1. The resurgence of Trade Wars in 2025

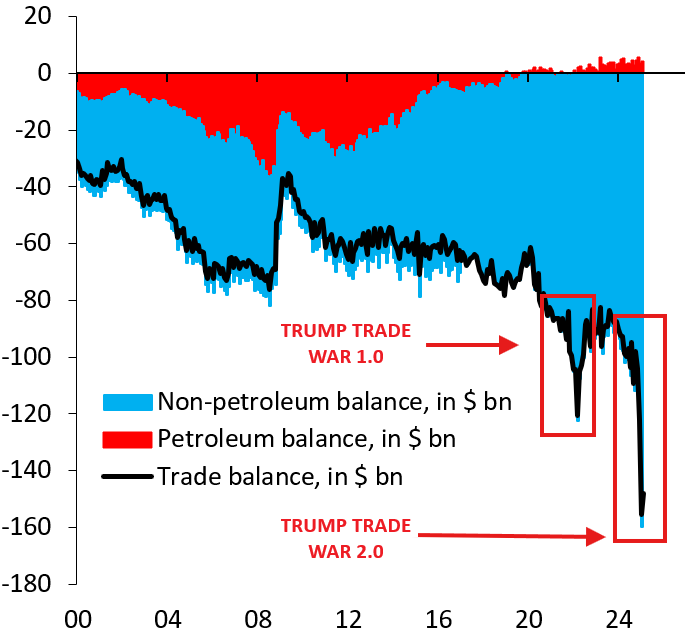

The year 2025 has marked a dramatic escalation in trade wars, driven by Trump’s protectionist agenda. Following his inauguration on January 20, the administration swiftly imposed a 25% tariff on imports from Canada and Mexico, alongside a 10% levy on Chinese goods, with additional measures like a 25% tariff on steel and aluminum announced in March.

These policies, aimed at reducing the U.S.’s $1.2 trillion trade deficit, have sparked retaliatory actions—Canada and Mexico vowed countermeasures, while China threatened legal action at the World Trade Organization. The uncertainty surrounding these tit-for-tat tariffs has rattled global markets, with the S&P 500 dropping over 7% since January and economists at Goldman Sachs slashing U.S. growth forecasts to 1.7% for the year. For cryptocurrencies, this macroeconomic turbulence has introduced both challenges and opportunities, as investors grapple with shifting risk appetites and inflationary pressures.

2. Short-Term volatility in the Crypto Market

The immediate impact of trade wars on cryptocurrencies has been a surge in volatility. Bitcoin, the market leader, exemplifies this trend—after hitting an all-time high of $109,200 post-inauguration, it plummeted to a three-week low of $91,000 in early February as tariff announcements triggered a sell-off across risk assets. Ethereum and smaller altcoins fared worse, with losses reaching up to 25% over a three-day period, the steepest since late 2022. This downturn reflects crypto’s growing correlation with traditional markets, a shift from its earlier days as an uncorrelated asset.

When trade war fears dampen economic growth prospects, investors often flee to safe havens like gold or the U.S. dollar, leaving Bitcoin and its peers vulnerable to sharp declines. Posts on X have noted that the crypto market, now valued at over $3 trillion—ten times its size during the last major trade war in 2018—experiences amplified swings due to its broader adoption and liquidity, a sentiment echoed by analysts observing weekend trading reactions to tariff news.

Yet, this volatility isn’t purely negative. Crypto products saw $1.3 billion in inflows in February, per CoinShares, as savvy investors capitalized on dips. Companies like Strategy, a Bitcoin treasury firm, resumed aggressive buying, snapping up 7,633 BTC for $742 million in early 2025, helping stabilize prices around $95,000 by March. This resilience suggests that while trade wars spark short-term turbulence, they also create buying opportunities for long-term believers in digital assets.

3. Long-Term Potential as an Inflation Hedge

Beyond the immediate chaos, trade wars are laying the groundwork for a potential crypto resurgence. Tariffs, by increasing the cost of imported goods, stoke inflation—a dynamic already evident in rising U.S. consumer prices for construction materials and electronics. The OECD warns that unchecked trade barriers could push global inflation higher, eroding the purchasing power of fiat currencies like the dollar. In this environment, Bitcoin’s narrative as a “digital gold” gains traction. Unlike gold, which has surged 10% year-to-date, Bitcoin’s growth component ties it to economic cycles, but its fixed supply of 21 million coins positions it as a hedge against currency devaluation over time. Analysts like James Butterfill from CoinShares argue that while tariffs may depress Bitcoin in the short term by slowing growth, the long-term inflationary fallout could drive adoption as investors seek alternatives to weakening fiat systems.

Stablecoins, too, are poised to benefit. In emerging markets hit by trade war fallout—think Argentina or Turkey, where capital controls and inflation are rife—stablecoins like Tether offer a stable, borderless store of value. Daily settlement volumes for stablecoins are projected to hit $300 billion by year-end, per VanEck, up from $100 billion in late 2024, as they integrate into global commerce amid trade disruptions. Trump’s pro-crypto stance, including an executive order banning a U.S. central bank digital currency (CBDC) and supporting private stablecoins, further bolsters this trend, potentially legitimizing their role in a fracturing global economy.

4. Key Drivers Shaping Crypto’s Response in 2025

Several factors are steering the crypto market’s reaction to trade wars this year. Regulatory shifts under Trump’s administration are a major catalyst—his nomination of crypto-friendly figures like Paul Atkins to lead the SEC and Brian Quintenz to head the CFTC signals a lighter regulatory touch. The establishment of a Presidential Working Group on Digital Asset Markets, led by David Sacks, aims to craft a supportive framework by mid-2025, potentially including a national Bitcoin reserve. This contrasts with the EU’s stringent Markets in Crypto-Assets (MiCA) rules, fully effective since December 2024, highlighting a regulatory divergence that could draw capital to U.S.-based crypto markets.

Market sentiment is another driver. Trade war uncertainty has pushed the U.S. Dollar Index (DXY) to mirror its 2016 trajectory, a period that preceded Bitcoin’s 2017 bull run. Analysts on X and platforms like BeInCrypto speculate that a weakening dollar, coupled with expanding M2 money supply, could ignite a similar rally by late 2025, with Bitcoin potentially reaching $160,000-$180,000. Meanwhile, institutional adoption—evidenced by Bitcoin ETFs now holding 7% of its market cap—provides a buffer against trade-induced sell-offs, deepening liquidity and tempering volatility compared to past cycles.

5. Broader Implications for Global Finance

The interplay between trade wars and cryptocurrency extends beyond price charts, hinting at a seismic shift in global finance. As tariffs fragment trade alliances, they accelerate the move toward decentralized systems. Tokenized securities, already worth $12 billion on blockchains like Provenance, are set to explode on public networks, per VanEck, offering liquidity to illiquid assets like real estate amid economic uncertainty. DeFi platforms, with trading volumes expected to top $4 trillion in 2025, could capture 20% of centralized exchange activity, driven by trade-disrupted markets seeking decentralized alternatives.

For everyday investors, the stakes are high. Trade wars amplify crypto’s dual nature—volatile risk assets in the short term, potential safe haven in the long run. Navigating this requires vigilance, as Edul Patel of Mudrex advises, emphasizing capital preservation amid news-driven swings. For the world economy, the tariff-crypto nexus underscores a broader trend: as traditional systems falter under protectionism, digital assets are stepping into the breach, reshaping how value is stored, moved, and traded.

6. Conclusion

In 2025, trade wars are both a curse and a catalyst for cryptocurrency. The immediate turbulence—Bitcoin’s dips, altcoin crashes—reflects a market still tethered to global risk sentiment. Yet, the underlying forces of inflation, regulatory support, and institutional embrace paint a brighter long-term picture.

Whether Bitcoin mirrors its 2017 surge or carves a new path, its fate is now intertwined with the trade war saga. Investors must stay nimble, balancing short-term caution with long-term optimism, as cryptocurrencies evolve from speculative novelties to pillars of a trade-warred world. In this volatile dance, the only certainty is change—and for crypto, that change could be transformative.

Readmore:

English

English Tiếng Việt

Tiếng Việt.png)