1. What is a Hammer Candle?

The hammer candle is one of the most classic trend reversal patterns in the Bitcoin market. Applying the hammer candle for trading is not exactly easy, but it’s not particularly difficult either. Therefore, I decided to dedicate an entire article to discussing the hammer candle. What is a hammer candle, how to identify it, and finally, how to apply it in trading?

Let's start with the first part: an overview of the hammer candle pattern!

Explanation of the Name: It’s called a hammer candle simply because it resembles a hammer.

2. How is a Hammer Candle Formed?

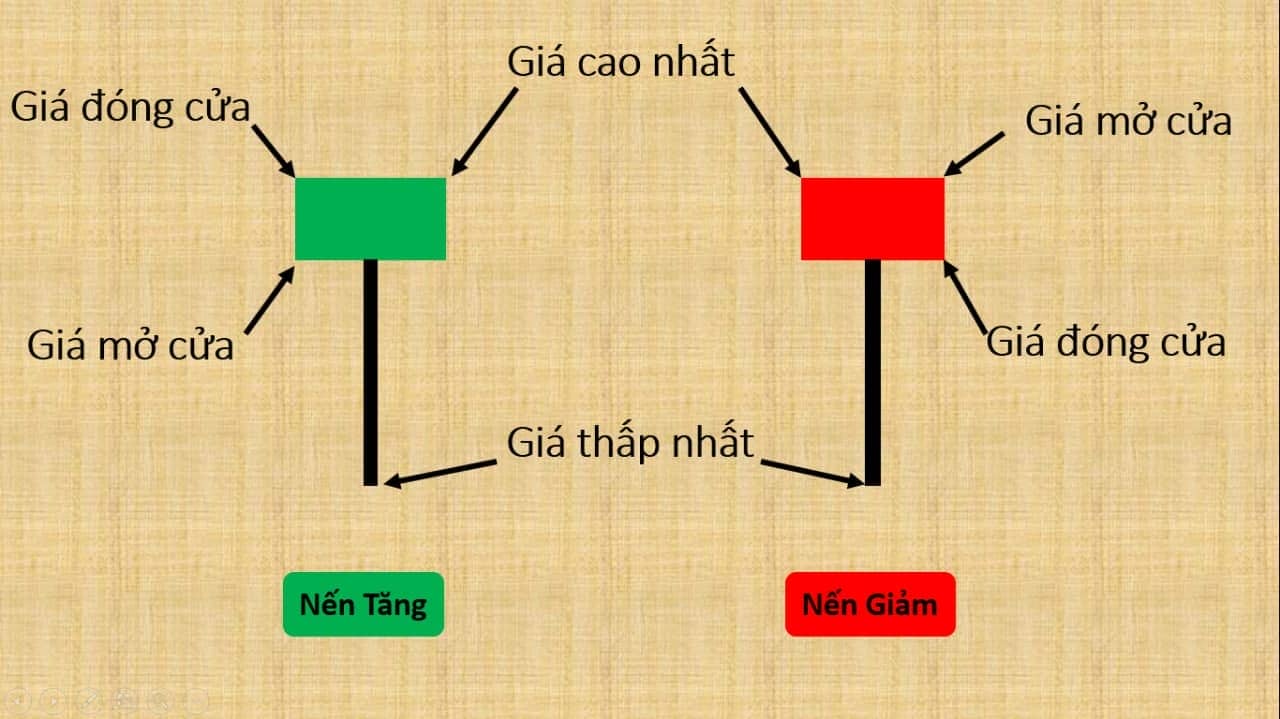

A hammer candle forms when, during a trading session, the price is pushed down initially, reaching a low point where there is significant buying interest. By the end of the session, strong buying pressure drives the price back up, closing near the opening level, as illustrated in the image below.

A hammer candle typically has a lower shadow (or "wick") that is 2-3 times longer than the body of the candle. The longer the lower shadow, the stronger the buying pressure from the market. Hammer candles with long lower shadows tend to be more effective.

Identifying a Hammer Candle

-

First, a hammer candle is a bullish reversal pattern and only appears at the bottom of a downtrend. Therefore, we need to determine what the trend was before the hammer candle appears—whether it was an uptrend or a downtrend.

-

The hammer candle has a small body, with the lower shadow being 2-3 times longer than the body. The color of the candle, whether green or red, is not crucial, but a green hammer candle typically indicates a stronger reversal momentum.

-

Another very important factor is its trading volume. If the hammer candle is accompanied by a "spike" in trading volume, it indicates that there is strong buying interest in that area of the market.

How to Determine the Effectiveness and Accuracy of the Hammer Candle Pattern

-

On the market, hammer candles can appear in many places and at various positions. When the market has not yet formed a peak or a trough, it can be challenging to determine if a hammer candle marks the bottom. However, here are some positions where the appearance of a hammer candle can potentially create a new bottom on the price chart, stabilize the price, and halt the downtrend. This is the most exciting part of today’s article, and I have integrated trading strategies within this section. If you pay attention and read this part thoroughly, you will likely be able to profit from this "magic hammer" in the near future.

-

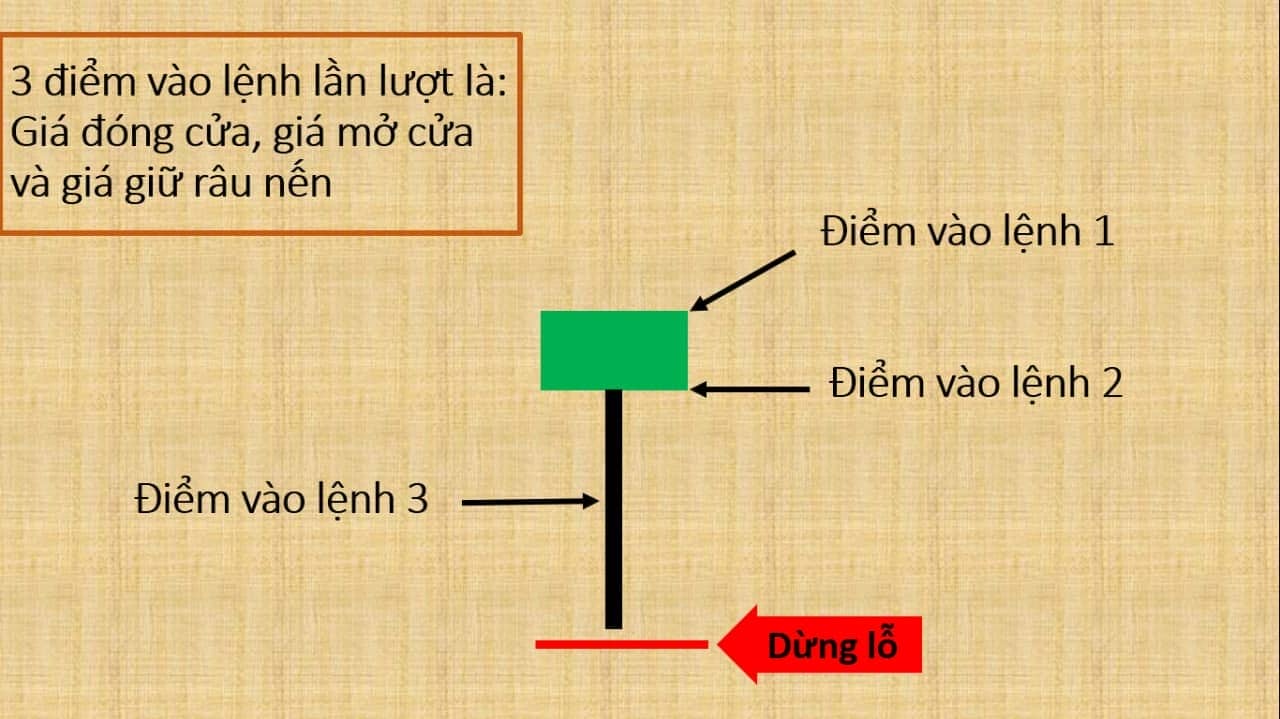

Before diving into the strategies for combining hammer candles with trading, you need to understand how to place orders when encountering a hammer candle. I will guide you on how to select entry points and set stop-loss levels. Afterward, we will move on to the strategies.

There are 3 entry points when we encounter a Hammer Candle

- Entry Point 1: At the closing price of the hammer candle, meaning right after the hammer candle closes, you can open a trade at this moment. This situation often occurs with green hammer candles where the highest price is close to the closing price. It indicates that during the trading session, the buying pressure from the bulls was strong enough that by the end of the session, the closing price was nearly the same as the opening price. A clear indicator of this is that the upper shadow of the candle is very small or almost non-existent.

-

Entry Point 2:The second entry point is at the opening price of a green hammer candle, which is also the closing price of a red hammer candle.

For a clearer understanding, refer to the example on the candlestick chart.

-

Entry Point 3: This is also a crucial and highly important entry point. When trading with the hammer candle pattern on higher time frames such as the 4-hour, daily, or weekly charts, be cautious because the price volatility (%) can be quite significant, especially with altcoins.

In cases where the price tends to move back towards the range of the hammer candle, it often happens when the preceding candle has a long lower shadow or wick extending below the hammer candle. In such scenarios, the price may not immediately increase after the hammer candle appears. Instead, it may slightly decrease back towards that wick area to retest the support zone before any significant upward movement occurs.

3.Effective Situations for Applying the Hammer Candle in Trading

Now, let's explore the common scenarios where the appearance of a hammer candle typically provides high effectiveness and accuracy.

- Scenario 1: This classic scenario occurs when the hammer candle appears at a support level. See the image below for a clearer understanding.

You can see that a hammer candle has previously appeared in this area, indicating strong buying pressure from the market. When the price returns once again, the buying pressure reemerges, forming a new hammer candle. This is one of the best scenarios where you can trust that the hammer candle pattern will be effective. If you encounter this situation in the market, you can apply the trading methods I described above.

All three entry points in this scenario can be used for trade execution, and the stop-loss level is consistently maintained, with the price never touching the stop-loss point. Besides this specific support zone, there are many other support levels that I cannot cover in this article. You can open your charts and explore them on your own.

As a bonus, the hammer candle pattern shown in the image forms a double bottom pattern. In future articles, I will share more about the double bottom pattern.

-

Scenario 2: Combining the Hammer Candle with RSI and RSI Divergence

When the RSI hits the oversold threshold (30 or below), this often indicates a potential reversal point. In addition to this scenario, we may also encounter bullish divergence on the RSI. Hammer candle patterns appearing at this level are typically highly effective, if not extremely accurate. However, understanding divergence can be quite complex, so I haven’t covered it in this article. In a future article focused on RSI and divergence, I will organize a live stream to provide a detailed guide on how to identify and apply these concepts in trading.

These are two typical scenarios where the hammer candle pattern is highly effective. There are many other situations where the hammer candle can also have a strong impact, but due to the sheer number, I can't cover them all in this article. In the near future, I will be organizing live streams to guide you through practical applications of the hammer candle pattern directly on price charts. If you want to register to participate, please leave a comment below this post. I will announce the official dates for the live streams later.

Read more:

English

English Tiếng Việt

Tiếng Việt

.jpg)