1. What is the Secondary Market?

.jpg)

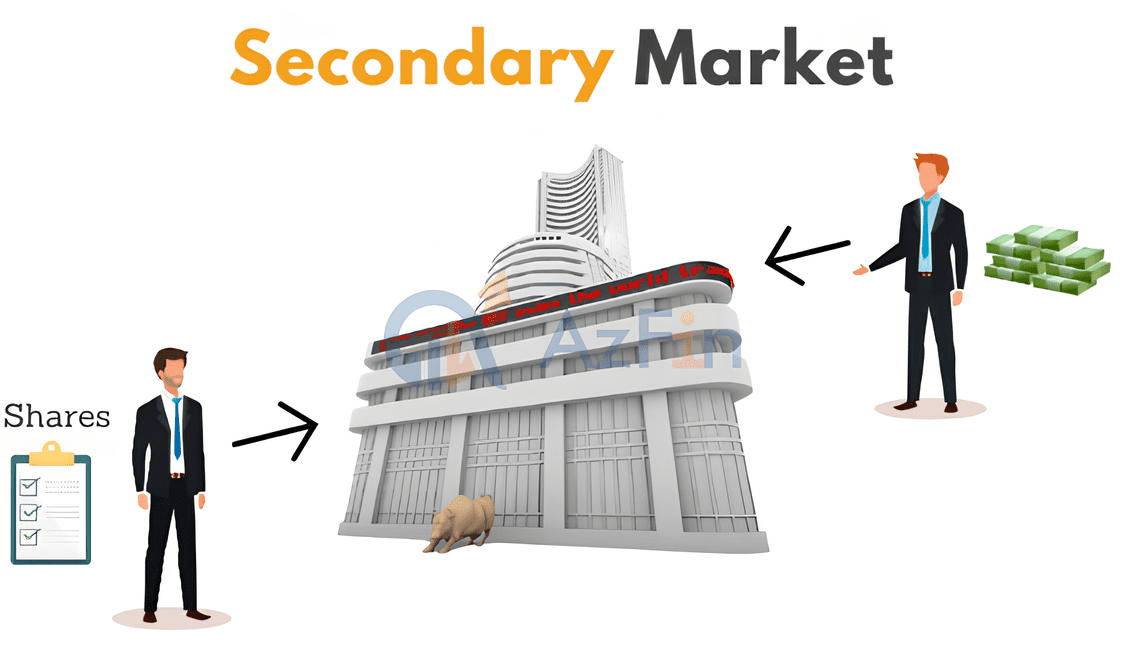

The secondary market plays a crucial role in the financial system because it provides a channel for investors and buyers/sellers to execute transactions after assets have been issued in the market.

In financial markets, the presence of a secondary market helps enhance asset liquidity, reduce risk for investors, and facilitate the valuation of assets.

The secondary market typically includes exchanges and electronic trading systems where investors can buy and sell financial assets after they have been listed on the official market. Transactions in the secondary market usually occur between individual investors, investment funds, or other financial institutions.

Examples of Transactions in the Secondary Market:

Binance Transaction:

An investor wants to buy 1 BTC at $30,000. They log into their Binance account, select the BTC/USDT trading pair, and place an order to buy 1 BTC at $30,000 USDT. If someone else agrees to sell 1 BTC at this price, the transaction will be executed, and the investor will own 1 BTC.

Swap token on Uniswap:

A user has 100 USDT and wants to exchange it for DAI. They connect their wallet to Uniswap, select the USDT/DAI pair, and perform a swap of 100 USDT for DAI. The transaction will be executed based on the current exchange rate in the liquidity pool, and the user will receive DAI in their wallet.

In some cases, the secondary market may become the primary venue for trading certain types of assets, especially when there are needs or specific factors affecting the liquidity of the primary market. For many investors, the secondary market is a crucial component of executing trading strategies and managing investment portfolios.

2. Importance and Practicality of the Secondary Market

The secondary market plays a significant role in the financial system due to its many important benefits, such as:

-

Enhanced Liquidity: The secondary market provides a platform for trading financial assets that have already been issued, enhancing liquidity by creating multiple options for buyers and sellers. This helps minimize the time and costs involved in finding suitable buyers or sellers in the market.

-

Risk Reduction: The secondary market offers opportunities for investors to exit unwanted investment positions, reducing investment risk by allowing for quick and efficient position liquidation.

-

Diversification: The secondary market offers a range of investment opportunities, enabling investors to diversify their portfolios. By investing in various asset types in the secondary market, investors can minimize risk and optimize potential returns.

-

Fair Pricing: The secondary market creates a mechanism for fair pricing by allowing investors to participate in the process of price determination based on supply and demand. This helps ensure that asset prices reflect their true market value.

-

Accessibility: The secondary market opens up opportunities for individual and retail investors to participate in financial markets and take advantage of investment opportunities. This creates a competitive and diverse environment in the market.

3. Risks of the Secondary Market

The secondary market also has drawbacks and risks that investors need to consider:

-

Liquidity Risk: Some assets in the secondary market may face liquidity risks, especially during market downturns or periods of market instability. This can make it challenging to sell assets and may lead to undesirable price reductions.

-

Sudden Price Drops: The secondary market can react strongly and suddenly to economic fluctuations or unexpected events, leading to abrupt price drops for assets. This can result in losses or even capital erosion.

-

Systemic Risk: The secondary market can be affected by systemic risks, including technical failures, system issues, or the collapse of financial institutions. Such incidents can cause significant losses for investors.

-

Lack of Transparency: Some secondary markets may lack transparency and oversight, leading to risks of fraud or unfair trading practices. This can result in substantial losses for investors without specialized knowledge.

-

Legal and Regulatory Risks: Secondary markets often face risks related to legal and regulatory issues, including changes in regulations, new control measures, or compliance problems.

-

Instability: The secondary market may experience instability due to economic, political, or market sentiment fluctuations. This instability can increase risk and cause anxiety for investors.

5. Differences Between Primary and Secondary Markets

| Criteria | Primary Market | Secondary Market |

| Definition |

|

|

| Participants |

|

|

| Purpose |

|

|

| Pricing |

|

|

| Specific Examples |

|

|

| Liquidity |

|

|

| Risk |

|

|

6. Conclusion

The secondary market is a crucial part of the global financial system and provides numerous attractive investment opportunities. However, participating in this market requires careful consideration and knowledge to ensure that investors can leverage opportunities without encountering unwanted risks.

Read more:

English

English Tiếng Việt

Tiếng Việt