1. What is passive income?

Passive income is money that you earn without being directly involved in the process of generating it.

Passive income in crypto can help you achieve financial freedom because it allows you to earn money without direct involvement. By owning passive income streams, you can dedicate time to more important goals while still ensuring financial security.

Moreover, passive income in crypto helps diversify your income sources. By diversifying income streams, you can mitigate risks if one source decreases or disappears.

Passive income in crypto enables you to accumulate assets and create long-term value. For instance, investing in rental properties allows you to profit from those assets over time. Similarly, you can generate passive income in the crypto market.

In the following article, I will guide you on simple ways to generate passive income on crypto trading platforms that beginners can easily implement.

2. How to generate passive income in crypto?

To generate passive income in crypto, you can utilize the passive income features supported by cryptocurrency exchanges such as Binance, Bybit, Kucoin, and others. Essentially, you can earn automatic income on these platforms through similar services offered (with differences in APY rates received).

2.1. Savings

Savings on a crypto exchange is similar to depositing savings in the bank. The main difference is that instead of depositing Vietnamese Dong (VND) into a bank account, you deposit cryptocurrencies on the exchange.

You can deposit savings in various coins on the exchange, typically including:

- Cryptocurrencies: such as BTC (Bitcoin), ETH (Ethereum), BNB (Binance Coin), SOL (Solana), etc.

- Stablecoins: stablecoins that are pegged to the value of 1 USD, such as USDT (Tether) and USDC (USD Coin).

Depositing savings on a crypto exchange allows you to earn a higher profit (APY) compared to traditional bank savings. The APY you earn depends on the specific coin and the duration of the savings deposit. Typically, people choose to deposit stablecoins for savings because these coins are pegged to a stable value (~1 USD) and help mitigate the risk of coin value fluctuations.

In summary, depositing savings on a crypto exchange provides an opportunity to earn higher interest rates than traditional banking, with the flexibility to choose different cryptocurrencies or stablecoins based on your risk tolerance and investment goals.

What types of savings accounts are available on cryptocurrency exchanges?

There are two common types of savings options when participating in depositing savings on cryptocurrency exchanges: flexible savings and fixed-term savings.

- Flexible Savings: You can deposit your funds, earn interest, and withdraw at any time you wish. However, the returns from flexible savings are typically not very high and are suitable for those with idle funds and no immediate need for their money

![Flexible savings on Binance]()

Flexible savings on Binance -

Locked Savings: You can deposit savings for a specific period of time to earn a higher interest rate. The lock-up period typically ranges from 7 to 120 days. During this time, you can withdraw your principal investment, but if you withdraw before the agreed-upon term ends, you will forfeit any accrued interest generated during the savings period.

![Locked Savings on Binance]()

Locked Savings on Binance

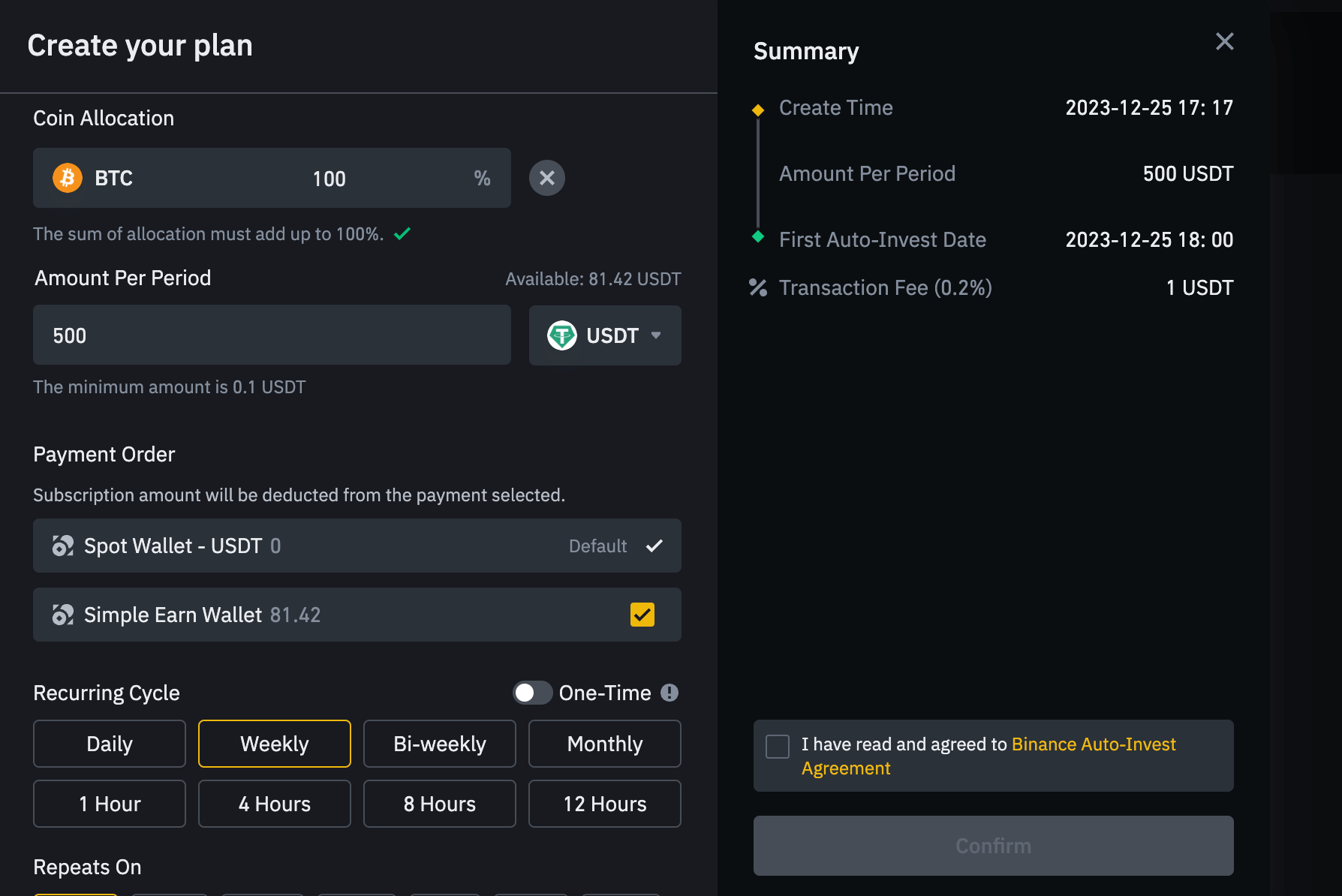

2.2. Auto-Invest

This is a feature supported by Binance for individuals who don't have the time to actively invest in the crypto market. It's particularly suitable for beginners or those without prior knowledge or experience in this market.

Binance's Auto-Invest feature supports users in setting up automated investment plans without the need for extensive research or monitoring of price fluctuations. You can gradually purchase a cryptocurrency multiple times according to a specified cycle, with a predetermined initial capital allocation, rather than investing all capital in one go.

The Auto-Invest cycles can be scheduled as follows:

- Every hour (1 hour, 4 hours, 8 hours, 12 hours)

- Daily

- Weekly

- Monthly

This feature leverages Dollar Cost Averaging (DCA) and automated capital allocation mechanisms, which help mitigate risks in case the cryptocurrency you intend to purchase experiences significant price volatility. The system automatically buys the cryptocurrency over time and according to your allocated capital, allowing you to minimize the need for constant market monitoring.

Trong hình trên là ví dụ minh họa cho việc đầu tư tự động mua BTC với số tiền 500$ hàng tuần. Tức là cứ mỗi tuần bắt đầu từ thời gian bạn thiết lập kế hoạch, hệ thống sẽ tự động mua BTC với khối lượng trị giá 500 USD.

Điểm đặc biệt của cơ chế Auto-Invest này không chỉ giúp bạn mua coin tự động với chiến lược DCA, mà còn tự động gửi tiết kiệm giúp bạn tạo ra thu nhập thụ động với lãi suất theo từng thời điểm của Binance.

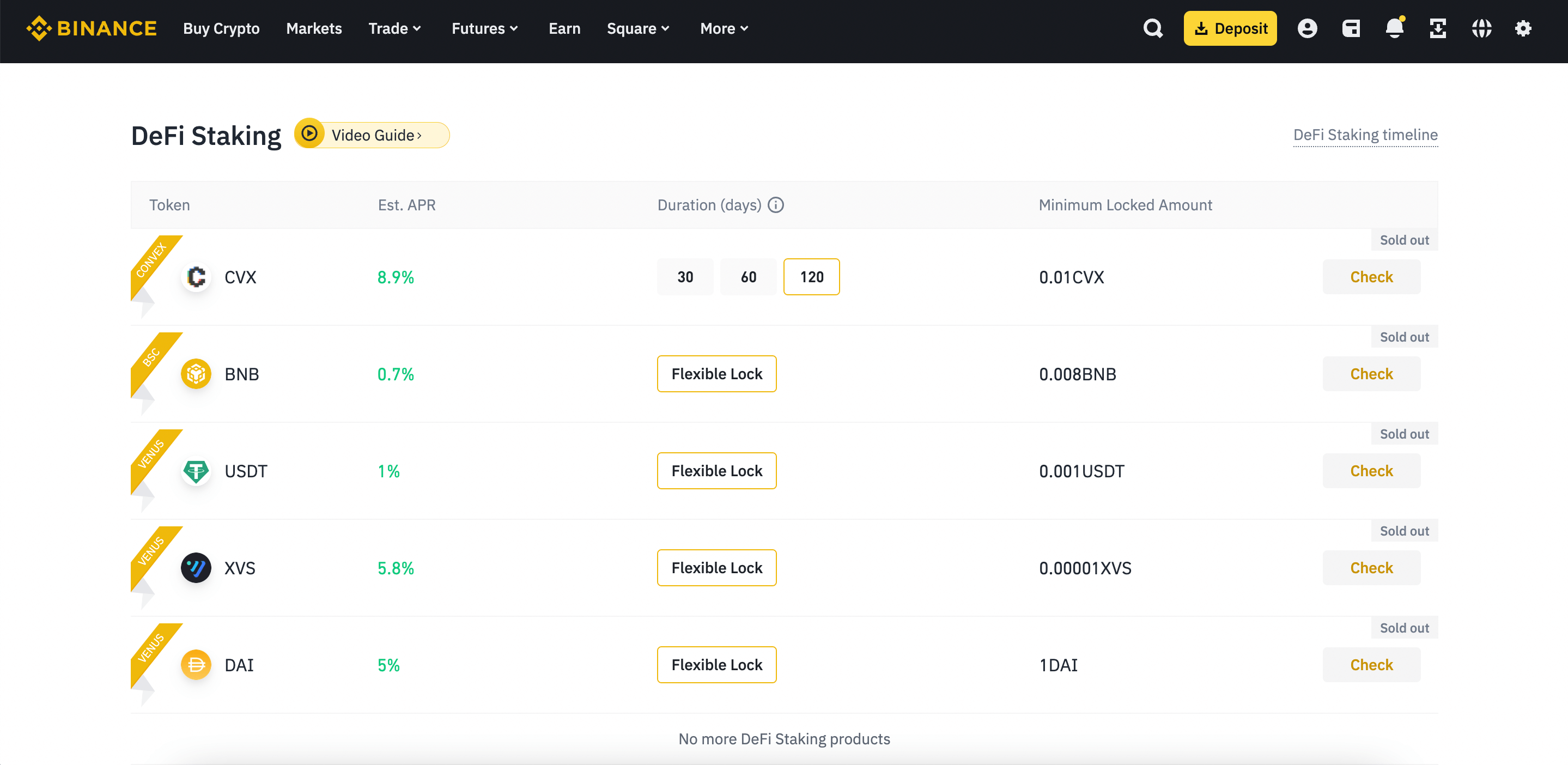

2.3. DeFi Staking

DeFi Staking on the Binance exchange involves placing cryptocurrencies into DeFi platforms to earn rewards, which are then distributed back to users based on specific ratios.

Investing in the DeFi market typically requires understanding various principles such as setting up personal wallets, securing them, connecting wallets, and using DeFi platforms for activities like lending, borrowing, staking, yield farming, etc. For newcomers, these processes are complex and demand a good understanding of the market.

However, Binance's DeFi Staking feature automates these processes for you. Your task is simply to select the investment type with an appropriate APY and the suitable cryptocurrency, then wait for Binance to distribute profits to you.

Advantages:

- Higher profits compared to other passive investment options.

- Simplified for beginners, enabling participation in DeFi projects without deep knowledge.

Disadvantages:

- Inherent risks associated with DeFi projects, such as platform hacks, team abandonment of projects, etc. Binance acts as an intermediary, so if DeFi platforms encounter issues, investors may bear the consequences, potentially losing their entire investment.

- The feature may not always be available and requires users to have a minimum capital requirement to participate. Therefore, preparation and careful monitoring are necessary when this feature is opened for additional opportunities.

In summary, while Binance's DeFi Staking feature simplifies participation in DeFi investments, it's crucial to be aware of the risks involved and to prepare adequately before investing.

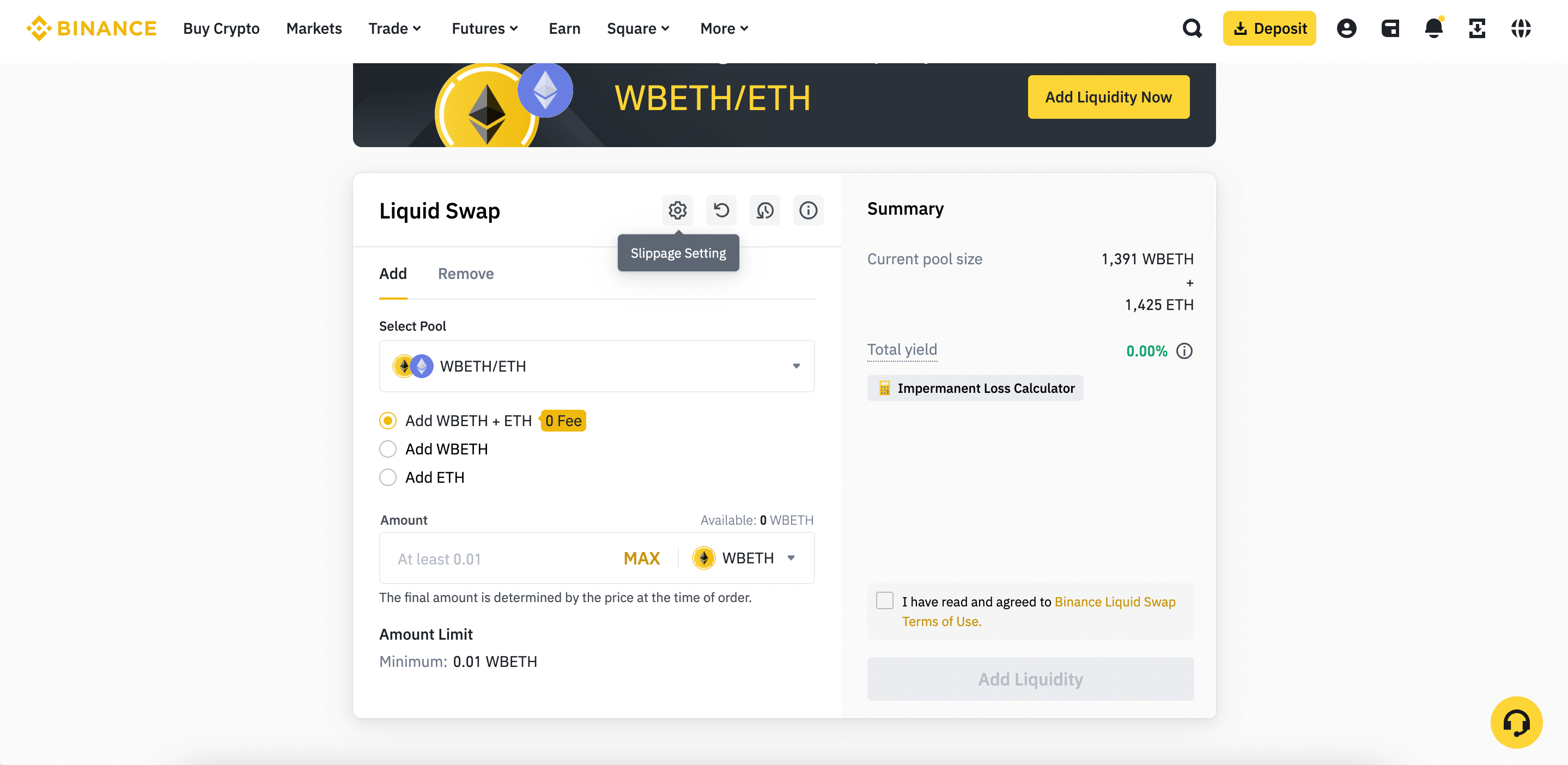

2.4. Liquid Swap

The activity of providing liquidity (Liquid Swap) involves depositing a certain amount of coins or tokens you own into a liquidity pool provided by the exchange to earn profits.

Exchanges operate on a model that relies on liquidity pools, which hold various coins and tokens to meet the buying and selling demands of users. Those who participate in providing liquidity to these pools receive a share of the platform's profits.

For this feature, you can choose to provide liquidity for both pairs of tokens A-B in each pool or individually provide liquidity for token A or token B.

Advantages:

- High profitability.

- No lock-up period for tokens; you can withdraw at any time.

Disadvantages:

- This method is safer compared to DeFi Staking but faces impermanent loss (IL) risk due to price divergences of tokens in the liquidity pool.

- Requires users to monitor price fluctuations regularly to mitigate risks effectively.

Providing liquidity in this manner allows you to earn profits from transaction fees while retaining flexibility in managing your assets. However, it's important to understand and manage the risks associated with impermanent loss, which occurs when the value of tokens in the pool diverges significantly. Regular monitoring is essential to respond to market movements effectively.

3. What are the risks from passive crypto investing?

In essence, any financial investment activity carries inherent risks. Even traditional investments and savings in banks entail risks, such as the possibility of bank insolvency leading to potential loss of funds. However, passive income methods on cryptocurrency exchanges are generally considered to have lower risk compared to other investment categories in the market.

In the crypto market, there are several common risks that users should consider:

3.1. Exchange Shutdown

When using services on a crypto exchange, you entrust your assets to the exchange. If the exchange encounters issues such as hacking or shutdown, you may lose access to your assets.

Although reputable exchanges like Binance, OKX, and KuCoin have lower chances of such incidents, nothing is completely risk-free. It's essential to have a capital allocation strategy and appropriate risk management, investing only funds you can afford to lose.

3.2. Price Volatility Risk

Investing in the crypto market often offers higher potential returns compared to traditional markets. However, this also means you face higher price volatility risks, especially with newer coins and tokens.

To mitigate some of this price volatility risk, you can choose to invest passively in stablecoins such as USDT and USDC. As mentioned earlier, these stablecoins are pegged 1:1 to the US dollar, resulting in lower price fluctuations compared to other coins and tokens. Participating in savings activities with these stablecoins typically ensures a stable return.

4. Conclusion

Creating passive income through crypto exchanges is a promising method, but it requires deep understanding and careful risk management. While many people profit from trading and investing in cryptocurrencies, it's also a highly volatile and risky field.

For those interested in generating passive income through crypto, thorough research and a solid understanding of projects and the market are crucial. Utilizing effective tools, strategies, and proper diversification can help participants capitalize on opportunities in this increasingly diverse and complex investment landscape.

If you don't already have accounts on reputable exchanges, you can register through the following links to take advantage of attractive offers:

English

English Tiếng Việt

Tiếng Việt

.jpg)