1. What Is Mindshare in Crypto?

Mindshare refers to the level of awareness, recognition, and mental space a cryptocurrency project occupies in the minds of its target audience. Unlike market share, which measures tangible metrics like trading volume or token ownership, mindshare is about perception and influence. It’s the extent to which a project is top-of-mind when people think about blockchain, DeFi, NFTs, or other crypto sectors.

In crypto, mindshare is driven by factors like:

-

Community Engagement: Active discussions on platforms like X, Discord, or Reddit signal a project’s relevance.

-

Media Presence: Coverage in crypto news outlets or mentions by influencers amplifies visibility.

-

Innovation and Narrative: Projects tied to trending narratives (e.g., AI tokens, Layer 2 solutions) often dominate attention.

-

Events and Announcements: Airdrops, partnerships, or protocol upgrades can spike interest.

For example, during the 2021 bull run, projects like Solana and Polygon gained significant mindshare due to their scalability solutions, while memecoins like Dogecoin thrived on viral community momentum. Mindshare isn’t just about hype—it reflects a project’s ability to stay relevant and resonate with its audience.

2. Why Mindshare Matters in Crypto?

In a market flooded with thousands of tokens and protocols, standing out is critical. Mindshare directly impacts a project’s growth and adoption in several ways:

-

Attracting Investors: Projects with high mindshare draw retail and institutional capital, as awareness often correlates with perceived potential.

-

Building Communities: Strong mindshare fosters loyal communities that advocate for the project, driving organic growth.

-

Influencing Sentiment: Positive mindshare can counter FUD (fear, uncertainty, doubt) and sustain confidence during market dips.

-

Driving Development: High visibility attracts developers, who contribute to a project’s ecosystem and innovation.

However, mindshare is fleeting. A project can lose relevance without consistent engagement, innovation, or adaptation to market trends. Tracking mindshare helps teams gauge their position and adjust strategies to maintain or grow their influence.

3. How to Track Mindshare in Crypto

Measuring mindshare is less straightforward than tracking price or volume, but several tools and methods provide valuable insights. Here’s how to monitor it effectively:

3.1. Social Media and Community Metrics

Social platforms are the pulse of crypto mindshare. Key metrics to track include:

-

Post Volume and Engagement: Count mentions, likes, and shares on platforms like X or Reddit. Tools like LunarCrush analyze sentiment and engagement for specific tokens.

-

Follower Growth: Rapid increases in followers on a project’s official accounts signal rising interest.

-

Hashtag Trends: Monitor project-specific hashtags (e.g., #Bitcoin, #Ethereum) to gauge visibility.

For example, a surge in posts about a project’s airdrop can indicate growing mindshare, but it’s essential to distinguish between genuine enthusiasm and paid promotions.

3.2. Media and News Coverage

Media mentions reflect a project’s prominence. To track this:

-

Use platforms like Google Alerts to monitor news articles mentioning the project.

-

Check crypto-specific outlets like CoinDesk, CoinTelegraph, or The Block for coverage.

-

Analyze influencer activity—mentions by key opinion leaders (KOLs) on YouTube or podcasts can boost mindshare.

A project featured in a major outlet or endorsed by a trusted influencer often sees a measurable spike in attention.

3.3. On-Chain and Market Data

While mindshare is intangible, on-chain activity offers clues:

-

Wallet Activity: Rising numbers of active wallets or transactions suggest growing interest. Platforms like Dune Analytics provide dashboards for this.

-

Token Velocity: High trading volume relative to market cap can indicate speculative buzz, a proxy for mindshare.

-

Developer Activity: GitHub commits and developer contributions reflect ecosystem health, often tied to long-term mindshare.

For instance, a Layer 2 protocol with increasing transaction volume and developer commits likely holds strong mindshare among builders and users.

3.4. Specialized Mindshare Tools

Several platforms are designed to quantify mindshare in crypto:

-

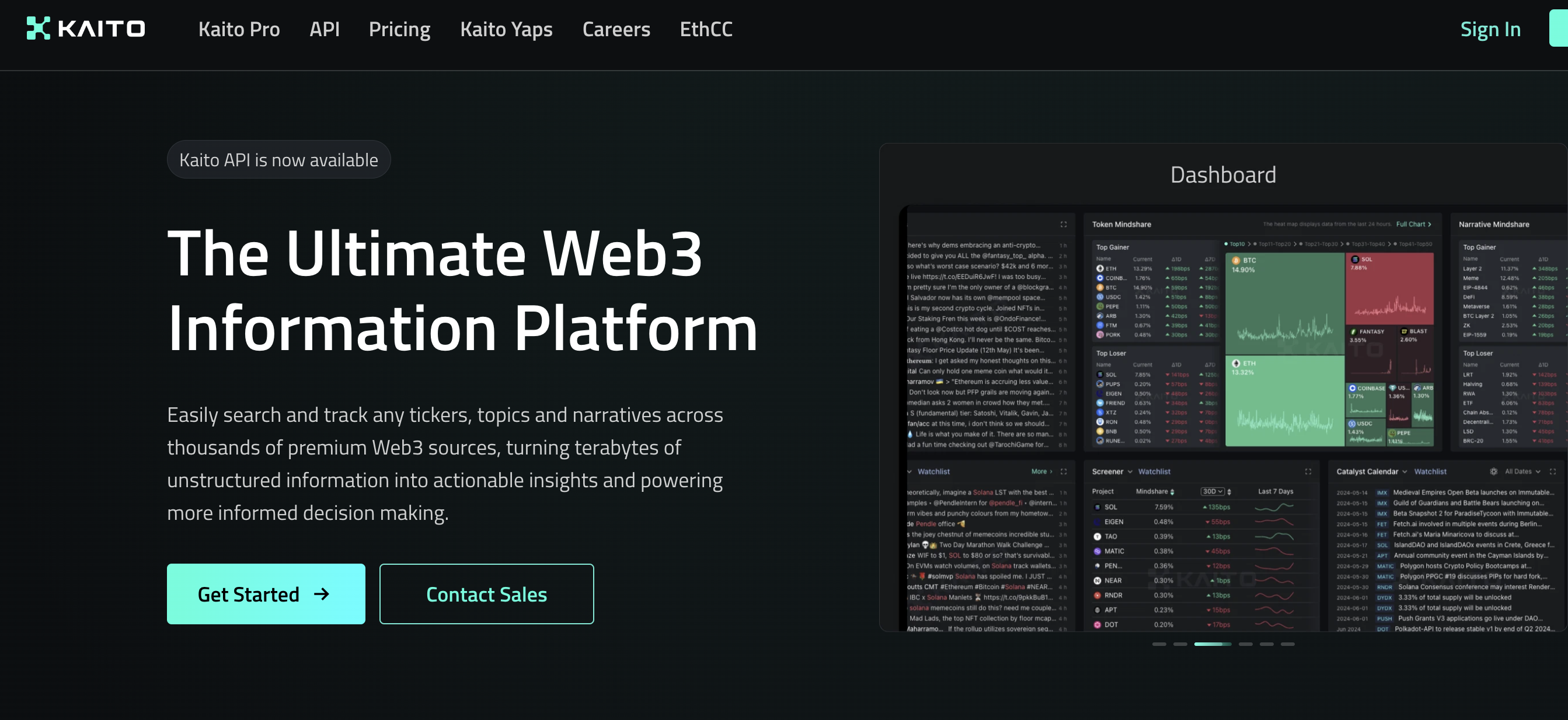

Kaito: An AI-powered tool that aggregates data from social media, news, and on-chain metrics to score a project’s mindshare. It’s ideal for comparing projects within a narrative (e.g., DeFi vs. AI tokens).

-

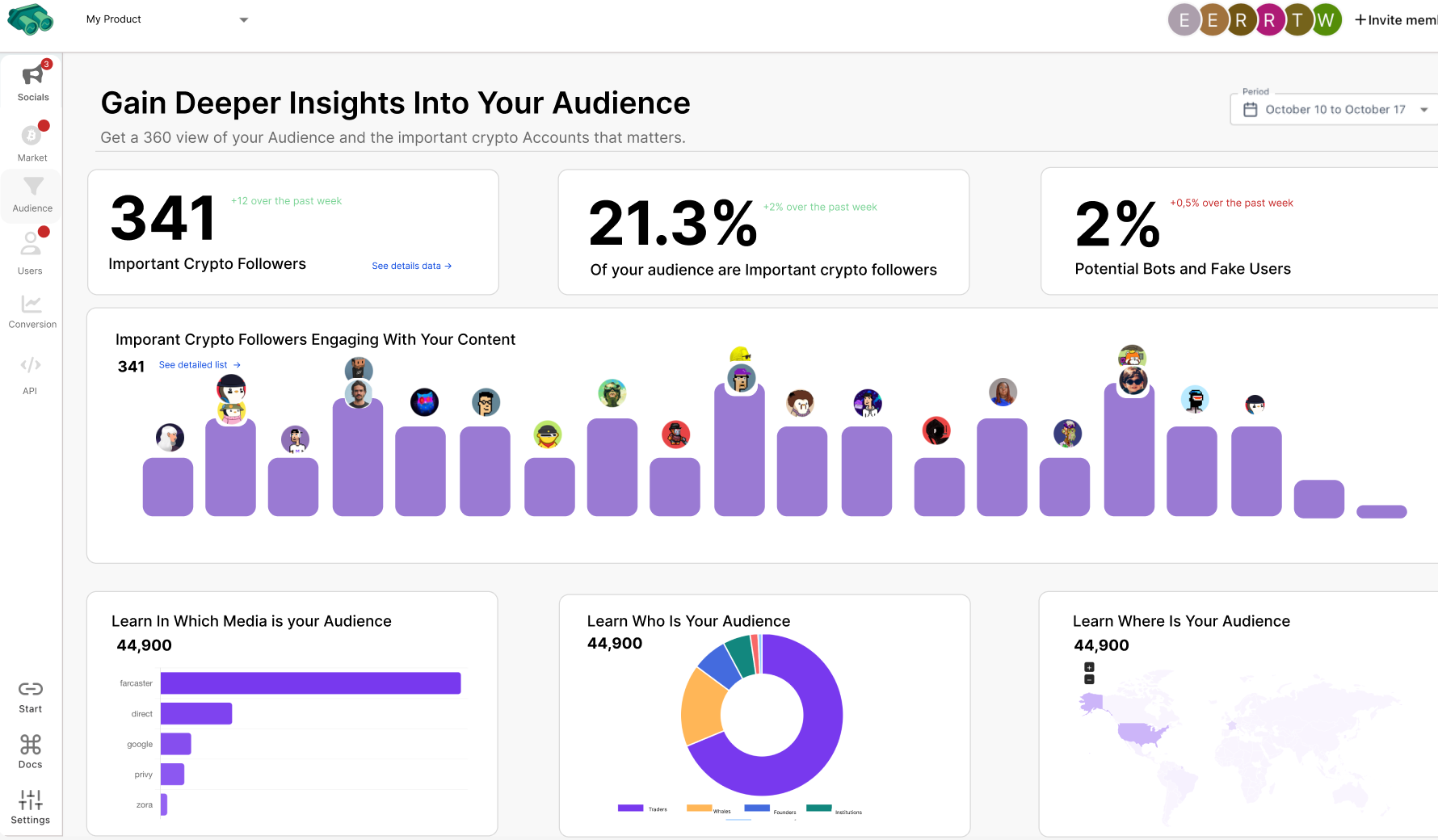

Cookie.fun: A platform by Cookie DAO that indexes AI agents, offering real-time analytics on mindshare, engagement, and on-chain activity to gauge market sentiment.

-

GoatIndex AI: A Solana-based tool providing dashboards to track AI project mindshare through social media mentions, trading signals, and on-chain metrics.

-

Sharpe AI: Offers interactive charts to track token mentions and narrative dominance across platforms like Farcaster.

-

Santiment: Combines sentiment analysis with market data to reveal how much attention a project commands.

These tools provide data-driven insights, helping teams identify trends and adjust marketing or development efforts.

3.5. Sentiment Analysis

Mindshare isn’t just about volume—it’s about tone. Positive sentiment strengthens a project’s position, while negative sentiment can erode trust. Tools like Brandwatch or custom sentiment models can analyze posts and comments to gauge whether a project’s mindshare is bullish or bearish.

For example, a project recovering from a security incident might have high mention volume but low positive sentiment, signaling a need for reputation management.

4. Challenges in Tracking Mindshare

While tracking mindshare is powerful, it comes with challenges:

-

Noise vs. Signal: Bots, shills, and paid campaigns can inflate metrics, masking genuine interest.

-

Short-Term Hype: Spikes in mindshare from airdrops or pumps may not translate to lasting adoption.

-

Fragmented Data: Crypto conversations span multiple platforms, making it hard to capture the full picture.

To overcome these, focus on long-term trends rather than short-term spikes and cross-reference data from multiple sources for accuracy.

5. Conclusion

Mindshare in crypto is the invisible force that drives awareness, adoption, and growth. By understanding what it is and leveraging tools like Kaito, LunarCrush, or on-chain analytics, projects can measure their influence and refine their strategies. In a market where attention is scarce, capturing and holding mindshare is a game-changer. Whether you’re a developer, investor, or enthusiast, keeping an eye on mindshare trends can help you stay ahead in the ever-evolving world of cryptocurrency.

Read more:

Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)

.jpg)