1. What are Tariffs and how do they work?

Tariffs are essentially taxes that governments place on imported goods. Typically calculated as a percentage of the product’s value, tariffs increase the cost of foreign products, making them more expensive for consumers. For instance, a 25% tariff on a $10 item would increase its price by $2.50. Companies that import these goods are required to pay the tariff to the government, though they can choose to pass the additional costs onto consumers.

The tariffs Trump has implemented are part of his broader strategy to protect American jobs and industries. By making foreign products more expensive, he believes that consumers will be incentivized to purchase American-made goods, thereby stimulating the economy and reducing the trade deficit.

2. The Scope of Trump’s new tariffs

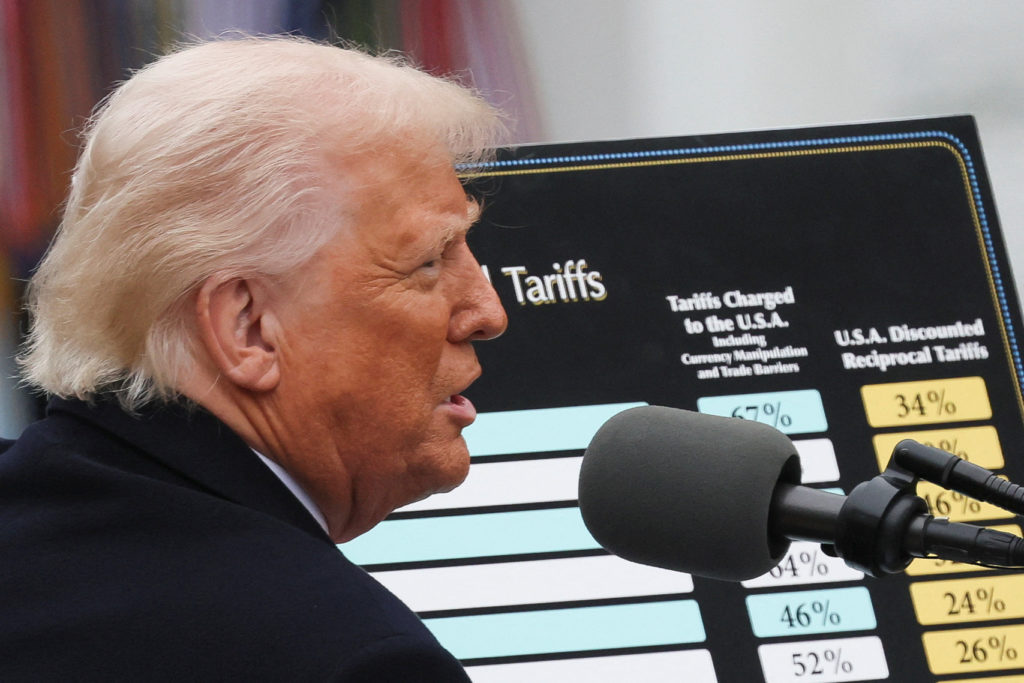

While the baseline tariff will start at 10%, certain countries will face even higher tariffs. Nations like Cambodia, Vietnam, Malaysia, and Bangladesh are set to be hit with tariffs as high as 50%. In comparison, UK goods will be subject to a 10% tariff, while imports from the European Union will be taxed at 20%. Furthermore, a previously announced 25% tariff on foreign-made cars will take effect from April 3, 2025. This measure aims to make domestic vehicle production more competitive, though it could raise car prices for consumers.

Trump’s administration has also made clear that these tariffs are a direct response to what he perceives as unfair trade practices by foreign nations, particularly those that have already imposed import charges on American products.

3. Vietnam Tariffs: A new target in the global trade war

In a significant expansion of his tariff policy, President Trump has announced a 46% duty on imports from Vietnam, effective from April 9, 2025. Vietnam, once a favored alternative for companies looking to avoid the crossfire of the US-China trade war, is now caught in the middle of Trump's expanding tariff targets.

For years, retailers and brands have turned to Vietnam to manufacture products like sneakers, apparel, and furniture as they shifted production away from China. Vietnam's growing role as a production hub had allowed companies to sidestep the economic friction caused by the US-China trade tensions. However, with the new tariffs on Vietnam, companies that relied on this strategy will now face higher costs.

The 46% tariff is set to significantly impact industries such as apparel, footwear, and furniture, which are heavily reliant on Vietnamese manufacturing. Notably, major brands like Nike, Adidas, and Steve Madden, which have seen a rise in production in Vietnam, will feel the pinch. Nike, for example, manufactures about 25% of its footwear in Vietnam, and the new tariffs could increase the cost of its products. The tariff hike is likely to lead to higher prices for consumers, especially as companies may pass these costs onto shoppers.

4. The economic impact on consumers and businesses

While Trump's tariffs are designed to benefit American manufacturers by encouraging the consumption of domestic goods, economists predict that these measures could drive up prices for US consumers. Products ranging from cars and steel to consumer goods like whisky, tequila, and avocados may become more expensive. As companies face higher import costs, they are likely to pass these costs onto consumers.

One of the most notable consequences is expected in the automotive sector. The 25% tariff on cars and car parts could significantly increase the price of vehicles, especially those made using components from countries like Mexico and Canada. Experts estimate that a car's price could rise by $4,000 to $10,000 due to the new tariffs. The car industry, which already faces a complex web of international supply chains, will be particularly impacted by these changes.

5. Trump’s Tariffs and the global trade landscape

While Trump’s tariffs are intended to bolster American industries, they are also leading to tensions in global trade. Several countries have already retaliated by imposing tariffs on US exports. The European Union, for example, has announced tariffs on US goods worth €26 billion, targeting products like bourbon, motorbikes, and steel. Canada has also implemented tariffs on US steel and aluminium, with Mexico considering similar measures.

These retaliatory tariffs are contributing to concerns of a potential global trade war, which could disrupt economies worldwide. The US's trading partners argue that such protectionist policies could harm global supply chains, lead to job losses, and create economic uncertainty.

6. Trump’s Economic Strategy

Trump’s tariff policy is central to his economic vision, which is focused on reshaping trade relations to favor American interests. He believes that the tariffs will force countries like China, Mexico, and Canada to address issues such as immigration and drug trafficking, which he sees as a threat to US security and economy. However, critics argue that the tariffs could provoke a recession, increase consumer prices, and hurt US exports.

Moreover, the uncertainty surrounding Trump’s trade policies has created an unpredictable business environment. Several tariffs that were initially introduced have been delayed, amended, or scrapped altogether, further contributing to market instability.

Conclusion

Trump's universal tariffs represent a significant shift in US trade policy, aiming to protect domestic industries and reduce the trade deficit. While these measures may benefit American manufacturers in the short term, they are likely to lead to higher prices for US consumers and strain relations with key trading partners. As the global economy adjusts to these changes, the long-term effects of Trump's tariff policies remain uncertain. The debate over the benefits and risks of tariffs will undoubtedly continue to shape America's economic landscape in the years to come.

Read more:

Tiếng Việt

Tiếng Việt.png)