1. What are blockchain bridges?

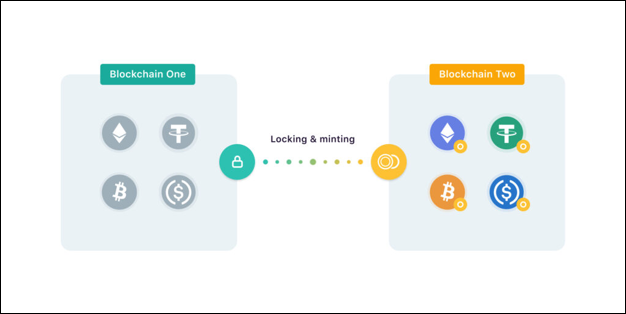

A blockchain bridge is a technology that enables the transfer of assets between different blockchain networks. These bridges play a crucial role in enhancing interoperability in the blockchain ecosystem, allowing data and assets to be shared across various networks. Without such a bridging mechanism, the utility of blockchain technology could be significantly limited, as it would be difficult to move assets from one blockchain to another.

For example, users can send Bitcoin to the Ethereum blockchain via a bridge, allowing Bitcoin holders to access decentralized finance (DeFi) applications that are native to Ethereum. This ability to move assets between chains opens up numerous possibilities for users, investors and decentralized applications (dApps).

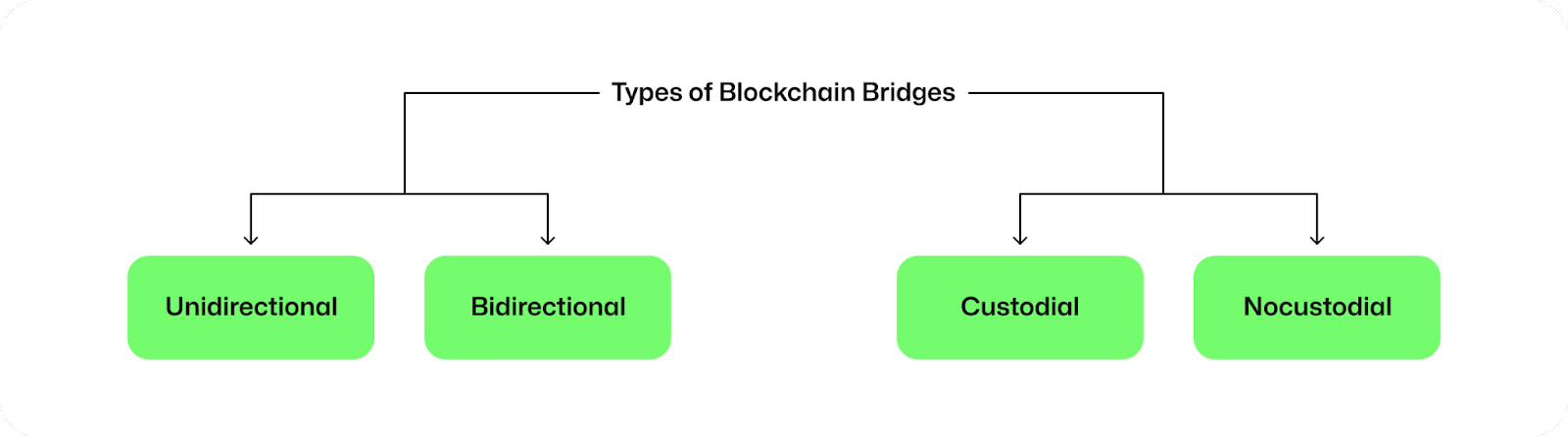

2. Types of blockchain bridges

There are different types of blockchain bridges, each with its characteristics and uses. These include unidirectional (one-way) bridges, bidirectional (two-way) bridges, and custodial vs non custodial bridges.

-

Unidirectional Bridges: These allow assets to be transferred to the target blockchain but not in the reverse direction. For instance, Wrapped Bitcoin (WBTC) allows Bitcoin to be converted to an ERC-20 token on the Ethereum blockchain but does not allow Ether to be sent to Bitcoin’s blockchain.

-

Bidirectional Bridges: These allow assets to move freely in both directions between blockchains. Examples include Wormhole and Multichain, where users can send assets like Solana to Ethereum and vice versa.

-

Custodial (Centralized) Bridges: In these bridges, a trusted third party holds the assets that are used to create bridged tokens. WBTC is an example of a custodial bridge, where assets are held in custody by BitGo.

-

Noncustodial (Decentralized) Bridges: These operate without a trusted third party, and the assets are held by the protocol itself. Bridges like Wormhole are examples of decentralized bridges, which aim to reduce the risk of a single point of failure.

Each type of bridge comes with different security implications. While decentralized bridges aim to reduce trust, they are still vulnerable to exploits, as seen in the Wormhole bridge attack.

3. Why use a blockchain bridge?

Blockchain bridges offer several key benefits, especially for users and investors in the cryptocurrency and DeFi space:

-

Cost Efficiency: Moving assets to a different blockchain might offer cheaper transactions and faster throughput. For example, transactions on the Ethereum blockchain can be expensive due to high gas fees. By using a bridge to transfer assets to a Layer 2 network like Polygon or Arbitrum, users can save on transaction costs while maintaining exposure to Ethereum-based tokens.

-

Access to New Markets: Bridges also allow users to access exclusive DeFi protocols available only on certain blockchains. For instance, Orca, a decentralized exchange, is available only on Solana, but a user can bridge ETH to Solana to use the platform.

-

Enhanced User Experience: Blockchain bridges are increasingly integrated into decentralized platforms and applications. This allows users to easily swap tokens across different networks without having to leave the platform, making the process more streamlined and user-friendly.

4. What are the biggest blockchain bridges?

As of early 2022, there is $21.8 billion worth of cryptocurrency locked in blockchain bridges. Some of the largest blockchain bridges in terms of total value locked (TVL) include:

-

Wrapped Bitcoin (WBTC): This is the largest bridge with a TVL of $10.2 billion, accounting for nearly half of the entire bridge market. WBTC allows Bitcoin to be used within the Ethereum ecosystem.

-

Multichain: Known as the largest cross-chain bridge, Multichain has a TVL of about $7 billion, providing users with seamless asset transfers between multiple blockchains.

-

Avalanche Bridge: This is the largest bridge for transferring assets from Ethereum to the Avalanche blockchain, with a TVL of around $6 billion.

Other notable blockchain bridges include Polygon, with $5 billion TVL, and Fantom’s Anyswap Bridge, which has a TVL of $4.2 billion.

5. Are blockchain bridges safe?

As with any financial technology, the security of blockchain bridges is a concern. While bridges enhance interoperability, they can also be vulnerable to exploits. A few examples of attacks include:

-

Wormhole Bridge Exploit: The Wormhole bridge was attacked, allowing the attacker to mint wrapped Ethereum (WETH) worth $120,000 without staking any ETH. The attack was possible due to a flaw in the bridge’s design, allowing unauthorized minting of assets.

-

Qubit Bridge Attack: Just a week prior to the Wormhole attack, Qubit, a decentralized bridge, was exploited, resulting in a loss of $80 million.

Despite the promise of decentralized bridges, they are not without risks. For custodial bridges, the primary risk lies in the centralized entity controlling the assets. If this entity is corrupt, negligent, or compromised (e.g., by government intervention), users' funds could be at risk.

6. Final thoughts

Blockchain bridges are an essential tool for anyone involved in the world of cryptocurrency, particularly for those who wish to take advantage of the benefits offered by multiple blockchains. They enhance interoperability and allow users to access different markets and protocols.

However, it is important to be aware of the potential security risks involved, especially when using newer or decentralized bridges. Users should also consider whether a custodial or noncustodial bridge suits their needs, depending on their security preferences. As blockchain technology continues to evolve, we can expect bridges to become even more robust and secure, contributing to the growing integration of various blockchain ecosystems.

Readmore:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)