1. What is a Spinning Top Candle?

A Spinning Top is a candlestick pattern characterized by a small body and long wicks, giving it an appearance similar to a spinning top. This pattern occurs when the market is at a standstill, with both buyers and sellers actively trading, or in other words, when there is indecision among market participants.

The primary purpose of the Spinning Top is to indicate the uncertainty among market participants; it is neither a reversal pattern nor a continuation pattern. However, some traders have a different perspective, believing that it signals market equilibrium and that the appearance of a Spinning Top, especially at the beginning or end of a trend, is an early signal of a potential reversal. When it appears in the middle of a trend, it usually does not carry much significance. It could be either a bullish or bearish candle, but this is less critical in technical analysis.

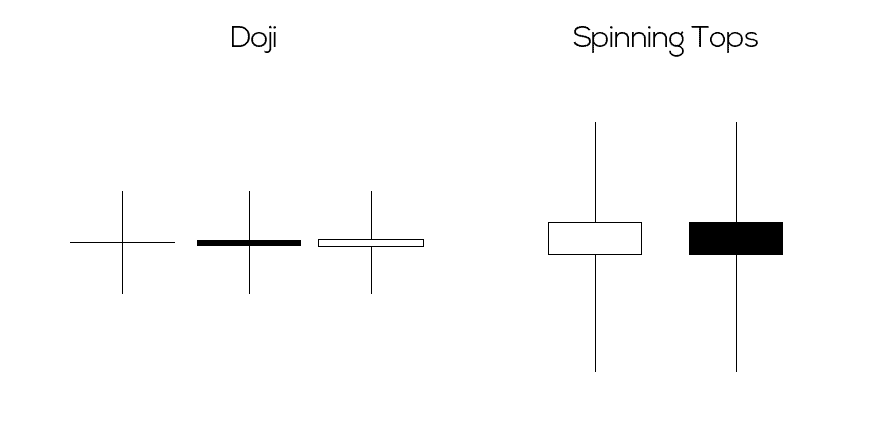

A Spinning Top, with its short body and long wicks, is often mistaken for a Doji or a Long-legged Doji. Here are some key points to distinguish between these types:

- A Doji has an extremely small body, with the opening and closing prices very close together, even overlapping. You can think of the characteristic shape of a Doji as resembling a plus sign (+).

- Compared to other candles, a Spinning Top has a small body, but it is still larger than a Doji, directly relating to the signals it provides, indicating minimal price movement.

Additionally, if the body of a Spinning Top were to be elongated, it would result in a different candlestick pattern.

The Spinning Top can be considered a versatile candlestick pattern, although it is not specifically useful for entering trades. Depending on the timing and position where it appears, it can provide certain insights for chart analysis.

2. Meaning of the Spinning Top

The Spinning Top indicates that both buyers and sellers are showing hesitation and have not taken strong actions. The equal length of the wicks on both sides demonstrates a balance in strength between the buyers and sellers, with neither side pushing the price in their desired direction.

If the candle is green, it slightly leans towards the buyers, and if it is red, it slightly leans towards the sellers. Of course, this difference is not significant.

If a Spinning Top appears in an uptrend, it suggests a continuation of the previous uptrend. Conversely, in a downtrend, it indicates a continuation of the prior downtrend.

Overall, when a Spinning Top appears, it generally means that the market will consolidate and continue the previous trend. In a future article, I will discuss how the Spinning Top behaves when combined with other candles.

Read more:

English

English Tiếng Việt

Tiếng Việt