1. What is Crypto Vesting?

Crypto vesting refers to the process of locking up cryptocurrency tokens or coins for a predetermined period before allowing tokenholders to fully access, transfer, or sell them. The primary purpose of vesting is to incentivize long-term commitment from key stakeholders, such as project developers, team members, advisers, and early investors. By locking tokens in a specific vesting schedule, blockchain projects aim to prevent individuals or entities from cashing out early and leaving the project prematurely.

Crypto vesting is typically used in initial coin offerings (ICOs), token sales, and other fundraising activities related to cryptocurrency projects. Vesting ensures that stakeholders stay aligned with the project's goals and that their interests are tied to the project's long-term success. Tokens may be released gradually over time, usually at regular intervals, with certain conditions or performance metrics attached.

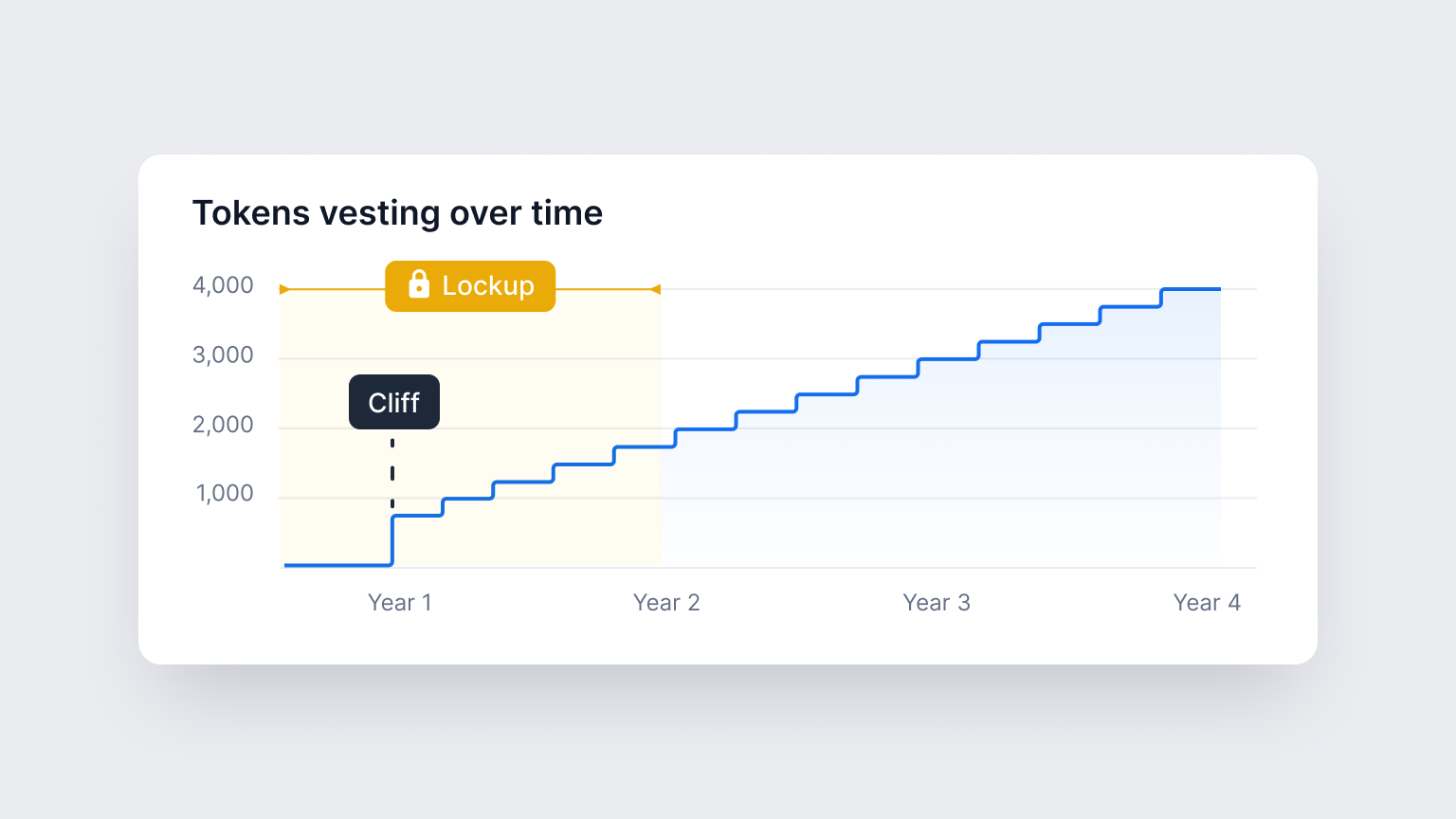

A typical vesting schedule includes a waiting period known as the "cliff," followed by incremental releases. For example, a project might have a one-year cliff, where no tokens are unlocked during the first year, followed by monthly releases over the next three years.

2. Why is Crypto Vesting Important?

%20(1).png)

Vesting serves multiple purposes in the crypto market:

-

Encouraging Long-term Commitment: By locking tokens for a set period, crypto vesting encourages stakeholders, such as team members and investors, to remain committed to the project's long-term success.

-

Preventing Speculation: Vesting helps prevent early investors from immediately selling their tokens for short-term profit, which could harm the project's credibility and market value.

-

Aligning Interests: Vesting aligns the interests of key stakeholders with the project's long-term performance, ensuring that those who contribute to the project are motivated to see it succeed over time.

-

Building Trust: Implementing crypto vesting through transparent and automated smart contracts on the blockchain builds trust among investors and the community by ensuring that vesting conditions are clear and applied consistently.

3. Types of Vesting in Crypto

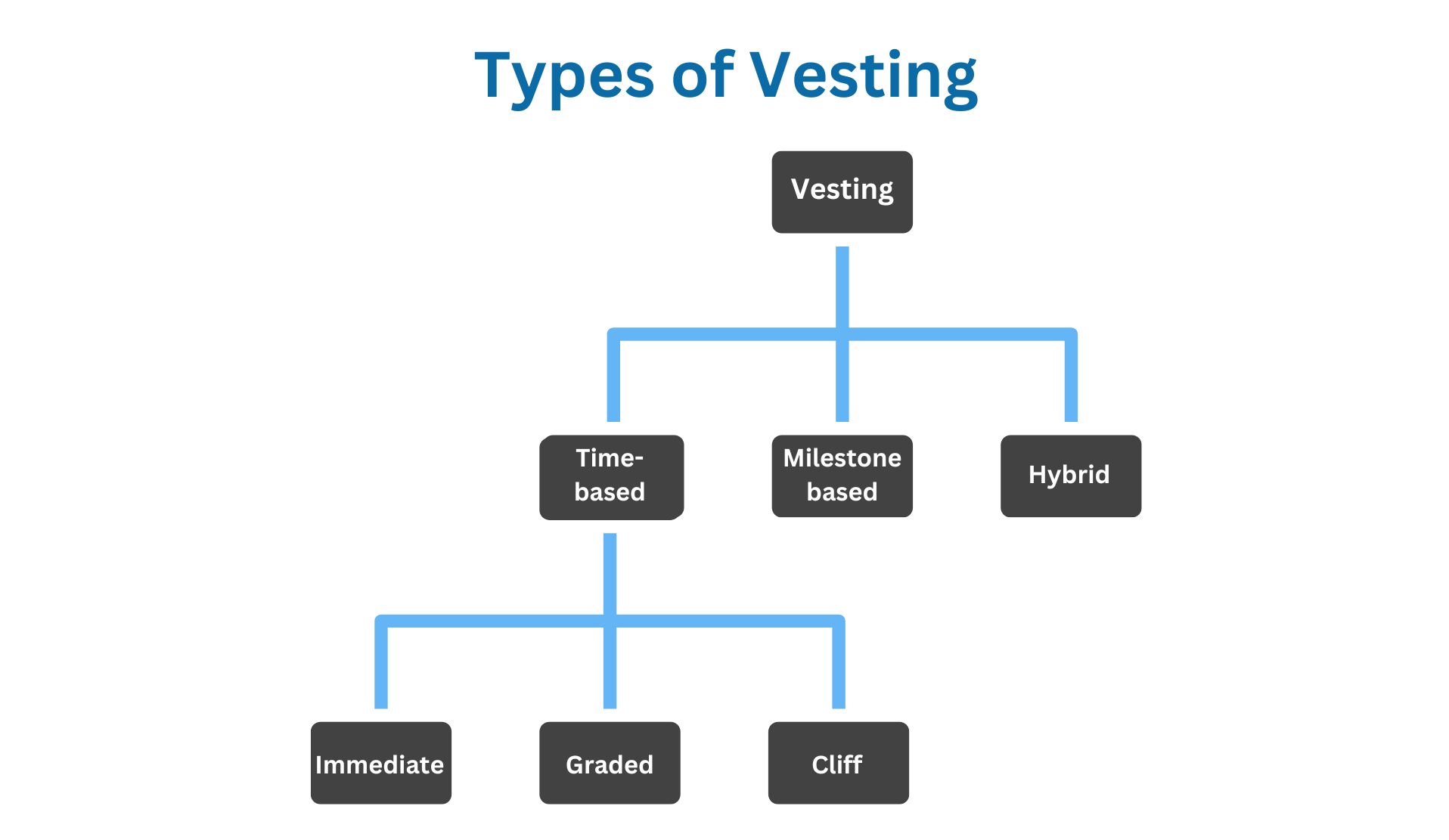

There are several types of vesting used in the crypto space, each designed to serve different purposes and align with various project needs. The most common types of vesting are time-based vesting, milestone-based vesting, hybrid vesting, and reverse vesting.

3.1. Time-based Vesting

Time-based vesting is the most straightforward method and involves the gradual release of tokens over a set period. Tokens are distributed according to a predefined schedule, typically in equal installments.

For example, Ethereum used a time-based vesting system for its early supporters, with tokens gradually becoming accessible over a set period. However, for raw Ether (ETH), which is the native cryptocurrency of the Ethereum blockchain, a time-based vesting mechanism is less common. Raw Ether is not tokenized like other assets and does not typically utilize the same vesting mechanisms as ERC-20 tokens.

3.2. Milestone-based Vesting

Milestone-based vesting ties the release of tokens to specific project milestones or objectives. These milestones may include the completion of key development phases, software updates, or achieving certain growth metrics. The idea behind milestone-based vesting is to incentivize stakeholders to remain involved in the project until significant objectives are met.

For instance, a blockchain project might distribute a portion of tokens to team members and advisers when the project hits a significant technical achievement, such as launching a new feature or completing a major network upgrade.

Milestone-based vesting ensures that tokenholders remain motivated to contribute to the project’s success, as their rewards are directly linked to the completion of key objectives.

3.3. Hybrid Vesting

Hybrid vesting is a combination of both time-based and milestone-based vesting. Under this system, a portion of tokens is gradually released based on the passage of time, while another portion is contingent on the successful achievement of specific milestones.

This dual approach offers the benefits of both models: long-term commitment through time-based releases, and motivation to reach important project goals through milestone-based releases. Hybrid vesting can be a useful strategy for blockchain projects that want to balance time commitment with tangible project progress.

3.4. Reverse Vesting

Reverse vesting is the opposite of traditional vesting. Under this model, a recipient who initially owns tokens may be required to forfeit those tokens if specific conditions are not met. Reverse vesting is often used in cases where tokens are granted based on a future performance condition, such as successfully completing a development milestone or fulfilling a contractual obligation.

Filecoin, for example, used reverse vesting for its Simple Agreement for Future Tokens (SAFT) investors. Filecoin's mining rewards are distributed in a way that 25% of the block rewards are immediately available to miners, while the remaining 75% vest gradually over six months.

4. Crypto Vesting vs. Traditional Financial Vesting Models

While the concept of vesting is not new and exists in traditional financial systems, crypto vesting has some unique characteristics due to the nature of blockchain technology.

4.1 Traditional Financial Vesting

In traditional finance, vesting is commonly used in the context of employee compensation. For example, stock options or restricted stock units (RSUs) are often subject to a vesting period to ensure that employees remain with the company. Traditional vesting is typically managed by centralized entities and does not involve the use of blockchain-based technology. The process is typically slow and can involve a significant amount of administrative oversight.

In traditional vesting, employees usually need to wait a set period (the "cliff") before receiving ownership of their equity. Over time, they receive incremental ownership, often tied to continued employment or achievement of certain business goals. Milestone-based vesting can occur in the context of performance-based stock options or other equity compensation plans.

4.2 Crypto Vesting

On the other hand, crypto vesting operates through decentralized systems and blockchain technology. Smart contracts are often used to automate and enforce vesting rules, providing transparency and security. The decentralized nature of blockchain means that once the conditions for vesting are set, they are automatically executed without the need for intermediaries or centralized control.

Crypto vesting also has the advantage of being able to handle complex scenarios, such as hybrid and milestone-based vesting, more efficiently than traditional systems. Furthermore, crypto vesting is typically faster and more accessible, as it does not require as much administrative overhead as traditional financial systems.

5. How does Token Vesting impact the Token Supply?

One of the most significant impacts of token vesting is on the supply and liquidity of tokens in the market. When tokens are locked in a vesting schedule, they are not considered part of the circulating supply. This means that they are not available for trading or sale until they are unlocked according to the vesting conditions.

As tokens gradually unlock, they enter the circulating supply, potentially impacting market dynamics. The release of tokens can affect the token's price, liquidity, and overall market capitalization. In general, vesting helps to prevent an oversupply of tokens in the market, reducing the potential for price volatility caused by large-scale selling.

The gradual unlocking of tokens also ensures that the project’s ecosystem remains stable, and that key stakeholders remain aligned with the project's goals over time.

6. The Benefits and Risks of Crypto Vesting

6.1. Key Benefits

-

Transparency and Trust: Smart contracts guarantee fair, automated token releases, boosting confidence.

-

Aligned Interests: Vesting incentivizes stakeholders to focus on long-term success over short-term gains.

-

Flexibility: Schedules can adapt to milestones or timelines, fitting unique project needs.

-

Decentralized Security: Blockchain removes central control, reducing risks of tampering or errors.

-

Reduced Speculation: Gradual token unlocking promotes stability and discourages early sell-offs.

6.2 Major Risks

-

Regulatory Uncertainty: Evolving rules may complicate compliance across jurisdictions.

-

Smart Contract Vulnerabilities: Bugs or exploits can disrupt vesting processes.

-

Liquidity Risks: Token unlocks may lead to market volatility if not managed carefully.

-

Lack of Standardization: Varying practices can confuse stakeholders and hinder comparisons.

-

Balancing Incentives: Overly long or short vesting periods can misalign stakeholder expectations.

7. Conclusion

Vesting is an essential tool in the cryptocurrency world, helping to ensure that stakeholders remain committed to the long-term success of a project. Whether through time-based, milestone-based, hybrid, or reverse vesting, crypto projects can use this mechanism to align interests and prevent short-term speculation.

Compared to traditional financial vesting models, crypto vesting offers the added benefits of decentralization, automation, and transparency, all of which are crucial in maintaining trust within the blockchain ecosystem. Understanding how vesting works, and its impact on token supply and market dynamics, is essential for anyone involved in the crypto space.

Read More:

- What is an Exit Scam? How Investors can Avoid Exit Scams

- What is a Crypto Wallet Finder? Your comprehensive guide to choose the Best Crypto Wallet

- Is Crypto safe? The secret to protecting assets in crypto

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)