1. What are Node Sales?

Node Sale is a form of selling blockchain nodes directly to investors in blockchain networks, where the nodes issued are in the form of NFTs and cannot be traded on the marketplace within the first year (depending on each project's strategy).

Usually, these nodes or NFTs will perform specific tasks for the blockchain, such as proof of stake, data verification, Checker, etc. Its price is based on the value of the nodes sold by level, with increasing and decreasing prices for each level.

Node rewards:

- Based on the X% ratio of the supply allocated for node rewards by the project.

- Additional allocation ratios based on rewards from the performance of network node operations, shared from Network fees or increased Stake.

- Typically, rewards are paid over time, and most projects implement locking mechanisms before recipients can access them. (usually locked for a period of 90-180 days).

In history, projects have launched this node sale model very successfully, such as GALA, where participants in the node sale received profits ranging from $1,000 to $100,000. However, this was only for early participants in the first 20,000 sales, while later stages had significantly longer breakeven ratios and risks.

In this cycle, we can see that the project initiating Node Sale is the Xai Game project, along with increasing participation from other projects such as Hytopia, Aethir, Sophon, Tabi, Carv, Myria, AlienX.

Currently, the node values of the projects at the following levels:

-

Aethir (Tier 53) = $4.8B FDV

-

Hytopia (Tier 8) = $800M FDV

-

XAI (Tier 18) = $761M FDV

-

Sophon (Tier 9) = $680M FDV

-

AlienX (Tier 11) = $67.9M FDV

2. Timeframe for ROI from investment in Node Sale

To determine the timeframe for return on investment, we will use the following formula:

💡 Breakeven Point = Node Cost ÷ Node Reward/Month/Node

Including:

-

Node Cost depends on the participation level, earlier participation levels being cheaper.

-

Node rewards can be calculated as: [percentage of rewards allocated for nodes] / [number of active nodes]

Most projects allocate 5-20% of the token supply for node rewards, so node operators will earn more when there are fewer active nodes. However, based on the typical sales structure, a higher proportion of nodes are sold at the initial levels, with approximately 66% of nodes being sold.

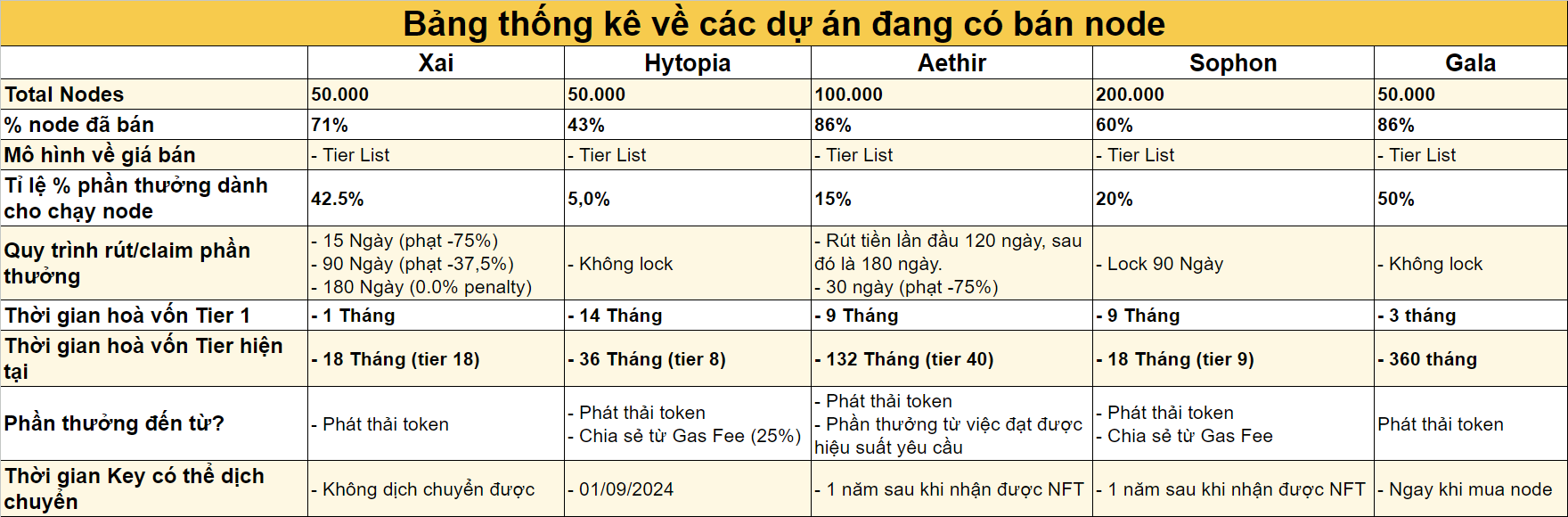

Based on the allocation ratio of rewards to nodes and the node sale prices at the current Tiers, we will have the following table:

Table of Projects using the Node Sale model

There are other costs not included in the analysis table above, including:

-

Most node sales are bought/sold using ETH, so the value will vary with token fluctuations. Therefore, the node value in the above table is taken at the $3000/ETH price point.

-

Node operation costs range from $20 to $50 per month, depending on the project's fee structure.

In this table, Tier 1 of XAI achieves breakeven so quickly because the project Airdropped tokens to the community that participated in purchasing the project's nodes. This virtually helped all users who participated in Tier 1 node purchases to achieve early profits, as well as significantly reducing the breakeven time for those participating in other tiers.

However, the statistics in the table also show the increasing risk ratio for users as the tier of the node they participate in increases. Currently, most node tiers being sold have high price points and long breakeven times. Therefore, as an investor, I advise against continuing to invest in projects with such high-tier node sales.

Note that the table above will provide relatively calculated figures. Additionally, only XAI and Gala projects currently have the most accurate figures because the projects have launched mainnets, listed tokens on exchanges, and users have started receiving tokens by running their nodes.

3. Advantages and disadvantages of the Node sale model

In general, the node sale model is similar to selling presale or public sale tokens to the regular user community. To determine the advantages and disadvantages of these two models, we will make the following assumptions:

- Tokenomics of a Project Using Traditional Public Sale:

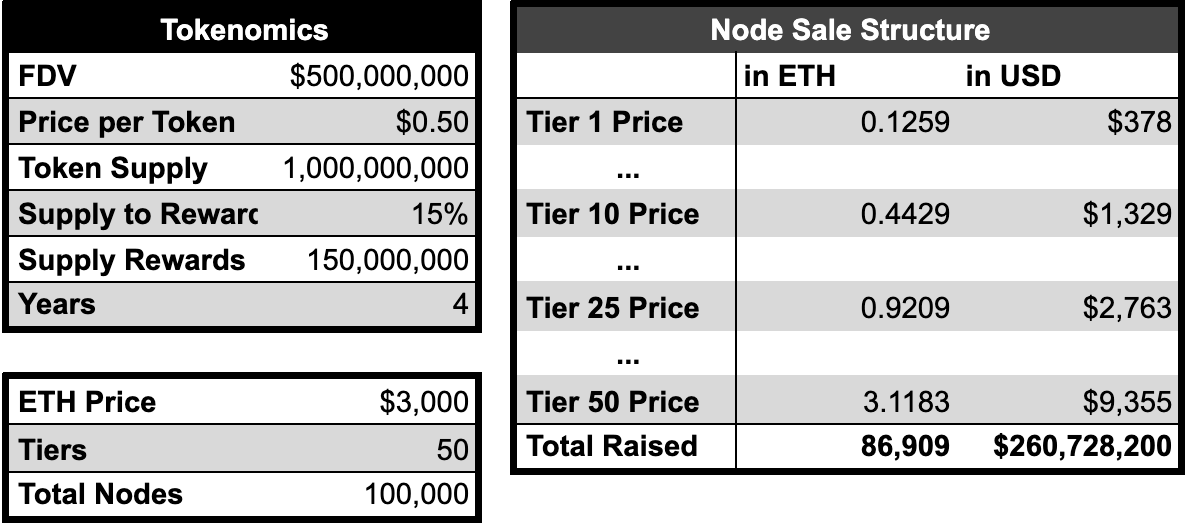

- This is the tokenomic structure of a project utilizing Node Sale and a Tier-based selling structure:

:

We will evaluate this model based on 4 factors including:

- Pricing

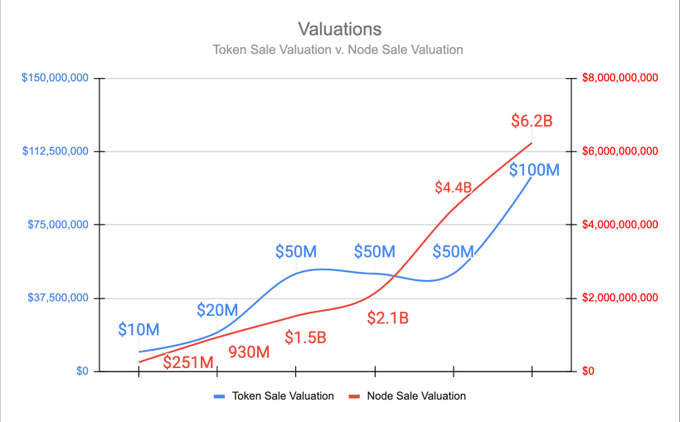

In terms of pricing, from the Pre-seed round to the Public Sale round, there is a difference of about x10, whereas for the Node sale, from tier 1 to tier 50, the difference is x25. If we compare the price gap between Public Sale and the last tier of Node sale, the difference will be x62; however, considering only 66% of the nodes are sold, then the gap will be x16.

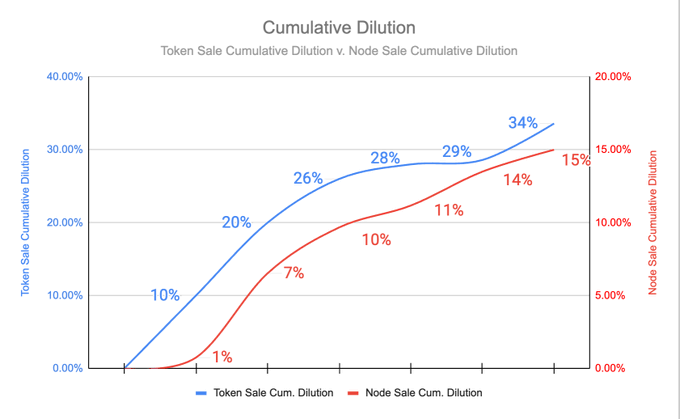

- Dilution ratio

On average, projects allocate 20-30% of the token supply to private investors (VCs) and then 5% to retail investors. For Node Sale, the range is broader, from 5-20% of the total token supply allocated as rewards for node operators, resulting in less dilution, almost double compared to traditional sales.

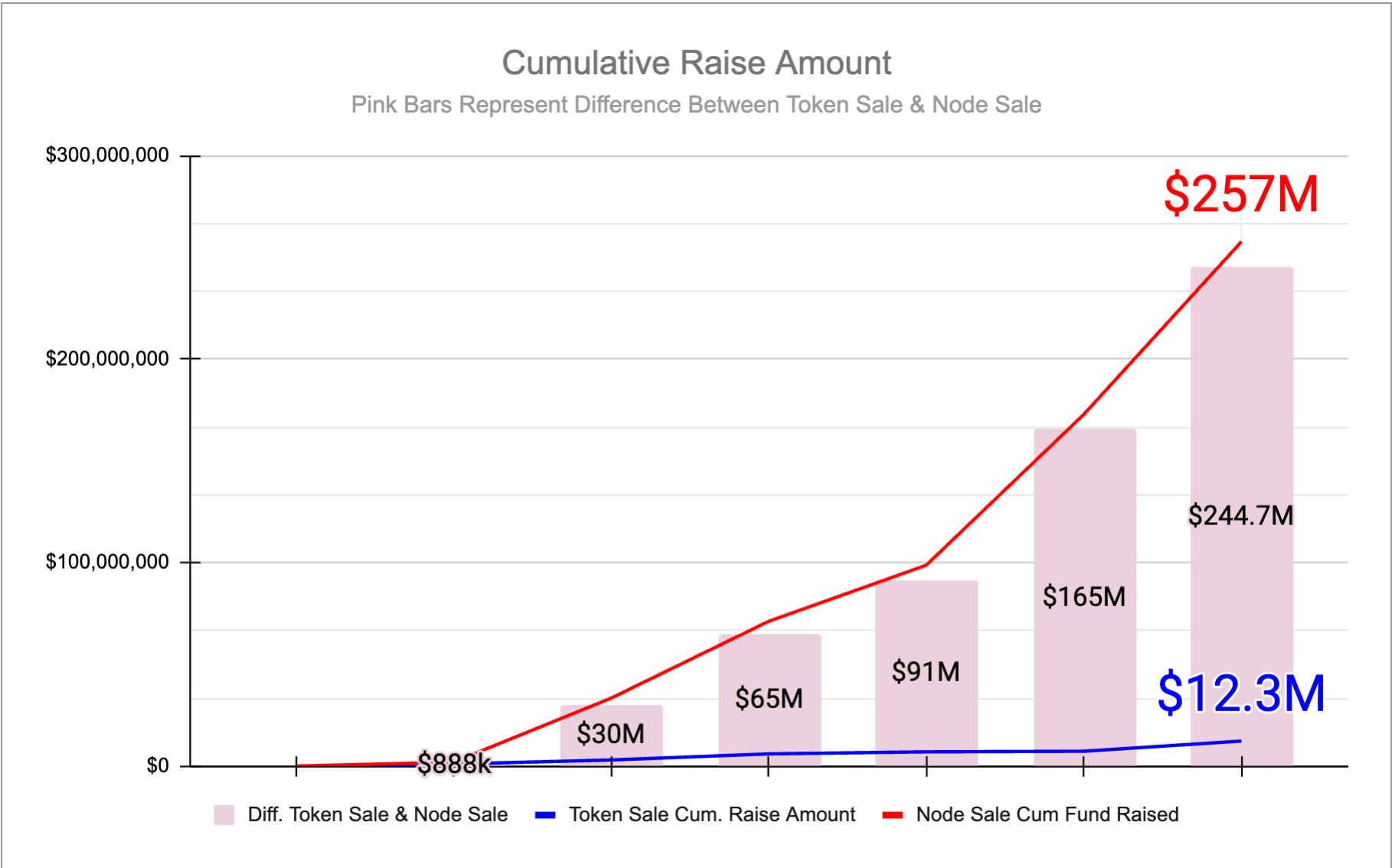

- The amount raised

The main difference in dilution ratio between the two models lies in the amount raised: the accumulated amount raised for one Public Sale is $12.3 million, while for Node Sale, it ranges from $257 million to $244 million. Applying a sell-out ratio of 66%, the raised amount is $75 million, which is still six times higher than that of the Public Sale.

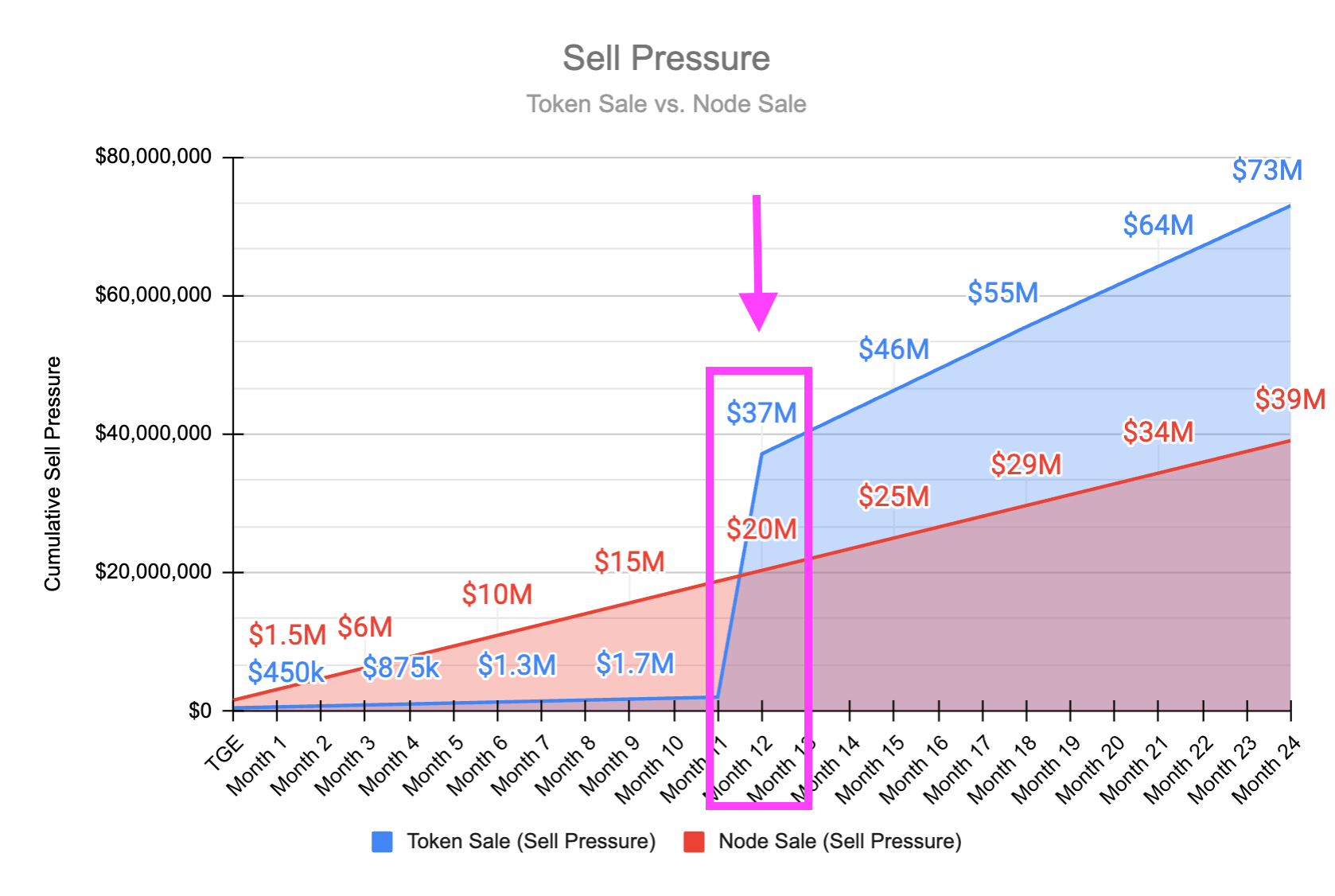

- Selling pressure

The release schedule of Node Sale will issue a quantity of tokens three times larger than Public Sale. However, the emission rate is linear over time. At the TGE, almost all participants running nodes are unable to earn their rewards because there will be a certain lockup period before they can claim those rewards. Therefore, the selling pressure of Node Sale tokens will be much lower compared to Public Sale in the initial stage.

At the 1-year mark, investors (VCs) receive the first batch of tokens they purchased. At this point, the selling pressure from those who bought tokens is 1.5 times higher than that of Node Sale.

Overall, the Node Sale model has several advantages over traditional Public Sale:

-

Higher valuation (up to 62x).

-

Reduced dilution by 50%.

-

Better fundraising capability, up to 20 times more.

-

Selling pressure is distributed among many smaller sellers, reducing the pressure during the Token Generation Event (TGE) phase.

This is why most projects in recent times have opted for the Node Sale model instead of the Public Sale. However, there are significant pitfalls for retail investors participating in the Node Sale model.

As analyzed earlier, Node Sale is sold based on Tiers, and the initial investment cost increases as Tiers rise. The breakeven time is also prolonged because there is a certain period required after running a node to claim rewards.

The Node Sale structure also brings certain benefits to investors, especially KOLs:

-

Easier project marketing: Projects selling Node can use discounts to attract users to participate in nodes through distribution to KOLs, helping the project reach customer files from market-leading KOLs.

-

Reduced selling pressure: With linear token issuance based on node activity, the selling pressure from users in the early stages is reduced.

-

Better community engagement: With recent airdrop models, projects can apply them to participants buying Node to stimulate participation in early Node sales.

-

Diverse valuation: Reward node adjustment based on node performance and increased node pool creation capabilities can attract more organizations and projects looking to profit from this node activity (XAI's Staking V2 mechanism is a prime example).

-

Enhanced allocation of token supply to Nodes: This is the simplest solution to make node activities more attractive.

4. Conclusion

Node Sale is a form of selling participation slots in the operations of a blockchain network, where nodes are issued as NFTs and typically cannot be traded or transferred on the marketplace for the first year (depending on the project's strategy).

The above is a basic analysis of the Node Sale model as well as its advantages and disadvantages compared to the traditional Token sale model in the market. Overall, the Node Sale model is bringing many positive aspects and long-term sustainability to the project. However, users will need to carefully calculate the stages when participating in this model.

Read more:

Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)

.jpg)