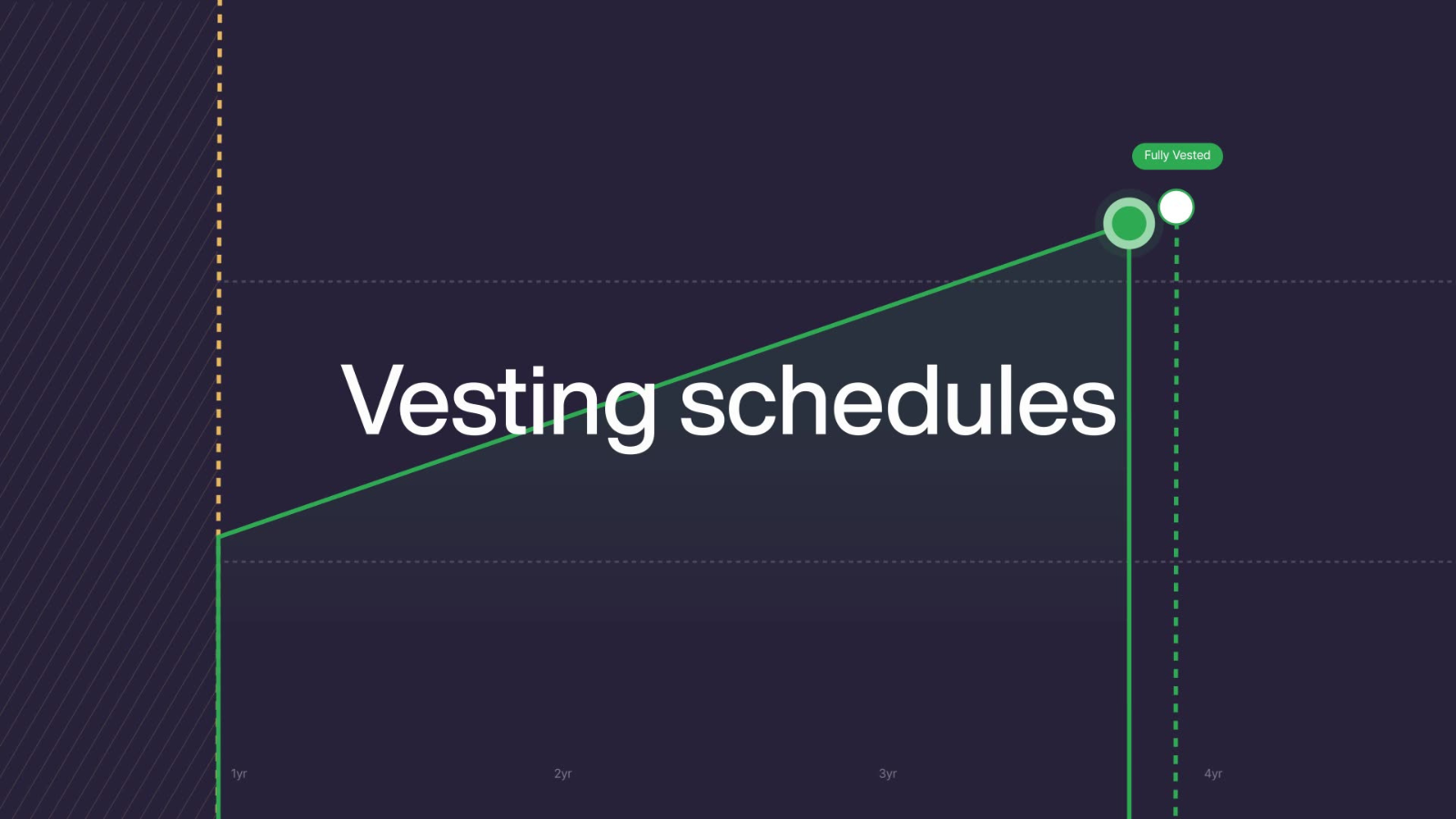

1. What is a Vesting Schedule?

A vesting schedule is a predetermined timeline that specifies when an employee or participant in a financial arrangement gains full ownership of certain assets, most commonly stock options, retirement account contributions, or other forms of compensation provided by an employer. This schedule is designed to incentivize employees to remain with the company or meet specific requirements before fully acquiring the benefits.

Typically, vesting schedules involve a series of milestones that gradually allow the individual to gain ownership of the granted assets. It is important for employees to be aware of the vesting terms to fully understand how their compensation package will unfold over time.

2. Key Components of a Vesting Schedule

A vesting schedule generally includes the following components:

-

Grant Date: This is the date when the assets (e.g., stock options or restricted stock units) are granted to the employee. It marks the beginning of the vesting process but does not mean the employee owns the assets yet.

-

Vesting Commencement Date: This is the starting point from which the vesting timeline begins. It can sometimes coincide with the grant date but may also be set for a later date.

-

Vesting Period: This is the duration over which ownership rights are acquired. The period typically spans multiple years, often four years, with specific milestones marking the employee’s progress toward full ownership.

-

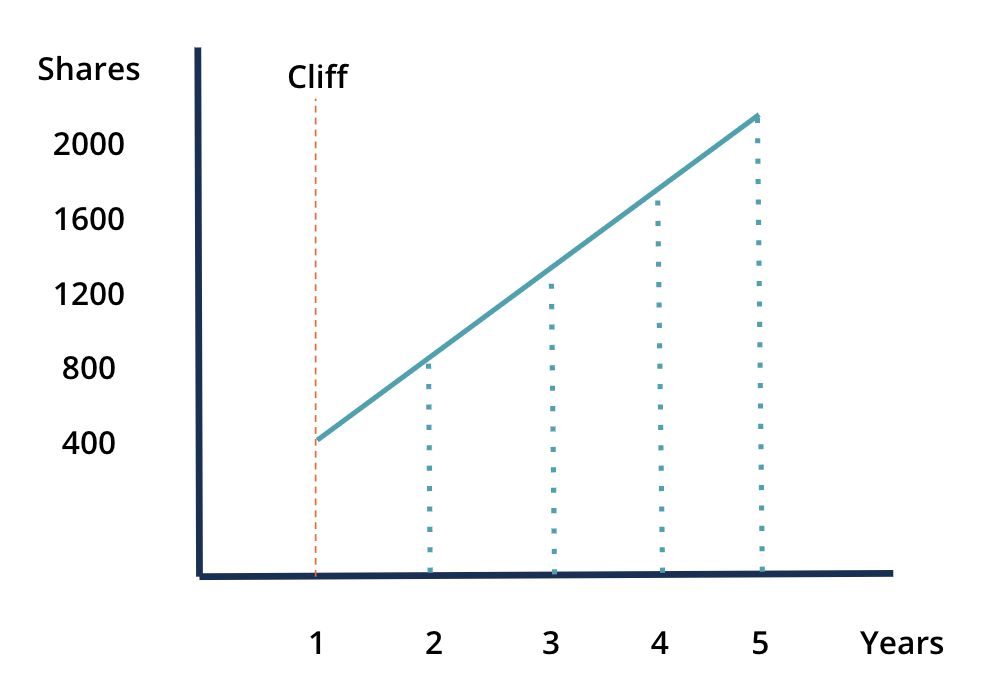

Cliff Period: Some vesting schedules include a cliff period. During this time, no ownership rights are granted. However, at the end of the cliff period, a large portion (or all) of the benefits may vest at once. This structure is designed to motivate employees to stay with the company at least until the cliff period is over.

-

Vesting Increments: After the cliff period, if applicable, ownership is typically granted gradually over time. For example, in a four-year vesting schedule with a one-year cliff, 25% of the asset may vest after the first year, with the remaining 75% vesting in smaller increments each quarter or year thereafter.

-

Forfeiture: If an employee leaves the company before the vesting period is complete, they may forfeit some or all of the unvested benefits. This is a crucial consideration when planning for long-term financial goals.

The vesting schedule aligns the interests of employees with the company’s long-term goals by rewarding employees who stay with the company or meet performance objectives over a period of time.

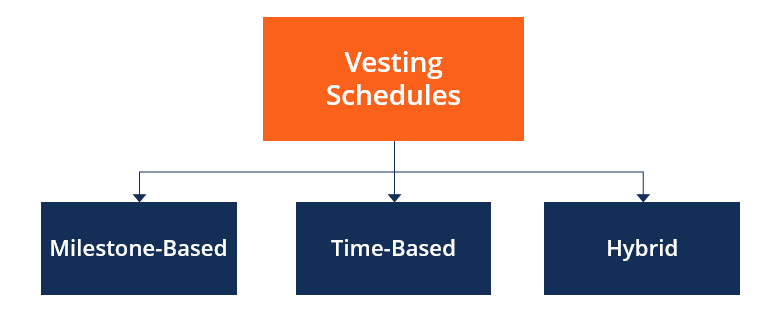

3. Vesting Schedule Types

There are three main types of vesting schedules commonly used in stock option plans, retirement plans, and other forms of employee compensation. Each type has its own structure and rules for how assets are vested over time:

-

Immediate Vesting: In an immediate vesting schedule, employees gain full ownership of the granted assets immediately, with no waiting period or specific timeframe required. This means that employees can access or exercise the benefit as soon as it is granted.

-

Graded Vesting: Graded vesting involves a gradual increase in ownership over time. Typically, ownership increments are spread out over a number of years, and the employee progressively gains more control of the assets. For example, an employee might receive 10% of the total benefits in the first year, 25% in the second year, 25% in the third year, and 40% in the fourth year, eventually reaching 100% ownership at the end of the vesting period.

-

Cliff Vesting: In a cliff vesting schedule, employees do not receive any ownership of the asset until a specific date, known as the "cliff" period. Once the cliff period is over, the employee gains full ownership of the asset in one lump sum. For example, a three-year cliff vesting schedule means that the employee will not own any of the asset until after three years, at which point they will acquire 100% ownership in one go.

4. Examples of Vesting Schedules

Different companies use varying vesting schedules, and they may structure their vesting plans in diverse ways. Below are examples from two well-known companies:

-

Nike: Nike offers a five percent match on employee 401(k) contributions, which vests immediately. This means that employees can take full advantage of the match right away, with no waiting period. For restricted stock units (RSUs), Nike typically follows a graded vesting schedule, where 25% of the RSUs vest each year over a four-year period. After the four years, the employee can choose to sell the stock or hold it for future growth.

-

Amazon: Amazon’s vesting schedule for restricted stock units (RSUs) follows a different approach. In the first year, only 5% of the RSUs vest. In the second year, another 15% vests, bringing the total to 20%. In the third year, 40% of the RSUs vest, totaling 60% over three years. By the fourth year, the remaining 40% vests, bringing the total to 100%. This staggered approach ensures that employees are incentivized to stay with the company for a longer period.

5. Why do Stockholders care about Vesting Schedules?

Stockholders and employees who are granted stock options or RSUs need to carefully consider the vesting schedule to understand when they can fully access their benefits. If an employee leaves the company before the vesting period is complete, they may forfeit unvested stock options, which can have a significant financial impact.

For example, let’s say an employee is granted 50 RSUs valued at $2,000 each. If the employee leaves the company after one year, only 5% of the stock options will be vested, which equals a $5,000 value. After two years, 15% of the RSUs will vest, increasing the stock’s value to $15,000. By year three, the employee’s stock options will have grown to $40,000, representing the vested value of their stock options.

Understanding the details of your company’s vesting schedule is critical for making informed financial decisions, particularly if you plan to leave the company before the full vesting period ends. It is also important to understand any tax implications related to vesting, as the timing of when stock options vest can have significant tax consequences.

6. Conclusion

A vesting schedule is an important element of many compensation packages, especially for employees receiving stock options, retirement contributions, or other forms of deferred compensation. By understanding the terms of the vesting schedule, employees can better plan for their financial future and avoid forfeiting unvested assets. Whether your company uses immediate, graded, or cliff vesting, it’s essential to carefully consider how your assets will mature and how your tenure with the company may impact your long-term financial goals.

Read more:

- What is NFTFi? What are the projects worth following in NFTFi?

- What are NFTs? Everything You Must Know About This Future Asset

- Ways to make money from NFTs

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)