1. What is Market Cap in Crypto?

.jpg)

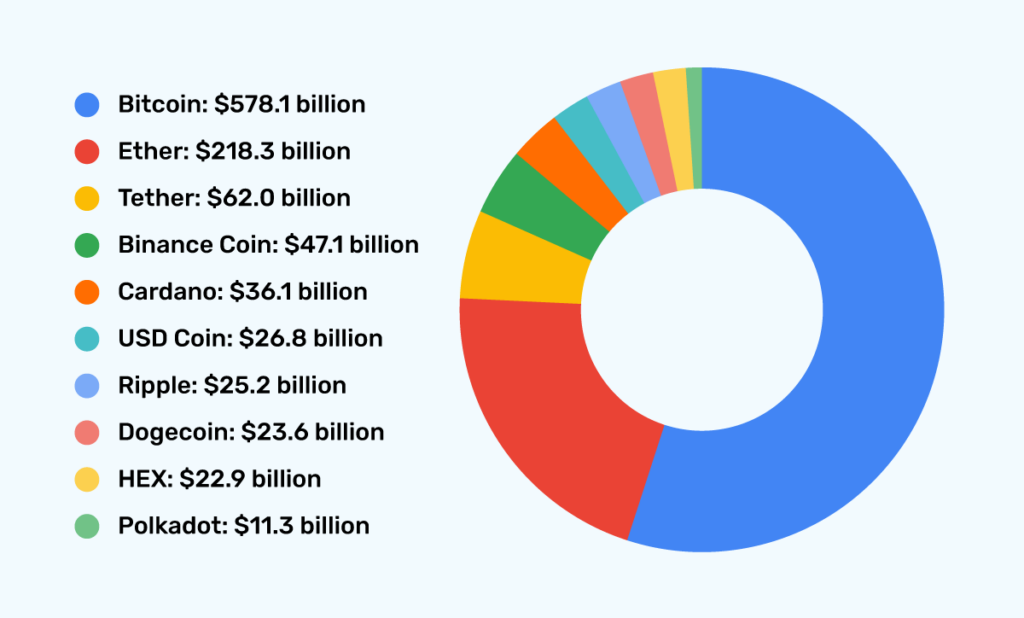

Market capitalization, or market cap, refers to the total value of a cryptocurrency in circulation. It is a critical metric that provides an overall view of the cryptocurrency’s market size and value. Market cap is used to categorize cryptocurrencies into different groups, such as large-cap, mid-cap, and small-cap coins, depending on their market value.

The formula to calculate the market cap of any cryptocurrency is simple:

Market Cap = Current Price of Coin × Total Circulating Supply

For example, if a cryptocurrency has a total circulating supply of 10 million coins and the current price per coin is $50, its market cap would be:

Market Cap = 10,000,000 × 50 = 500,000,000 USD

This means the total value of that particular cryptocurrency is $500 million.

2. Why Is Market Cap Important?

Market cap serves as a benchmark for evaluating a cryptocurrency’s size, growth potential, and overall market presence. It helps investors understand a coin's relative value compared to other cryptocurrencies. Below are several reasons why market cap is important:

2.1. Risk Assessment

Market cap can give investors an idea of the risk level associated with a particular cryptocurrency. Generally, cryptocurrencies with a larger market cap tend to be more stable and less volatile, while smaller market cap cryptocurrencies can be riskier, more volatile, and subject to significant price fluctuations.

-

Large-cap cryptos (>$10 billion): These cryptocurrencies are usually well-established, widely adopted, and considered more stable. Bitcoin (BTC) and Ethereum (ETH) fall into this category.

-

Mid-cap cryptos ($1 billion to $10 billion): These coins have strong potential but are typically less proven than large-cap coins.

-

Small-cap cryptos (<$1 billion): Small-cap cryptocurrencies often carry higher risks but may offer higher growth potential.

2.2. Market Sentiment

Market cap is an indicator of market sentiment and investor confidence. For instance, if a cryptocurrency’s market cap is consistently growing, it suggests increasing interest, demand, and adoption. Conversely, a shrinking market cap could indicate waning interest or falling prices, which might signal caution.

2.3. Comparison Between Cryptocurrencies

Market cap allows investors to compare the relative sizes and values of different cryptocurrencies. This comparison can help them make informed decisions about which cryptocurrency to invest in, especially when diversifying their portfolio. A higher market cap doesn't necessarily mean better performance, but it does give insight into the coin's potential for growth and its level of adoption.

2.4. Liquidity and Volatility

A larger market cap often corresponds to higher liquidity, meaning there are more buyers and sellers in the market. This increases the ease with which an investor can buy or sell without significantly affecting the price. Smaller market cap coins tend to have lower liquidity, making them more susceptible to large price swings when large trades are executed.

3. How to Use Market Cap for Investment Decisions

Market cap is one of the first factors investors should consider when evaluating potential investments in the crypto market. However, it should not be the sole factor, as it doesn’t tell the entire story. Here are some ways investors use market cap in decision-making:

3.1. Diversification

When diversifying a crypto portfolio, market cap helps investors strike a balance between high-risk, high-reward investments and safer, more established assets. For instance, a portfolio might include a mix of:

-

Large-cap cryptocurrencies (e.g., Bitcoin, Ethereum) for stability and long-term growth.

-

Mid-cap cryptocurrencies for potentially higher returns but with moderate risk.

-

Small-cap cryptocurrencies for speculative investments with higher volatility but greater potential for growth.

3.2. Identifying Undervalued Coins

Investors often look for undervalued cryptocurrencies that may be trading at a low market cap relative to their potential. If a coin has strong fundamentals, promising technology, or growing adoption, it may present an opportunity for growth. However, this approach requires careful analysis and risk assessment, as smaller cryptocurrencies are often more volatile.

3.3. Assessing Long-Term Viability

Large-cap coins tend to have more established use cases, stronger developer communities, and better market liquidity. As a result, these coins are often considered safer bets for long-term investment. Smaller-cap coins, on the other hand, may have promising features but face greater uncertainty and higher risk.

4. Market Cap Categories: Understanding the Segments

As mentioned earlier, cryptocurrencies are often categorized based on their market cap into three primary segments:

4.1. Large-Cap Cryptocurrencies

These coins have a market cap of over $10 billion and are typically well-established. The largest and most widely recognized cryptocurrencies, like Bitcoin (BTC) and Ethereum (ETH), fall into this category. Large-cap cryptocurrencies are usually considered safer investments, although they may offer lower growth potential compared to smaller coins.

Examples:

-

Bitcoin (BTC)

-

Ethereum (ETH)

-

Binance Coin (BNB)

-

Cardano (ADA)

4.2. Mid-Cap Cryptocurrencies

Mid-cap cryptocurrencies generally have a market cap between $1 billion and $10 billion. These coins often have strong potential but may not have the same level of widespread adoption as large-cap cryptocurrencies. Mid-cap cryptos can be a good option for investors seeking growth while still maintaining a moderate level of stability.

Examples:

-

Polkadot (DOT)

-

Chainlink (LINK)

-

Litecoin (LTC)

-

Solana (SOL)

4.3. Small-Cap Cryptocurrencies

Small-cap cryptocurrencies are those with a market cap under $1 billion. These coins can be highly volatile and speculative but may offer significant returns if they gain traction. Small-cap coins are riskier but might appeal to investors willing to take on higher risk in exchange for the potential of high rewards.

Examples:

-

Dogecoin (DOGE)

-

VeChain (VET)

-

Theta (THETA)

5. Limitations of Market Cap

While market cap is a useful metric, it has limitations and should not be the only factor used to make investment decisions. Some of the key limitations include:

-

Market cap doesn't reflect intrinsic value: A coin with a large market cap doesn’t necessarily mean it is fundamentally strong. The price of a cryptocurrency can be influenced by speculation, hype, or temporary trends.

-

Inflation of supply: Cryptocurrencies with a high total supply can have a high market cap without significant demand, which can mislead investors.

-

Market cap can fluctuate rapidly: Market cap can change quickly with price movements, making it less reliable for short-term decision-making.

6. Market Cap and FDV

Market Cap and FDV (Fully Diluted Valuation) have some difference:

| Metric | Market Cap | FDV (Fully Diluted Valuation) |

| Definition | The total value of a cryptocurrency circulating supply at current market price. | The total value of a cryptocurrency assuming all possible coins or tokens are in circulation at the current market price. |

| Formula | Market Cap = Price per Token × Circulating Supply | FDV = Price per Token × Total Supply (Max Supply) |

| Indicates | Represents the current market value of a project based on available coins/tokens. | Represents the potential future market value of a project if all tokens are unlocked or mined. |

| Usefulness | Useful to evaluate the current size and rank of a project. | Provides a potential future outlook of a project if all tokens are released. |

| Impact of Token Release | Does not include tokens that are locked or reserved. | Takes into account all tokens, including those that are locked, reserved, or not yet mined. |

This comparison highlights the differences in how each metric is calculated and what it represents for investors.

7. Conclusion

Market capitalization is one of the most important metrics for evaluating cryptocurrencies. It provides a snapshot of the total value of a cryptocurrency and allows investors to categorize coins based on their size, risk, and potential for growth. However, market cap should be used alongside other factors, such as technology, adoption, team strength, and use cases, when making investment decisions.

By understanding market cap and how it reflects a cryptocurrency’s position in the market, investors can better navigate the complexities of the crypto space and make more informed decisions. As always, it's essential to conduct thorough research and consider your own risk tolerance before making any investment.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)