1. What Are Memecoins?

Memecoins are cryptocurrencies that typically originate from internet culture, often tied to memes, jokes, or social media trends. Unlike traditional cryptocurrencies like Bitcoin or Ethereum, which aim to solve real-world problems through decentralized finance or smart contracts, memecoins are usually created for entertainment or speculative purposes. Their value is often driven by community enthusiasm, social media buzz, and endorsements from influencers or celebrities.

Dogecoin, for instance, started as a lighthearted joke in 2013 but gained traction due to its vibrant community and high-profile endorsements, such as those from Elon Musk. Similarly, Shiba Inu capitalized on the "Doge" craze, branding itself as a "Dogecoin killer." While some memecoins have achieved legitimacy and sustained value, many others are launched with malicious intent, designed to exploit unsuspecting investors.

2. The Emergence of Scam Memecoins

Scam memecoins are fraudulent tokens created to deceive investors into parting with their money. These projects often mimic the branding, marketing, and hype of legitimate memecoins to attract attention. However, their underlying goal is not to build a sustainable ecosystem but to enrich their creators through deceitful practices. The decentralized and relatively unregulated nature of the cryptocurrency market makes it an ideal breeding ground for such scams.

Scam memecoins typically follow a predictable pattern:

-

Hype Generation: Creators use social media platforms like Twitter, Telegram, or Discord to promote their token, often promising astronomical returns or revolutionary features.

-

Token Launch: The memecoin is launched on decentralized exchanges (DEXs) like PancakeSwap or Uniswap, where anyone can list a token with minimal oversight.

-

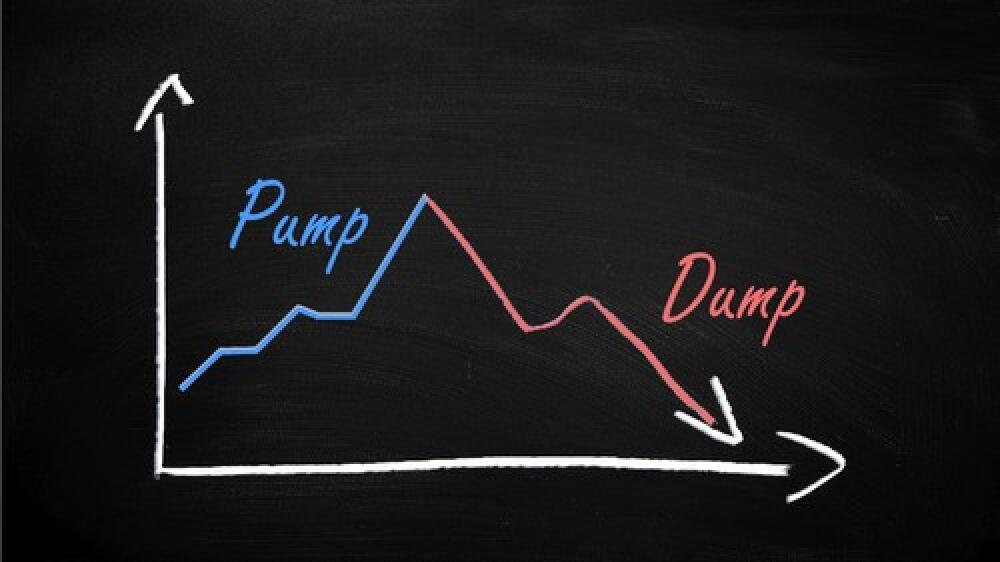

Pump and Dump: Early investors or insiders artificially inflate the token’s price by buying large quantities, creating the illusion of demand. This attracts more investors, driving the price higher.

-

Rug Pull: Once the price peaks, the creators or insiders sell off their holdings (a "dump"), causing the token’s value to plummet. In some cases, they drain the liquidity pool, leaving investors with worthless tokens.

-

Disappearance: The creators abandon the project, delete social media accounts, and vanish with the profits, leaving investors with no recourse.

3. Common Tactics Used by Scam Memecoins

Scammers employ a variety of tactics to lure victims into investing in fraudulent memecoins. Some of the most prevalent include:

-

Fake Whitepapers: Many scam memecoins release poorly written or plagiarized whitepapers that promise ambitious features, such as NFT integrations or play-to-earn games, without any intention of delivering.

-

Impersonation: Scammers often impersonate well-known figures or create fake endorsements to gain trust. For example, a scam memecoin called "MoonDoge" used a fake Twitter account mimicking Elon Musk to falsely claim his endorsement, deceiving investors into believing the token had credible backing.

-

Shilling: Paid promoters or bots flood social media with exaggerated claims about the memecoin’s potential, creating a false sense of urgency.

-

Locked Liquidity Promises: Some projects claim their liquidity is "locked" to prevent rug pulls, but they use loopholes or fake contracts to bypass these restrictions.

-

Airdrops and Giveaways: Scammers offer free tokens or rewards to attract users, often requiring them to connect their wallets to malicious websites that steal private keys or funds.

-

Copycat Tokens: Fraudsters create tokens with names or logos similar to popular memecoins, tricking investors into buying the wrong asset.

Example of a Scam Memecoin:

A notable example of a scam memecoin is "StarPuppy," a token launched in early 2024 on a decentralized exchange. Promoted heavily on Telegram and Twitter, StarPuppy promised to revolutionize the pet-themed memecoin space with a play-to-earn game and NFT collection. The anonymous developers used bots to inflate social media engagement and released a flashy website with a plagiarized whitepaper. They offered an "exclusive airdrop" requiring users to connect their wallets to a malicious site, which drained funds from unsuspecting participants. After raising $2 million in a week, the developers executed a rug pull by draining the liquidity pool and deleting all online presence, leaving investors with worthless tokens and no recourse.

4. The Risks of Investing in Memecoins

Investing in memecoins, even legitimate ones, is inherently risky due to their speculative nature. However, scam memecoins amplify these risks, posing severe financial and security threats. Key risks include:

-

Financial Loss: The most immediate risk is losing one’s entire investment. In rug pulls, investors are left with tokens that have no value and no market.

-

Data Breaches: Interacting with scam projects often requires connecting wallets to malicious websites, which can lead to the theft of private keys or personal information.

-

Emotional Toll: Falling victim to a scam can lead to feelings of shame, anger, or distrust, discouraging individuals from participating in the crypto market altogether.

-

Market Manipulation: Scam memecoins contribute to market volatility, eroding trust in the broader cryptocurrency ecosystem.

-

Regulatory Risks: In some jurisdictions, investing in unregistered or fraudulent tokens could lead to legal complications, especially if the project is under investigation.

5. Red Flags to Watch For

To avoid falling victim to scam memecoins, investors must exercise due diligence and remain vigilant. Here are some red flags to watch for when evaluating a memecoin project:

-

Anonymous Teams: Legitimate projects typically have transparent teams with verifiable identities. Anonymous developers or pseudonymous teams are a major warning sign.

-

Unrealistic Promises: Claims of guaranteed profits or exaggerated returns are almost always indicative of a scam.

-

Lack of Transparency: If a project lacks a clear roadmap, audited smart contracts, or verifiable code, it’s best to steer clear.

-

High-Pressure Tactics: Scammers often create a sense of urgency, urging investors to buy immediately to avoid "missing out."

-

Suspicious Tokenomics: Be wary of projects with massive token supplies, excessive allocations to developers, or unclear distribution mechanisms.

-

Poor Community Engagement: Legitimate memecoins have active, organic communities. If the project’s Telegram or Discord is filled with bots or lacks meaningful discussion, it’s likely a scam.

6. How to Protect Yourself

Protecting oneself from scam memecoins requires a combination of research, caution, and skepticism. Here are some practical steps to stay safe:

-

Research Thoroughly: Before investing, investigate the project’s team, whitepaper, and smart contracts. Use tools like Etherscan or BscScan to verify token contracts and liquidity locks.

-

Verify Sources: Double-check the authenticity of social media accounts, websites, and endorsements. Avoid clicking on unsolicited links or joining unverified groups.

-

Use Reputable Platforms: Trade on established exchanges with strong security measures. Be cautious with new or obscure DEXs that lack oversight.

-

Secure Your Wallet: Use hardware wallets or secure software wallets, and never share your private keys or seed phrases.

-

Diversify Investments: Avoid putting all your funds into a single memecoin. Diversification reduces the impact of a potential scam.

-

Stay Informed: Follow reputable crypto news outlets and communities to stay updated on emerging scams and red flags.

-

Trust Your Instincts: If something feels too good to be true, it probably is. Walk away from projects that raise doubts or lack transparency.

7. The Future of Memecoins and Scam Prevention

As the cryptocurrency market matures, efforts to combat scam memecoins are gaining traction. Decentralized exchanges are implementing stricter listing requirements, and blockchain analytics firms are developing tools to identify suspicious activity. Additionally, regulators worldwide are beginning to crack down on fraudulent crypto projects, imposing fines and sanctions on bad actors.

However, the responsibility ultimately lies with investors to educate themselves and approach memecoins with caution. While memecoins can be a fun and potentially profitable part of the crypto ecosystem, they require careful scrutiny to avoid falling prey to scams.

8. Conclusion

Scam memecoins represent a significant challenge in the cryptocurrency market, exploiting the hype and excitement surrounding memecoins to deceive investors. By understanding their tactics, recognizing red flags, and adopting safe practices, individuals can protect themselves from financial loss and contribute to a healthier crypto ecosystem. While the allure of quick profits may be tempting, the risks of scam memecoins underscore the importance of diligence and skepticism in the world of cryptocurrency. As the market continues to evolve, staying informed and cautious will be key to navigating the wild and unpredictable world of memecoins.

Read more:

Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)

.jpg)