1. Why shouldn’t you buy when the price hits support level?

The reason is that no support level is absolutely strong, and no resistance level is absolutely strong either. We can only determine its strength based on how the price reacts to the support area. You should only buy if a reversal candle pattern, such as an engulfing candle, appears.

There are many cases where, as the price approaches a support level, it either falls through it or bounces slightly before continuing to decrease. I’ll provide a few examples:

Newbies in the Bitcoin market often face many issues with support and resistance. Drawing a reasonable support line is already challenging, and applying it in trading is even more difficult. Often, people see or hear about trading signals suggesting buying at support levels like $5, $10, $15. But do people really understand why trades are executed at these levels?

In my Trade Recap series, I’ll share how to trade and handle orders when encountering a support price level.

2. How to handle orders when the price hits a support level

Case 1:

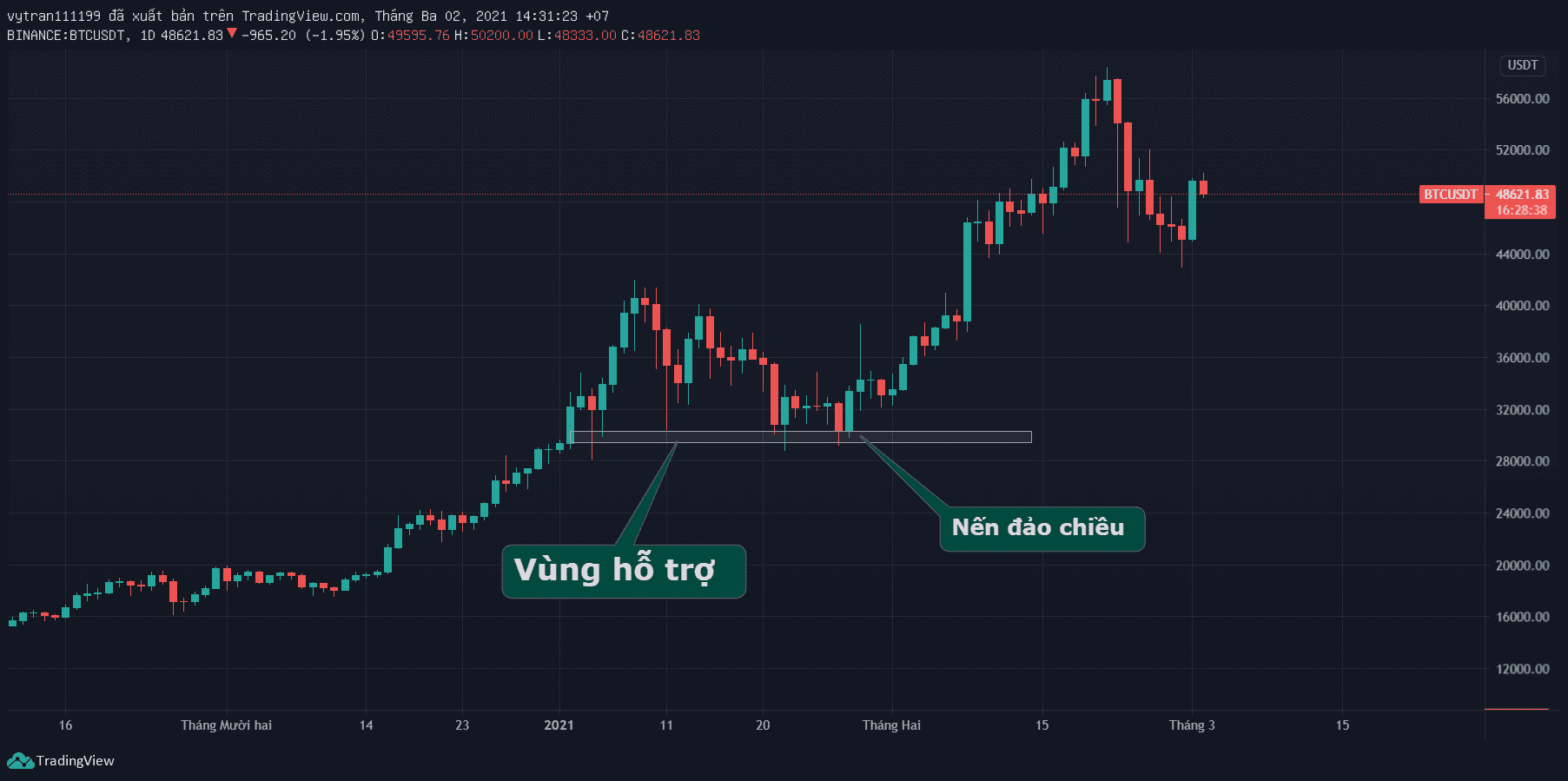

The chart below shows Bitcoin.

During the decline from $42,000 to $30,000, Bitcoin tested the $30,000 support level multiple times. This support level was not broken. On the fourth touch, BTC formed a bullish engulfing candle pattern. Here, we apply the skills to trade based on the bullish engulfing candle combined with the support level. For those who are not familiar with how to trade using the engulfing candle pattern, you can learn more here. I will discuss the engulfing candle pattern in detail in this article.

Case 2:

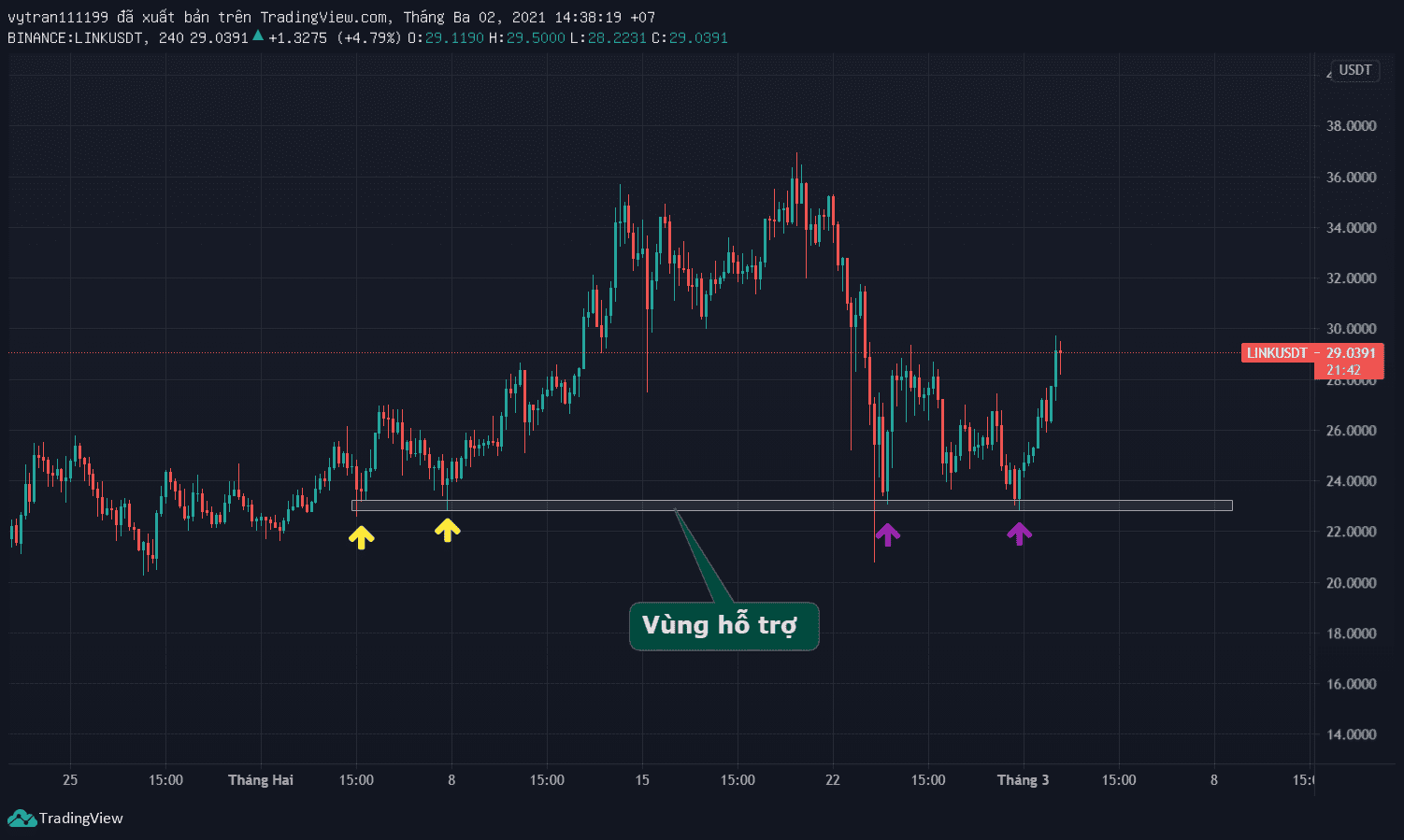

On the LINK chart, based on the two previous troughs, we can extend a support zone at $23. Remarkably, the price held above this support level on two occasions. On the most recent touch, a bearish engulfing pattern appeared, similar to Case 1. We use knowledge of the engulfing pattern to trade here.

This is an effective way to use candlestick patterns. The appearance of a pattern is not as important as where it appears. A bullish reversal candlestick pattern appearing at a support area can be highly effective.

Case 3:

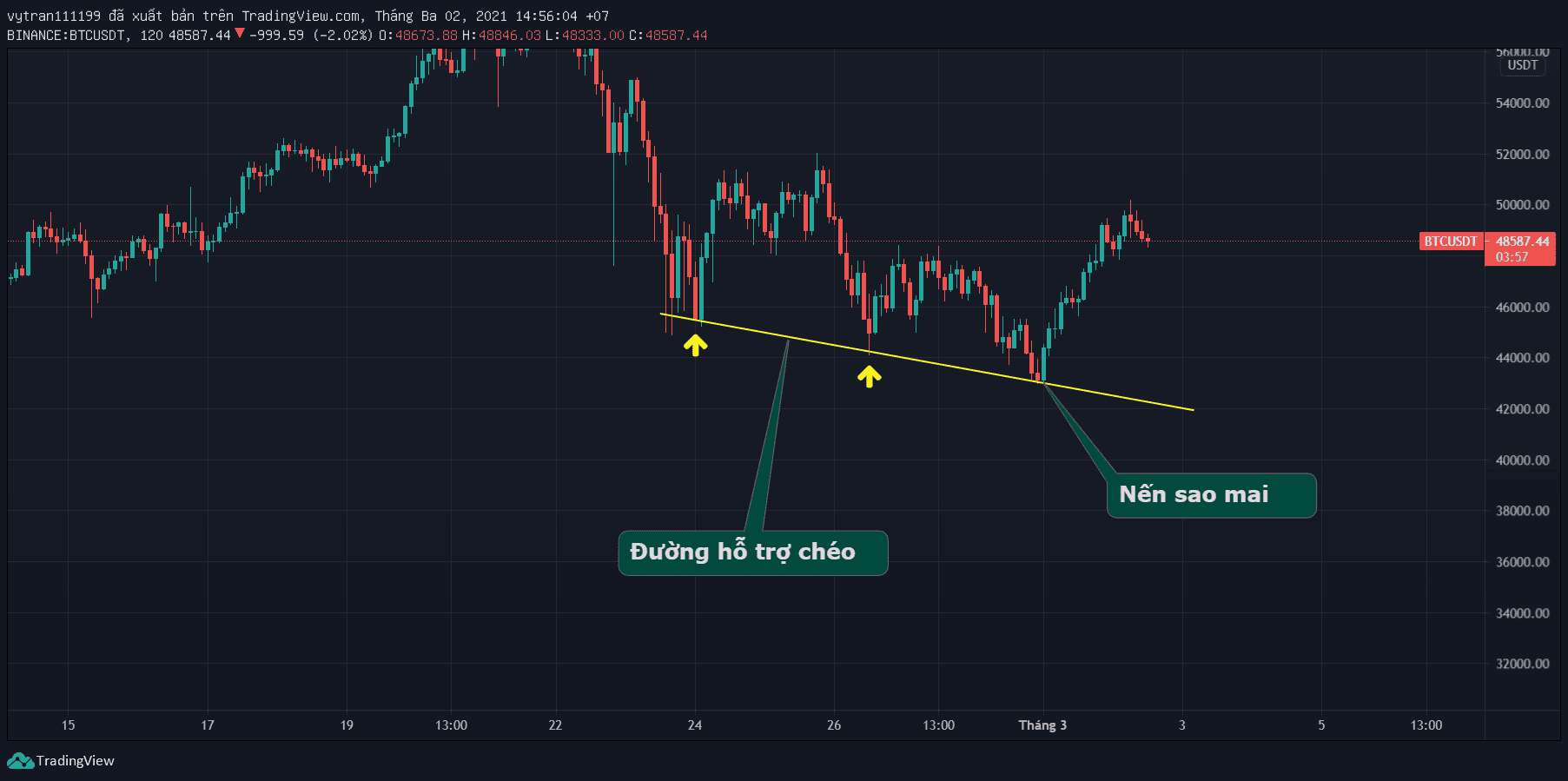

We can draw a diagonal support line through two of Bitcoin's troughs. On the third touch, the chart showed a morning star reversal pattern. If you are not familiar with the morning star, you can also apply the knowledge of the engulfing candle to trade here. With diagonal support lines, each touch usually has a better reaction than horizontal lines.

Case 4:

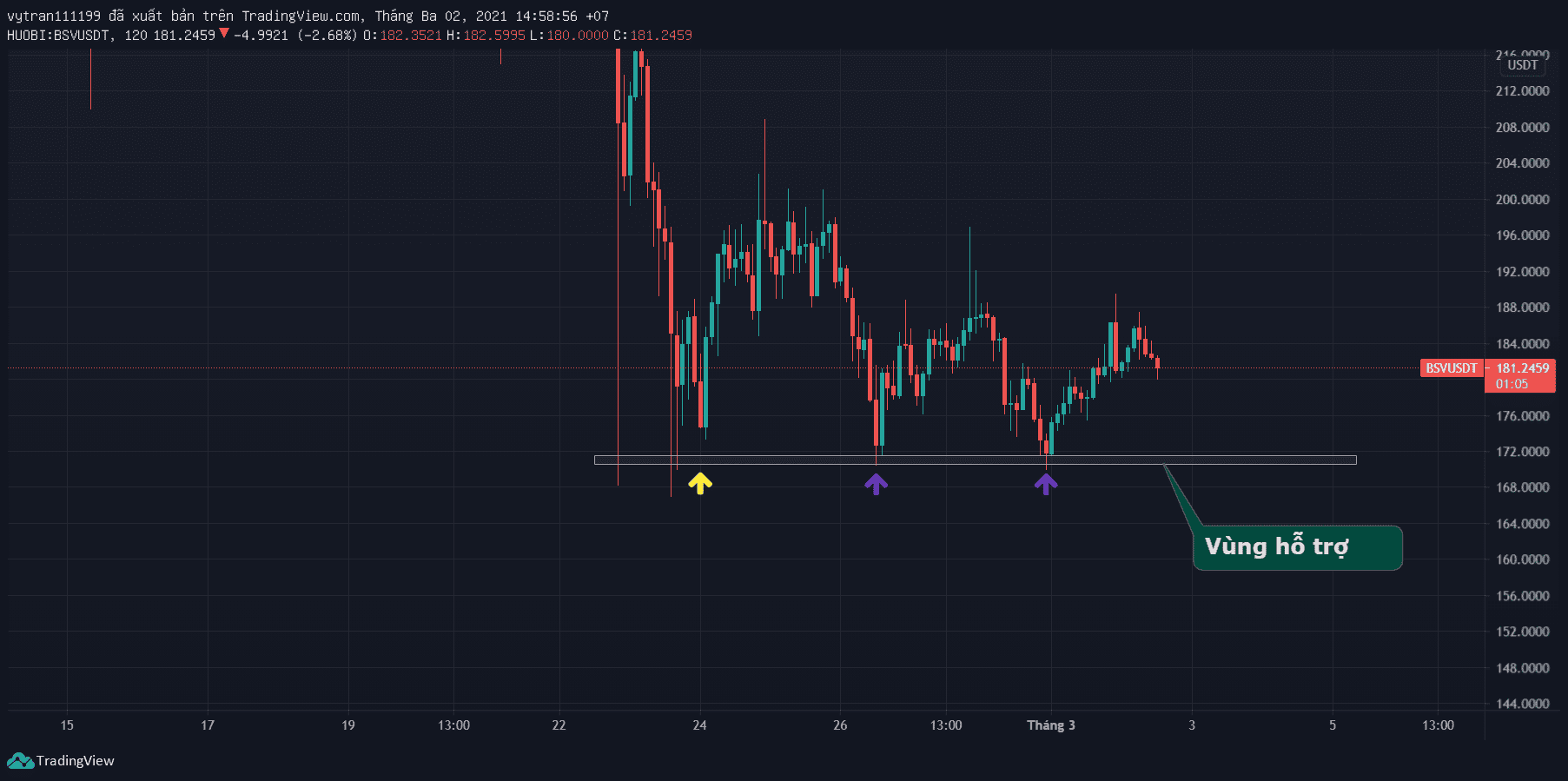

BSV formed a support zone at $172. On the third touch, the price formed a bullish engulfing pattern. If you are observant and recognize this, it will be an opportunity to place a trade.

3. Summary

In summary of the four cases: we see a straightforward trading signal here. It involves combining the bullish engulfing pattern with the support line. It is quite simple if you have these two skills:

- Identifying support

- Trading with the engulfing candle pattern

The examples provided across four different coins show that this is a recurring signal in the market. With practice, you can become proficient in this strategy and potentially make profits. This scenario occurs frequently: weekly, monthly, and yearly. So, if you’re not familiar with it, start practicing this strategy now.

How to practice?

- Learn how to draw support lines and trade with the engulfing candle pattern.

- Then, check different time frames like M15, H1, H4, D1 to find similar price setups. Reevaluate the theory to see where it is correct or incorrect, and whether there are similar cases where the price moves contrary to the theory.

There will be cases where this knowledge may deviate from actual price movements, but through trading, you will find that managing risk and capital effectively, combined with a solid strategy, will significantly increase your chances of becoming a profitable investor.

Read More:

English

English Tiếng Việt

Tiếng Việt.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)