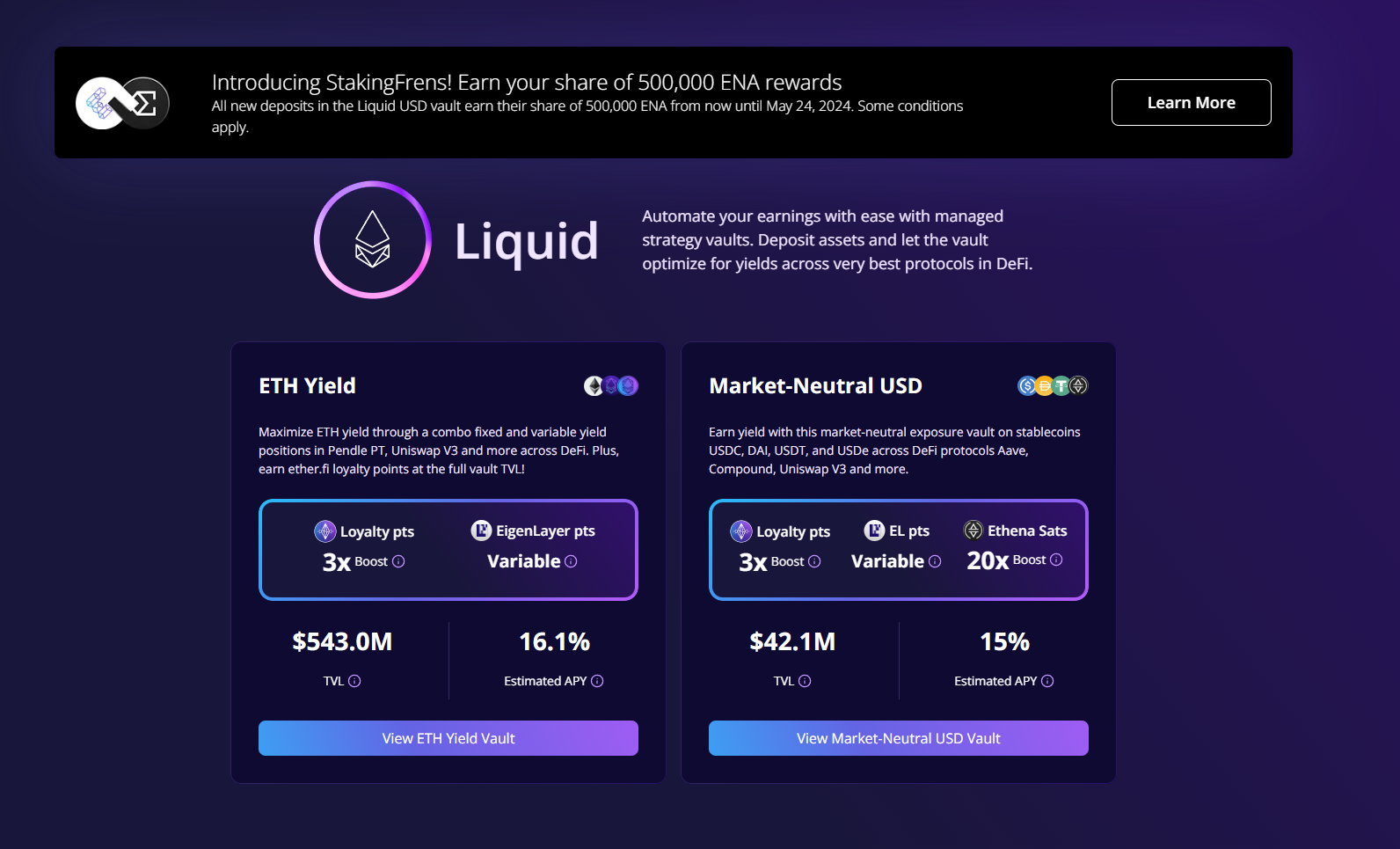

2.3 Vault

With the integration of a multitude of leading DeFi protocols in the market, managing strategies with Etherfi to optimize profits is also a challenging task. To address this issue, Etherfi introduces Vault - an integrated money pool that automatically selects strategies and optimizes APY (Annual Percentage Yield) for holders of ETH, eETH, or even stablecoins.

Benefits of participating in Vault:

-

Simply depositing funds into Liquid's Vaults, users have the opportunity to earn up to 16% APY with ETH, weETH, or eETH.

-

For Stablecoins, currently earning a 15% APY and supporting prominent stablecoins such as USDT, USDC, DAI, or USDe.

-

In addition to earning passive income, users will also earn Etherfi points - a quantity of points to exchange for Etherfi tokens in the upcoming second airdrop.

-

Furthermore, by providing Stablecoins, users will earn Eigenlayer points, Etherfi points, and Ethena Sats - a strategy to farm airdrops from all three projects (season 2).

Note that alongside the benefits of participating in Vault, consideration should be given to security risks despite the protocol being audited.

Vault's achievements:

-

Etherfi will collaborate with Nexeus Mutual - an insurance project aimed at insuring funds for those depositing into Vaults.

-

At present, the Vault product has successfully attracted $600 million in Total Value Locked (TVL).

2.4 DVT

DVT is one of the notable technologies of Etherfi, with DVT users can fully launch an Ethereum Node through Etherfi with just 2 ETH (the original requirement from Ethereum is 32 ETH).

By implementing DVT, Etherfi will help the Ethereum ecosystem increase decentralization to minimize barriers regarding technological knowledge as well as the minimum amount of ETH required to become node validators.

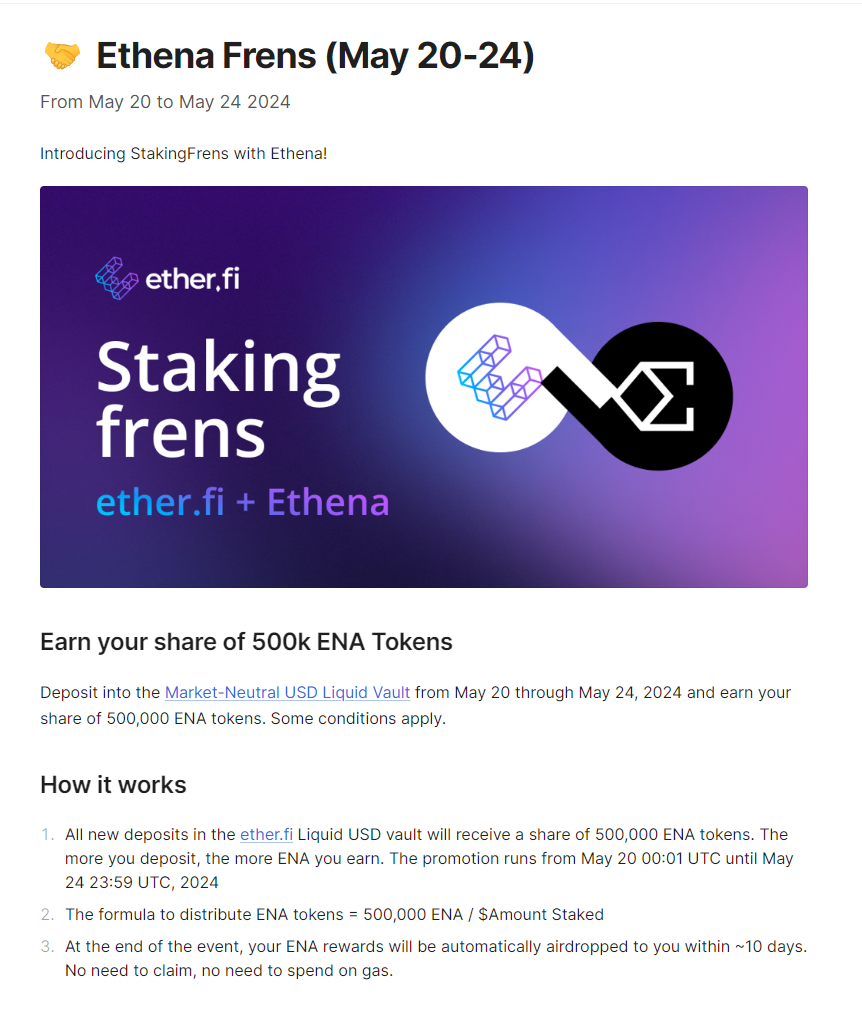

2.5 Staking Frens

Staking Frens are undertaken by Etherfi and their partners. At present, Etherfi is partnering with Ethena and launching the Staking Frens program from May 20th to May 24th, as follows:

-

Users deposit funds into the Market-neutral USD Vault to share a reward pool of 500,000 $ENA tokens.

-

The valid period lasts for 4 days, and the total amount of $ENA will be allocated based on the total amount of funds deposited into the protocol during the 4-day period.

-

The Staking Frens program is conducted in collaboration with Etherfi's partners, including previous projects such as Ondo, Gearbox, Omni, and Polyherdra Network.

3. Introducing Ether.fan

3.1. What is Ether.fan?

Ether.fan is a program designed for members of Ether.fi, built upon eETH to help users increase additional rewards when staking.

3.2. Components of Ether.fan

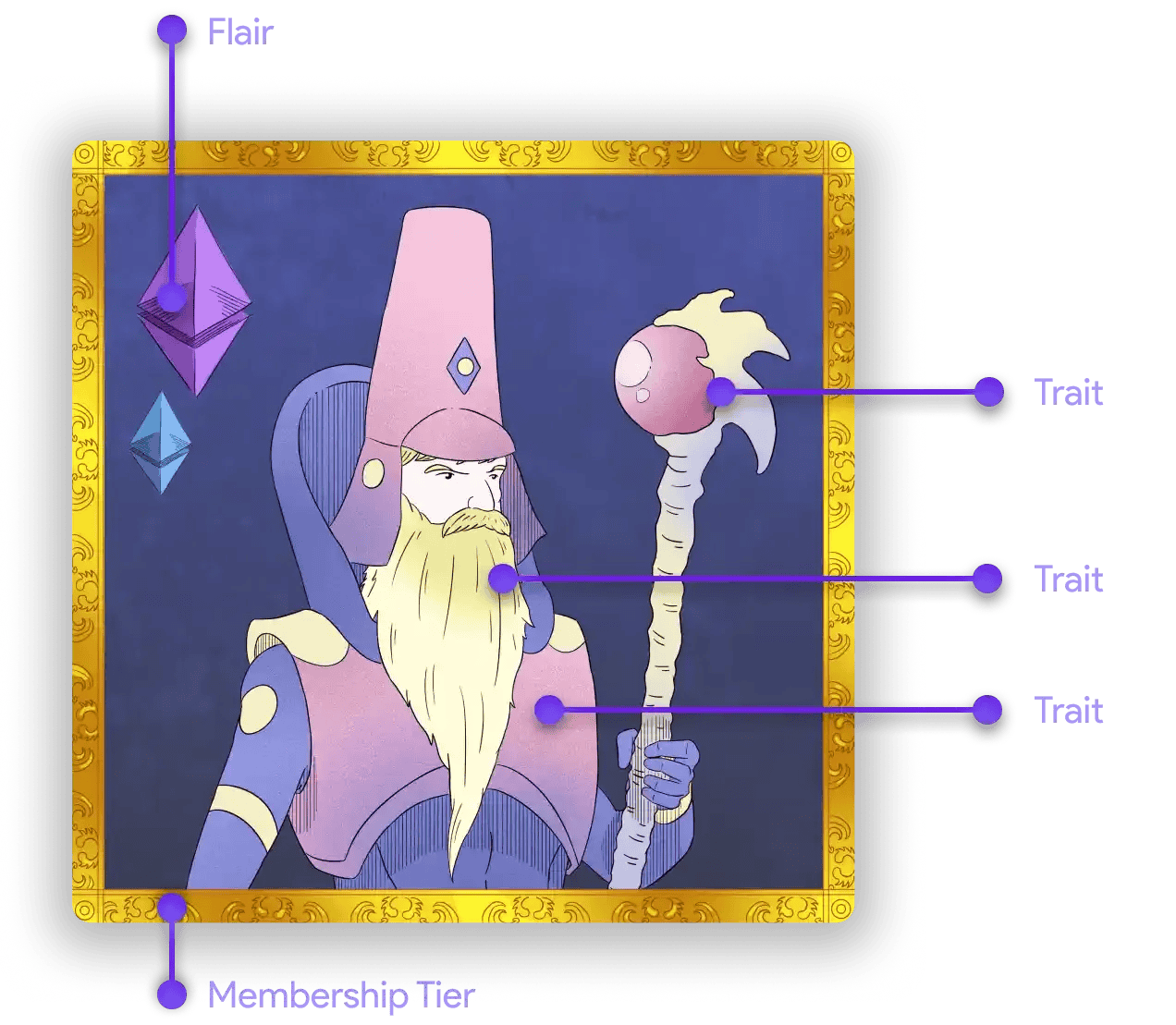

An NFT fan consisting of three components: traits, flair, and membership tiers.

-

Traits: Provide individuality through features such as eyes, hair, skin, etc.

-

Flair: Reflects the amount of ETH the user stakes.

-

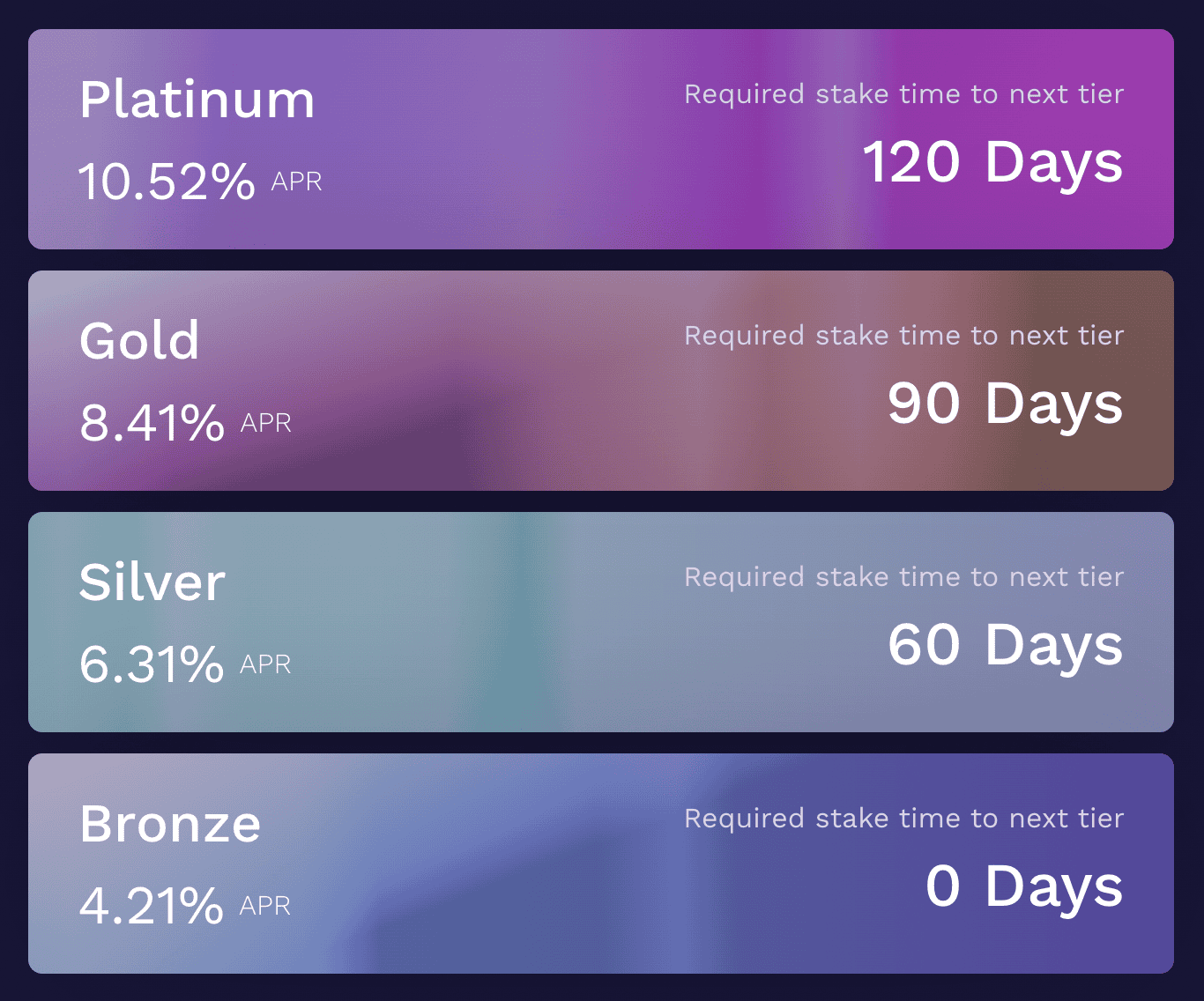

Membership tier: The membership program is a system of rewards for user loyalty. The longer they participate, the higher their membership tier. Therefore, they can earn more staking rewards depending on the tier of the NFT.

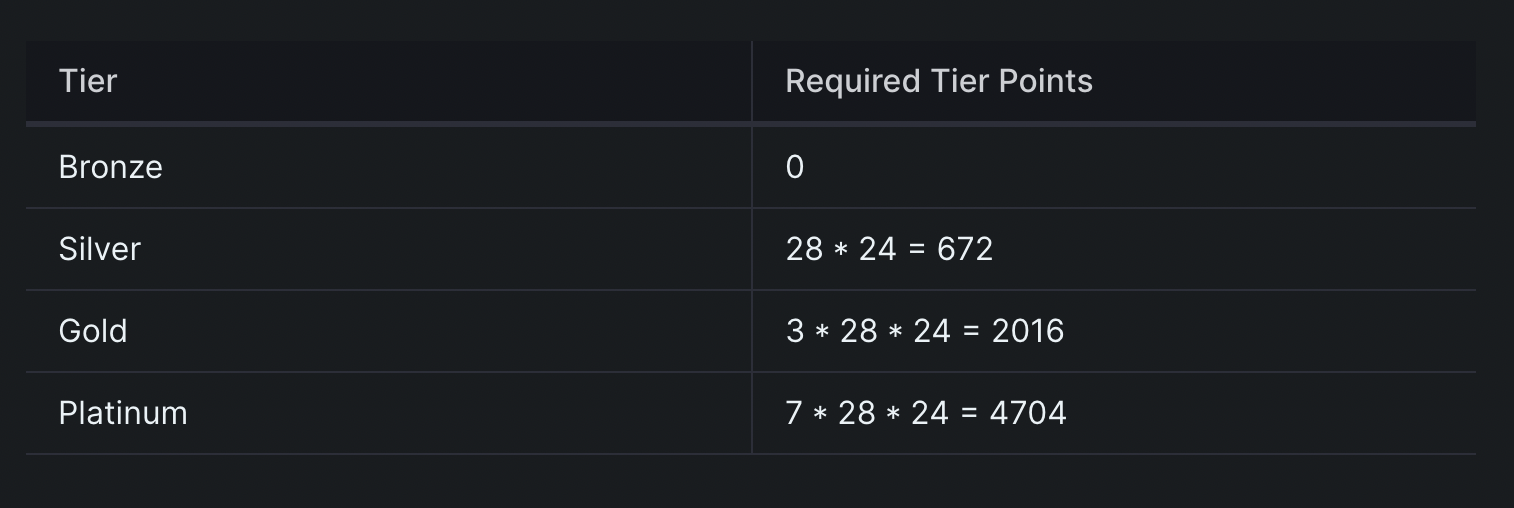

You can see that NFTs with higher tiers receive larger APRs. So, how many points does each tier require? Here are the points required for each tier

3.3 Utility of NFT

- Utilize as a PFP NFT across social media platforms.

- Serve as an exclusive access ticket to events at major Ethereum conferences.

- Participate in governance at Ether.fi - can propose or vote on proposals based on stake ratio.

- Upon upgrading membership over time, from Bronze to Diamond to unlock additional staking rewards.

3.4. How to join Ether.fan?

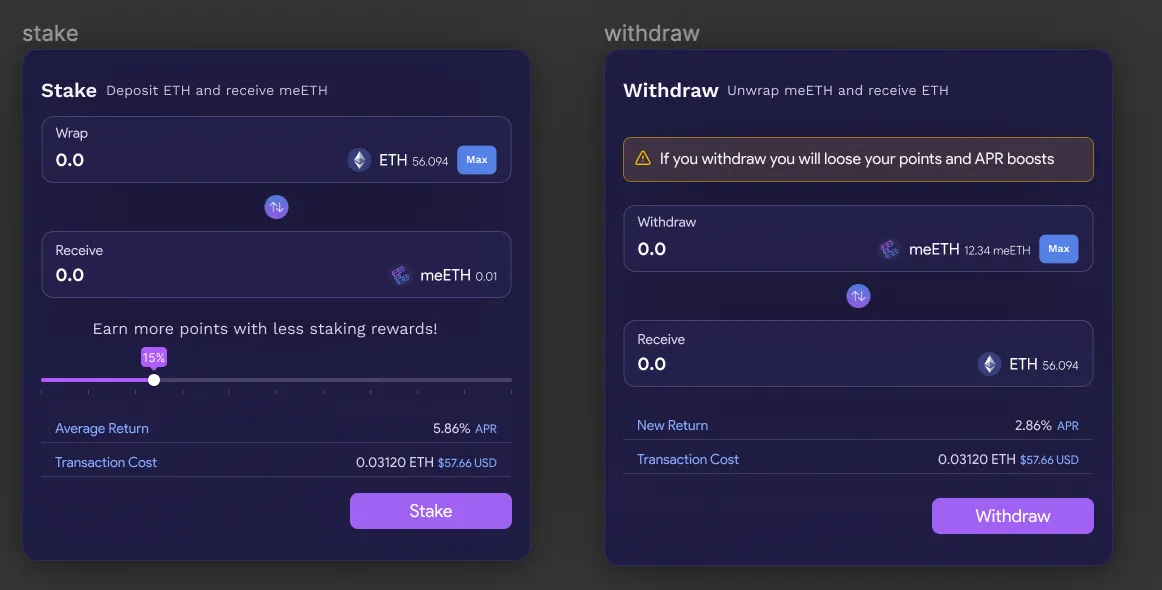

Users can stake ETH and mint NFTs with Ether.fan. By staking ETH through Ether.fan, users earn staking rewards and also contribute to making Ethereum more decentralized.

All ETH staked through Ether.fan is allocated to solo node operators through Ether.fi's Operation Solo Saker, ensuring diversity in the node network and supporting a more decentralized Ethereum ecosystem.

Users can upgrade their NFT by sending additional ETH. Additionally, they can withdraw ETH at any time, but this action will result in at least a one-tier downgrade. If they wish to withdraw more than 50% of the ETH previously contained in the fan NFT, they need to burn the NFT to receive back all the ETH.

3.5. NFT lending

The project is collaborating with Arcade to bring NFTs to the NFT lending market. Anyone participating in Ether.fan will be able to receive additional liquidity from lenders on Arcade.

Lenders tend to favor this product because it offers two things that traditional NFTs do not have: floor value and predictable profits.

4. Tokenomics

4.1 Token information

- Project Name: Etherfi

- Ticker: ETHFI

- Network: ERC20 (Ethereum)

- Contract Address: 0xFe0c30065B384F05761f15d0CC899D4F9F9Cc0eB

- Total Supply: 1,000,000,000 $ETHFI

- Circulating Supply: 115,200,000 $ETHFI

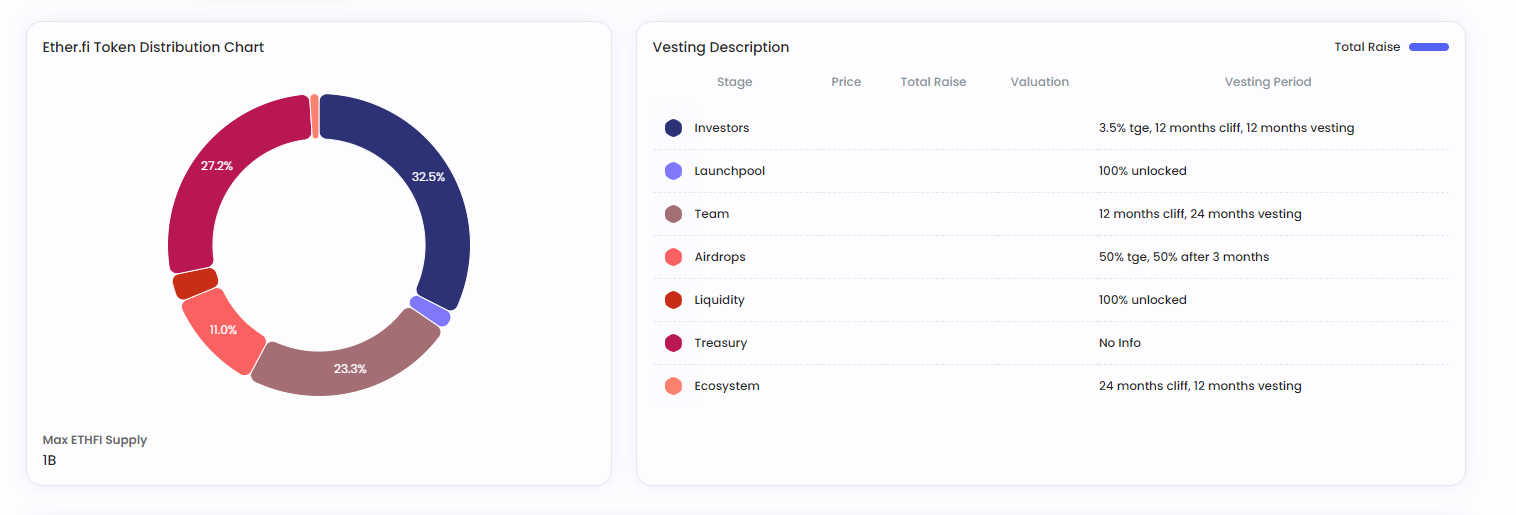

4.2 Allocation rate

- Team: 23.26%

- DAO Treasury: 27.24%

- Airdrop: 11% (5.5% for phase 1)

- Investors: 32.5% - 3.5% unlocked at TGE, locked for 12 months, linear unlocking over the following 12 months

- Launchpool: 2%

- Liquidity: 3%

- Protocol Guild: 1%

Etherfi's tokenomics allocate a significant portion, up to 32.5%, to investors, notably unlocking 3.5% at TGE, which is a noteworthy point.

Initial selling pressure stems from Launchpool, airdrop, and early Investors & Advisors, as these entities acquired tokens at very low costs.

Furthermore, Etherfi plans to conduct a second airdrop after June 2024, distributing the remaining 5.5% of the token supply from the Airdrop pool.

4.3 Token application

The $ETHFI token is primarily used for governing the protocol, voting on important decisions such as the use of protocol revenue, token purchases and burns, and the allocation of funds in the treasury.

However, with investors and the team holding over 55% of the total supply, this clearly raises concerns about centralization and transparency in DAO voting mechanisms.

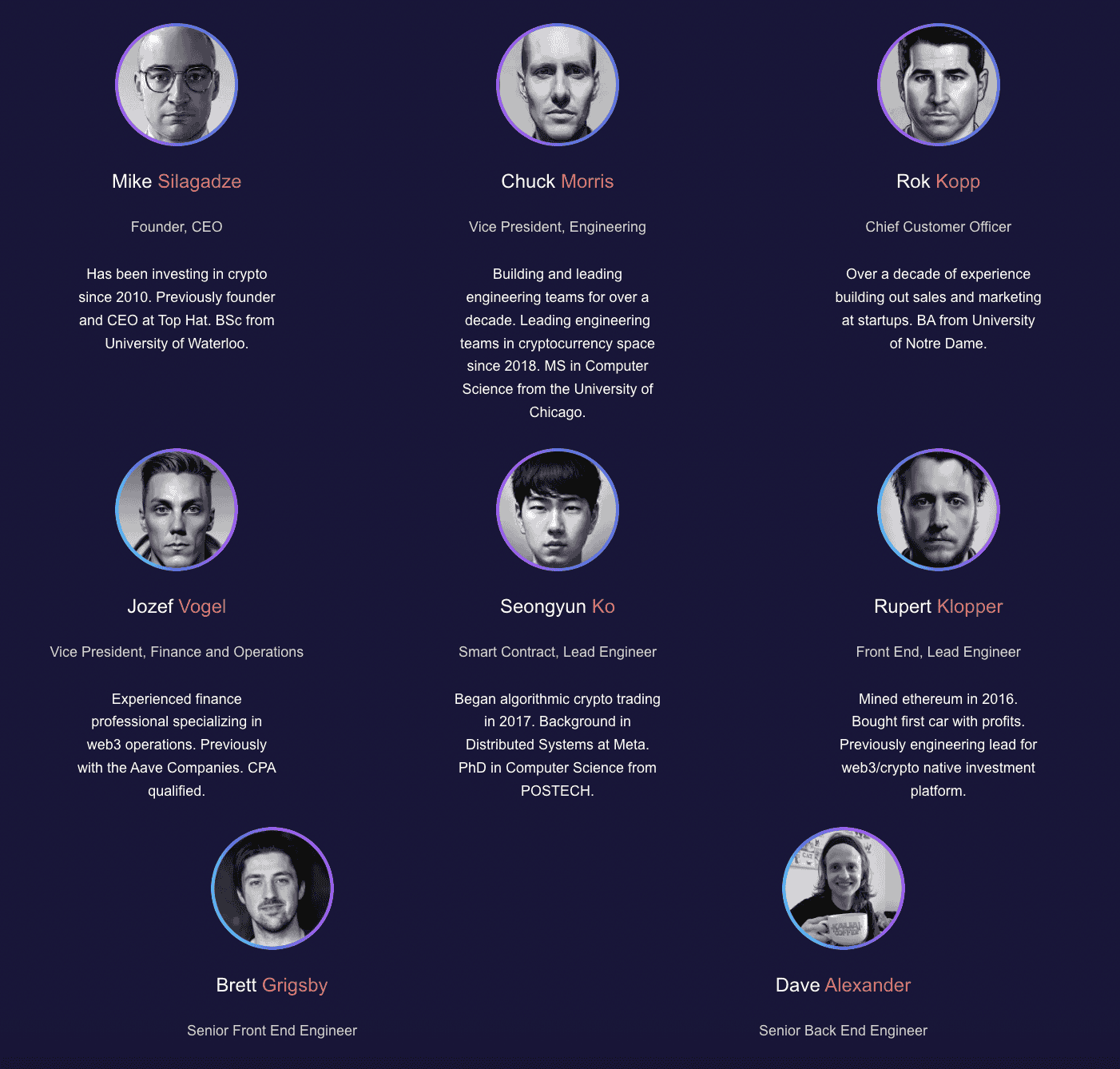

5. Team

- Mike Silagadze: Founder and CEO

- Rok Kopp: Chief Commercial Officer (CCO)

- Chuck Morris: Vice President, Engineering

- Jozef Vogel: Vice President, Finance and Operations

- Seongyun Ko: Senior Software Developer

With other team members.

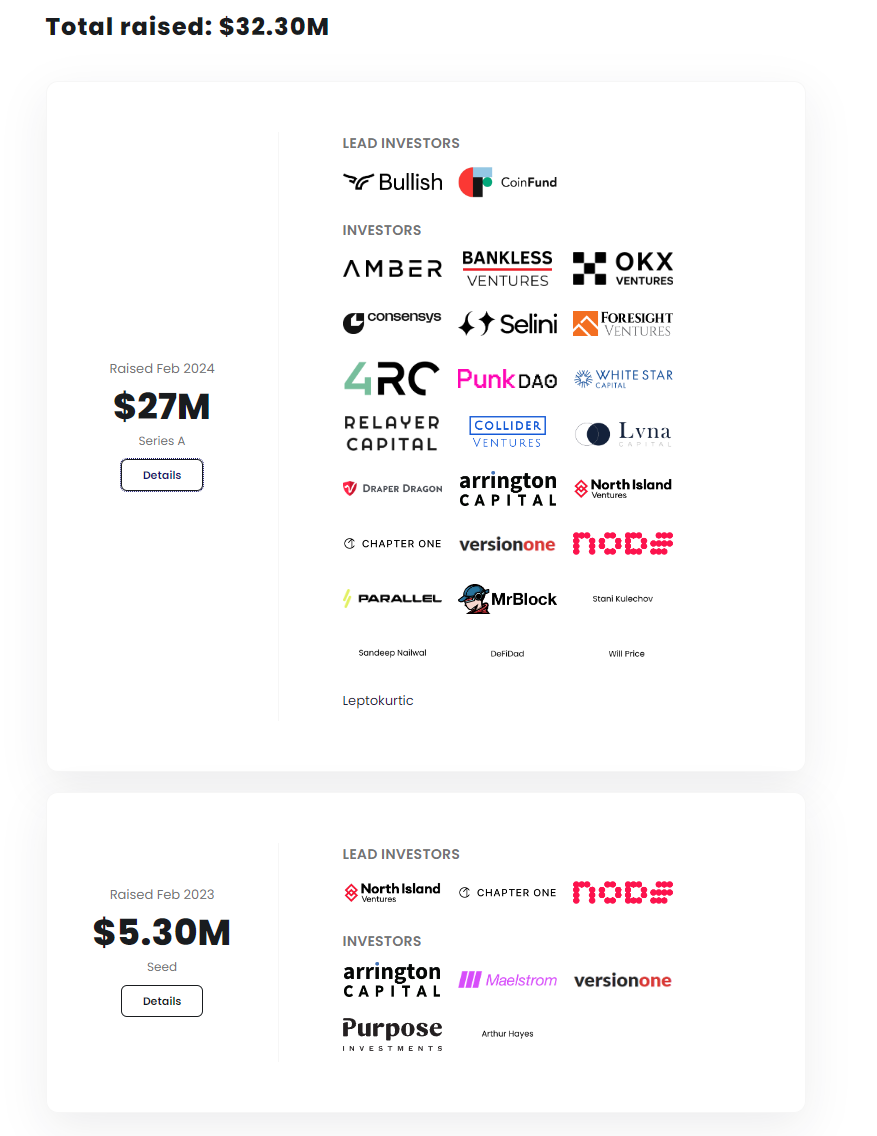

6. Investors

Etherfi has successfully raised over $32 million USD in funding after 2 rounds, with the participation of leading VCs such as Coinfund, OKX, Bankless, Amber, ConsenSys, and others.

7. Project information

- Website: https://twitter.com/ether_fi

- Twitter: https://twitter.com/ether_fi

- Join Defi strategies at Pendle: https://www.pendle.finance/

8. Assessment and Investment Decision

Etherfi stands out as a prominent project in the field of Liquid Restaking, especially in the upcoming months as the pioneer Eigenlayer launches its TGE token. However, there are some notable points to consider. Although Etherfi currently leads in Liquid Restaking protocols, the $ETHFI token has yet to demonstrate significant value in protocol governance.

Etherfi also enjoys a relatively stable revenue stream despite its recent launch. Evaluating the project's tokenomics reveals selling pressure from the Airdrop and VCs immediately upon listing, alongside the anticipated Airdrop 2 scheduled for June-July 2024. Other token categories of $ETHFI will begin unlocking in March 2025, with over 55% of the total supply belonging to the Team and Investors.

Despite operating for over 2 months, Etherfi has not proposed any governance votes to enhance benefits for $ETHFI holders. The delay in the second Airdrop raises questions about whether Etherfi can maintain its leading position after completing the Airdrop.

However, personally, I believe we will soon witness a powerful surge in Restaking, an incredibly promising field with current TVL in the tens of billions of dollars. Etherfi remains the most promising name, second only to Eigenlayer.

Apart from being one of the most successful Liquid Restaking protocols to date, Etherfi also leads the race with pioneering products and a vast network of partners. It is expected that the $ETHFI token will have many more exciting applications in the future.

8. Conclusion

Etherfi is a major player in the current Liquid Restaking projects and eETH is arguably the most promising Liquid Restaking Token with integration into various DeFi applications.

Additionally, the project has integrated DVT technology from Obol Labs, allowing users to operate a Node with a minimum amount of only 2 ETH instead of the typical 32 ETH.

With a dense network of partners, Etherfi is leveraging this to bring more applications to its Liquid Restaking Token, eETH, as well as its native token $ETHFI. However, the current applications of the $ETHFI token are not diverse enough to exert pressure on the price of Etherfi, and I anticipate that the project will introduce new proposals to bring more value to holders.

Read more:

English

English Tiếng Việt

Tiếng Việt