1. What are Moving Averages (MA)?

Moving Averages (MAs) are technical indicators that smooth out price data on a chart, simplifying price action over time. Two primary types of MAs are widely used: Simple Moving Average (SMA) and Exponential Moving Average (EMA).

As with most indicators, MAs inherently exhibit a lag due to their reliance on historical price data. While they effectively reveal the general trend of past price movements, their true value lies in their ability to provide insights into potential future price directions. By studying past patterns, traders can make more informed decisions.

Rather than solely focusing on the current market price, MAs offer a broader perspective, enabling us to measure the overall price trajectory. SMAs, in particular, allow us to identify whether the price is trending upwards, downwards, or consolidating. However, it's important to note that SMAs can be significantly influenced by sudden price spikes or drops.

2. SMA and EMA Explained

2.1 Simple Moving Average (SMA)

SMA is the arithmetic mean of the closing prices of the previous n periods, where n represents the calculation period. In simpler terms, while SMA assigns equal weight to all data points within the n-period window, EMA places greater emphasis on more recent data. It is calculated by summing the closing prices of the last X periods and dividing by X. For example, if you apply a 5-period SMA to a 1-hour chart, you would add up the closing prices of the previous 5 hours and divide by 5. This gives you the average closing price for those 5 hours. By repeating this calculation for subsequent periods and connecting the data points, you obtain the SMA line. Commonly used EMA periods include 12, 36, 21, 50, 89, and 200.

2.2 Applications of SMA

Despite its simplicity, SMA is a highly effective indicator. Some of its common applications include:

- Trend identification: The 200-day SMA is often used to determine long-term trends on daily charts.

- Dynamic support and resistance levels: In addition to identifying long-term trends, SMAs can be used to identify both short-term and intermediate-term trends.

2.3 Applications of EMA

Essentially, any application of SMA can also be applied to EMA. However, due to EMA's faster responsiveness, it is better suited for shorter timeframes.

3. What Moving Averages Reveal

Moving averages are lagging indicators that provide a smoothed representation of past price data. Due to their reliance on historical data, they are inherently slower to react to recent price changes.

- Simple Moving Average (SMA): SMA calculates the arithmetic mean of closing prices over a specified period. It assigns equal weight to all data points within that period, resulting in a smoother line that is less sensitive to short-term price fluctuations.

- Exponential Moving Average (EMA): EMA, on the other hand, places greater emphasis on recent data points. By assigning exponentially decreasing weights to older data, EMA is more responsive to price changes. This makes it a valuable tool for identifying short-term trends and potential reversal points.

While both SMA and EMA provide valuable insights into market trends, the choice between the two often depends on the trader's specific trading style and the desired time horizon. For longer-term trend analysis, SMA may be more suitable, while EMA is often preferred for shorter-term trading strategies.

4. Advantages and Disadvantages of SMA and EMA

Let's focus on EMA first. If you need a moving average that can quickly react to price changes, a short-term EMA is the most suitable choice. It can help you capture trends promptly and potentially generate higher returns. However, a drawback of EMA is that it may produce false signals during sideways markets. Due to its sensitivity to price fluctuations, EMA may incorrectly identify a new trend when it's actually just a temporary price movement.

While SMA responds more slowly to price changes, it can help filter out false signals. Nevertheless, a downside of SMA is that it can cause traders to miss out on good entry points. Many traders use a combination of different moving averages to analyze the market from multiple perspectives. They often employ a long-term SMA to identify the overall trend and a short-term EMA to pinpoint entry points.

5. How to Use Moving Averages

Moving averages provide a smoothed representation of past price data. As a result, they are inherently lagging indicators. The length of the moving average period directly influences the degree of lag. Longer-period moving averages are slower to react to recent price changes, while shorter-period moving averages are more responsive.

This lag is a direct consequence of the calculation method. When a new data point is added to the dataset, it replaces the oldest data point. For longer-period moving averages, the impact of a single new data point is relatively small, resulting in a smoother line that is less sensitive to short-term price fluctuations. Conversely, for shorter-period moving averages, the impact of a new data point is more significant, leading to a more volatile line that is quicker to react to price changes.

The choice between short-term and long-term moving averages depends on the trader's investment horizon and risk tolerance. Long-term investors often use longer-period moving averages to identify major trends, while short-term traders may prefer shorter-period moving averages to capture smaller price movements.

6. Moving Average Crossover Signals

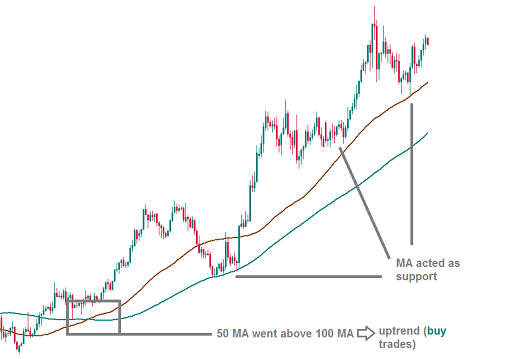

Moving average crossovers provide valuable insights into potential changes in market trend. When a shorter-term moving average crosses above a longer-term moving average, it suggests that buying pressure is overcoming selling pressure, and an uptrend is likely to develop. Conversely, a crossover below the longer-term moving average indicates that selling pressure is dominating, and a downtrend may be imminent.

The reliability of moving average crossover signals can be influenced by several factors, including:

- The specific moving averages used: The choice of moving averages (e.g., 50-day and 200-day) can impact the sensitivity of the crossover signal

- Market conditions: Crossovers may be less reliable during periods of high volatility or sideways markets.

- Combination with other indicators: Using moving average crossovers in conjunction with other technical indicators can improve the accuracy of trading signals.

Traders often use moving average crossovers as a component of their trading strategies, but it's important to note that no single indicator is foolproof. A comprehensive analysis that incorporates multiple technical indicators and fundamental factors is recommended.

Readmore:

English

English Tiếng Việt

Tiếng Việt.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)