1. What is Dexscreener Analytics?

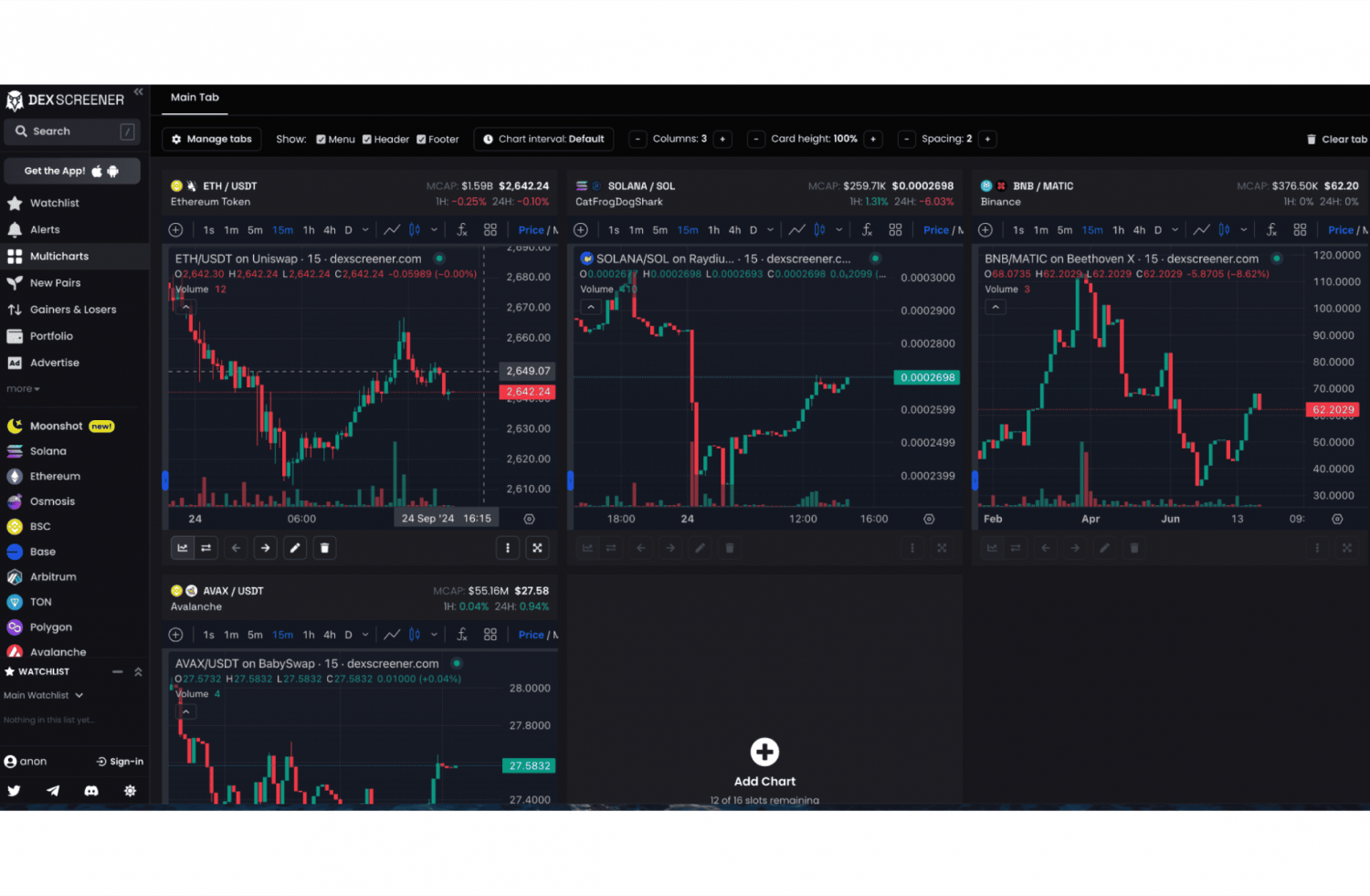

Dexscreener Analytics is the analytical layer of the platform DEX Screener (often written “DexScreener”). It aggregates real-time on-chain data across multiple decentralized exchanges and blockchains to provide token pair metrics, liquidity analysis, price/volume movements, and more.

By framing it as “analytics,” we emphasize how traders and analysts can use the data, not just view it-to gain actionable insights.

2. Why Dexscreener Analytics Matters for DeFi Traders

For anyone active in DeFi, the difference between success and loss often boils down to timing, awareness of liquidity, and spotting new pairs early. Using Dexscreener Analytics gives you advantages in four key areas:

2.1 Multi-chain Visibility

Unlike many tools that focus only on Ethereum or one chain, Dexscreener Analytics covers dozens of Layer 1 and Layer 2 networks (Ethereum, BNB Smart Chain, Solana, Avalanche, Arbitrum, …)

This is vital because many high-growth tokens now launch on lesser-known chains or side-chains, and being able to monitor them early can provide an edge.

2.2 New Pair & Early Listing Discovery

One of the features highlighted is the ability to list new token pairs as soon as they appear on a DEX:

“Its main feature is its ability to automatically list new tokens as soon as they appear and make their first transaction on a blockchain.”

This means that if you are tracking “what’s next” before a token hits major centralized exchanges, Dexscreener Analytics helps you spot those opportunities.

2.3 Liquidity / Volume / Price Impact Insights

In DEX environments, liquidity and volume matter more than just price, because low liquidity can mean high slippage, manipulation risk, or rug pull threats. Dexscreener Analytics provides:

-

Liquidity pool sizes and deeper detail about token pair liquidity.

-

Volume statistics and trending tokens (gainers/losers) across chains.

-

Price change, market cap, token age, and chain age metrics.

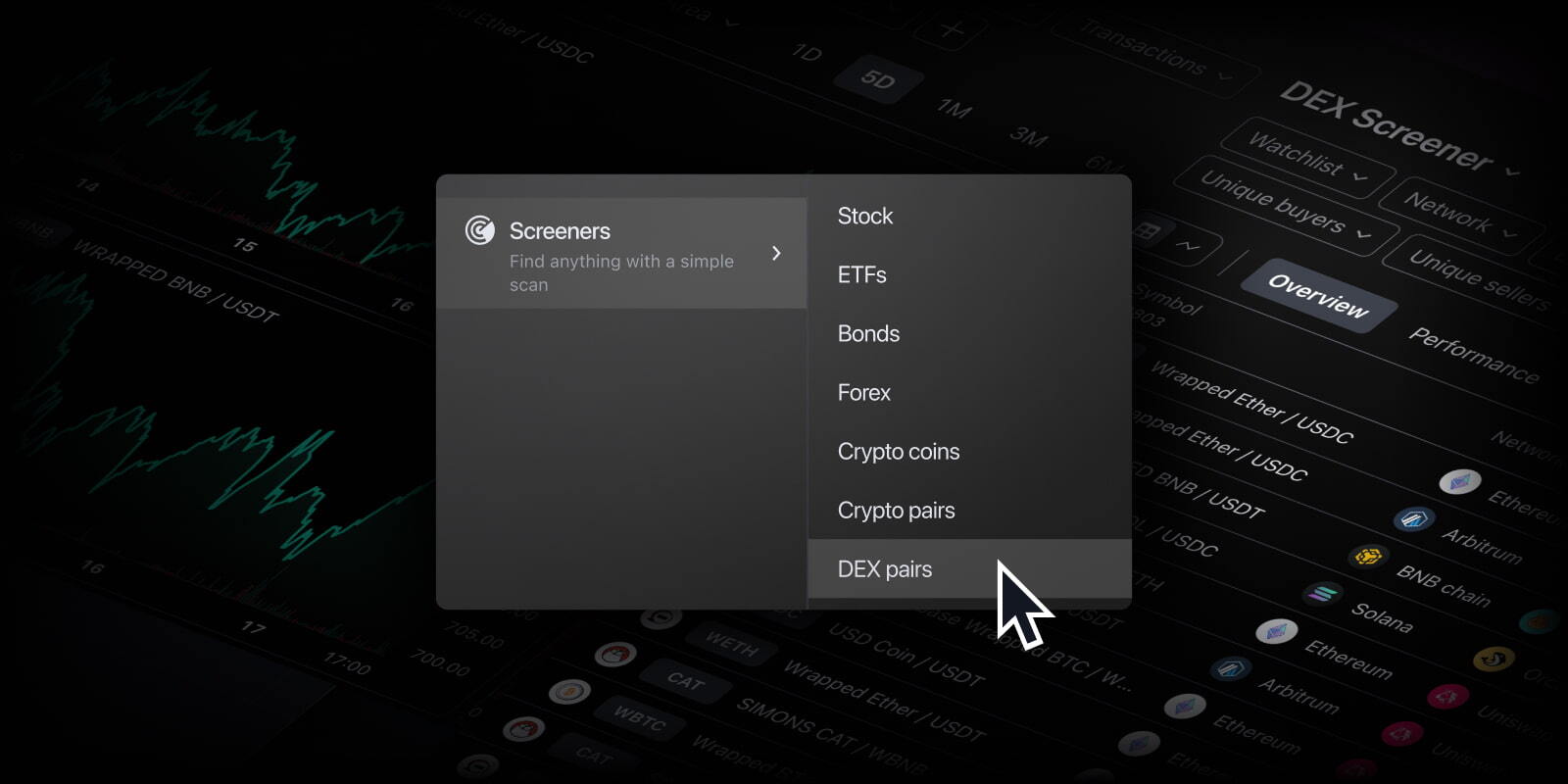

2.4 Developer/API Integration

For advanced users and projects, Dexscreener Analytics offers API endpoints so you can build custom screens, bots, or dashboards.

“An autonomous AI agent that provides real-time token analytics using DexScreener’s API.”

This means you can integrate Dexscreener Analytics data into your own systems, which is a big plus for projects, funds, or algorithmic traders.

3. Key Metrics & Screens to Use in Dexscreener Analytics

Here’s a breakdown of the most important metrics you should monitor when using Dexscreener Analytics, and how to interpret them for your trading or token-launch strategy.

Token Age / Pair Age

-

A very new token pair could mean high growth potential but also high risk (rug pulls, dumps, low liquidity). Use the “pair age” filter to spot those early-stage listings.

-

Older pairs with established volume/liquidity tend to be safer but less likely to moon quickly.

Liquidity Pool Size & Depth

-

How much liquidity (USD value) is locked in the pool? Larger liquidity means lower slippage and lower chance of sudden liquidity drain.

-

Monitor liquidity changes: a sudden drop in liquidity can be a red-flag (e.g., someone pulling out funds). Dexscreener Analytics displays this.

24h/7d Volume & Volume Trend

-

High trading volume relative to liquidity can mean momentum or hype.

-

A volume spike may suggest a breakout, but also could signal manipulation. Use caution.

Price Change & Market Cap Filters

-

Filter for tokens with significant price increases (or decreases) in short time windows to spot fast movers. Dexscreener Analytics supports this.

-

But also consider market cap: very low market cap + high price change = high risk.

Chain & DEX Platform

-

Check which chain the token lives on and which DEX is listing it (e.g., Ethereum vs. BNB vs. Solana). Some chains may have higher risk profiles (fewer audits, smaller user base) → consider risk accordingly.

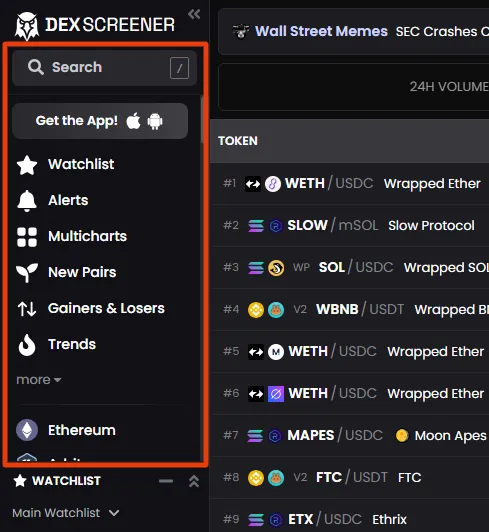

Trending / Newly Listed Tokens Screen

-

Use the “New Pairs” / “Gainers & Losers” tabs in Dexscreener Analytics to monitor early assets.

This is where many “gem” tokens show up before they are listed on major exchanges.

API / Custom Alerts

-

Set price alerts, volume alerts or integrate via API to get notifications or build dashboards. Dexscreener Analytics supports this.

4. Best Practices & Risks When Using Dexscreener Analytics

Using Dexscreener Analytics can give you an edge, but only if you use the data wisely. Here’s a list of best practices and risks you must be aware of.

Best Practices:

-

Combine on-chain data with qualitative research: Metrics alone don’t tell you everything. Check token contracts, team credibility, community, etc.

-

Use filters: Don’t dive into every token; filter by liquidity, volume, age, etc. Dexscreener Analytics gives you these filters.

-

Stay multi-chain aware: Since Dexscreener Analytics covers many chains, cross-chain arbitrage or spotting chains with less competition can help.

-

Set alerts & watchlists: Use the watchlist feature and set alerts in Dexscreener Analytics to act quickly.

-

Test small: When you identify a new pair via analytics, consider entering with a small position first until you verify real-world behaviour.

Risks & Limitations:

-

“New pair” risk: Many tokens listed very early are unverified, may lack audits, may be rug pull setups. Dexscreener Analytics shows them early, but that doesn’t guarantee legitimacy.

-

Low liquidity tokens: Even if volume looks high, if liquidity is shallow you may face slippage or inability to exit. Dexscreener Analytics shows liquidity but you must interpret it.

-

Data delay / Network issues: Real-time is nearly real-time, but on some chains or less active pairs the data may lag.

-

Over-reliance on analytics: The tool is only as good as your interpretation, analytics don’t replace due diligence or understanding of fundamentals.

5. How to Integrate Dexscreener Analytics into Your Crypto Strategy

Dexscreener Analytics provides traders, DeFi projects, and token researchers with powerful data to help make informed decisions. Here are concrete ways each group can leverage this tool to enhance their crypto strategies:

5.1 For Day Traders / Momentum Traders

For day traders looking to capitalize on short-term price movements, Dexscreener Analytics can provide crucial insights to spot profitable opportunities.

-

Monitor the “New Pairs” Tab: Keep an eye on newly listed tokens on smaller DEXes/chains via Dexscreener Analytics. Early discovery of tokens can give you an edge.

-

Use Filters: Apply filters for pairs with specific criteria like: age < 24h, liquidity > X USD, volume > Y USD, and price change > Z%. This ensures you focus on high-potential, liquid pairs.

-

Set Alerts for Breakouts or Volume Spikes: Dexscreener Analytics allows you to set alerts for significant price movements or volume increases, which can signal potential breakout opportunities.

-

Cross-check Token Info: Always check the smart contract, token information, and community sentiment before making any trades. Analyzing all available data helps reduce risk.

These steps will help day traders stay ahead of market trends and avoid missing out on fast-moving opportunities.

5.2 For DeFi Projects / Token Launchers

For DeFi projects or token launchers, Dexscreener Analytics is an invaluable tool to track performance, monitor liquidity, and gauge the success of new token listings.

-

Embed the Dexscreener Analytics API: Use the API to integrate Dexscreener Analytics data into your own dashboards. This allows you to track the performance of your token pair post-launch and make data-driven decisions.

-

Monitor Liquidity, Volume, and Swap Activity: Keep track of liquidity movement, trading volume, and swap activity to evaluate how your token is performing. These metrics can help you assess whether liquidity provider (LP) incentives are needed.

-

Compare Performance with Competitors: Use Dexscreener Analytics to compare your token’s performance with competitors on similar chains or DEXes. This helps you identify areas where your token might need more attention or strategic adjustments.

By utilizing Dexscreener Analytics, DeFi projects can ensure they are continually optimizing their launch strategy and responding quickly to market shifts.

5.3 For Researchers / Analysts

Researchers and analysts can use Dexscreener Analytics not only for real-time data but also for historical data analysis to identify long-term trends and patterns.

-

Analyze Historical Data: Use Dexscreener Analytics to analyze patterns such as the number of new pairs launched in the last 24 hours, the distribution of liquidity across different chains, and the average age of tokens before they are listed on centralized exchanges (CEX). These insights can help you identify emerging trends and market behaviors.

-

Build Custom Dashboards and Reports: Leverage the API to create custom dashboards or detailed reports. This will allow you to filter data according to specific criteria, track token performance over time, and identify trending tokens early.

-

Trend Token Identification: Use Dexscreener Analytics’ advanced tools to spot tokens that are gaining traction across various chains and DEXes. This data can help inform predictions and market analyses.

For researchers and analysts, the ability to filter, track, and report on multi-chain data makes Dexscreener Analytics a powerful tool for uncovering long-term trends in the crypto space.

In the fast-moving world of DeFi, where new tokens and trading pairs surface every minute, having the right analytical tool is a must. Dexscreener Analytics gives you multi-chain visibility, early listing detection, and deep liquidity/volume metrics that can help you make more informed decisions. However, like any tool, it’s only as good as your interpretation and risk management. Use it wisely, combine it with your own research, and treat it as one part of your broader crypto strategy.

Read more:

Tiếng Việt

Tiếng Việt