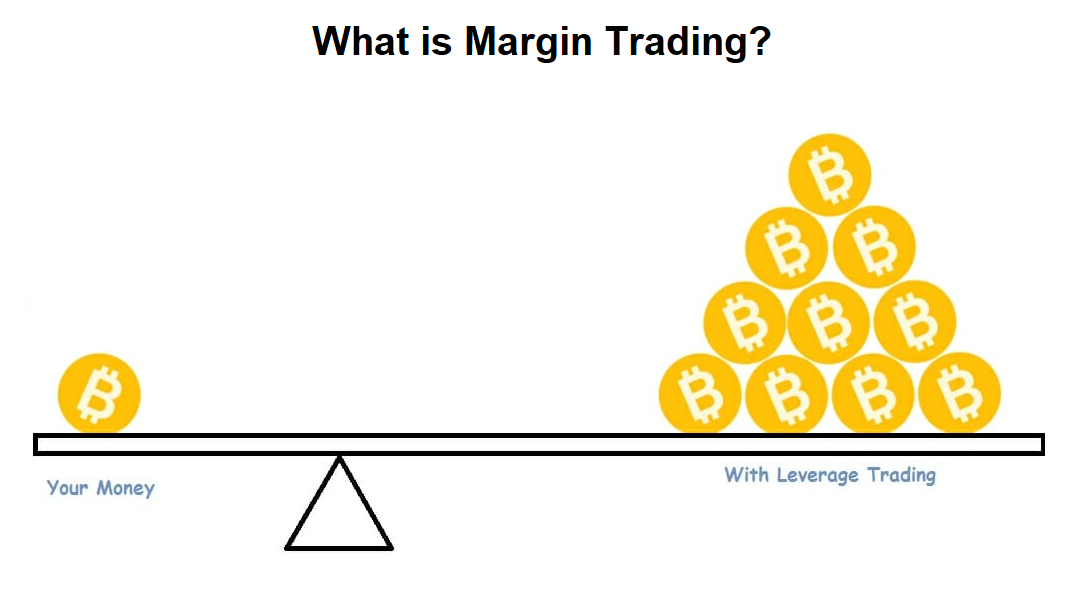

1. What is Margin?

Margin refers to the amount of money an investor borrows from an exchange to purchase assets. It allows investors to buy more assets than their available capital would otherwise permit. Margin trading can amplify potential profits but also comes with greater risks, as losses are magnified as well.

2. Margin Trading Operation

Margin trading operates on the principle of leverage. Investors deposit a margin amount and borrow the remainder from the exchange. The exchange requires a minimum margin ratio, typically a percentage of the total transaction value. If the asset's price drops and the margin balance falls below the minimum threshold, the investor will receive a margin call, demanding additional funds be deposited into the account or the position be closed to mitigate risk.

3.Common Types of Margin

Margin isolated chỉ sử dụng một phần cụ thể của số dư tài khoản làm ký quỹ cho một vị thế cụ thể. Điều này giúp giới hạn rủi ro cho từng vị thế riêng lẻ và bảo vệ số dư tổng thể của tài khoản.

-

Fixed Margin: Requires investors to maintain a fixed margin ratio throughout the position's duration. This is the simplest type of margin and is suitable for beginners.

-

Variable Margin: Allows the margin ratio to fluctuate based on market conditions and the risk level of the position. This type is more complex but also more flexible, making it suitable for experienced investors.

-

Cross Margin: Utilizes the entire balance of the investor's account as margin. This helps maximize capital usage and minimize the risk of a margin call but can result in the loss of the entire account balance if the trade goes against the investor.

-

Isolated Margin: Uses only a specific portion of the account balance as margin for a particular position. This limits the risk to that specific position and protects the overall account balance.

4. Benefits of Margin Trading

-

Enhanced Profits: Margin trading allows investors to use leverage to boost profits from trades. With the same amount of capital, investors can control a larger amount of assets and achieve higher returns if the asset price rises.

-

Diversified Portfolio: By using margin, investors can diversify their portfolios without increasing the initial capital. This helps to reduce risk and increases the potential to earn from various sources.

-

Trading Flexibility: Margin provides flexibility for investors in managing and capitalizing on market opportunities. Investors can quickly open and close positions, taking advantage of short-term price movements to profit.

5. Risks of Margin Trading

-

Large Losses: While margin trading can lead to high profits, it also carries the risk of large losses. If the asset price falls, losses are amplified due to leverage, and investors may lose more than their initial capital.

-

Margin Call Risk: If the margin balance falls below the required minimum, investors will receive a margin call, requiring additional funds or position closure. This could force the sale of assets at unfavorable prices and result in significant financial damage.

-

Psychological Pressure: Margin trading can impose significant psychological pressure on investors due to market volatility and the risk of losing capital. This pressure can affect investment decisions and lead to poor decision-making.

6. Risk Management in Margin Trading

-

Set Stop-Loss Levels: Establish stop-loss levels for each trade to limit the maximum loss you can tolerate. This helps protect your capital and minimize the risk of losing the entire account balance.

-

Use Leverage Wisely: Employ leverage at levels you can manage effectively. Avoid using all your capital for margin trades to prevent the risk of losing your entire asset base.

-

Diversify Your Portfolio: Diversify your investments to mitigate the risk associated with any single asset. This helps protect your capital and increases the opportunity to earn from various sources.

-

Monitor the Market Closely: Keep a close watch on market movements and price fluctuations to adjust positions timely and reduce risk. This helps in making informed investment decisions and safeguarding your capital.

7. Effective Margin Trading Strategies

-

Technical Analysis: Use technical analysis tools to forecast price trends and identify entry and exit points. Technical analysis helps you seize trading opportunities and optimize profits.

-

Stay Informed About News and Events: Keep track of news and events related to the market to identify potential opportunities and risks. Economic, political, and social news can significantly impact asset prices and create margin trading opportunities.

-

Combine Long-Term and Short-Term Strategies: Integrate both long-term and short-term trading strategies to exploit market opportunities. Long-term strategies help you hold potential assets over extended periods, while short-term strategies allow you to capitalize on short-term price fluctuations for profit.

8. Conclusion

Understanding margin and knowing how to trade on margin effectively are crucial factors for success in the crypto market. Always maintain a clear mindset, conduct thorough research, and apply smart trading strategies to optimize profits and minimize risks. Investing is a long journey, and patience and discipline will help you achieve sustainable success.

Read more:

English

English Tiếng Việt

Tiếng Việt