1. What is Ethena Labs?

Ethena Labs is a decentralized Stablecoin protocol on Ethereum. The goal of Ethena Labs is to create a stablecoin that maintains its value independently of traditional banking systems, along with a USD-based savings tool called Internet Bond.

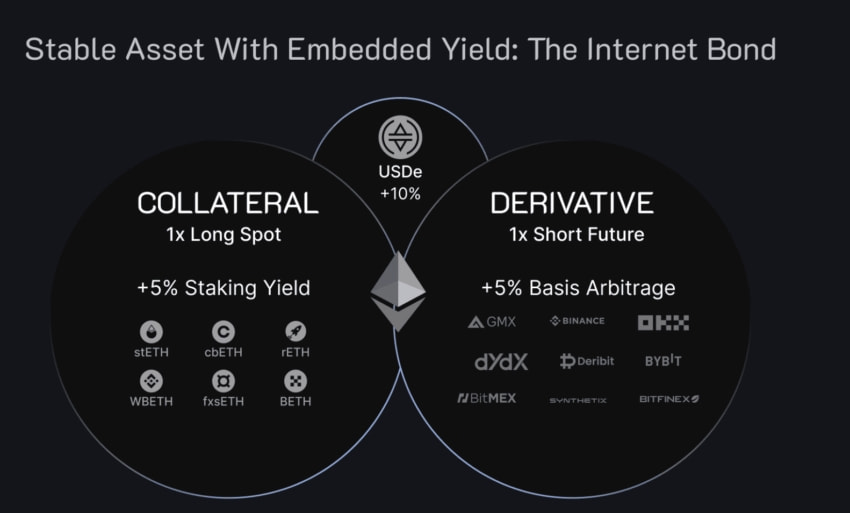

The Internet Bond ensures that USDe (the stablecoin) maintains a stable price by staking Ethereum and using a 2-way Hedging strategy to keep the price at $1. Any price fluctuations in Ethereum are balanced by profits or losses from the hedging position, helping to maintain the stable value of USDe against USD. This enables USDe to maintain its pegged value and not be subject to market fluctuations.

The Internet Bond combines profits from Liquid Staking Token (LST) earnings as well as the futures contract market and perpetual swap contract market, serving as a USD savings tool that generates profits for users.

2. Products

2.1 Structure of Ethena

To understand Ethena's operation mechanism better, unlike existing stablecoin models that use Real World Assets (RWA) or Collateralized Debt Positions (CDP) as collateral, Ethena's USDe is supported by an "ETH delta-neutral" position. In other words, each USDe is collateralized by 1 long-term staked ETH (stETH) position, while being offset by a corresponding short position in perpetual ETH futures contracts (ETH-PERP), according to the following formula:

Positive Delta (stETH) + Negative Delta (Short ETH-PERP) = Delta-Neutral (USDe)

If the price of ETH changes from $3000 to $2500, the short ETH-PERP position will offset the price fluctuation of $500. Similarly, if the price of ETH rises to $3500, the short ETH-PERP position will decrease by $500. Ethena has also introduced BTC as additional collateral, where BTC will be paired with a corresponding short position in BTC perpetual futures contracts (BTC-PERP) to create a similar delta-neutral support level.

2.2. Benefits from Stablecoin USDe

Due to the fundamental risks in the ETH model compared to CDP and RWA-backed stablecoins, most people label USDe as a "synthetic dollar" with the following characteristics:

-

1:1 collateralization: Each USDe is backed by an equivalent amount of ETH (or USD, LST) with the value of 1 USDe, ensuring that USDe always maintains a value of 1 USD.

-

Derivative positions: Based on the Delta-neutral method and using derivative positions to offset price fluctuations in ETH. This helps maintain the stability of USDe's price.

-

Anti-censorship capability: USDe is not reliant on banking systems or any other centralized entities, protecting it from censorship.

-

DeFi and CeFi integration: USDe allows users to access liquidity on centralized exchanges while still retaining custody of their assets on the blockchain.

With the above characteristics, Ethena's USDe brings the following benefits:

-

Increased Profitability Compared to Other Stablecoins: USDe generates fixed profits for users through staking rewards from LST and the funding rate of the short position.

-

Issued Based on Delta-Neutral Mechanism: Unlike other stablecoins that rely on collateralized debt positions (CDPs), USDe is issued based on a delta-neutral mechanism. Therefore, users holding USDe do not face liquidation risks when the value of collateral assets fluctuates significantly.

-

Decentralized Asset Custody: By separating collateral assets from the banking system and storing them on decentralized platforms, asset custody can be easily verified on-chain.

In essence, Ethena's product will have similarities with the Luna project. However, instead of pegging the stablecoin $UST along with the token $LUNA as before, Ethena utilizes a delta-neutral mechanism based on the short ETH-PERP position and other LST assets to ensure the USDe peg is balanced and not subject to market fluctuations. Ethena can be considered an upgrade to Luna's previous Yield Stablecoin project.

2.3. Risks from the Ethereum model

We have 3 main risks directly related to Ethena's model: Partner risk, Funding risk, and Liquidity risk.

-

Partner Risk

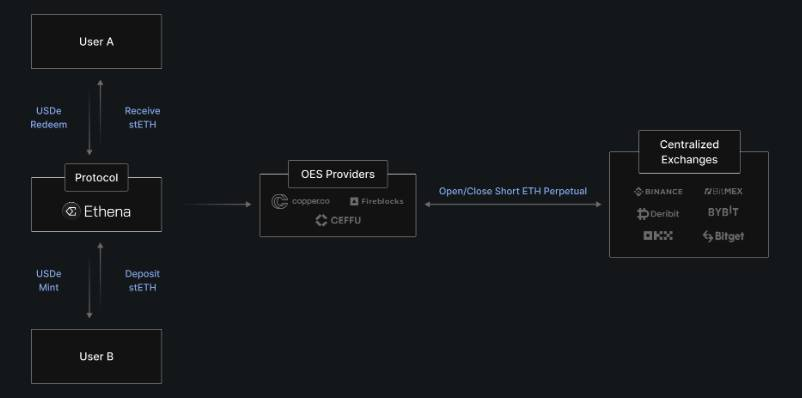

Ethena's architecture relies on two main partners to operate: Centralized Exchanges (CEX) and Off-Exchange Payment Service Providers (OES).

CEXs handle the trading of Ethena's perps positions, while OES providers handle the custody and settlement of Ethena's collateral assets. Although both partners are suitable for Ethena, there are still risks that may arise when relying on external partners, such as:

-

High and low price discrepancies across exchanges.

-

Liquidity issues on exchanges, such as those experienced by FTX, could affect Ethena's collateral assets on the platforms.

Overall, Ethena has addressed these issues by expanding partnerships with multiple parties to minimize this concentration risk. This is demonstrated through Ethena's collaboration with major CEXs in the market such as Binance, Bybit, Okex, etc.

-

Funding Risk

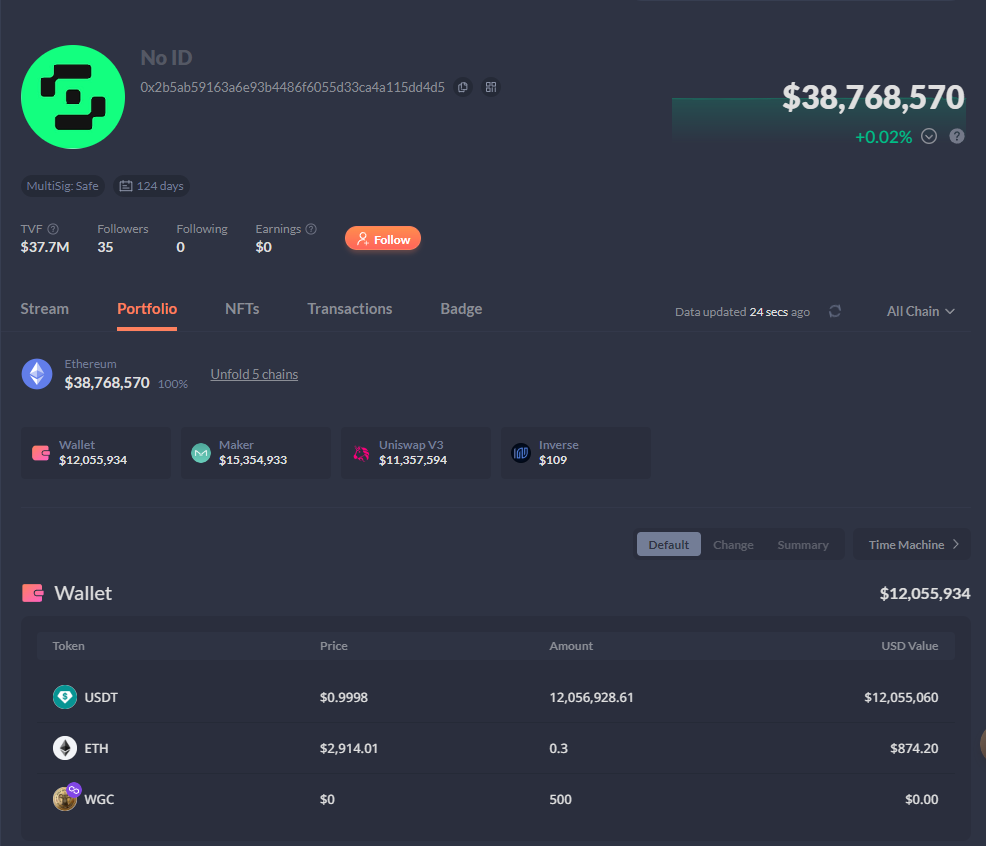

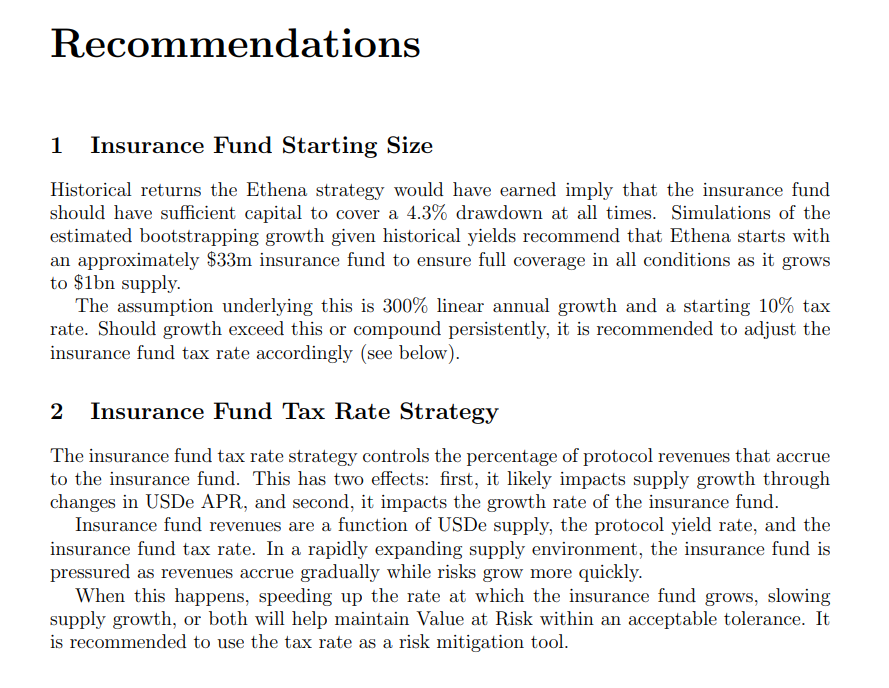

When ShortETH positions are utilized, there will always be a Funding issue, and if negative Funding occurs, the final reserve pool will act as a buffer to ensure that USDe can maintain its 1:1 exchange rate. However, both Ethena and Chaos Labs have conducted research to calculate the optimal scale for this reserve pool. (Link wallet to check reserve balance).

Currently, the reserve fund is valued at just over $32 million compared to the USDe's $2.3 billion supply. Although this figure is significantly lower than what Chaos Labs recommends, Ethena is currently allocating 80% of its revenue to the reserve fund. Ethena has added $5 million to the reserve fund recently, so if it continues at this pace, the reserve fund will reach Chaos Labs' recommended level. Details of Chaos Labs' analysis can be found here.

However, this is only a basic reserve determined based on relatively small market fluctuations, so to ensure greater safety, Ethena will need to further expand its reserve, and in my opinion, it should reach at least $500 million to help ensure the stability of its assets and Short ETH position.

-

Liquidity Risk and USDe Redemption

A scenario could occur where the Fundrate ratio continuously becomes negative and pushes high, coupled with users continuously redeeming USDe back to their assets through liquidation. Ethena holds a large amount of LST as well as the market experiencing a "Black Swan" event causing severe liquidity reduction in assets such as ETH, LST. At this point, the reserve fund will be used to pay off the entire negative Funding to ensure the ETH Perp position. However, if the reserve fund is not strong enough to guarantee this, the sale of other assets such as ETH, LST, BTC will occur, leading to a depletion of funds. From there, a collapse will ensue, which will be quite similar to the collapse of Luna's UST, although Ethena's mechanism does not rely on its $ENA token for support like UST but uses highly liquid assets like ETH and BTC. However, when a "Black Swan'' occurs, the above event is likely to happen.

Of course, the assumptions above are based on extremely adverse market factors such as the sharp decline in ETH and BTC liquidity along with LST assets losing liquidity and ETH peg. Therefore, at the current time, this risk is considered the least likely to occur compared to the above risks.

In addition to the main risks mentioned above, there are also other potential risks such as:

-

LST losing its Peg.

-

Incorrect price notifications from Oracles.

-

Being hacked from Smart Contracts.

Most of Ethena has announced the use of services from reputable and large partners in the market. However, there may still be unforeseen events that could cause losses to this ecosystem's model.

3. Tokenomic

3.1. Information

-

Ticker: $ENA

-

Total supply: 15,000,000,000

-

Current price: $0.754

-

Fully diluted valuation (FDV): $11.3 billion

-

Market cap: $1 billion

-

Total value locked (TVL): $2.3 billion

-

Users: 178,570

3.2. Token utility

-

Ecosystem management

-

Supporting USDe ecosystem components

-

Utilized for developing new products

-

Community sponsorship

-

Scaling and diversifying the reserve fund

-

Allocation between sUSDe and reserve fund

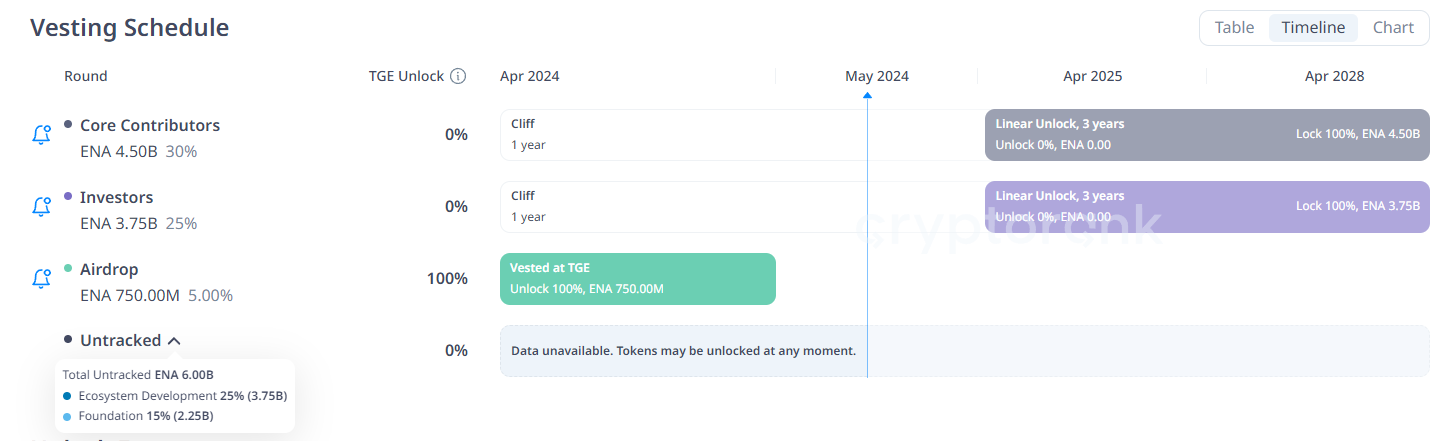

3.3 Allocation ratio and timing

-

Core Contributors (30%): Locked for 12 months and then gradually unlocked over 3 years.

-

Investors (25%): Locked for 12 months and then gradually unlocked over 3 years.

-

Foundation (15%): The allocation of the Foundation will be used for future initiatives to expand the reach of USDe. (No specific unlock schedule).

-

Ecosystem Development and Airdrops (30%): 5% will be airdropped and fully unlocked at TGE. The remaining allocation will be used for various Ethereum initiatives, including ongoing Season 2 initiatives, as well as various cross-chain initiatives, exchange partnership initiatives, which will be held in a multisig controlled by a DAO. (No specific unlock schedule).

Overall, the tokenomics of the project are relatively favorable, with investor rounds being locked for a year. In the Q3-Q4 period, the highest amount of tokens expected to be unlocked originates from the Ecosystem Development allocation, with the projected total circulating supply of $ENA reaching 3 billion by the end of this year.

4. Team

Ethena Labs was founded by Guy Young and his colleagues. Before establishing Ethena Labs, Guy Young spent a considerable amount of time working in the traditional finance industry with major institutions such as Cerberus Capital Management.

Additionally, the team at Ethena Labs has extensive experience in the cryptocurrency industry. Notably, Ethena Labs receives advisory support from Arthur Hayes, the renowned CEO of the long-standing exchange Bitmex. Most team members of the project bring years of experience in the market and have backgrounds in various financial fields within the traditional market.

5. Backer

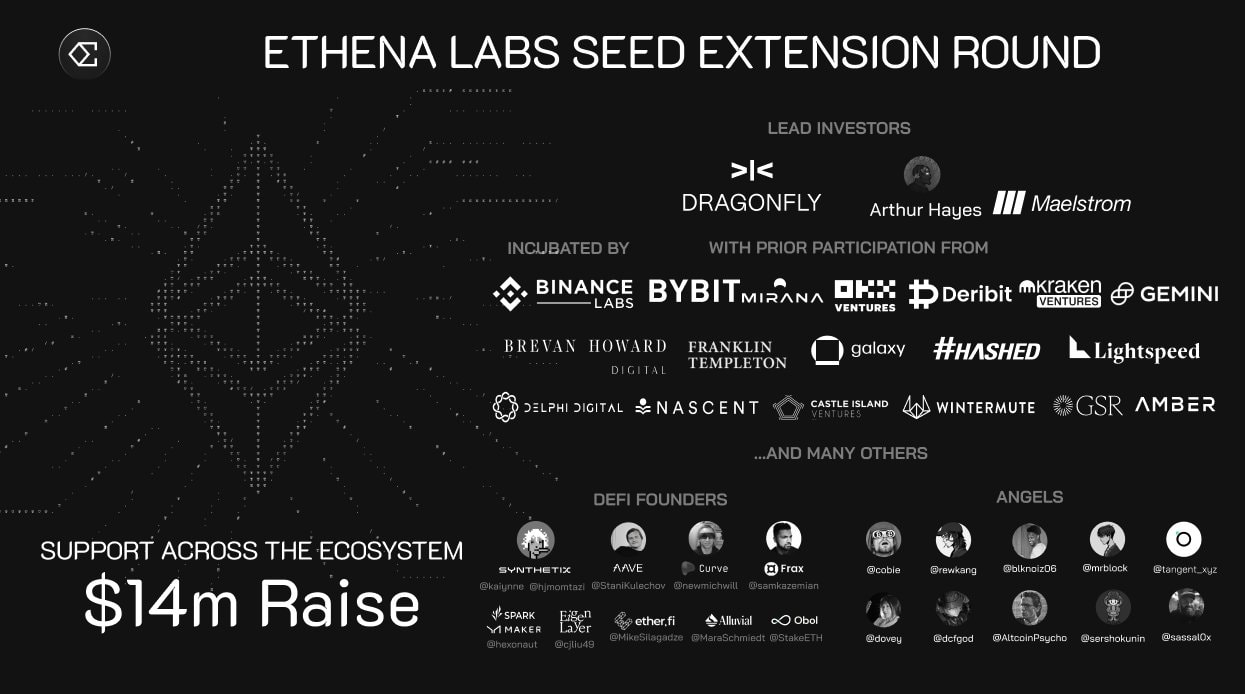

The project has raised a total of $20.5 million through three funding rounds, including:

-

Seed Round (July 2023) - $6.5 million: With participation from funds such as Dragonfly, Deribit, Okx Venture, Gemini, etc.

-

February 2024: The project received investment from Binance Labs, but the amount raised is not specified.

-

Strategic Round (February 2024) - $14 million: With participation from funds such as Dragonfly, Deribit, Okx Venture, Binance Labs, Gemini, Delphi Digital, etc.

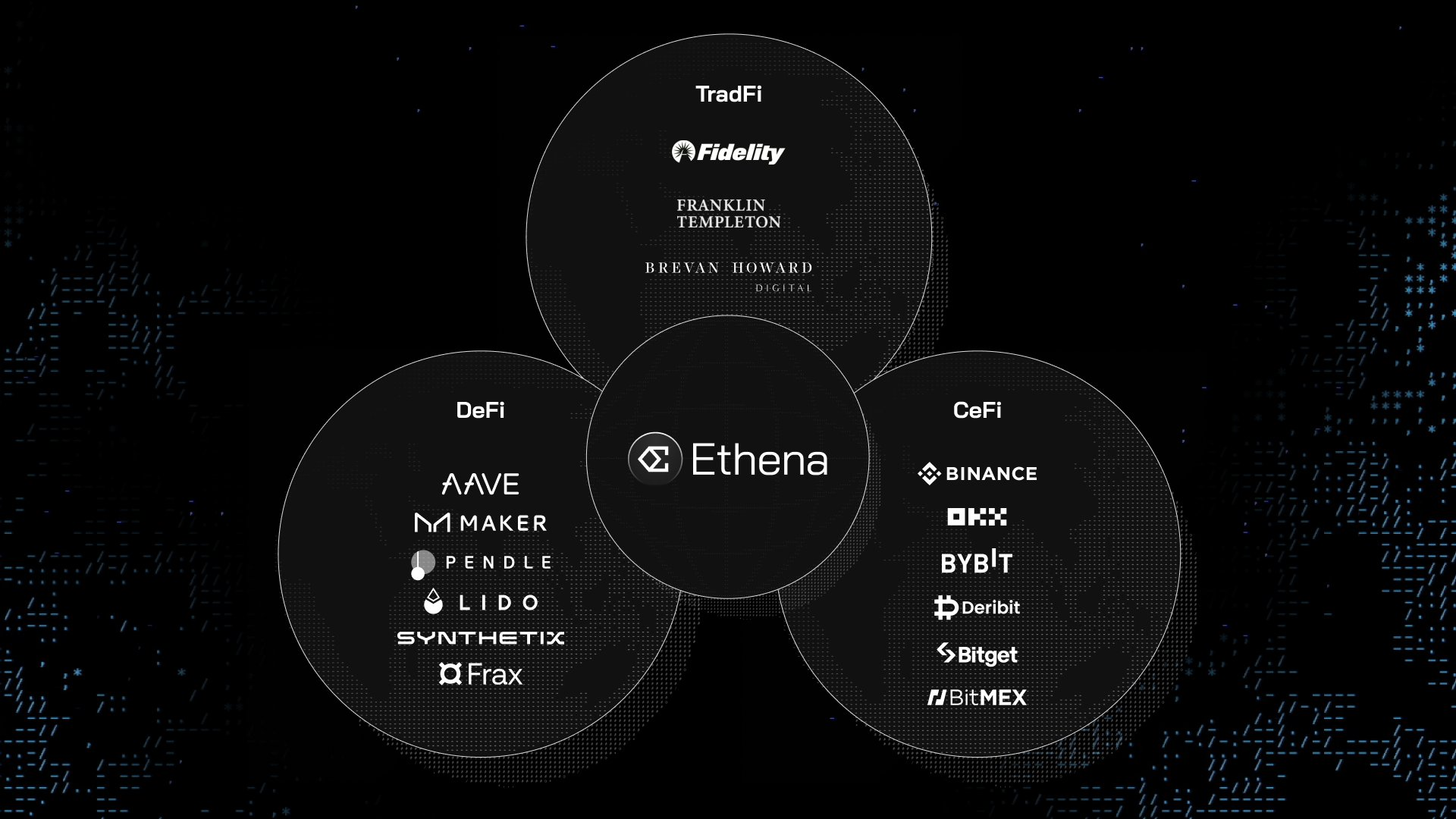

Looking at the lineup of backers, we can see that most of the major VCs in the market have participated in this project, along with traditional large investment funds like Franklin and Brevan Howard. This project is considered to have the involvement of most major VCs in the market.

6. Roadmap

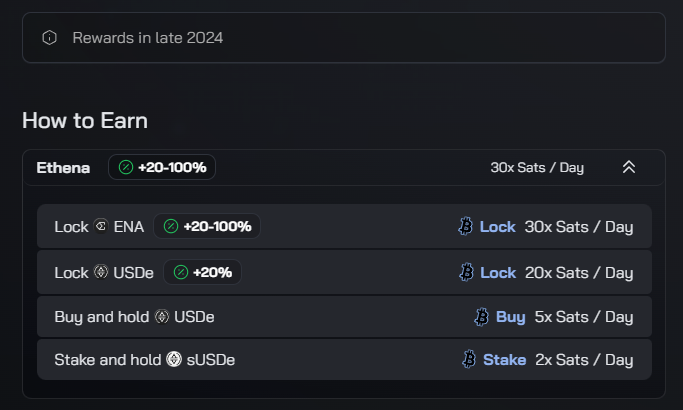

The project has just concluded Season 1 and is launching Season 2, similar to its first season, through integration with various platforms.

In Season 2, participants from Season 1 will benefit from an additional 50% bonus when participating.

This will be the next major event to allocate a large amount of Incentive tokens to project users in Q3, scheduled to end in September this year, as indicated by Delphi Digital. However, this information is not yet confirmed by the project.

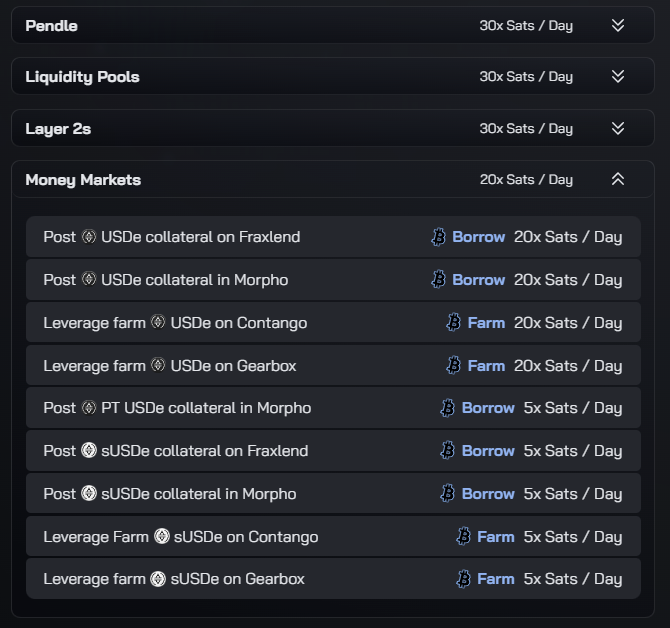

Additionally, the project is actively expanding its ecosystem by integrating the usability of USDe into various DeFi Dapps in the market. Looking at the image below, we can see that both USDe and sUSDe are currently being used on several platforms such as:

-

Pendle

-

Morpho

-

Fraxlend

-

Gearbox

-

Contango

-

Zircuit

-

Swell

-

Karak

The most notable development is the recent integration of USDe into Bybit, which can be seen as the first step to increase utility for this stablecoin.

7. Conclusion

Ethena is considered a promising project in the Stablecoin sector and is seen as a tool for profit-making based on Stablecoins. The project brings greater accessibility to stablecoins and reduces reliance on traditional banks compared to projects using RWA as collateral assets, such as the Marker Dao model.

With prominent mechanisms in its structure, the project will provide better risk management for its stablecoin. With the potential support from major players in both traditional and VC markets, Ethena's development prospects are expected to grow stronger over time.

The essence of increasing the value of the $ENA token lies in expanding the usability of the Stablecoin USDe. Therefore, in the coming period, when this type of stablecoin is integrated and supported on many lending platforms, the token value can be enhanced.

Furthermore, the project's tokenomics is quite attractive, with a large portion of tokens from the funds being locked up for one year and scheduled to be unlocked in Q1 2025. This will create significant motivation for price appreciation during the uptrend cycle in the latter part of this year.

Read more:

English

English Tiếng Việt

Tiếng Việt