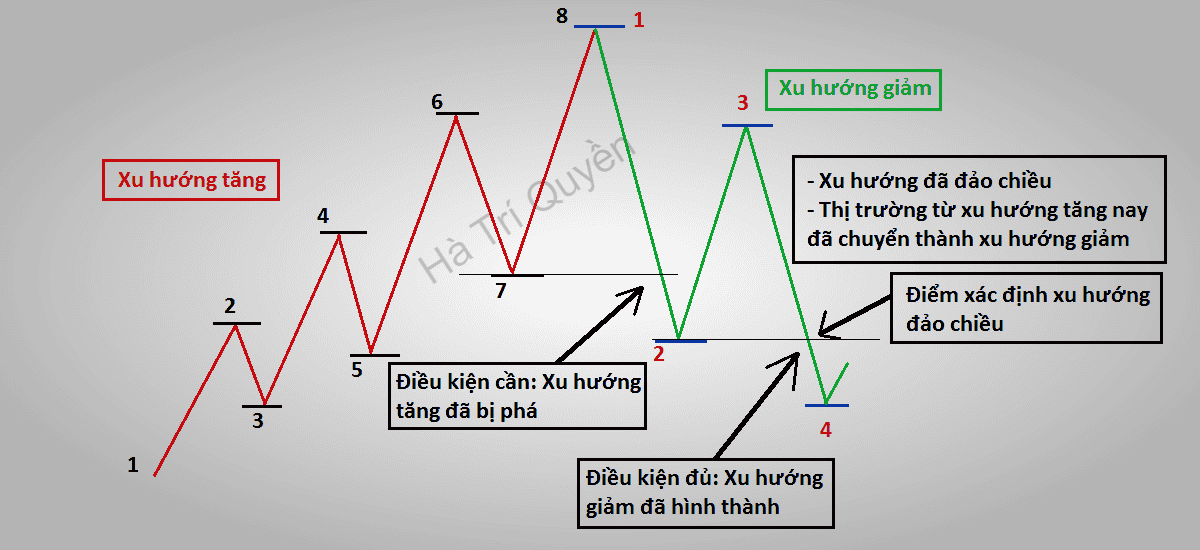

1. Considering the market trend

The devotees of technical analysis always worship market trends. They consider the market trend across various timeframes, from larger to smaller. More specifically, they analyze the trend structures of monthly, weekly, daily, and 4-hour candlesticks. For day traders, they scrutinize even smaller timeframes like the 1-hour, 15-minute, and 5-minute candlesticks. In the global trading community, they often remind each other with this saying: 'The Trend Is Your Friend.' They see the trend as their companion because trading with the market trend makes it much easier to profit compared to going against it. If the trend is upward, you should not open a Short position, and vice versa. Always trade with the market trend!

2. Reason for entering a trade. Why are you entering a trade?

Never trade based on emotions. There must be a reason to enter a trade, known as a signal from the market. For example: bullish candlestick patterns, reversal candlestick patterns, divergence signals, moving average crossovers, breakout patterns, etc.

3. Risk/Reward - What is the risk/reward ratio? It should be at least 1:2

The risk/profit ratio can be understood as how much profit you stand to gain if you are right and how much loss you might incur if you are wrong. This is an equally important factor as market trends. Managing the risk/reward ratio can help you become a profitable trader even if your win rate is very low. For example, if you have 5 winning trades and 5 losing trades, you can still be a profitable trader if you control this ratio effectively. This article is written for those who are already familiar with the R:R ratio, so it does not delve deeply into explaining it. If you're interested in learning more about the risk/reward ratio, you can read article #2 in this investment guide series.

4. What is the stop loss for this trade?

Before entering a trade, you must determine your stop loss point. Think immediately about how much you would lose if that trade fails. This is crucial to avoid serious mistakes that could result in significant financial losses. Never allow yourself to fall into a situation where you lose so much that you can't recover 100% of your initial capital or it takes a long time to restore it. Allocate your capital wisely and always know your stop loss point before entering a trade.

5. Is this a Scalping or Swing trade (intraday or longer-term)?

6. Are you following any trading strategy?

If you have a trading strategy or are testing out a particular one, knowing in advance will help you understand why you succeed or fail.

After completing a trade, always analyze its profit or loss. Identify which factors contributed to your success and which led to losses. Address weaknesses and leverage strengths. Understanding these aspects can increase your success rate in the Bitcoin market compared to inexperienced traders who struggle due to lack of planning and diligence in reviewing their trades.

Wishing you success in the cryptocurrency market!

Read more:

English

English Tiếng Việt

Tiếng Việt

.jpg)