1. What is an Initial Coin Offering (ICO)?

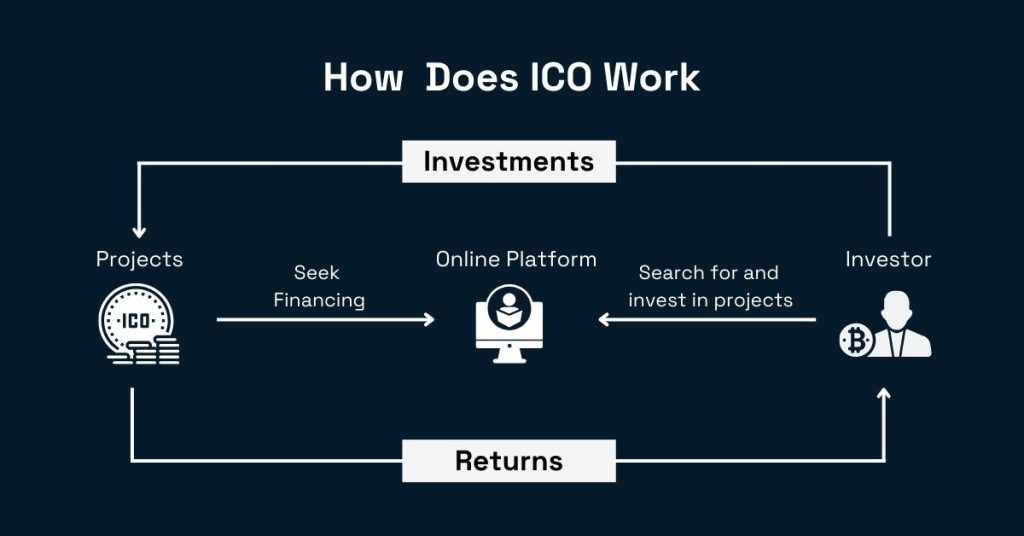

An Initial Coin Offering (ICO) is a method used by companies to raise funds for blockchain-related projects by issuing a new cryptocurrency or token. ICOs have become a key fundraising tool in the crypto space, enabling startups to access capital quickly and efficiently from a global pool of investors.

In an ICO, the company issues a new digital token, which investors can purchase in exchange for established cryptocurrencies such as Bitcoin or Ethereum, or even traditional fiat currencies. These tokens can represent a variety of things, such as a stake in the company or a utility token that will be used within the product or service that the company is developing. In essence, an ICO provides the opportunity to invest in a project at its earliest stage, often before the product or service is even fully developed.

2. How does an ICO work?

When a cryptocurrency project wants to raise money through an ICO, the organizers must first determine how they will structure the coin and the overall fundraising process. There are several ways to structure an ICO:

-

Static Supply and Static Price: In this model, the project has a fixed supply of tokens, and each token is sold at a preset price. The ICO's funding goal is also predefined, meaning the total amount raised is capped.

-

Static Supply and Dynamic Price: This model features a fixed number of tokens, but the price per token fluctuates based on the amount of funds raised. The more funds the ICO attracts, the higher the price per token.

-

Dynamic Supply and Static Price: Some ICOs operate with a dynamic token supply, meaning the number of tokens issued can increase depending on the funds raised, while the price per token remains the same.

Once the structure of the ICO is decided, the project team prepares a white paper—a detailed document that outlines the project's goals, its vision, the problem it aims to solve, and how much capital is needed. The white paper typically includes the following critical elements:

-

Project Overview: A clear description of the project, its purpose, and the technology behind it.

-

Token Information: Details on the number of tokens being issued, how they will be distributed, and what role they will play within the ecosystem.

-

Funding Goal: The amount of money the project intends to raise and how the funds will be used.

-

Token Sale Terms: Information about the pricing structure, the accepted payment methods (such as Bitcoin, Ethereum, or fiat currency), and the ICO's timeline.

-

Team Information: A list of the core team members and their qualifications, often including links to social media profiles or past projects.

3. What happens to the funds raised in an ICO?

After the ICO ends, the funds raised are used for the development of the project, as outlined in the white paper. If the ICO does not meet its minimum funding goal, the project may cancel the offering and refund the investors. However, if the funding requirements are met, the funds are typically allocated as planned, with the project team working toward bringing the product or service to market.

In many cases, ICO investors may not receive their tokens immediately after the sale. Depending on the structure of the ICO, there could be a waiting period before the tokens are distributed to investors. These tokens may not be tradable right away, depending on the market conditions and the specific rules set by the project team.

4. Who can launch an ICO?

One of the defining features of ICOs is their low barrier to entry. Technically, anyone with the knowledge and resources can launch an ICO, making it an attractive option for blockchain startups. However, this also makes ICOs prone to misuse and fraud, as it’s relatively easy to create a fake ICO and deceive investors.

In many countries, including the United States, ICOs are subject to regulation, particularly when the tokens issued could be classified as securities. This means that while anyone can technically launch an ICO, the project may need to comply with relevant securities laws and register with financial regulatory bodies like the SEC (Securities and Exchange Commission) in the U.S. However, even with regulatory scrutiny, many ICOs remain unregistered, and investors must exercise caution when participating in such projects.

5. How to buy into an ICO?

If you are interested in participating in an ICO, it's essential to conduct thorough research beforehand. Here are the steps you should take:

-

Verify the Legitimacy of the ICO: Ensure that the team behind the ICO is real and accountable. Look for information about the founders, their background, and their experience in the blockchain or cryptocurrency space.

-

Evaluate the White Paper: A reputable ICO will have a clear and detailed white paper that outlines the project’s goals, token structure, and how the funds will be used. If the white paper is vague or lacks substance, it could be a red flag.

-

Check for Transparency: Transparent communication is vital. Ensure that the project team is open about the tokenomics, funding usage, and progress updates.

-

Review the ICO’s Terms and Conditions: Carefully read the terms and conditions of the ICO to ensure that the investment process is legitimate and secure. Many ICOs include disclaimers regarding the risks of investing.

-

Use Secure Payment Methods: Most ICOs accept cryptocurrencies like Bitcoin or Ethereum, but make sure to use secure wallets and exchanges to make payments.

6. Identifying ICO Scams

.jpg)

While ICOs offer exciting opportunities, they also come with significant risks. The lack of regulation in the early stages of the cryptocurrency market has led to many scams and fraudulent ICOs. Here are some tips to help you avoid falling victim to an ICO scam:

-

Look for a Clear Purpose: Legitimate ICOs will have a clear and well-defined project. Avoid ICOs that lack concrete goals or come across as overly vague or confusing.

-

Ensure Transparency: The ICO should have a transparent roadmap, team information, and detailed use of funds. Lack of transparency is often a sign of a scam.

-

Check for an Escrow Wallet: Ensure that the funds raised in the ICO are stored in an escrow wallet, which requires multiple keys to access, providing an additional layer of security.

-

Avoid ICOs with Unrealistic Promises: If an ICO promises sky-high returns with little to no risk, it's likely too good to be true. Be cautious of exaggerated claims and unrealistic projections.

-

Research the Team: Verify the identity and track record of the team behind the ICO. A credible team with experience in blockchain or cryptocurrency is a good indicator of legitimacy.

7. Initial Coin Offering (ICO) vs. Initial Public Offering (IPO)

7.1. Process and Regulation

An IPO follows a highly regulated, structured process that includes detailed marketing efforts, roadshows, and financial disclosures, including the issuance of brochures and the listing of shares on a public stock exchange. Companies that opt for an IPO must work closely with regulatory bodies such as the U.S. Securities and Exchange Commission (SEC) to ensure compliance with securities laws. In this context, the IPO process is governed by stringent rules to protect investors.

On the other hand, ICOs, although increasingly under scrutiny, operate in a less regulated space. Many countries, including the U.S., have yet to fully regulate ICOs, and the legal landscape is still developing. For instance, in the U.S., the Howey Test is used to determine whether a digital asset qualifies as a security. If a cryptocurrency token meets the criteria of the Howey Test, it may be considered a security by the SEC, and therefore, the ICO could be subjected to the same regulatory rules as an IPO. However, in many jurisdictions, creating a cryptocurrency is not illegal unless it meets the criteria that define it as a security.

7.2. Investor Information and Protection

When participating in an IPO, investors typically receive detailed information through documents such as a prospectus, financial statements, and disclosures about the company's risks, business model, and management. This information is critical for making informed decisions and is regulated by authorities to ensure transparency and fairness in the process.

In contrast, ICOs are often less transparent. While many ICO projects provide a white paper—a document that outlines the project, its goals, and how the funds will be used—there is no requirement for the same level of detailed financial disclosures that are mandatory for IPOs. The white paper in ICOs can vary significantly in quality and comprehensiveness. As a result, ICO investors often face greater risks due to the lack of proper investor protections and potential for fraud.

7.3. Financial Instruments Tokens vs. Shares

In an IPO, investors buy shares in a company, which represent partial ownership in the business. These shares can potentially appreciate in value if the company performs well, and shareholders may receive dividends depending on the company’s profits.

In an ICO, investors buy tokens or cryptocurrencies issued by the company. These tokens typically serve a functional role in the project’s ecosystem, such as allowing access to a service or platform, or they may act as a stake in the future of the project. Unlike shares, tokens do not represent ownership in a company, although they may confer certain rights within the project's platform. Depending on the ICO’s design, tokens may be traded on cryptocurrency exchanges, but they are often subject to significant price volatility.

8. Examples of Initial Coin Offerings (ICO)

The ICO market has seen several high-profile fundraising campaigns that have raised significant amounts of capital for blockchain projects. Some notable examples include:

-

Ethereum’s ICO (2014): Ethereum's ICO, which took place in 2014, is one of the most successful and well-known early examples of an ICO. Ethereum raised approximately $18 million over a 42-day period. The funds were used to develop the Ethereum blockchain, which has since become one of the most widely used platforms for decentralized applications (dApps) and smart contracts.

-

Dragon Coin’s ICO (2018): Dragon Coin, a project aiming to create a cryptocurrency for the gaming and entertainment industry, raised about $320 million during its one-month ICO in 2018. This was one of the larger ICOs at the time, highlighting the growing popularity and size of blockchain-based fundraising efforts.

-

EOS ICO (2017-2018): The EOS ICO broke all previous records by raising an astounding $4 billion during its yearlong fundraising campaign. EOS is a platform designed to support decentralized applications and smart contracts, and its ICO raised more than any IPO in history at that time.

9. Conclusion

Initial Coin Offerings (ICOs) have revolutionized the way blockchain projects raise funds, offering both opportunities and risks to investors. While ICOs can offer high returns if the project succeeds, they also come with significant dangers, including the risk of fraud and loss of capital. As the regulatory landscape surrounding ICOs continues to evolve, it is important for both investors and project teams to remain informed and cautious. By doing thorough research, reviewing white papers, and checking for transparency, investors can better navigate the ICO space and avoid falling victim to scams.

If done correctly, ICOs can provide a platform for innovative blockchain projects to succeed while offering investors a chance to participate in the early stages of exciting new ventures. However, always remember that, as with any investment, caution and due diligence are key.

Read More:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)