1. What is Ponzi?

1.1. What is Ponzi Scheme?

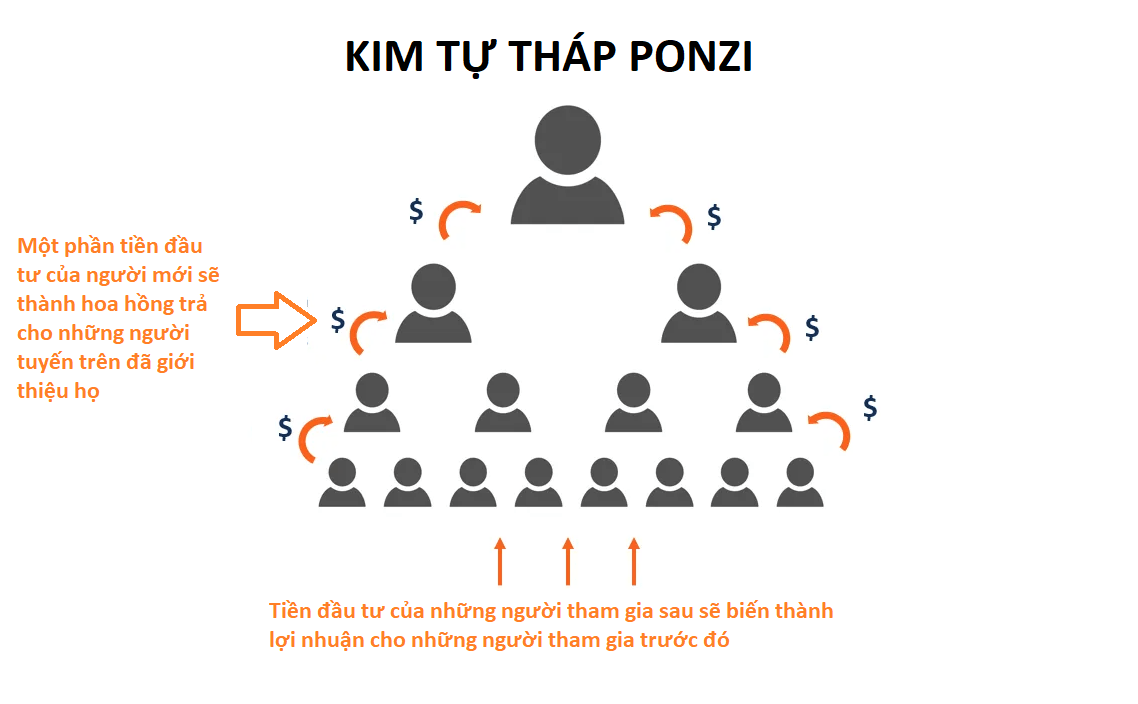

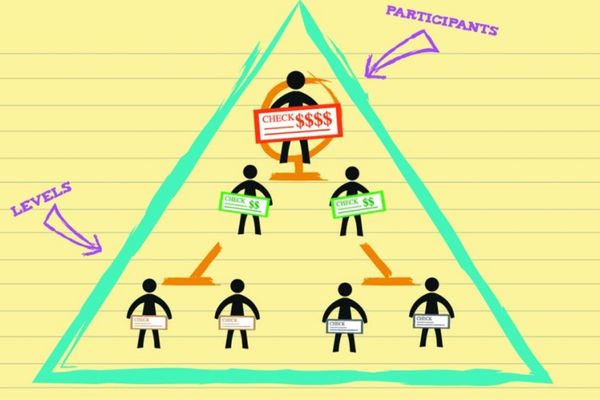

The Ponzi model, also known as a pyramid scheme, is a type of disguised scam that operates by promising high returns to investors using the funds of new investors to pay earlier investors, rather than generating real profits from legitimate investments.

Today, Ponzi schemes can manifest in various business forms, including product sales, stock market investments, or even cryptocurrency transactions. The investment methods in these schemes are often promoted as easy ways to achieve high profits, creating an illusion of quick and simple wealth accumulation.

However, when new entries dry up, the Ponzi model loses momentum and usually collapses, causing participants to lose their investments. Investors should always be wary of unrealistic yield promises and thoroughly vet any investment opportunities to avoid falling into Ponzi schemes or other financial scams.

1.2. Origins of the Ponzi Model

The Ponzi model is named after its creator, Charles Ponzi. Charles Ponzi was an Italian businessman born in 1882, who became famous for his financial fraud campaign in the United States during the 1920s.

Ponzi created this model by exploiting the price differences between international currencies. He promised investors extremely high returns (up to 50% in 45 days) by purchasing vouchers issued by the International Respighi Agency in Italy, which were redeemable in postage stamps. Ponzi mainly paid returns using the money from new investors to pay earlier ones.

Charles Ponzi’s fraud campaign began in late 1919 and quickly attracted public attention with promises of high returns. However, as the number of new investors was no longer sufficient to pay the earlier ones, Ponzi’s scheme collapsed.

Charles Ponzi was arrested in August 1920 and subsequently sentenced to prison. Although his scheme lasted only a short time, it became a symbol of financial fraud, and the term "Ponzi" has since been used to describe any similar fraudulent financial system.

2. Signs of Ponzi Schemes in Crypto

In the crypto realm, where projects and ICOs (Initial Coin Offerings) are prevalent, spotting a Ponzi scheme can sometimes be challenging. Here are some warning signs:

-

Extremely High and Unreasonable Returns: Ponzi schemes often promise extremely high returns, well beyond traditional investment opportunities. Given the inherent risks and volatility in crypto projects, sudden high returns can be a red flag. If a project promises returns far above market norms, reconsider.

-

Lack of Transparency: Ponzi schemes are typically opaque about how they generate profits and may keep accounting information secret. If a crypto project lacks clear and transparent information, it is a warning sign. Investors should know how their money is used, where it is invested, and where the profits come from.

-

Paying Returns from New Deposits: A significant indicator of a Ponzi scheme is when returns are paid to earlier participants from the investments of new participants, rather than from any real investment activity of the crypto project.

-

Dependence on New Investors: A Ponzi scheme can only remain sustainable if there is a continuous influx of new capital. Without new entries, the system usually collapses.

-

Promises of Quick and Easy Profits: Ponzi schemes often create the illusion of making quick and easy profits without needing knowledge or investment risk.

-

"Get Rich Quick" Orders and Flashy Advertising: If a crypto project overly emphasizes rapid and flashy returns without clear explanations about the infrastructure and business model, it could be a warning sign.

Crypto investors should always be cautious and conduct thorough research before engaging in any investment opportunities, especially if there are signs resembling a Ponzi model. This helps protect their assets from financial scams.

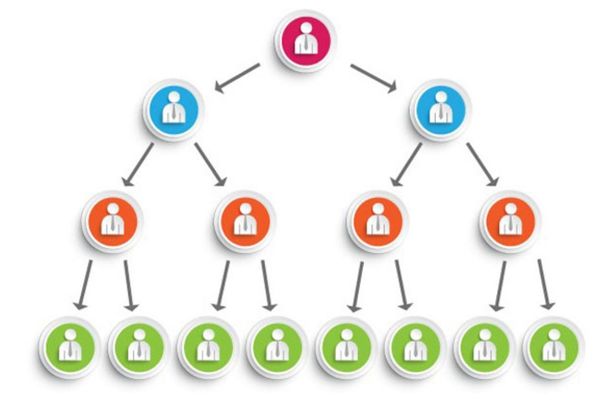

3. The operation of Ponzi Model

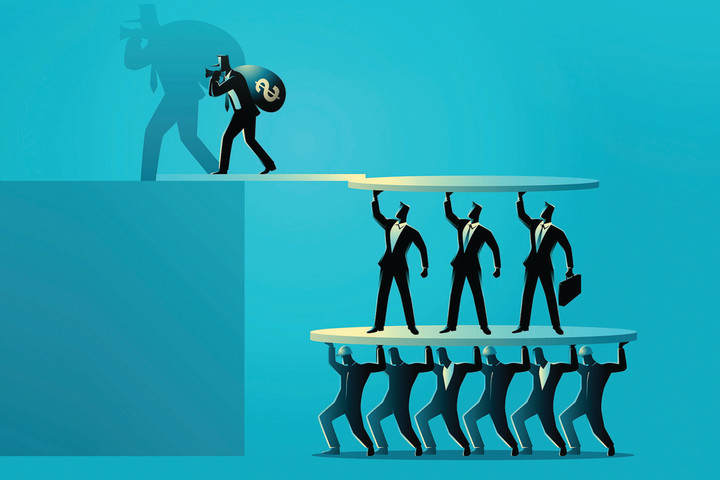

In Vietnam, Ponzi schemes are often referred to as "multi-level" schemes. This describes the main operational structure of such models. Participants are usually divided into different levels based on the number of new members they can attract. The highest level is typically occupied by the person who founded and runs the scheme.

Participants are drawn in by the promise of high returns, which motivates them to seek and recruit new members. The money brought in by new participants is used to pay returns to those higher up. As more people join, the pressure to pay returns increases, requiring even more new participants to ensure enough funds to pay earlier members.

Eventually, when the number of new participants is insufficient to cover the returns for those above, the total investment reaches a maximum level. The mastermind then withdraws and escapes with the entire amount.

Members in a Ponzi scheme are typically categorized into the following groups:

-

Founders (Schemer): These individuals set up the scheme, create the image, and build a personal brand to attract others. They often portray themselves as successful entrepreneurs with excellent persuasion skills.

-

Early Investors (Investor): These are the initial participants invited by the Schemer. They invest large sums of money, believing they will receive high returns from commissions without having to do anything.

-

Introducers (Ponzi Introducing Investor): These people join the scheme without investing much or at all. They are paid by those higher up to recruit others, earning commissions from the people they attract.

4. Reasons Crypto Investors Fall into Ponzi Traps

One major reason crypto investors fall into Ponzi schemes is a lack of knowledge and experience in the market. Faced with high return promises, they can easily be swayed by attractive language and become influenced by psychological factors.

Another important factor is the professionalism of those running the schemes in creating enticing "bait." Often, multiple individuals collaborate to create an appealing system. In such cases, investors usually follow the path laid out for them.

While everyone is aware of the relationship between risk and return in the crypto market, Ponzi schemes promise high returns from the outset, despite the high risk. The allure of these returns often impairs the investor's ability to assess risks critically and leads them into traps.

5. Notable Ponzi Scheme Cases

Many Ponzi schemes have occurred worldwide. Here are some notable and influential cases:

-

Bernie Madoff (2008): Bernie Madoff was an investor and founder of an investment fund. He ran a massive Ponzi scheme, defrauding billions of dollars from thousands of investors over many years. This case resulted in massive losses and a major shock in the financial world.

-

Zeek Rewards (2012): Zeek Rewards was an online investment program considered a Ponzi scheme. It promised high returns through the purchase of "advertising points" and recruiting new members. When the program closed, thousands of people lost money.

-

BitConnect (2018): BitConnect was a cryptocurrency investment project that promised high returns through lending and trading virtual currencies. When the scheme was exposed as a Ponzi scheme, the token's value plummeted, and many investors lost money.

-

OneCoin (2017): OneCoin was a cryptocurrency project many believed to be a Ponzi scheme. The founder promised high returns and collected billions of dollars from millions of investors before being shut down by authorities.

These fraud cases clearly illustrate the dangers of Ponzi schemes and serve as warnings to investors about the risk of losing assets when engaging in projects with dubious origins and overly enticing promises.

6. How Crypto Investors Can Avoid Ponzi Projects?

To avoid falling into Ponzi schemes and protect your assets, here are some effective strategies:

-

Conduct Thorough Research: Before embarking on any investment journey, avoiding Ponzi schemes—where funds from new participants are used to pay older ones—is crucial. To protect your assets and choose sustainable investment opportunities, thoroughly research the project founders' credibility, the project's infrastructure, and technology. Additionally, check relevant licenses and certifications to ensure the project is registered and compliant with legal regulations.

-

Beware of Promises of Profits: Be cautious of projects promising inherently high returns with no risk. Avoid projects that advertise returns significantly higher than the market, as this is often a sign of unsustainable models. Assess investment opportunities by understanding the business model, logic, and sustainability of the project to ensure safety and make informed choices.

-

Analyze Commission Structures: Be wary of projects with complex and opaque commission structures, or those heavily reliant on recruiting new members. Checking forums and review sites can help you gather information from the investment community, providing a broader view and helping you avoid unwanted risks.

-

Diversify Your Portfolio: Maintaining a diversified investment portfolio is a smart strategy. Avoid putting all your assets into a single project or asset type to minimize risk and optimize potential returns. Use secure wallets to protect your cryptocurrency assets from unexpected loss.

-

Stay Vigilant and Cautious: Always remain alert and cautious. Watch out for projects with complex, opaque commission structures, and especially those requiring you to recruit new members for profits. By doing so, you can build a solid, safe investment strategy with long-term value.

7. Conclusion

In summary, Ponzi schemes are a significant threat to investor asset safety. These fraudulent schemes continue to evolve and become more complex, posing challenges to market participants. To avoid falling victim to Ponzi scams, it is essential to stay informed, conduct thorough research, and remain vigilant. Remember, awareness and wisdom are key to protecting yourself from the challenges of a volatile market.

Read more:

English

English Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)