1. What is Day Trading?

.jpg)

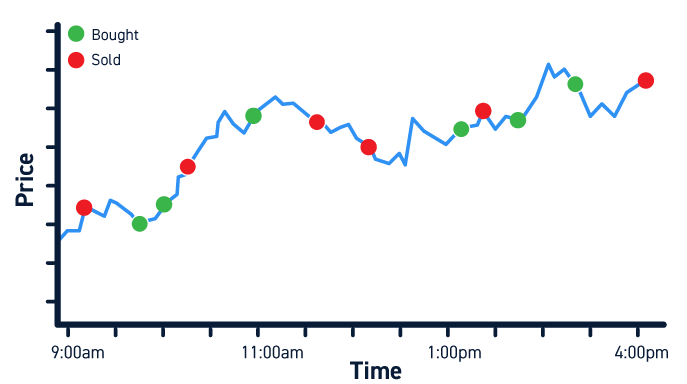

Day trading refers to the practice of buying and selling assets within the same trading day to capture short-term price movements. Unlike long-term investing, where assets are held for extended periods, day trading relies on frequent transactions, typically aiming for small profits that accumulate over time.

Key Features of Day Trading in Crypto:

-

24/7 Market: Unlike traditional stock markets that close after hours, the cryptocurrency market operates around the clock. This continuous market opens up numerous trading opportunities.

-

Volatility: Cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH) are known for their significant price swings, which can be both a blessing and a curse for day traders.

-

Decentralized and Transparent: Cryptocurrencies run on blockchain technology, ensuring transparent transactions and reduced reliance on intermediaries.

Day trading crypto is not for everyone. It requires keen attention to market trends, discipline, and a strong understanding of both technical analysis and market sentiment. Traders need to stay updated with the latest news and trends that can affect the price movements of digital assets.

2. How much can a Crypto Day Trader make?

The earnings of a crypto day trader vary significantly depending on multiple factors, including skill level, experience, market conditions, and risk management practices.

Key Factors Affecting Profitability:

-

Volatility: High volatility, such as that seen with popular coins like Bitcoin and Ethereum, creates profit opportunities but also increases risk.

-

Risk Tolerance: Successful traders have a clear understanding of how much risk they are willing to take. They set boundaries to avoid large losses.

-

Scalping: High-frequency strategies like scalping (making rapid trades for small profits) can generate consistent returns but require excellent focus and discipline.

Some experienced traders report making hundreds or even thousands of dollars in a single day, while others may experience substantial losses. It’s essential to remember that crypto markets can be unpredictable, and there are no guarantees.

3. How to Start Day Trading Cryptocurrency

Starting your journey as a crypto day trader requires preparation, patience, and a solid strategy. Here’s a step-by-step guide on how to get started:

3.1. Set a Specific Time Frame

Before you begin trading, decide on a time frame that fits your goals, lifestyle, and availability. Common time intervals used by day traders include:

-

15-minute charts: Useful for capturing quick, small price movements.

-

1-hour charts: Suitable for medium-term trades with a slightly broader perspective.

-

4-hour charts: Great for understanding larger trends and making fewer trades with more significant price swings.

Shorter time frames allow you to capture faster movements, but they require more focus and quick decision-making. Longer time frames give you a broader view of trends and can help avoid getting caught in short-term market noise.

3.2. Perform Technical Analysis

Technical analysis (TA) is the cornerstone of successful day trading. By reading candlestick charts and identifying patterns, you can make more informed decisions. Key technical indicators to focus on include:

-

Moving Averages (MA): Used to identify trends by smoothing out price data over a specific period.

-

Bollinger Bands: Help identify overbought and oversold conditions, signaling potential entry or exit points.

-

Candlestick Patterns: Look for patterns such as engulfing, doji, and hammer candles that often signal reversals.

Using these indicators in conjunction with chart patterns helps you predict price movements with greater accuracy.

3.3. Practice Risk Management

Risk management is essential for long-term success. Here are a few tips to manage your risks:

-

Stop-Loss Orders: Set a stop-loss at a predetermined price to limit potential losses if the market moves against you.

-

Take-Profit Orders: Set take-profit orders to automatically lock in gains when your target price is reached.

-

Risk-Reward Ratio: Aim for a risk-reward ratio of 1:2 or higher. For example, if you’re risking $50, try to make at least $100.

It’s recommended to never risk more than 1-2% of your capital on a single trade. This helps preserve your capital and avoids large losses.

4. Pros and Cons of Crypto Day Trading

Crypto day trading presents several advantages and challenges. Whether it's worth pursuing depends on your risk tolerance, goals, and dedication.

Advantages

-

High-Profit Potential: Crypto markets are highly volatile, offering opportunities to make significant profits within a short period.

-

Flexibility: Since the crypto market operates 24/7, you can trade from anywhere, anytime — ideal for those who prefer working remotely or during different time zones.

Challenges

-

Requires Significant Focus: Day trading requires constant monitoring of market trends, which can be time-consuming and mentally exhausting.

-

High Risk: Due to the inherent volatility of cryptocurrencies, profits are never guaranteed. A lack of discipline can lead to quick losses.

If you're disciplined, well-informed, and use proper risk management, crypto day trading can be a highly rewarding venture. However, it is essential to approach it with a clear plan and commitment to continuous learning.

5. Best Indicators for Day Trading Cryptocurrency?

Day traders rely on various technical indicators to spot trends and make informed trading decisions. Here are some of the most essential indicators for crypto day trading:

Relative Strength Index (RSI)

RSI measures the speed and magnitude of price movements and helps identify overbought or oversold conditions. A reading above 70 indicates that an asset may be overbought (a potential sell signal), while a reading below 30 suggests it may be oversold (a potential buy signal). Divergences between the RSI and price can also indicate potential reversals.

Moving Averages (MA)

Moving averages help identify the overall trend. The Simple Moving Average (SMA) tracks the average price over a set period, while the Exponential Moving Average (EMA) gives more weight to recent prices. Look for crossovers between short-term and long-term MAs to signal trend changes.

MACD (Moving Average Convergence Divergence)

The MACD shows the relationship between two EMAs, typically the 12-day and 26-day averages. It’s used to identify potential trend reversals and momentum. When the MACD line crosses above the Signal Line, it’s a bullish signal, and when it crosses below, it’s a bearish signal.

Volume

Volume measures the number of trades within a given period. It confirms the strength of a trend — high volume during a price movement indicates strong momentum, while low volume suggests weak conviction. Volume also helps validate breakouts and prevent false signals.

By combining these indicators, traders can gain a more comprehensive view of the market. It’s generally best to use multiple indicators to avoid relying on just one for decision-making.

6. How does market sentiment affect Crypto Day Trading?

Market sentiment refers to the general mood or psychology of traders and investors. Social media, news, and major events can rapidly shift sentiment and, consequently, price action.

Leveraging Social Media Trends

Cryptocurrency sentiment is often influenced by social media platforms like Reddit and Twitter. Trending hashtags or posts from influential figures can drive prices up or down. Traders can use sentiment analysis tools to track and gauge market tone.

Responding to News and Events

Positive news, such as large institutional investments or regulatory clarity, can boost prices, while negative news, like government crackdowns or exchange hacks, can lead to sell-offs.

Sentiment Analysis Tools

Various tools analyze social media trends and market sentiment, providing insights into whether the market is bullish or bearish. On-chain analytics platforms can also provide data on wallet movements and exchange inflows or outflows, which can signal shifts in sentiment.

7. Conclusion

Crypto day trading offers exciting opportunities for those who are prepared to dedicate time and effort to learning the markets, refining their strategies, and managing risks effectively. Whether you are a beginner or an experienced trader, it’s essential to focus on developing a disciplined approach, using the right tools and strategies, and understanding market sentiment. Remember, success in day trading doesn’t happen overnight — it takes practice, persistence, and a commitment to continuous improvement.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)