1. What is VeSync?

veSync, a decentralized exchange (DEX), has been established on the zkSync network utilizing a (3,3) rollup structure. This project is a fork of Velodrome Finance. According to Defilama, veSync is ranked among the top 10 projects in terms of Total Value Locked (TVL) on zkSync.

.png)

2. Product

VeSync operates under the (3,3) model with two distinctive features:

-

The "Ve" mechanism, denoting Vote Escrow, entails locking assets to secure voting rights and rewards. The longer the assets are locked, the greater the voting rights and rewards become. However, a drawback of this mechanism is its lower liquidity. This model has been implemented by Curve Finance.

-

The (3,3) model integrates Staking/Rebasing/Bonding, originally devised by Olympus DAO. This Ve(3,3) mechanism tightly aligned behaviors with the protocol's success, encouraging liquidity provision and long-term token holding. Liquidity providers receive $VS tokens, while holders of $veVS tokens gain transaction fees, rebases, and governance rights.

VeSync's core offerings include Swap, Liquidity, Vest, and Vote.

2.1. Swap

veSync accommodates 21 distinct asset types with minimal price slippage. Transaction fees on veSync are directly subtracted from the quantity of tokens involved in the transaction.

In the case of veSync, the transaction fees for both Stable and Volatile Pools are initially fixed at 0.02%, but there is an option for adjustment, allowing for an increase up to 0.05%.

.png)

2.2. Liquidity

Users can add liquidity to different pools to earn extra profits on VeSync, with each pool offering varying Annual Percentage Rates (APRs).

VeSync categorizes its pools into two primary types:

-

Stable Pool: Geared towards assets with low price changes, such as the BUSD/USDC or USDC/USD+ pools.

-

Volatile Pool: Specifically designed for commonly traded tokens, exemplified by pools like USDC/ETH or VS/ETH.

.png)

2.3. Vest

Users can commit their $VS tokens to obtain $veVS tokens on veSync. veVS holders actively engage in governing the protocol and earn rewards by voting for the platform's gauges within the ve(3,3) DEX model.

The maximum lock-in duration on veSync is limited to one year.

.png)

The conversion rate between VS and veVS is influenced by the number of Epochs chosen for token lock-up, with each Epoch spanning a period of 7 days.

For example:

-

Locking 1 VS for 52 Epochs yields 1 veVS.

-

Locking 1 VS for 39 Epochs yields 0.75 veVS.

-

Locking 1 VS for 26 Epochs yields 0.5 veVS.

-

Locking 1 VS for 13 Epochs yields 0.25 veVS.

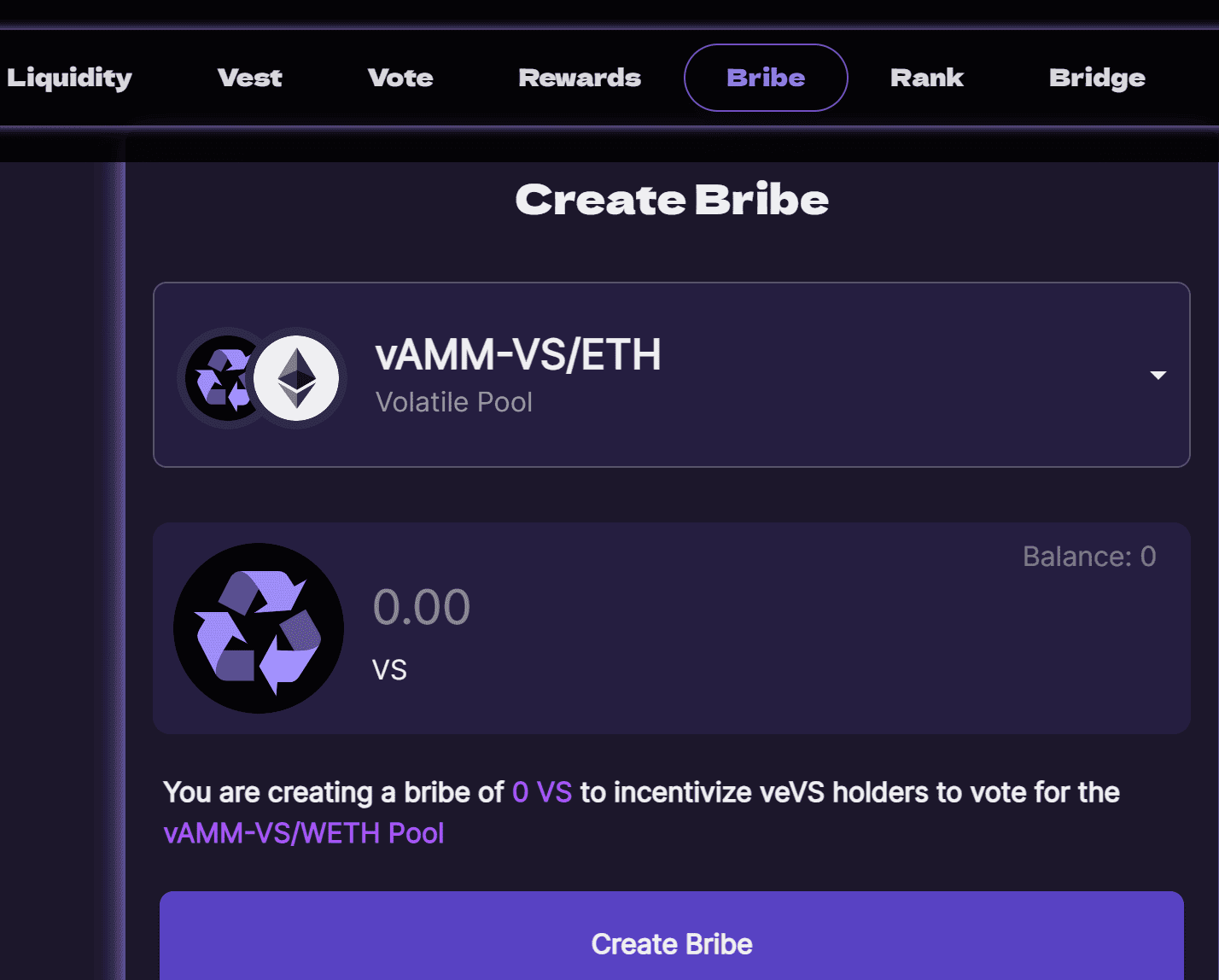

2.4. Bribe

Users have the capability to institute supplementary incentives termed as "Bribes" within the veSync platform to encourage participation in voting on the gauges. This strategic approach aims to foster increased liquidity for specific trading pairs.

If you hold the role of project owner for "abc" with the associated $abc token, and you seek heightened visibility for your abc/usdc liquidity pool on veSync, you can introduce additional rewards (Bribes) tailored for that specific pool. The primary aim is to attract a greater number of veVS holders to actively engage in your pool.

In simpler terms, pool owners willingly allocate funds to motivate veVS holders, thereby incentivizing them to cast their votes in favor of their respective pools.

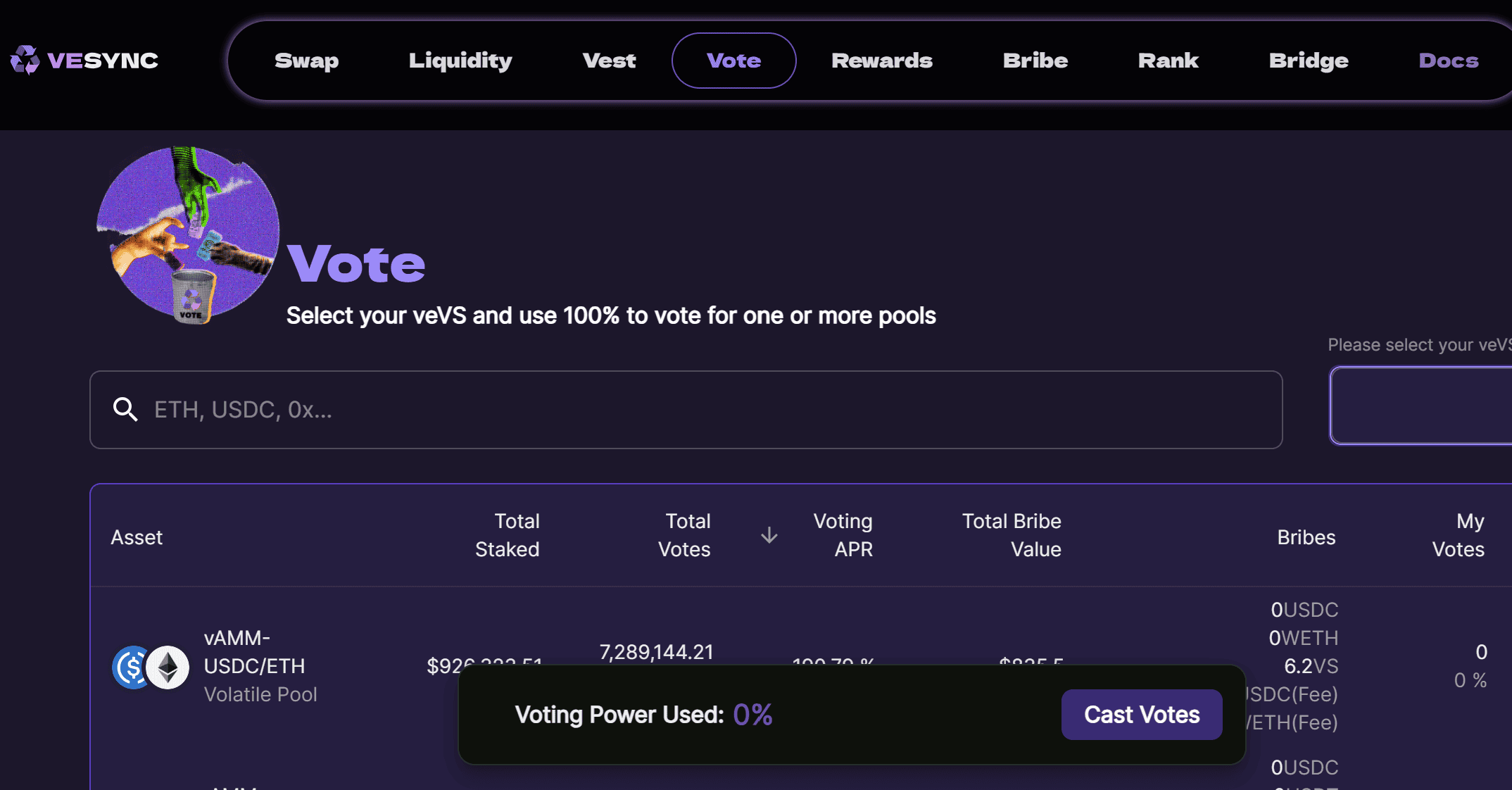

2.5. Vote

Understanding epochs is essential to participate in veSync's voting system. Each epoch spans 7 days, and rewards are distributed at the end of this period. Every epoch commences at 12 AM UTC every Thursday. veVS owners earn Bribes and transaction fees solely for the pools they have voted on. These rewards are proportionally distributed based on the voting weights of participants on that specific gauge.

For example, if Participant A possesses a higher voting weight than Participant B on a specific gauge, Participant A may receive a more substantial share in comparison to Participant B during the bribery distribution, reflective of their respective voting weights. Users need to vote weekly to qualify for rewards (veSync is developing an optimized voting mechanism to facilitate users in automated voting).

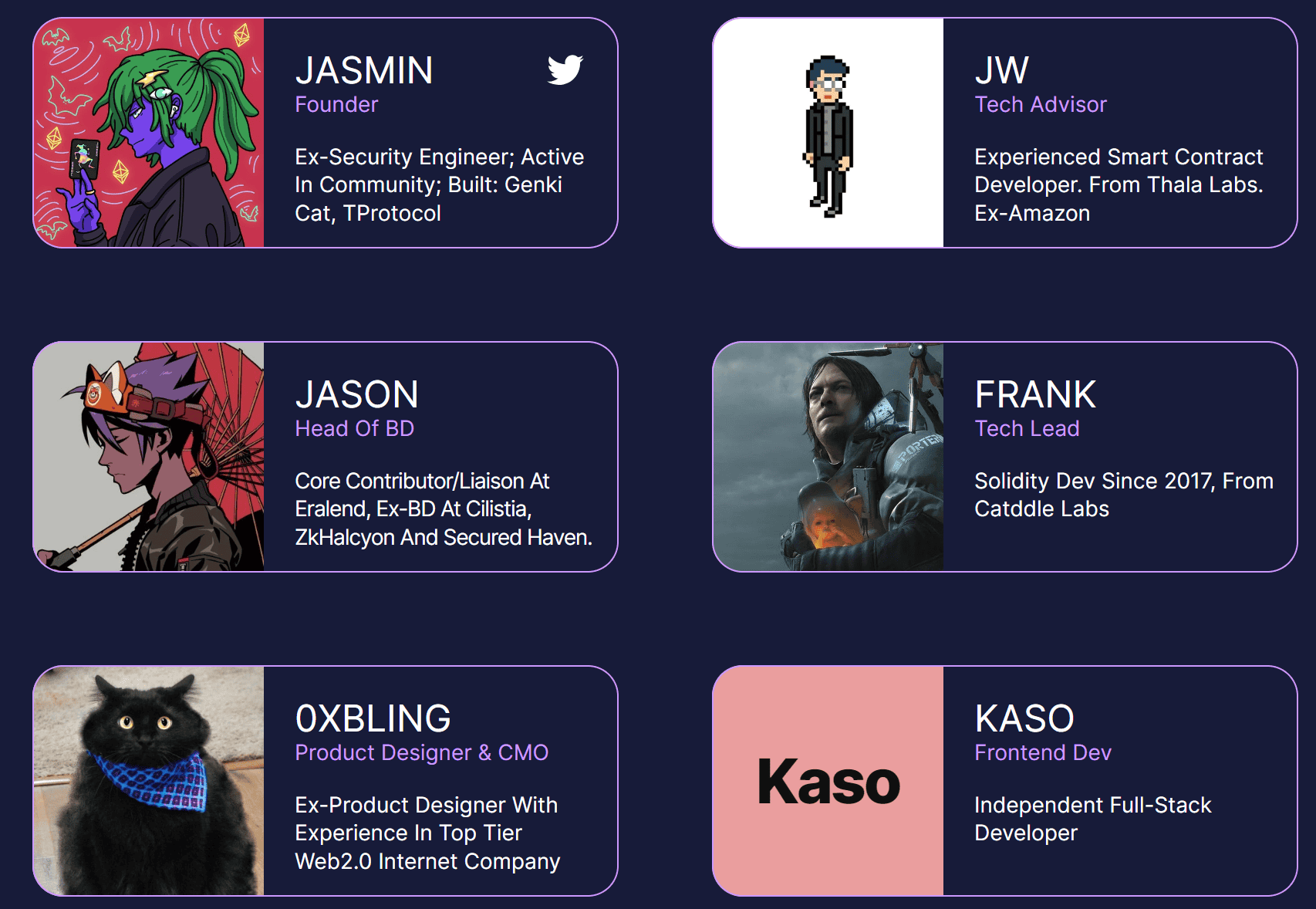

3. Team

4. Investors & Partners

4.1. Partners

4.2. Investors

5. Tokenomics

5.1. Key metrics

-

Token Name: veSync

-

Ticker: $VS

-

Total Supply: 100,000,000 $VS

-

Contact Address: 0x5756A28E2aAe01F600FC2C01358395F5C1f8ad3A

5.2. Token features

The $VS token functions as the utility token for the project, serving as a reward incentive for encouraging participation in liquidity provision. Locking $VS tokens enables users to receive $veVS tokens, granting access to governance functions.

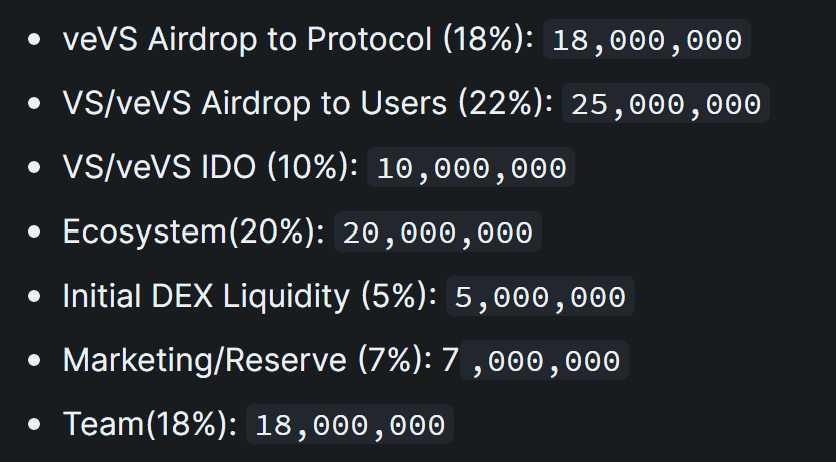

5.3. Token Allocation

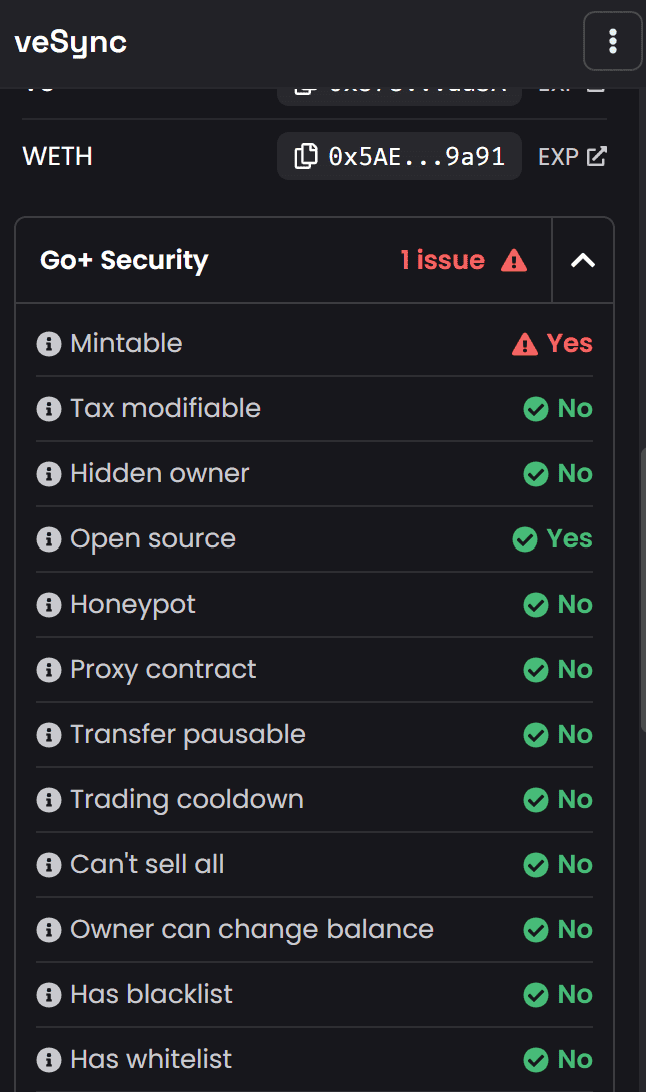

5.4. Smart Contract Evaluation

The project's smart contract exhibits one potential security concern related to the mint token function.

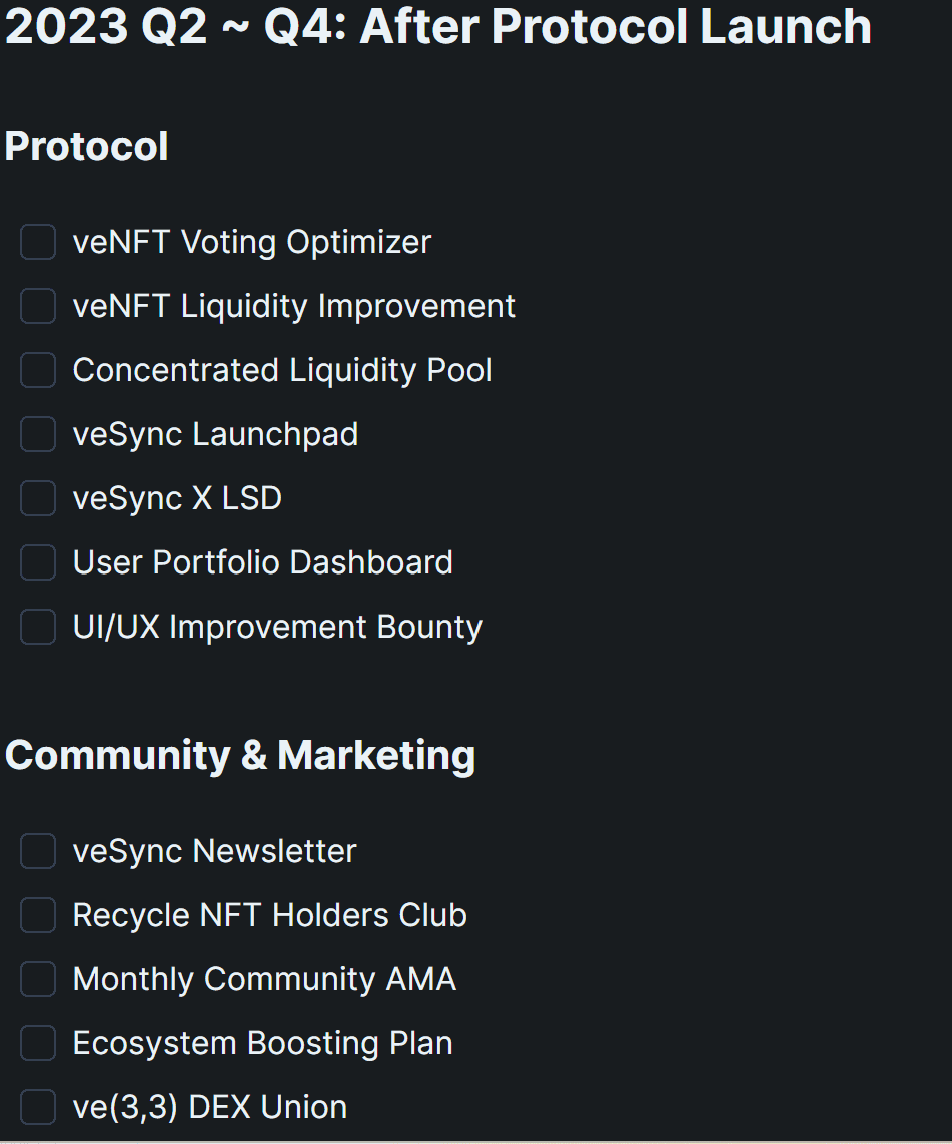

6. Roadmap

veSync aims to enhance product features and intensify project marketing efforts in the latter half of 2023.

7. Channels

Website: https://vesync.finance/

Docs: https://docs.vesymc.finance/

Twitter: https://twitter.com/veSyncL2

8. Conclusion

This encapsulates the comprehensive details of the veSync project. Functioning as a decentralized exchange (DEX) with the v(3,3) model, veSync exhibits noteworthy resemblances to the Velocore project. However, the venture lacks substantial affiliations with prominent names in terms of partnerships and investors. The presence of security vulnerabilities within the contract raises considerable risks for potential investors.

Read more:

English

English Tiếng Việt

Tiếng Việt

.jpg)