1. Countries with Comprehensive Crypto Regulation

Several countries have established clear and comprehensive frameworks to regulate cryptocurrency. These regulations are often designed to create a balance between fostering innovation and ensuring consumer protection.

-

European Union (EU): The EU is leading the way with its MiCA (Markets in Crypto-Assets Regulation) framework, which aims to create a unified regulatory environment for crypto-assets across member states. This regulation addresses key areas such as licensing, anti-money laundering (AML), and consumer protection, providing a clear legal framework for crypto companies.

-

United Kingdom: The UK has adopted a similar approach, with the Financial Conduct Authority (FCA) overseeing the regulation of crypto exchanges, custodians, and other service providers. The UK’s rules are designed to ensure transparency, investor protection, and to combat financial crime. In addition, the UK is considering new regulations to enhance crypto market integrity and stablecoin use.

-

Singapore: Singapore is known for its crypto-friendly regulatory environment, with the Monetary Authority of Singapore (MAS) regulating digital payment token services. Singapore offers a clear licensing framework for cryptocurrency exchanges and wallet providers, while also ensuring compliance with AML and anti-terrorism financing rules.

These countries aim to provide clarity and attract crypto businesses by offering well-structured regulatory frameworks that encourage growth while managing risks.

2. Countries with Minimal or No Crypto Regulation

Some countries either do not have specific crypto regulations or provide minimal oversight. These regions are often seen as “gray areas” for crypto businesses, offering both opportunities and risks.

-

Portugal: Portugal is an example of a country that, while not having a full regulatory framework, is known for its favorable tax treatment of cryptocurrency. In the past, Portugal has not taxed crypto capital gains, making it an attractive destination for crypto investors. However, this lack of regulation leaves businesses and investors vulnerable to sudden changes in law or enforcement.

-

Cayman Islands: The Cayman Islands is another jurisdiction with no specific crypto regulation. While the country has a well-established financial services industry, crypto businesses may face uncertainty as the industry evolves. The lack of clear guidelines can be a double-edged sword, offering operational flexibility while potentially attracting regulatory scrutiny in the future.

-

Malaysia: Malaysia has a mixed stance on cryptocurrency, with the Securities Commission regulating some aspects of the industry, such as initial coin offerings (ICOs) and crypto exchanges. However, there is still no comprehensive framework for broader crypto usage, creating a sense of uncertainty for businesses and investors in the space.

In these regions, companies operating in the crypto space must be cautious and stay updated on any changes to the law, as the absence of clear regulations can result in legal risks.

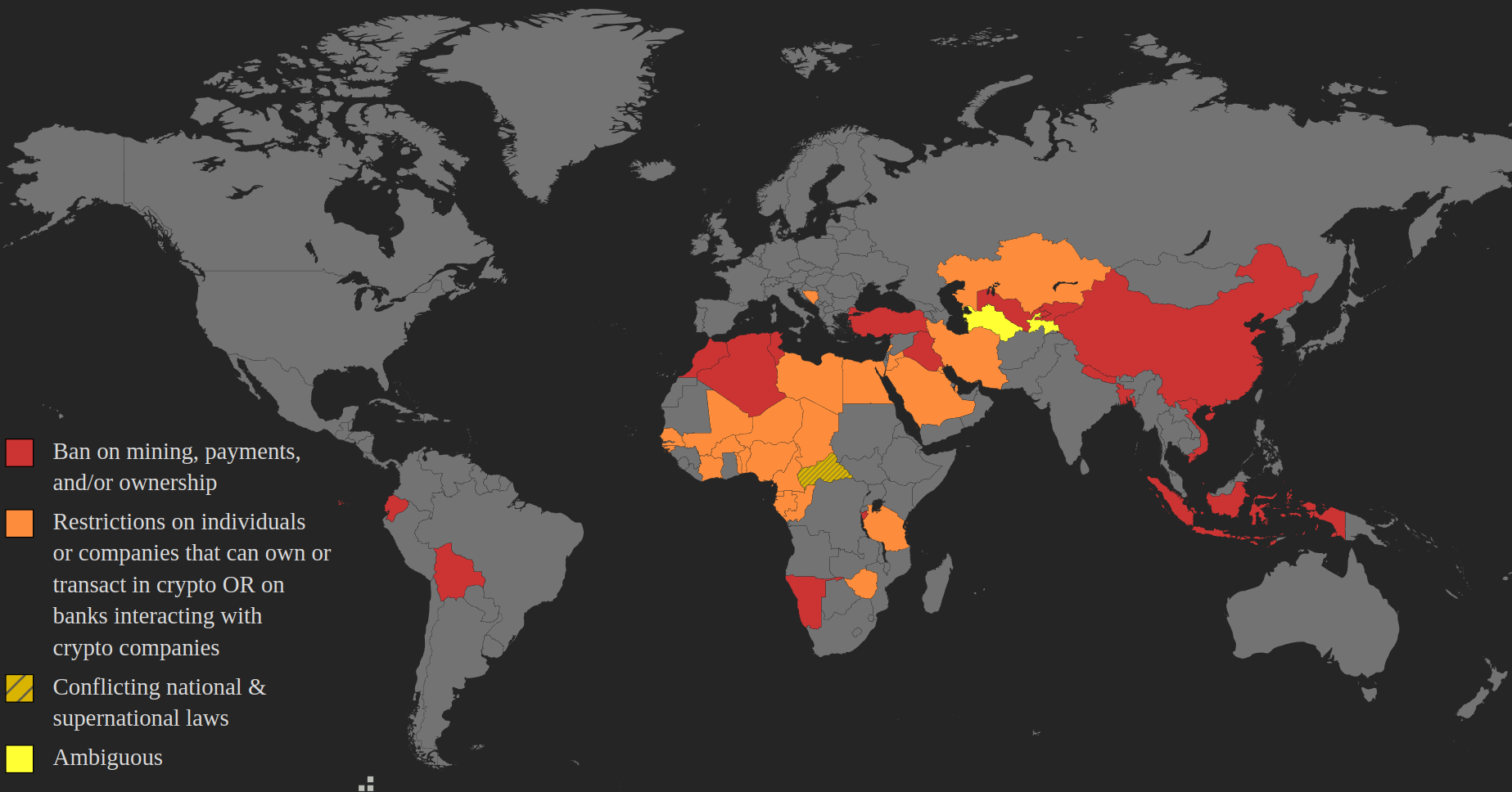

3. Countries with Bans or Severe Crypto Restrictions

A few countries have taken an outright approach to ban or heavily restrict cryptocurrency. These nations typically cite concerns over financial stability, capital flight, or money laundering as the primary reasons for their stance.

-

China: China has one of the most famous bans on cryptocurrency, including the prohibition of crypto trading and mining. The government views crypto as a threat to its financial system and has actively enforced the ban, closing down crypto exchanges and cracking down on mining operations.

-

India: While India has not yet outright banned cryptocurrency, it has imposed stringent regulations on crypto trading, including heavy taxation. There have been ongoing discussions about implementing stricter measures, such as banning cryptocurrencies or creating a government-backed digital currency, which has created an uncertain regulatory environment for crypto businesses.

-

Algeria: Algeria has also banned the use of cryptocurrency, with the government imposing penalties on anyone found to be trading or using digital assets. Other countries like Nepal and Bolivia have followed suit with similar bans, citing concerns about illicit activities and the potential threat to their local currencies.

These countries make it challenging for crypto businesses to operate, as any involvement with cryptocurrencies could result in penalties or legal action.

4. Why Crypto Regulation is Crucial for the Industry’s Growth

Effective regulation of cryptocurrency is essential for the long-term success and stability of the industry. Countries with clear frameworks offer several advantages:

-

Consumer Protection: Regulatory standards ensure that investors are protected from fraud, scams, and market manipulation. These protections are especially important in the volatile and often unregulated crypto market.

-

Market Integrity: Clear rules prevent insider trading, price manipulation, and other unfair practices. For example, regulations like the Travel Rule require exchanges to share transaction details, helping prevent money laundering and terrorist financing.

-

Attracting Investment: A well-regulated environment encourages institutional investors to enter the market. By offering transparency and clear legal guidelines, countries can become global hubs for crypto innovation and investment, leading to job creation and economic growth.

However, it’s important for countries to strike a balance, excessive regulation can stifle innovation and drive crypto businesses to more favorable jurisdictions with fewer barriers.

5. The Future of Global Crypto Regulation

As the crypto space continues to grow, it’s clear that more countries will implement comprehensive regulations. The EU’s MiCA framework, along with evolving rules in the US, UK, and Asia, will likely serve as models for other countries to follow. The trend is toward creating legal certainty for businesses and consumers, while addressing concerns about security, fraud, and illicit activity.

For crypto businesses, the future of regulation offers opportunities, but also challenges. Companies will need to stay flexible and ready to adapt to new regulations, especially in jurisdictions that are still in the process of defining their crypto rules. Meanwhile, countries with minimal regulation or bans may find themselves at a disadvantage as the industry matures.

6. Conclusion

In summary, crypto regulation by country is a rapidly evolving landscape. Countries like the EU, UK, and Singapore are leading the way with comprehensive and transparent frameworks that aim to balance innovation and regulation. On the other hand, regions with minimal or no regulation offer more flexibility but come with significant risks. Lastly, countries that impose bans or restrictions present a more hostile environment for crypto businesses, limiting opportunities for growth.

As the industry continues to expand, understanding these global regulatory trends is essential for anyone involved in cryptocurrency, whether as an investor, entrepreneur, or service provider.

Read more:

Tiếng Việt

Tiếng Việt