1. What is the DAX 30?

The DAX 30 (Deutscher Aktienindex 30) is Germany's leading stock market index, comprising the 30 largest companies by market capitalization listed on the Frankfurt Stock Exchange. This index is considered an important barometer of the German economy and attracts the attention of investors worldwide.

2. The member companies of the DAX 30

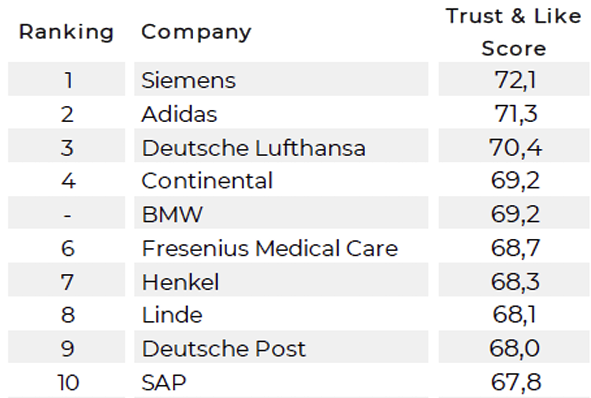

2.1. Major companies in the DAX 30

The DAX 30 includes leading companies such as:

- Siemens AG: One of the world's largest industrial conglomerates, operating in various fields including energy, healthcare, and technology.

- Volkswagen AG: A leading automobile manufacturer with well-known brands like Audi, Porsche, and Lamborghini.

- BASF SE: The world's largest chemical producer, providing products for various industries.

2.2. Representative sectors

The DAX 30 represents a wide range of industries, from industrial, technology, automotive, and chemical to finance and pharmaceuticals. This diversity helps the index comprehensively reflect the health of the German economy.

3. The importance of the DAX 30

3.1. Measuring economic health

The DAX 30 is an important barometer of the German economy, which is the largest economy in Europe and a key driver of the eurozone. The fluctuations of this index often reflect the economic situation and investor confidence in Germany's economic outlook.

3.2. Tool for investors

The DAX 30 index not only helps investors track the performance of leading companies but also serves as the basis for many investment funds, ETFs, and other financial products. For example, the iShares DAX ETF tracks the performance of the DAX 30, providing investors with an easy and efficient way to access the German stock market.

4. Calculation method of the DAX 30 index

The DAX 30 index is calculated based on the market capitalization of its constituent companies. A company's market capitalization is determined by multiplying the current stock price by the number of outstanding shares. The index uses a market capitalization-weighted method, meaning companies with larger market capitalizations have a higher weight in the index.

4.1. Example

Suppose there are three companies in the DAX 30 with market capitalizations of 50 billion euros, 100 billion euros, and 150 billion euros, respectively. The total market capitalization of these companies is 300 billion euros. The weight of each company in the index is determined by its market capitalization relative to the total market capitalization of all the companies in the index.

5. Factors influencing the DAX 30

5.1. Global economic conditions

Fluctuations in the global economy, including economic growth, inflation, and international events, can significantly impact the DAX 30. For example, the global financial crisis in 2008 led to a significant decline in the value of the DAX 30.

5.2. Monetary policy

The monetary policy of the European Central Bank (ECB) also has a major impact on the DAX 30 index. Decisions on interest rates and quantitative easing measures by the ECB can affect borrowing costs and investor confidence.

5.3. Domestic economic situation

The economic growth, unemployment rate, and other economic indicators in Germany directly influence the DAX 30. Strong economic growth in Germany tends to increase investor confidence in the companies within the DAX 30, and vice versa.

6. Applications of the DAX 30 in investing

6.1. Portfolio Diversification

By investing in index funds or ETFs based on the DAX 30, investors can diversify their investment portfolios, reduce risks, and capitalize on growth opportunities from leading German companies.

6.2. Investment Performance Evaluation

The DAX 30 index is also used as a benchmark to evaluate the performance of investment portfolios and funds. Investors can compare the performance of their portfolios against the DAX 30 index to determine if they are achieving expected returns or not.

7. The relationship between DAX 30 and cryptocurrencies (crypto)

Although the DAX 30 primarily relates to traditional stock markets, the rise of cryptocurrencies has also created new connections and applications:

7.1. Combined Investment Strategies

Some investors use combined strategies involving both stocks and cryptocurrencies to diversify their portfolios and reduce risks. For example, they may invest in index funds based on the DAX 30 alongside purchasing crypto assets like Bitcoin and Ethereum.

7.2. Blockchain Technology Applications

Blockchain technology, the foundation of cryptocurrencies, is being explored and implemented by companies within the DAX 30 to enhance transparency, security, and efficiency. For instance, Siemens has started deploying blockchain projects for supply chain management and energy sectors.

7.3. New Financial Products

New financial products, such as cryptocurrency ETF, may be linked or inspired by traditional stock indices like the DAX 30. This creates new opportunities for investors to access both types of assets within the same investment portfolio.

8. Conclusion

The DAX 30 is an important index that reflects the health of the German economy and provides a useful tool for investors. Understanding the DAX 30 index and the factors influencing it will give you a deeper insight into the market and help you make informed investment decisions.

English

English Tiếng Việt

Tiếng Việt