1. What is Copy Trade?

Copy Trade is an automated investment strategy in the cryptocurrency market. This method allows investors to mimic or automatically replicate the trades of experienced and successful traders.

Instead of focusing on market trend research or employing complex trading strategies, Copy Trade users simply identify successful traders and replicate their trades using automated software (Copy Trade platforms).

For example, if a copy trade software is following an expert investor investing $100 in coin A, the software will also allocate $100 to the same cryptocurrency.

Copy trade not only enables novice traders to use the trading formulas of experts but also helps them learn the skills needed to make informed investment decisions.

It's important to note that using copy trade does not guarantee profitable trades every time. Even professional traders make mistakes and have specific loss rates. Therefore, when using copy trade, it's essential to continuously monitor and evaluate the profit rates on the platform you are using for copy trading.

2. Advantages and disadvantages of Copy Trade

2.1. Advantages

-

Accessing numerous Pro Traders: Novice and less experienced investors can engage with and replicate the trading strategies of seasoned and successful traders in the cryptocurrency market.

-

Time Efficiency: Copy Trade offers a passive investment strategy, making it an appealing choice for those with limited time to analyze the market themselves.

-

Portfolio Diversification: Investors can easily diversify their portfolios by copying multiple traders with varied strategies, thereby spreading risk across different assets.

-

Learning Opportunity: Copy Trade provides a chance to learn from experienced Pro Traders, enabling you to closely observe their actions and gain detailed insights into crypto market dynamics.

-

Flexibility: Practitioners of Copy Trade enjoy high flexibility, able to switch the traders they follow or adjust their investment levels according to their preferences.

2.2. Disadvantages

-

Market Risks: Despite the potential benefits of copying traders, market volatility in the crypto space remains an unavoidable factor. Price fluctuations can be intense, potentially leading to losses even when replicating trades from experienced traders.

-

Dependence on Trader Performance: Your profitability is directly tied to the success of the traders you choose to emulate. If they experience setbacks, it can negatively impact your investment portfolio.

-

Control limitations: While trade copying offers convenience, it also means relinquishing some control over your investment decisions to the traders you follow, as they dictate the trading actions.

-

Price slippage: Due to potential delays in executing trades compared to the primary trader, especially in volatile markets, achieving similar results may be challenging. Some platforms may cancel orders if there's a significant disparity between the market price and the price used by the primary trader.

-

Profit sharing: You may be required to share a portion of your profits with the primary trader as a form of compensation for their trading expertise.

Advantages and disadvantages of Copy Trading

3. What do you need to participate in Copy Trading?

Selecting a skilled trader and a reliable trading platform are essential for achieving successful Copy Trading. Here are steps to begin with Copy Trade:

- Choosing a Copy Trade platform: Opt for a reputable platform that suits your cryptocurrency investment goals. Look for platforms offering a variety of experienced traders and detailed information about their trading history and strategies.

- Selecting Traders: The effectiveness of Copy Trade depends on the skill level of the traders (Pro Traders) you follow. Thoroughly research traders based on metrics such as trading profits, total managed capital, risk levels, follower count, and other relevant factors.

- Allocating Capital: Decide on the amount of capital you want to allocate for Copy Trading. This capital will be used to replicate trades from chosen traders based on their investment strategies.

- Note: It's important to allocate capital wisely and diversify to optimize potential profits.

- Monitoring and Learning: Monitor automated trades copied from the Lead Trader's portfolio. Copy Trading not only offers profit opportunities but also allows you to gain insights into traders' decisions and strategies.

4. Tips to maximize profit with Copy Trading

- Selecting quality traders: Conduct thorough research on the trading history and performance of traders before copying them. Consider factors such as profitability, risk levels, trading frequency, and strategy.

- Proper capital allocation: Avoid putting all your capital into one trader. Allocate your capital among multiple traders to mitigate risks. Clearly define your investment goals and risk tolerance.

- Monitor trader performance: Always monitor the trading performance of the traders and ensure their strategy aligns with your objectives. Evaluate and adjust your list of copied traders based on actual results.

- Learn Fundamental and Market Influencing Factors: Learn from each trade, both wins and losses, to understand the fundamentals and factors impacting the market.

- Adapt Your Copying Strategy Over Time: Don't hesitate to adjust your copying strategy as needed. Trust the selected traders' strategies and avoid making rapid changes based on short-term fluctuations.

- Patience in Profitability: Profit may not come immediately. Maintain patience and never surrender to market volatility.

5. The popular copy trading platforms

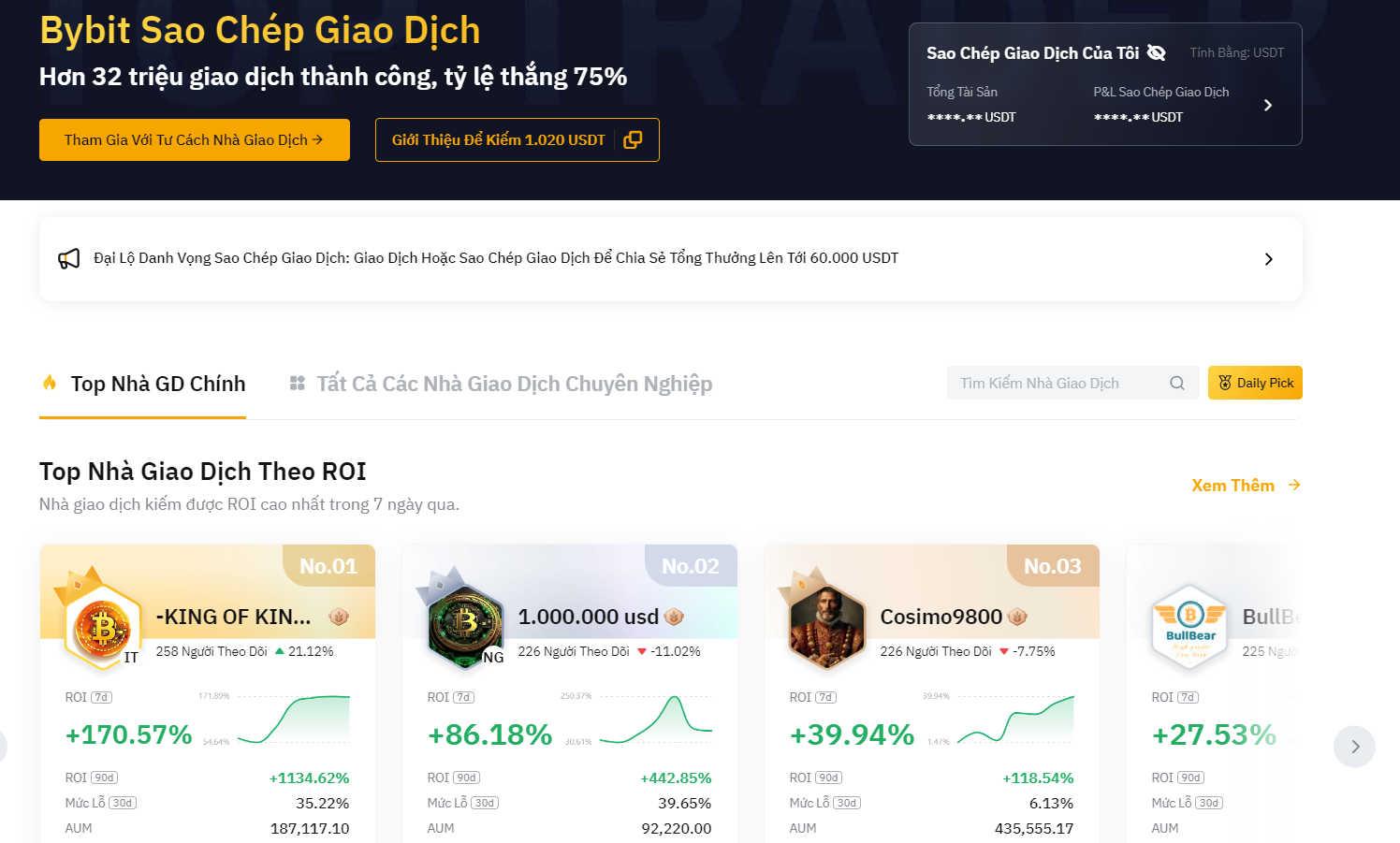

5.1. Bybit

Bybit is a renowned cryptocurrency exchange that offers Copy Trading features. Users can participate as Lead Traders or investors copying others. As a Lead Trader, users can earn a commission of up to 11%.

Advantages:

- A wide selection of traders to copy

- Customize your preferences, along with fund allocation options, user-friendly

- Up to 100x leverage

- $10 BTC free offer upon registration

- Automatic mode

- Online customer support

Disadvantages:

- Not available in the United States

- Fees may increase

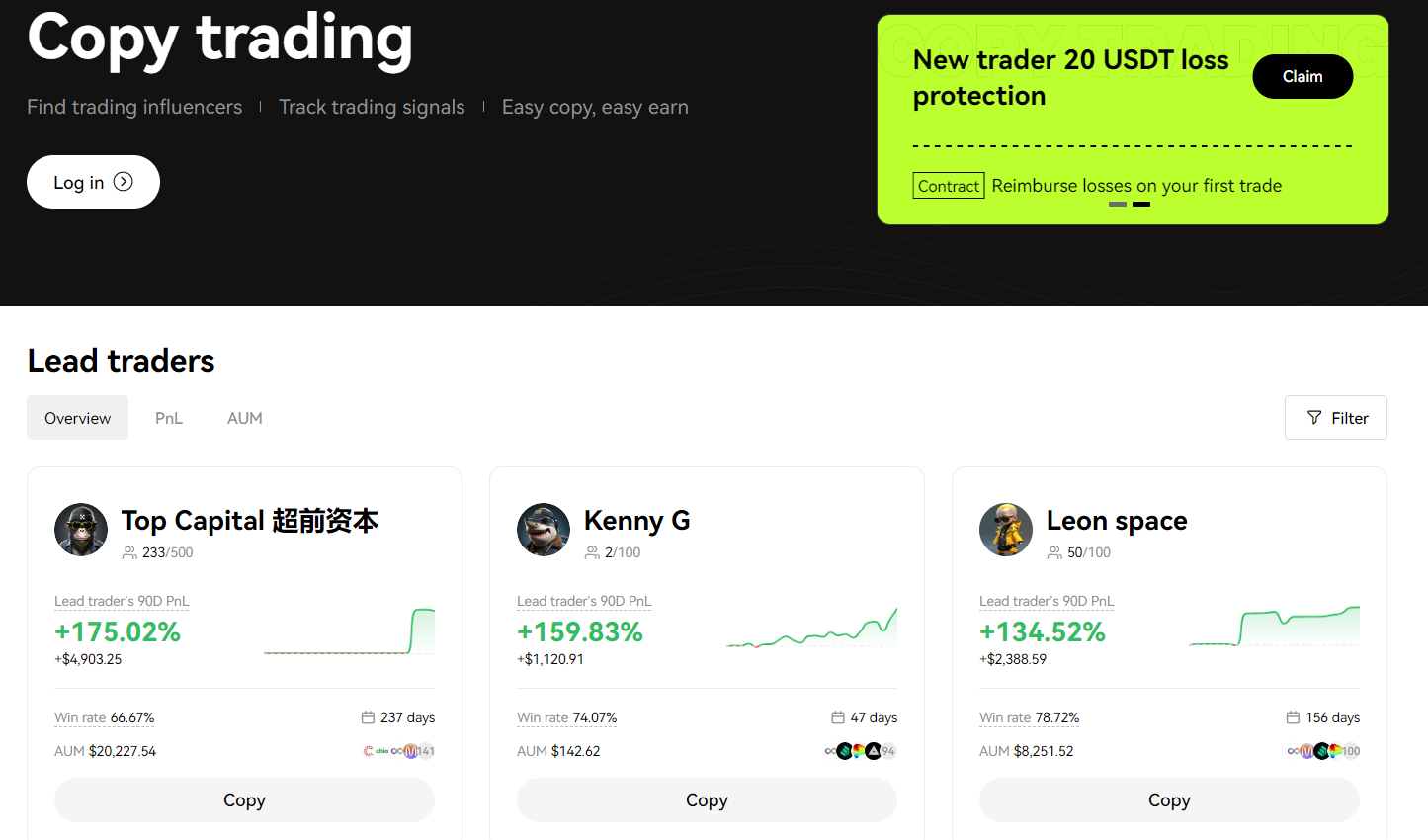

5.2. OKX

OKX exchange offers Copy Trading functionality, supporting a wide range of coins and over 114 trading pairs for users to explore. Professional traders can earn a 13% profit share from anyone copying their trades.

Advantages:

- Low fees

- User-friendly for beginners

- No deposit and conversion fees

- Ability to filter quality traders by assets under management (AUM)

Disadvantages:

- Not available for US residents

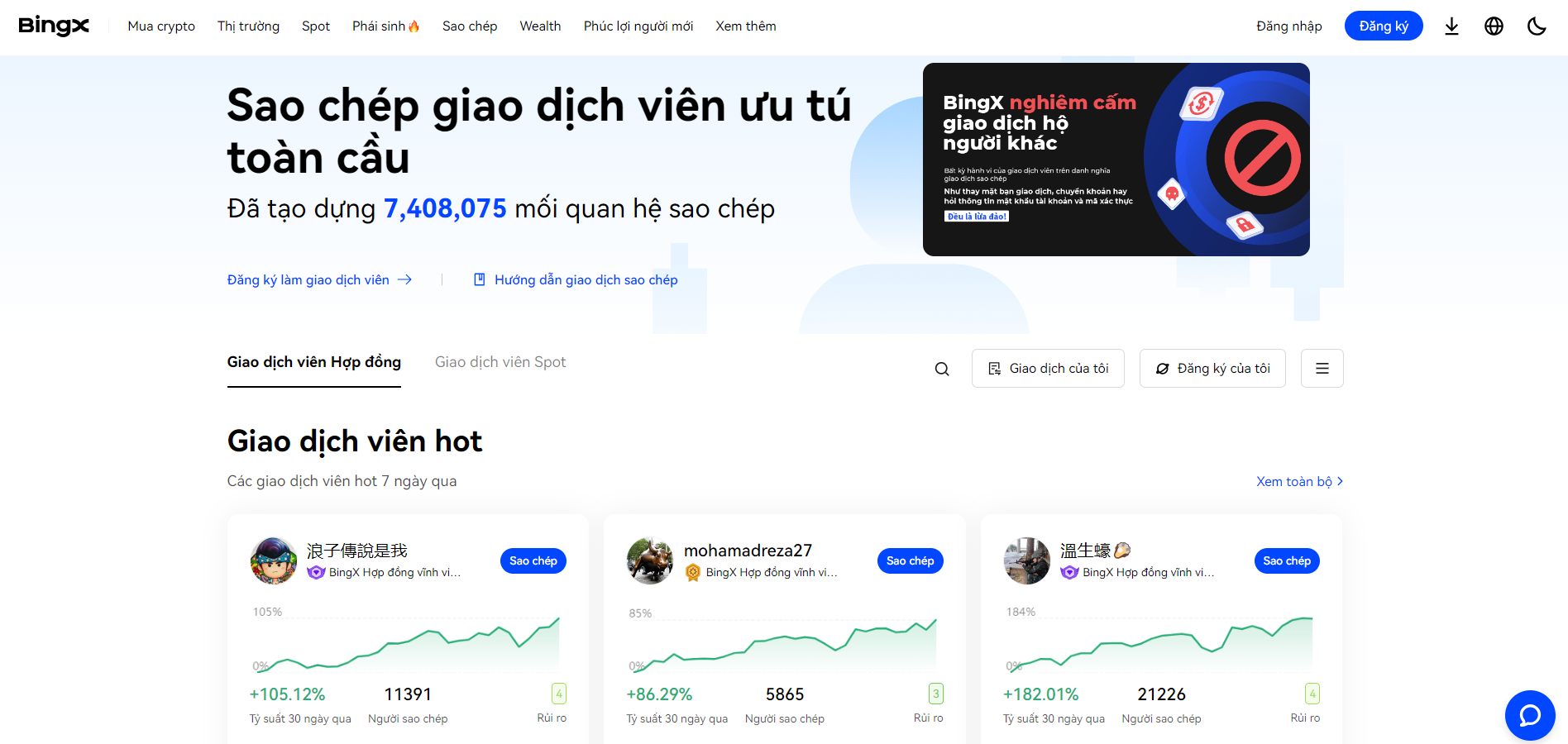

5.3. BingX

BingX is a cryptocurrency trading platform that offers users a straightforward and flexible Copy Trading feature. On BingX, users can evaluate the past trading performance of Lead Traders, define their risk tolerance, and choose whom they wish to copy.

Advantages:

- Active social trading community

- Easy-to-use interface

- Demo accounts available

Disadvantages:

- High trading fees

- Not available for US residents

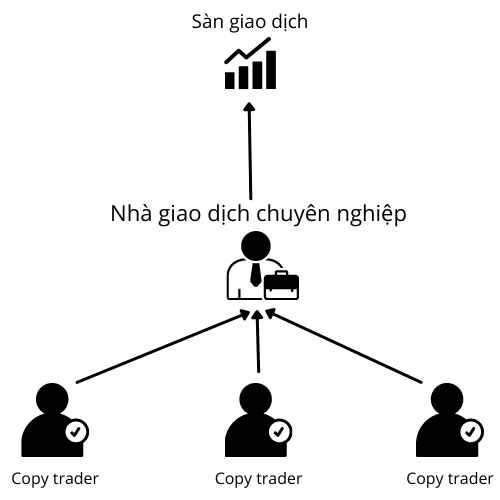

6. Entities participating in Copy Trading

Entities participating in Copy Trading

Copy trading is not just a collaboration between individual investors and trading experts but also involves other important intermediary entities. Here's a brief overview of the entities involved in copy trading:

Pro trader/master or professional investor:

Pro traders, or professional investors, possess deep knowledge and significant experience in financial markets. They not only execute intelligent trades but also analyze market trends based on signals and trading strategies.

Pro traders actively participate in trading activities, manage orders, and share information with their follower community so that others can replicate their trading strategies. In the event of profitable trades, pro traders earn a percentage of the profit as commission, motivating them to continue providing quality signals and effective strategies.

Copy trader/follower:

Copy traders are investors who follow the trading strategies of pro traders and decide how much capital to invest in each copied trade. When a copied trade is successful, copy traders pay a commission to the pro trader they copied, as a form of compensation and acknowledgment for the successful strategy.

Broker or brokerage platform:

Brokers or brokerage platforms act as intermediaries that record all trading orders of master traders. They provide detailed information and rankings of pro traders so investors can evaluate and choose suitable traders to copy. Additionally, brokers handle transaction fees and manage both master and follower accounts, facilitating the copy trading process smoothly.

7. 5 steps to master copy trading

7.1. Regularly review risk management metrics

Risk Management in Copy Trading

When participating in copy trading in the crypto market, there are several important risk parameters that investors should pay attention to in order to ensure they have a safe and sustainable strategy. Here are some key parameters:

- Risk Ratio: Determines the level of risk you are willing to accept per trade, often measured as a percentage of total invested capital.

- Number of Open Trades: Limits the number of simultaneous open trades to reduce risk and maintain risk management under control.

- Stop Loss Sets a maximum price level you are willing to accept to tolerate losses before cutting the trade.

- Take Profit Sets a price level to automatically sell when profits reach a certain threshold.

- Maximum Drawdown: The maximum amount your account can decrease before it begins to recover. Limiting drawdown helps protect your invested capital.

- Maximum Holding Time: Defines the maximum duration you will hold a position. This helps mitigate risks from unexpected market fluctuations.

- Risk Allocation: Allocates your investment capital across multiple strategies and copied traders to minimize the impact of an unsuccessful trade.

- Event Risk Control: Monitors major market events and ensures your copy trading strategy has preventive measures in place.

Nhớ rằng, mặc dù có những thông số này, việc quản lý rủi ro trong thị trường crypto vẫn là một thách thức. Nhà đầu tư cần liên tục đánh giá và điều chỉnh chiến lược của mình dựa trên điều kiện thị trường và sự thay đổi trong tình hình tài chính.

7.2. Choosing a reputable trading platform

When engaging in copy trading, it's advisable to choose platforms that are both transparent and reputable. These platforms should provide an overview as well as detailed insights into potential traders, including their trading habits, achieved results, and risk assessments.

Choosing a reputable Copy Trading platform

Besides that, it's essential to focus on reputable platforms widely used in the industry. Develop a habit of reading reviews, gathering user feedback, and verifying platform credentials.

If a demo version or trial is available, utilize it to explore features without any financial commitment.

You might consider reliable platforms such as Binance, Gate.io, and BingX.

7.3. Thoroughly Evaluate and Communicate with Copied Traders

You need to thoroughly check the trading history of traders you plan to copy. Look for evidence of consistent success in their risk management strategies and ensure their trading approach aligns with your goals.

There are several key criteria when evaluating traders for copy trading, such as trading history, win/loss ratio, number of followers, trading duration (at least 6 months), portfolio diversity, and risk management.

Additionally, pay attention to long-term performance statistics to assess their skills in managing various market situations. Take advantage of all interaction methods provided by the platform to communicate with traders and ask questions to understand their strategy logic better.

7.4. Diversifying Investment Portfolio

To minimize risks and maximize the benefits of copy trading, it's advisable to allocate your funds across multiple trading experts.

Diversification will limit the impact of any single trader on your overall investment portfolio to a minimum.

A balanced investment portfolio will enable you to copy traders using different strategies, gain exposure to various cryptocurrencies, and explore different trading timeframes.

7.5. Monitoring and Adjusting

Monitoring the performance of the traders you are copying is essential. Observe how they react to different market situations and any changes in their behavior. Always be prepared to make necessary adjustments, including switching out traders who are not meeting your goals.

Additionally, dedicate time to staying updated and researching market developments and news. Understanding the market can empower any trader to make informed decisions and capitalize on existing opportunities.

6. Conclusion

Copy Trading is becoming increasingly popular in the cryptocurrency community, offering investors the opportunity to benefit from the knowledge and experience of professional traders. Throughout this article, we have explored the strengths and weaknesses of Copy Trading, as well as important considerations when using this strategy.

The cryptocurrency market is highly volatile, and the decision to copy trades must be accompanied by careful consideration of personal risk tolerance and investment strategy. Understanding the strategy of the traders you are copying, managing risk diligently, and maintaining continuous monitoring are key to achieving optimal investment results.

Read more:

Tiếng Việt

Tiếng Việt

%20(21).png)

%20(19).png)

%20(18).png)