1. The Need for Government Regulation on Cryptocurrency

Cryptocurrencies, with their decentralized nature, have raised concerns about their potential for misuse. From money laundering and terrorist financing to tax evasion and fraud, the risks associated with unregulated cryptocurrency markets are significant. As such, cryptocurrencies should be regulated by government authorities to mitigate these risks and ensure the stability of the global financial system.

Government control over cryptocurrency can bring numerous benefits, including the protection of consumers, the enforcement of anti-money laundering (AML) measures, and the prevention of illicit activities. Moreover, regulation can foster innovation by providing a clearer legal framework, allowing businesses to operate within defined boundaries.

2. Key Aspects of Government Regulation on Cryptocurrency

Government regulation of cryptocurrency is becoming increasingly important as the market grows. It focuses on security, taxation, anti-money laundering, and market stability to ensure compliance and mitigate risks.

2.1. Legal Frameworks for Cryptocurrencies

The absence of government-approved cryptocurrency regulations has led to a fragmented global landscape. Countries like Japan, Switzerland, and the United States have implemented their own laws governing cryptocurrencies, while others, such as China, have imposed strict bans on crypto trading and mining activities. The regulatory landscape is thus diverse, and businesses in the cryptocurrency space must navigate a complex set of rules.

For cryptocurrencies to achieve global acceptance and integration into traditional financial systems, government regulation must be harmonized across borders. This would allow for international cooperation on anti-money laundering (AML) policies and taxation, among other things.

2.2. Taxation and Financial Reporting

One of the key issues in cryptocurrency regulation is taxation. Governments want to ensure that profits made from crypto investments are taxed appropriately. Government control over cryptocurrency transactions could enable authorities to monitor these investments and enforce tax compliance. This is especially important as more people are using cryptocurrencies for trading, investment, and even as a store of value.

A well-designed regulatory framework will require cryptocurrency exchanges and wallets to report transactions to tax authorities. This will help to track taxable events such as capital gains from cryptocurrency sales and help prevent tax evasion.

2.3. Consumer Protection and Fraud Prevention

Another significant benefit of cryptocurrency government regulation is consumer protection. Cryptocurrencies can be highly volatile, and investors, especially those new to the space, can be vulnerable to scams, fraud, and market manipulation. Government-approved cryptocurrency regulations can ensure that crypto exchanges and service providers follow best practices in terms of transparency, security, and accountability.

Regulations that enforce rigorous KYC (Know Your Customer) and AML standards would protect users from fraud and ensure that the crypto ecosystem remains secure and trustworthy.

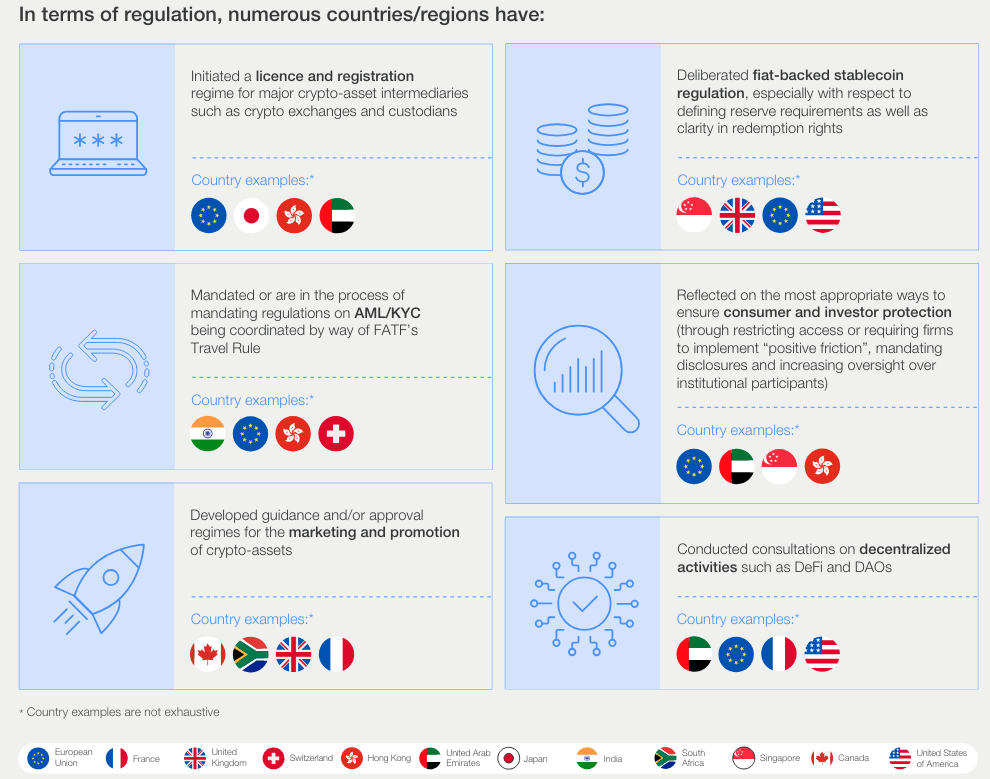

3. How Governments Approach Cryptocurrency Regulation

Governments are taking different approaches to regulating cryptocurrencies, but most share a common goal of ensuring the stability of their financial systems while addressing the risks posed by the crypto market. Let’s take a closer look at the strategies being employed:

- Regulatory Clarity: Some governments, such as Switzerland and Singapore, have adopted a clear regulatory stance on cryptocurrency and government regulation, providing specific guidelines for businesses and investors. These countries view cryptocurrencies as part of the broader financial landscape and have put in place legal frameworks that allow for growth while mitigating potential risks.

- Banning Cryptocurrencies: On the opposite end of the spectrum, countries like China have taken a more aggressive stance, banning crypto exchanges and initial coin offerings (ICOs). These countries argue that government control over cryptocurrency is essential for maintaining monetary sovereignty and preventing financial instability. However, such bans have often led to the relocation of crypto businesses to more crypto-friendly jurisdictions.

- Balancing Innovation with Control: The key challenge for governments is to strike a balance between regulating cryptocurrencies and allowing for innovation in the space. Overregulation could stifle growth, while underregulation could expose the financial system to significant risks. Governments must find ways to allow cryptocurrency and government regulation to coexist, promoting innovation without compromising on safety and security.

4. The Impact of Government Regulation on the Crypto Industry

The implementation of cryptocurrency government regulation could have a profound impact on the crypto space. Let’s explore some of the potential outcomes:

- Increased Legitimacy and Institutional Adoption: A well-structured regulatory environment would give cryptocurrencies government-approved status, making them more attractive to institutional investors and traditional financial institutions. This could lead to greater mainstream adoption, as more businesses and individuals become comfortable with the idea of using digital currencies in their everyday transactions.

- Enhanced Security and Trust: By enforcing regulatory standards such as AML, KYC, and cybersecurity requirements, governments can help to create a safer environment for cryptocurrency users. This could lead to reduced fraud and a higher level of trust among consumers, businesses, and investors alike.

- Improved Market Stability: With clearer regulations in place, the volatility that often characterizes the cryptocurrency market may be reduced. Government regulation on cryptocurrency can help to prevent market manipulation and create a more stable environment for investors and users.

- Encouraging Global Cooperation: Cryptocurrency regulation by government bodies can also encourage global cooperation, leading to more effective coordination on international issues such as tax evasion, money laundering, and financial stability. By aligning regulatory standards, countries can work together to create a global framework that addresses the risks associated with cryptocurrencies while promoting innovation and growth.

5. Conclusion

As the cryptocurrency market continues to evolve, the role of government regulation on cryptocurrency will only become more important. While there are challenges in creating a uniform regulatory framework, the benefits of cryptocurrency government regulation are clear. Governments must work together to create balanced, clear, and enforceable regulations that protect consumers, foster innovation, and ensure the stability of the global financial system.

In the coming years, we can expect to see more government control over cryptocurrency, whether through the approval of specific government-approved cryptocurrency projects or the establishment of comprehensive regulatory guidelines for the industry as a whole. Ultimately, the regulation of cryptocurrencies will be a crucial factor in shaping the future of digital finance and the global economy.

Read more:

Tiếng Việt

Tiếng Việt