1. What is Blockchain?

At its heart, blockchain is a digital ledger that records transactions or data in a secure, transparent, and tamper-resistant way. Unlike traditional databases managed by a central authority—such as a bank or government—blockchain operates on a distributed network of computers, known as nodes. Each node maintains an identical copy of the ledger, ensuring no single entity can dominate or manipulate the system. This decentralization is what sets blockchain apart, fostering trust among participants without relying on intermediaries.

The name "blockchain" reflects its structure: data is stored in "blocks" that are linked chronologically to form a "chain." Each block contains a set of transactions, a timestamp, and a cryptographic hash—a unique code derived from the block’s contents and the hash of the previous block. This design makes altering a block nearly impossible without changing all subsequent blocks, ensuring the ledger’s integrity. Experts describe blockchain as a revolutionary approach to data management, emphasizing its ability to create trust in environments where parties may not inherently trust one another.

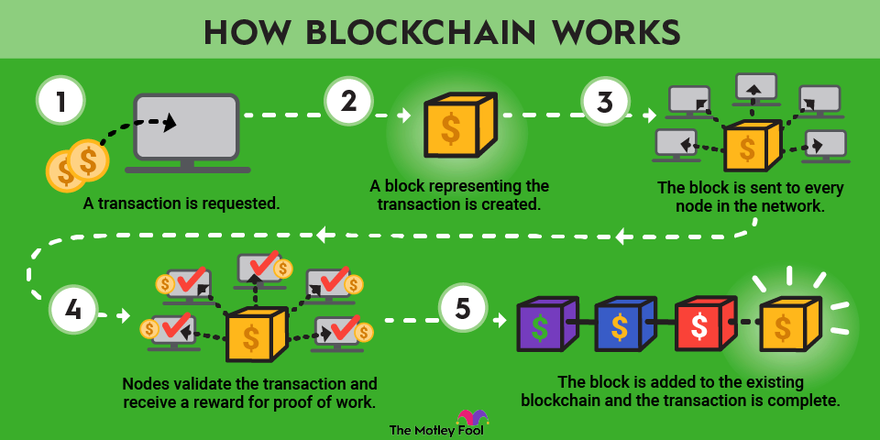

2. How Blockchain Works: A Step-by-Step Breakdown

Understanding blockchain requires a look at its operational mechanics, which combine cryptography, consensus algorithms, and decentralization. Here’s how it functions:

-

Transaction Initiation: The process begins when a user initiates a transaction, such as transferring cryptocurrency or recording a contract. This transaction is broadcast to the blockchain network.

-

Network Verification: Nodes across the network validate the transaction using predefined rules. For instance, in a cryptocurrency blockchain, nodes confirm whether the sender has sufficient funds.

-

Block Formation: Validated transactions are grouped into a block, which includes a cryptographic hash linking it to the previous block. This hash acts as a digital fingerprint, ensuring continuity.

-

Consensus Process: Before a block is added, the network must agree on its validity through a consensus mechanism. Popular methods include Proof of Work (PoW), where nodes solve complex mathematical puzzles, and Proof of Stake (PoS), where validators are selected based on their stake in the system.

-

Block Integration: Once consensus is achieved, the block is appended to the blockchain, and all nodes update their ledgers. The transaction becomes a permanent part of the record.

-

Immutability: The cryptographic linkage ensures that altering a block would require recalculating the hashes of all subsequent blocks—a task deemed infeasible in large networks.

This process, while technical, underscores blockchain’s strength: it creates a reliable, transparent system without centralized control. The launch of Bitcoin in 2009 by the pseudonymous Satoshi Nakamoto demonstrated blockchain’s viability, marking a pivotal moment in the technology’s history.

3. Defining Features of Blockchain

Blockchain’s appeal lies in its unique characteristics, which distinguish it from conventional systems:

-

Decentralization: By distributing control across a network, blockchain eliminates single points of failure, reducing risks like hacking or censorship.

-

Transparency: Public blockchains allow all participants to view transaction histories, fostering accountability. Private blockchains, meanwhile, limit access to authorized users.

-

Security: Advanced cryptography safeguards data, making unauthorized alterations extremely difficult.

-

Immutability: Once recorded, data cannot be easily changed, providing a trustworthy record.

-

Efficiency: By removing intermediaries, blockchain streamlines processes, cutting costs and delays.

These features have fueled blockchain’s adoption, with industries recognizing its potential to enhance trust and efficiency. For example, the 2015 launch of Ethereum, a blockchain platform enabling programmable smart contracts, expanded the technology’s scope beyond simple transactions, showcasing its versatility.

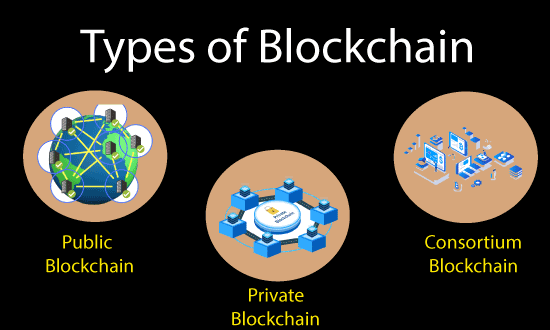

4. Types of Blockchains

Blockchain is not a one-size-fits-all technology. It comes in different forms, each suited to specific needs:

-

Public Blockchains: Open to anyone, these are fully decentralized. Bitcoin and Ethereum are prime examples, allowing global participation in transaction validation.

-

Private Blockchains: Restricted to specific users, these are often used by businesses for internal processes, prioritizing privacy and control.

-

Consortium Blockchains: Managed by a group of organizations, these balance decentralization with restricted access, ideal for collaborative industries like banking.

The diversity of blockchain types reflects its adaptability, enabling tailored solutions for various sectors. The rise of consortium blockchains, such as the Hyperledger project initiated in 2015 by the Linux Foundation, highlights how organizations collaborate to leverage blockchain’s benefits.

5. Real-World Applications

Blockchain’s versatility has led to its adoption across numerous fields, transforming traditional processes:

-

Cryptocurrencies: Blockchain underpins digital currencies like Bitcoin and Ethereum, enabling secure, intermediary-free transactions. By 2025, the global cryptocurrency market is valued at billions, reflecting blockchain’s financial impact.

-

Supply Chain Management: Blockchain enhances traceability, reducing fraud and ensuring product authenticity. Companies like Walmart have adopted blockchain to track food supply chains, improving safety and efficiency.

-

Smart Contracts: These self-executing agreements, popularized by Ethereum, automate processes like payments or property transfers. In 2021, the growth of decentralized finance (DeFi) platforms showcased smart contracts’ potential, managing billions in transactions.

-

Healthcare: Blockchain secures patient records, ensuring privacy and interoperability. Pilot programs, like those tested by IBM in 2020, aim to streamline medical data sharing.

-

Finance: Beyond cryptocurrencies, blockchain powers DeFi, offering lending and trading without banks. The 2023 surge in DeFi adoption underscored blockchain’s role in democratizing finance.

-

Voting Systems: Blockchain could ensure secure, transparent elections. Trials, such as Estonia’s blockchain-based e-governance initiatives since 2016, highlight its potential.

-

Digital Identity: Blockchain enables decentralized identity verification, reducing fraud. Projects like Microsoft’s ION, launched in 2021, aim to create secure digital IDs.

These applications demonstrate blockchain’s transformative power, with real-world events—like the 2022 adoption of blockchain by Maersk for shipping logistics—proving its practical value.

6. Challenges Facing Blockchain

Despite its promise, blockchain faces hurdles that must be addressed for widespread adoption:

-

Scalability: Many blockchains struggle with transaction speed. Bitcoin processes just 7 transactions per second, compared to Visa’s thousands, highlighting a gap in scalability.

-

Energy Consumption: Proof of Work blockchains, like Bitcoin’s, consume vast amounts of energy. In 2021, Bitcoin’s energy use rivaled that of some countries, sparking environmental concerns.

-

Regulation: Governments are still navigating how to regulate decentralized systems. The 2023 crackdown on unregulated crypto exchanges illustrated the tension between innovation and oversight.

-

Interoperability: Different blockchains often operate in silos, hindering seamless data exchange. Efforts like Polkadot, launched in 2020, aim to address this.

These challenges, while significant, are not insurmountable. Advances like Ethereum’s 2022 transition to Proof of Stake, which reduced energy use by 99.95%, show progress toward solutions.

7. The Future of Blockchain

Looking ahead, blockchain’s trajectory appears bright. Innovations like layer-2 scaling solutions, energy-efficient consensus mechanisms, and cross-chain interoperability are addressing current limitations. The 2024 rise of blockchain-based tokenized assets—such as real estate on platforms like RealT—suggests new economic models. Moreover, governments are exploring blockchain for public services, with initiatives like Dubai’s blockchain strategy, launched in 2016, aiming for city-wide adoption by 2030.

However, blockchain’s success hinges on balancing innovation with regulation and ensuring equitable access. If these challenges are met, blockchain could become a cornerstone of the digital age, fostering trust and efficiency across societies.

8. Conclusion

Blockchain is more than a technological novelty; it is a paradigm shift with the potential to reshape industries and empower individuals. Its decentralized, secure, and transparent nature addresses longstanding issues of trust and inefficiency, as evidenced by its growing adoption in finance, supply chains, and beyond. While challenges like scalability and regulation persist, ongoing advancements and real-world applications—from Ethereum’s smart contracts to Maersk’s logistics solutions—demonstrate blockchain’s viability.

In evaluating blockchain’s impact, it’s clear that its strengths outweigh its hurdles. The technology’s ability to foster trust without intermediaries positions it as a catalyst for a more connected, equitable world. As we move deeper into 2025, blockchain stands poised to redefine how we interact with data, transactions, and each other, making it a technology worth watching—and understanding.

Read more:

Tiếng Việt

Tiếng Việt