1. What are Resistance and Support Levels?

In the context of technical analysis, including cryptocurrency analysis, "resistance" and "support" are crucial concepts used to forecast future price movements based on price charts.

-

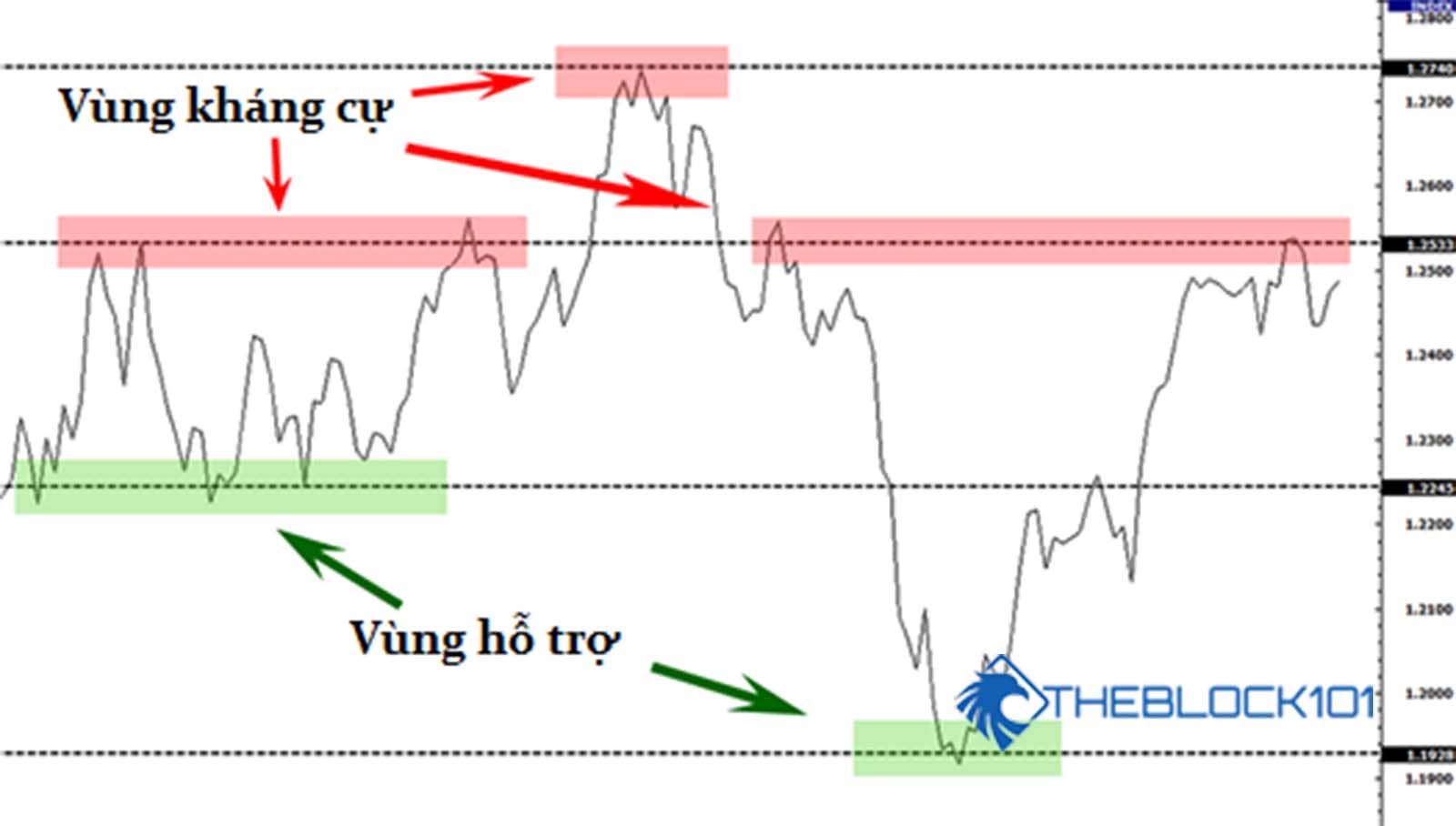

Resistance: Resistance refers to a price level or zone on a chart where the price faces difficulty in moving higher. This is often due to a high volume of sellers at that price, creating downward pressure and preventing the price from rising further. Resistance levels can be derived from previous price reversal points or technical indicators like moving averages and chart patterns.

-

Support: In technical analysis, support refers to a price level or zone on a chart where the price tends to stop declining and may bounce back. This typically occurs because of a high volume of buyers at that price, creating upward pressure and preventing the price from falling further. Support levels can also be based on previous price reversal points or technical indicators.

When applied to cryptocurrencies, technical analysis utilizes resistance and support levels to predict future price movements. Traders and investors can leverage information about these levels to make trading decisions, place buy or sell orders, or identify entry and exit points based on technical signals.

2. How to Identify Support and Resistance Levels in Crypto

Identifying support and resistance levels in the cryptocurrency market is a crucial aspect of technical analysis that helps traders understand price charts and predict future price movements. Here are the five most common methods to determine support and resistance levels:

- Examining Historical Price Charts: By analyzing historical price charts, traders can identify price levels where the price has previously struggled to break through or decline. Areas where the price has formed multiple peaks or troughs can indicate potential resistance or support levels.

- Using Moving Averages: Moving averages, such as the 50-day or 200-day moving average, are frequently used to identify support and resistance levels. When the price approaches a moving average, it may form a support level. Conversely, when the price crosses above a moving average, it may form a resistance level.

- Employing Chart Patterns: Chart patterns like triangles, cup and handle, head and shoulders, etc., can also help identify support and resistance zones. These patterns often emerge at specific price levels and can forecast potential price reversals.

- Utilizing Fibonacci Levels: Fibonacci levels (23.6%, 38.2%, 50%, 61.8%, 78.6%) are employed to determine support and resistance levels based on these percentage ratios. These levels are typically identified by selecting the high and low of a chart and applying the Fibonacci ratios to that range.

- Using Technical Indicators: Technical indicators like the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Stochastic Oscillator can also provide insights into support and resistance levels.

It's essential to combine multiple methods when identifying support and resistance levels, rather than relying solely on one technique. Given the highly volatile nature of the cryptocurrency market, it's crucial to remain flexible and adapt to changing market conditions.

English

English Tiếng Việt

Tiếng Việt