1. What is a DEX (Decentralized Exchange)?

A decentralized exchange (DEX) is a peer-to-peer marketplace where cryptocurrency transactions take place directly between traders, without the involvement of intermediaries like banks, brokers, or payment processors. DEXs embody a core principle of cryptocurrency: enabling financial transactions that are independent of traditional financial institutions. Popular DEX platforms, such as Uniswap and Sushiswap, run on the Ethereum blockchain and are part of the broader decentralized finance (DeFi) ecosystem, which offers a wide array of financial services directly accessible via a compatible crypto wallet.

The adoption of DEXs has been growing rapidly; in Q1 2021, decentralized exchanges saw $217 billion in transactions. By April 2021, the number of DeFi traders exceeded two million, marking a ten-fold increase since May 2020.

Unlike traditional financial exchanges, which operate through opaque processes with intermediaries and offer limited visibility into operations, DEXs provide complete transparency. Every transaction is recorded on the blockchain, allowing anyone to see the movement of funds and the mechanisms that facilitate these exchanges. Additionally, as user funds never pass through a third party's wallet, DEXs reduce counterparty risks and minimize systemic risks associated with centralized exchanges.

2. How does a DEX work?

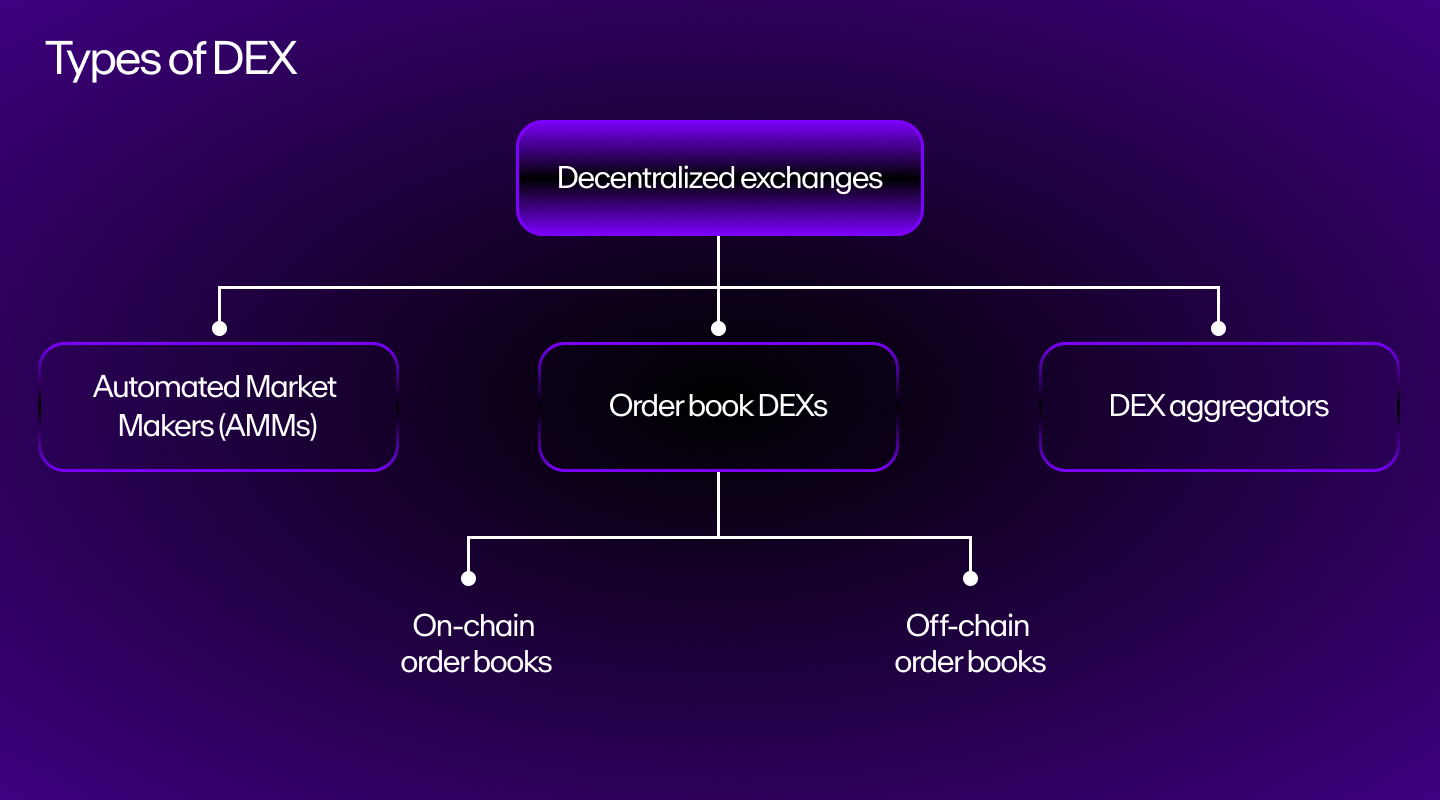

DEXs are designed in different ways, with each offering distinct features, scalability, and levels of decentralization. The two most common types are order book DEXs and automated market makers (AMMs). There are also DEX aggregators, which scan multiple DEXs on the blockchain to find the best price or lowest gas fees for a transaction.

A key advantage of DEXs is the deterministic nature provided by blockchain technology and immutable smart contracts. While centralized exchanges (CEXs) like Coinbase and Binance use an internal matching engine to facilitate trades, DEXs execute trades directly through smart contracts and on-chain transactions. Importantly, DEX users retain full custody of their funds via self-hosted wallets during trading, offering a higher level of security and control.

Users of DEXs typically pay two types of fees:

-

Network fees, which are the transaction costs required for on-chain activity (gas fees).

-

Trading fees, which are collected by the protocol, its liquidity providers, or token holders, depending on the design of the exchange.

Many DEXs aim to create a fully decentralized, permissionless system with no central points of failure. This is often achieved through decentralized autonomous organizations (DAOs) that allow stakeholders to vote on key decisions regarding the protocol. However, achieving decentralization while remaining competitive is challenging, as central teams often have more expertise to make critical decisions.

3. Types of DEX

3.1 Order Book DEXs

An order book is a real-time list of open buy and sell orders in a market, used to match transactions. Fully on-chain order book DEXs have been less common in decentralized finance (DeFi) due to scalability challenges. Blockchain networks, particularly in the past, lacked the throughput to handle large order books. Early on-chain order book DEXs faced issues with low liquidity and poor user experience.

However, with recent advancements such as layer-2 networks (like optimistic rollups and ZK-rollups) and app-specific blockchains, fully on-chain order books are becoming more feasible and attracting more trading volume. Some DEXs also use hybrid order books, where the order book management and matching process occur off-chain, but the settlement of trades is done on-chain.

Popular order book DEXs include 0x, dYdX, Loopring DEX, and Serum.

3.2 Automated Market Makers (AMMs)

Automated market makers (AMMs) are the most widely used type of DEX. They allow for instant liquidity and democratize access to liquidity provision. Instead of an order book, AMMs use a liquidity pool—a smart contract that holds reserves of different tokens. Users can trade against these pools, with prices determined by an algorithm based on the ratio of tokens in the pool.

AMMs provide instant liquidity, which is not always the case with order book DEXs, where a buyer may need to wait for a match with a seller. In an AMM, the price is continuously adjusted by the smart contract, ensuring liquidity is always available for users. Liquidity providers (those who deposit tokens into the pool) earn passive income in the form of trading fees.

AMMs have enabled the launch of numerous new tokens and have given rise to a variety of market designs, such as those specifically created for stablecoin swaps.

Popular AMM DEXs include Uniswap, Sushiswap, Curve, PancakeSwap, Balancer and Bancor.

4. Benefits of Decentralized Exchanges?

DEXs offer several advantages over traditional financial systems and centralized exchanges:

-

Increased Transparency: Every trade is recorded on the blockchain, offering full visibility into the movement of funds and exchange mechanisms.

-

Reduced Counterparty Risk: Users retain full control of their funds via self-hosted wallets, eliminating the need to trust a third party with their assets.

-

Permissionless and Borderless Access: Anyone with an internet connection and a compatible wallet can access DEXs, making them more inclusive and accessible globally.

-

Lower Risk of Systemic Failures: By decentralizing trading and liquidity provision, DEXs reduce the risk of a single point of failure, such as in the case of major centralized exchanges that have been hacked or experienced operational failures.

5. DEX Risks and Considerations

Despite their benefits, DEXs also carry certain risks:

-

Smart Contract Risk: Vulnerabilities in smart contract code can lead to exploits or bugs. DEX developers use audits and peer reviews to mitigate this, but risks remain.

-

Liquidity Risk: Some DEXs suffer from low liquidity, resulting in slippage and a poor user experience. Centralized exchanges still dominate in terms of liquidity.

-

Frontrunning Risk: Due to the transparency of blockchain transactions, DEXs can be subject to frontrunning by bots or traders who exploit network latency to execute trades before regular users.

-

Centralization Risk: Although many DEXs strive for decentralization, some may still have centralized points of failure, such as server-hosted matching engines or centralized governance structures.

-

Network Risk: DEXs depend on blockchain networks. If a network becomes congested or experiences downtime, it could disrupt trading.

-

Token Risk: DEXs allow for the creation of permissionless markets, leading to risks of exposure to low-quality or malicious tokens.

Some users may also find the responsibility of managing private keys and custody of assets daunting, though practicing good security and key management can help mitigate these challenges.

6. Conclusion

DEXs have become a vital part of the cryptocurrency ecosystem, offering decentralized, peer-to-peer trading without intermediaries. With their growing adoption, instant liquidity, and user-friendly access, DEXs are reshaping how digital assets are exchanged.

While their future in mainstream and institutional markets remains uncertain, DEXs will continue to evolve, driving innovation in security, scalability, and user experience.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)