1. What is SmarDex?

SmarDex is an emerging decentralized finance (DeFi) platform that uses advanced algorithms to minimize the risk of impermanent losses for liquidity providers and even turn them into profits. temporary profit. SmarDex is built on Ethereum Virtual Machine (EVM) compatible blockchains such as Ethereum, BNB Chain, Polygon and Arbitrum, allowing users to swap ERC-20 tokens with lower transaction fees compared to traditional AMMs.

Structure of SmarDex

SmarDex uses a special algorithm called "fictive reserve" to equalize swap prices and minimize temporary losses. This structure helps liquidity providers earn more profits and minimize the risk of price fluctuations.

2. Products

SmarDex offers many products and services on its platform to assist users in trading and investing in cryptocurrencies.

Swap

SmarDex allows users to swap ERC-20 tokens with transaction fees as low as 0.07% (on the Ethereum blockchain), compared to the typical 0.3% fees of other AMMs. Users can choose from multiple tokens such as ETH, WETH, USDT, WBTC, and SDEX.

Liquidity

Users can contribute assets to SmarDex liquidity pools and receive equivalent LP tokens in return. SmarDex's fictive reserves automatically maintain reserve balances, minimizing the risk of temporary losses. Users can manage their assets through the Liquidity tab on the platform.

Farming

Users can deposit LP tokens into SmarDex farms to earn more SDEX. Popular farm pairs include SDEX/WETH, SDEX/USDT, WBTC/WETH. Users can manage and track their profits via the Farming dashboard.

Staking

Staking SDEX tokens allows investors to earn passive income through staking rewards. Users can start staking on the platform and check in periodically to monitor profits and withdraw tokens when necessary.

3. Tokenomics

Basic information

- Symbol : $SDEX

- Price : $0.01

- Marketcap : $68.83M

- Total supply : 10,000,000,000

- Circulating supply : 6,700,000,000

Token feature

- Trading currency : SDEX is used for trading and paying fees on SmarDex.

- Stake : Users can stake SDEX to receive rewards and access premium features.

- Administration : Participate in the administration and development direction of the platform through the DAO mechanism.

Token allocation

- Liquidity : 50% for SDEX/USDT pair

- Staking reward : 37.5%

- Long-term staking reward : 12.5%

4. Development team

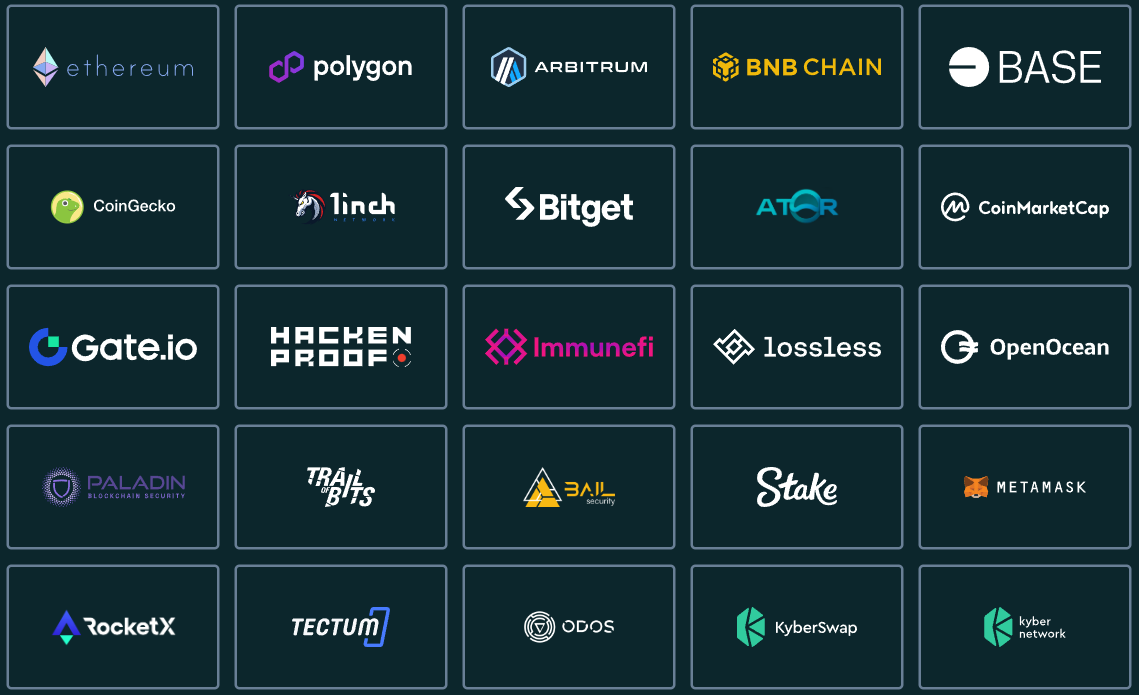

5. Partners and investors

SmarDex has attracted interest and investment from many partners and strategic investors in the cryptocurrency industry.

Strategic partnership

- Zelwin Finance : Financial support and platform development cooperation.

- Seedify : Provides financial solutions and community outreach.

Investors

- Strategic Round : $200k from Zelwin Finance

- IDO : $1.5M from Seedify, Gate, and SingularityDAO platforms

6. SmarDex's influence on the Crypto market

Minimize temporary loss

SmarDex uses a fictive reserve algorithm to minimize temporary losses, helping liquidity providers maintain asset value and enhance profitability.

Enhance market liquidity

SmarDex contributes to providing liquidity to the DeFi market, helping to enhance the trading capacity and price stability of digital assets.

Support new cryptocurrency projects

SmarDex helps new projects grow by providing liquidity and supporting ICOs, creating new investment opportunities for the market.

Enhance investor confidence

With professional development and management, SmarDex helps increase investor confidence in the DeFi market, encouraging participation and long-term investment.

7. Community

- Telegram: https://t.me/realSmarDex

- Twitter (X): https://twitter.com/SmarDex

- GitHub: https://github.com/SmarDex-Dev/smart-contracts

8. Conclusion

SmarDex is a potential DeFi platform with many useful products and services for users. With a professional development team, diverse investment strategies and support from reputable partners, SmarDex is gradually asserting its position in the crypto market. Come join and explore the opportunities that SmarDex offers to optimize your profits and protect your assets in the crypto world.

English

English Tiếng Việt

Tiếng Việt