1. What is Andreessen Horowitz?

Andreessen Horowitz (a16z) is one of the best venture capital firms in Silicon Valley, California, founded in 2009 by Marc Andreessen and Ben Horowitz - two reputable investors in the technology industry. The investment fund focuses on technology startups at every stage and has built a reputation for supporting promising projects to create significant value.

The a16z investment fund not only focuses on a specific field but also participates in various sectors such as AI, biotech, healthcare, gaming, fintech, consumer goods, and notably, crypto. They target long-term investment activities, a16z does not invest too early in projects and always aims for long-term investment.

A notable feature of a16z is the "Build" investment strategy - they not only provide investment capital but also contribute knowledge, relationships, and strategic support to the companies they invest in. With a history of investing in a series of major technology companies such as Facebook, Twitter, Slack, Skype, Coinbase, ConsenSys, and many others, a16z has cemented its position in the technology community and continues to drive industry development.

2. Founding team of Andreessen Horowitz

The founding team of Andreessen Horowitz are not only pivotal figures in the venture capital area but also talented, creative, and influential individuals in the global technology community. In this section, we'll explore the people behind the resounding success of Andreessen Horowitz, individuals who have shaped and propelled the development of numerous groundbreaking projects.

2.1. Marc Andreessen

Marc Andreessen is a venture capitalist and entrepreneur in the United States, as well as the co-founder and CSO of the investment fund Andreessen Horowitz. With co-founding experience at Netscape and Loudcloud (now known as Opsware), he has demonstrated prowess in building and shaping technology. Marc is not only one of the pioneers in developing software used by billions but also a prolific angel investor, with successful investments in startups like Twitter and Qik.

Marc Andreessen has a Bachelor of Science in Computer Science from the University of Illinois at Urbana-Champaign, He has shaped and propelled the development of the Internet from its early days. Currently, he is not only behind many renowned technology companies but also a board member of several leading enterprises, including Facebook.

2.2. Ben Horowitz

Ben Horowitz is the co-founder and partner of Andreessen Horowitz. With a challenging journey from a talented engineer to a successful investor and entrepreneur, Ben has demonstrated the power of perseverance and determination.

Born in London in 1966, Ben Horowitz moved to Berkeley, California, at an early age and began his career in Silicon Valley after graduating from college. With bachelor's and master's degrees in Computer Science from Columbia and UCLA, he started his career at Silicon Graphics before joining Netscape as a Product Manager.

However, a significant highlight in Ben's career came when he established Loudcloud with Marc Andreessen, one of the pioneering companies in the cloud services sector. Despite facing challenges from the dot-com crash and market downturn, Horowitz turned adversity into opportunity by transforming Loudcloud into Opsware, a data center automation software company.

With the experience and success of Opsware, Ben Horowitz and Marc Andreessen have founded a16z. The success of a16z is not only in successful investments in companies like Facebook, Twitter, or Pinterest but also in Ben Horowitz sharing his knowledge and experience by writing books and creating opportunities for future leaders.

3. Investment strategy of Andreessen Horowitz

3.1. Investment trends

Before 2013, a16z focused on investing in pioneering technology startups such as technology infrastructure, mobile platforms, software, and social media. The fund invested in many prominent technology companies when they were just starting out, including Facebook (2008), Twitter (2010), Spotify (2011), along with supporting numerous startups in Silicon Valley such as Tesla Motors, Slideshare, and Fitbit.

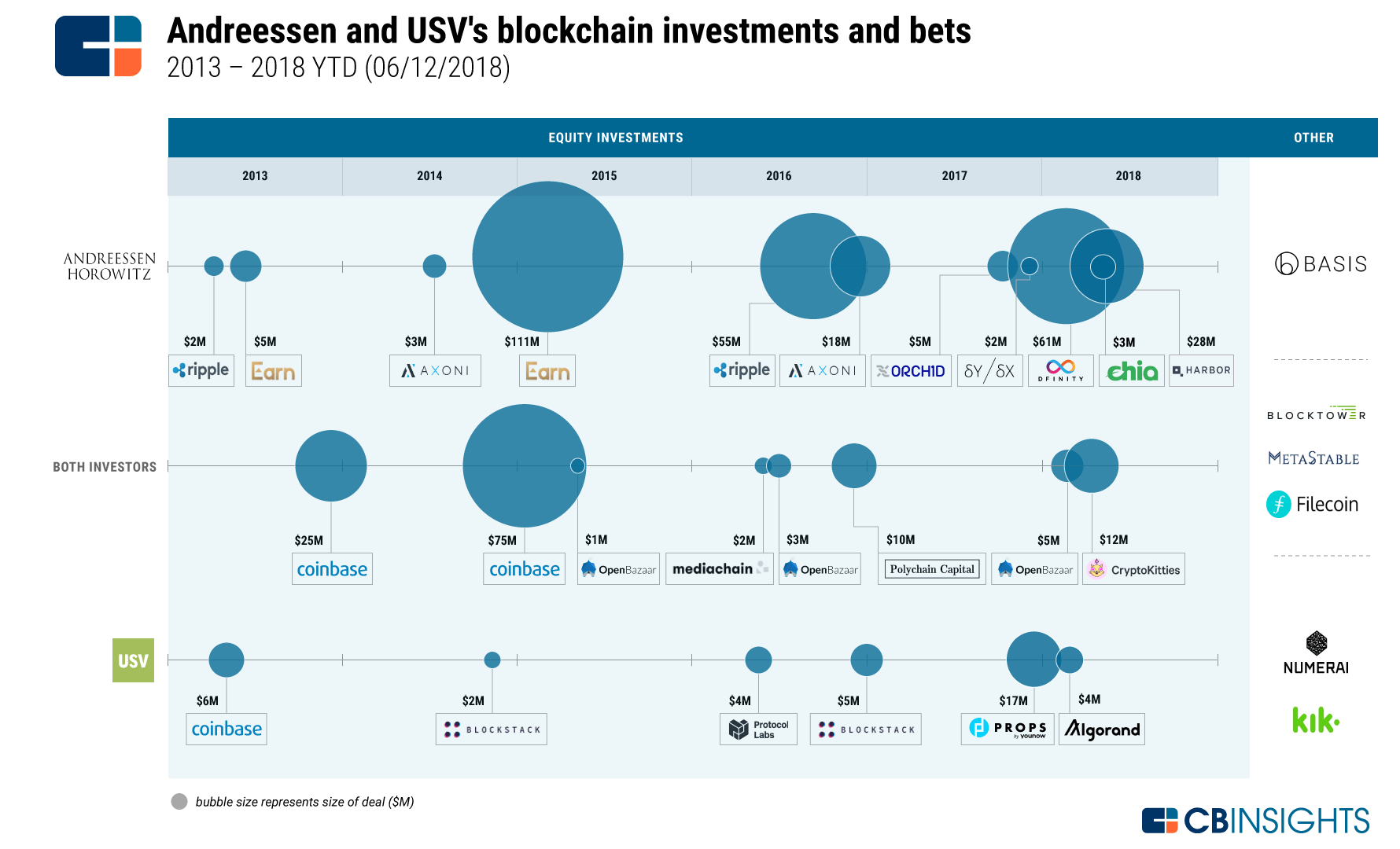

Since 2013, a16z has shifted its investment focus strongly towards Blockchain, cryptocurrencies, and Web3 technologies:

- In 2013, a16z conducted a $3 million Series A investment round for Coinbase, the first cryptocurrency exchange in the United States. This was one of a16z's standout deals as the initial investment surged to $11.2 billion from Coinbase's IPO.

- In 2014, a16z invested $7 million in ConsenSys, a company developing Ethereum technology.

- Also in 2014, a16z led a $25 million Series B round for Counterparty, the first decentralized financial platform.

- In 2015, a16z invested in Koinify, the first Blockchain exchange and game platform.

These early investment rounds demonstrated a16z's recognition of the potential of Blockchain and played a significant role in driving the development of this industry.

3.2. Investment portfolio

Currently, Andreessen Horowitz has completed over 200 investment projects, including various areas such as DeFi, Blockchain, Infrastructure, NFT & GameFi, and the Metaverse. The fund also participates in funding rounds for many promising Blockchain startups like Anthropic, BlockFi, Dapper Labs, and many other well-known companies like Coinbase, Docker, Epic Games, Instagram, and Reddit.

The fund is currently focusing on investing in the decentralized finance (DeFi) and Web3 markets. The investment team at a16z emphasizes selecting projects with long-term development potential and transparent, experienced development teams. Alongside investing in major projects, a16z also invests in smaller projects within each field.

Below are some notable projects that a16z has invested in across various sectors:

Layer 1 Projects:

- Near Protocol: a16z led a $21.6 million investment round in Near Protocol in May 2020.

- Avalanche: Avalanche received a $6 million Series A investment from a16z in 2019.

- Solana: a16z and Polychain invested $314 million in Solana in June 2021.

Exchange projects:

- Uniswap: Andreessen Horowitz, USV, Paradigm, Parafi Capital invested $11 million in Uniswap's Series A in July 2020.

- dYdX: The largest decentralized derivatives exchange completed a Series C funding round in June 2021, raising $65 million.

Stablecoin Projects:

- MakerDAO: In September 2018, a16z invested $15 million to acquire 6% of the total supply of the MAKER token, the governance token of MakerDAO.

- Trust Token: Trust Token is the issuer of the TUSD stablecoin, with a centralized stablecoin market cap of up to $1.2 billion.

Lending/Yield Projects:

- Compound: Compound Finance has had two funding rounds with a16z's participation.

- Goldfinch: Goldfinch's $11 million funding round was announced in June 2021, led by a16z.

Ethereum Layer 2 Solutions Projects:

- Optimism: Ethereum's scalability solution operating on the Optimistic Rollup mechanism, a16z led a $25 million Series A investment round in March 2021.

NFT Projects:

- OpenSea: The world's largest NFT marketplace, OpenSea raised $23 million in Series A funding in March 2021 from a16z, Blockchain Capital, Founders Fund, and Coinbase and Gitcoin co-founders.

Gaming/Metaverse/NFT Projects:

- Sorare: Sorare, an NFT platform for football, received a $50 million investment round in February 2021, with a16z participating.

- Forte: Forte, a Blockchain gaming platform, received a $185 million Series B investment led by a16z in March 2021.

4. Successful investments of Andreessen Horowitz

Andreessen Horowitz's investment projects before 2023 have demonstrated the strength and vision of one of the leading investment firms in Silicon Valley. From investing in emerging technology companies to supporting projects with potential to disrupt industries, Andreessen Horowitz continues to assert its position in the global startup community.

4.1. Airbnb

One of the standout investment projects of Andreessen Horowitz is its investment in Airbnb, the platform for online house and accommodation rentals, which has created a revolutionary wave in the travel and lodging industry. Not only is it a successful financial investment project, but Airbnb is also evidence of the power of innovative business models and the ability to create real value for users.

4.2. Coinbase

Coinbase is the world's leading cryptocurrency exchange, an investment project that Andreessen Horowitz has believed in from the beginning. The strong growth of the cryptocurrency market has made Coinbase one of the most valuable companies in the sector, generating huge profits for Andreessen Horowitz and at the same time providing an important platform for popularity and acceptance of cryptocurrencies worldwide.

4.3. Clubhouse

Clubhouse is a social networking app with a format of direct audio communication, attracting the attention of millions of users worldwide. Andreessen Horowitz made significant investments in Clubhouse from its early stages, helping the app become one of the technology sensations before 2023.

5. Conclusion

Andreessen Horowitz (a16z) is not just a conventional investment fund but also a reliable and highly influential partner in the crypto community and the technology industry. With a long-term investment strategy, diversified portfolio, and commitment to building and developing businesses, a16z continues to be a pioneer in shaping the future of the industry. This fund is also a source of inspiration for founders and investors worldwide.

Read more:

English

English Tiếng Việt

Tiếng Việt.jpg)

.jpg)

.jpg)

.jpg)