1. What is a Stop-Limit Order?

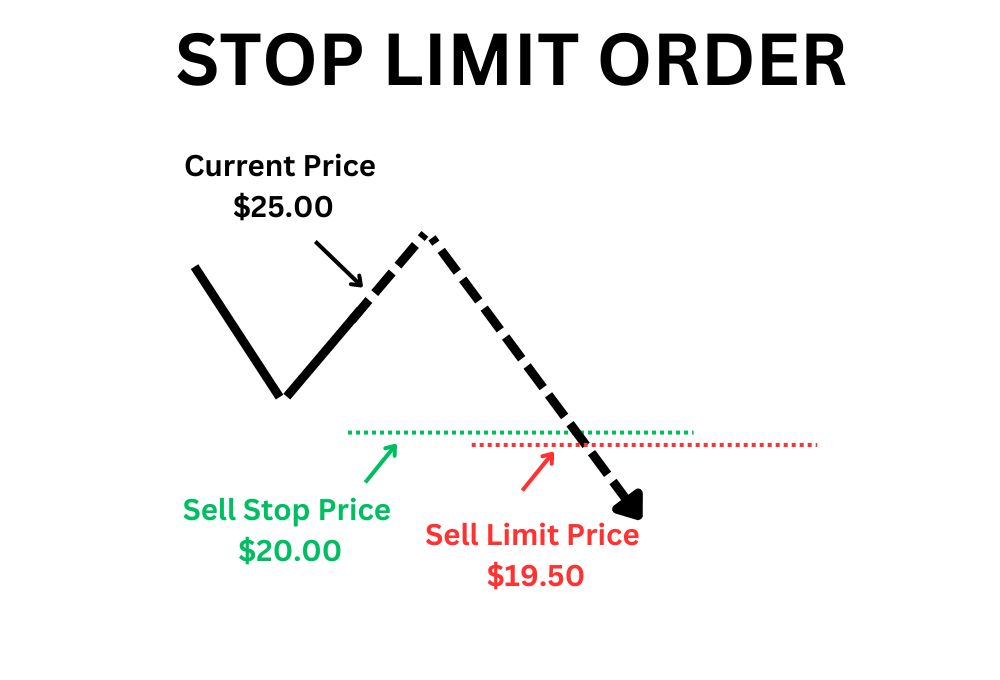

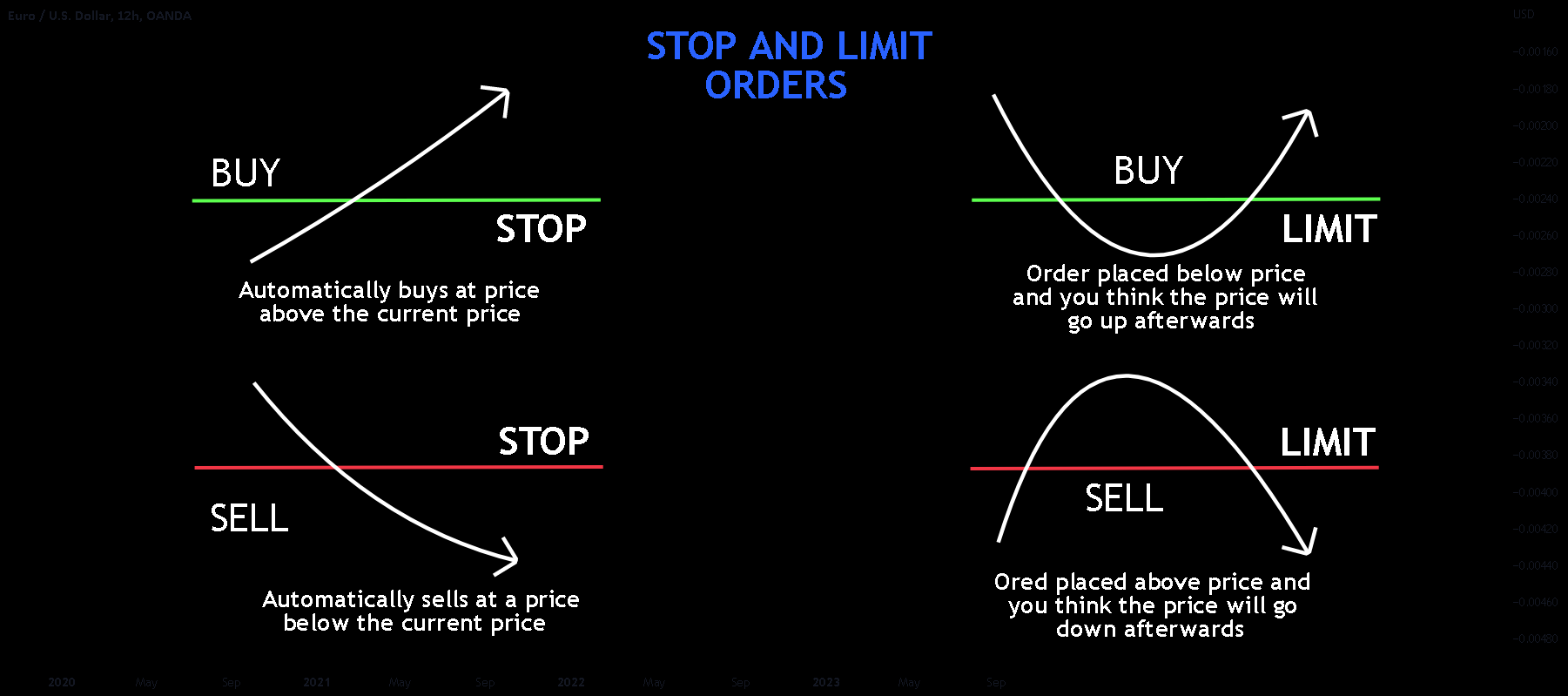

A stop-limit order is a combination of a stop order and a limit order, used to minimize losses by selling or buying a digital asset at a specified limit price when the market price hits the stop price. In other words, once the market reaches the stop price, the stop-limit order is triggered and becomes a pending sell (sell limit) or buy (buy limit) order for any digital asset.

Example: If you want to buy 1 BTC when the price drops to $20,000, you can place a stop-limit order to buy at $20,000. When the price of BTC drops below $20,000, the buy order will be executed. Similarly, if you want to sell 1 BTC when the price rises to $50,000, you can also place a stop-limit order to sell at $50,000.

In summary, a Stop-Limit Order is a type of trading order where the trader specifies a maximum or minimum price for buying or selling an asset. When the asset’s price reaches this specified level, the order is executed.

2.How a Stop-Limit Order Works?

The main advantage of a stop-limit order is that the trader has complete control over when the order will be executed.

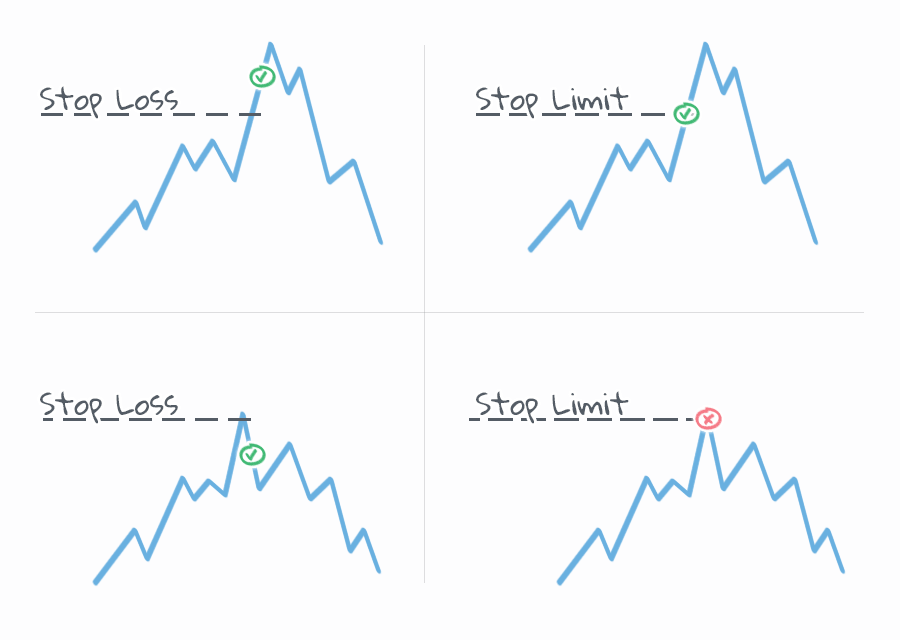

However, like all limit orders, a stop-limit order does not guarantee that the trade will be executed if the stock or commodity does not reach the stop price within a specific time frame.

Stop price: The price at which the trade is triggered. If the stock price reaches or falls below the stop price, the order is activated.

Limit price: The price you set to buy or sell the stock. This price acts as a cap on the highest or lowest price you'll pay or receive for the trade.

A stop-limit order will be executed at a specified price or better once the stop price is reached. When the stop price is hit, the stop-limit order becomes a limit order to buy or sell at the limit price or better. This type of order is an option available to nearly all online traders.

It's important to note that a stop-limit order does not guarantee that your trade will be executed. If the price of the asset drops quickly and falls below the limit price before the order can be executed, the order may not be completed, causing you to miss the potential profit opportunity if the price does not meet your criteria.

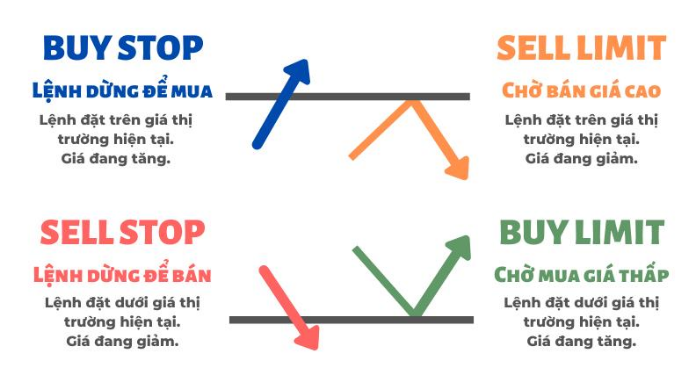

3. Characteristics of Stop Orders and Limit Orders

Stop Order: A stop order is executed only when a certain price level is reached, after which it is carried out at the current market price. A traditional stop order is fully executed, regardless of any fluctuations in the security’s price during the transaction.

Limit Order: A limit order is set at a specific price and will only be executed if the transaction occurs at the limit price or a more favorable price. If trading conditions cause the price to become unfavorable relative to the limit price, the order will be halted.

4. Evaluation of Stop-Limit Orders

4.1 Advantages of Stop-Limit Orders

Price Control

With a stop-limit order, you can control the price at which you want to enter or exit a trade. This means you can set a limit price higher or lower than the stop price, depending on whether you are buying or selling. This provides greater control over the execution price and helps investors avoid being executed at an undesirable price.

Risk Management

A stop-limit order is an effective way to manage risk. By setting a stop price, investors can limit their losses if the market moves downward. By establishing a limit price, you can ensure that you are not executed at an excessively high or low price. This helps investors manage their risk and minimize their losses.

Automation

Once you set a stop-limit order, it will be automatically executed when the stop price is reached. This means you don’t need to constantly monitor the market and can let the order execute automatically. This can be particularly beneficial for traders who cannot keep an eye on the market or prefer to adopt a more passive trading style.

Flexibility

Stop-limit orders can be used in various trading strategies, including day trading, swing trading, and position trading. They can be utilized to enter or exit a trade and can be applied for both long-term and short-term investments. This makes stop-limit orders a flexible tool for traders, regardless of the trading method they wish to employ.

4.2. Disadvantages of Stop-Limit Orders

-

No Guarantee: While stop-limit orders allow you to control the price at which you enter or exit a trade, there is no guarantee that the order will be executed. If the market moves quickly and the price never reaches the limit price, your order may not be filled. This can have serious consequences in markets where prices fluctuate rapidly, such as BTC, ETH or DOGE

-

Price Gaps: Another potential drawback of stop-limit orders is that they do not protect you from price slippage, which occurs when the price of a security jumps from one price to another without any trades happening in between. If this occurs and your limit price is not reached, you could end up with a much worse price than originally intended.

-

Psychological Pressure: Stop-limit orders can also create psychological pressure for traders. When a stop-loss order is triggered, it can lead to holding onto a coin in the hope that the market will reverse and the price will come back. This can result in hesitation and emotion-driven trading, which can be detrimental and affect the overall trading strategy.

-

Complexity: Setting up and executing stop-limit orders is more complex compared to other types of orders. Unlike market orders or limit orders, there are multiple factors, considerations, and inputs required when placing a stop-limit order. Traders need to be familiar with the process of setting stop and limit prices, and they must understand how these prices interact with the market.

5. Comparison Between Stop-Limit Orders and Stop-Loss Orders

Stop-Limit Orders and Stop-Loss Orders

6. How to Place a Stop-Limit Order on Binance Exchange?

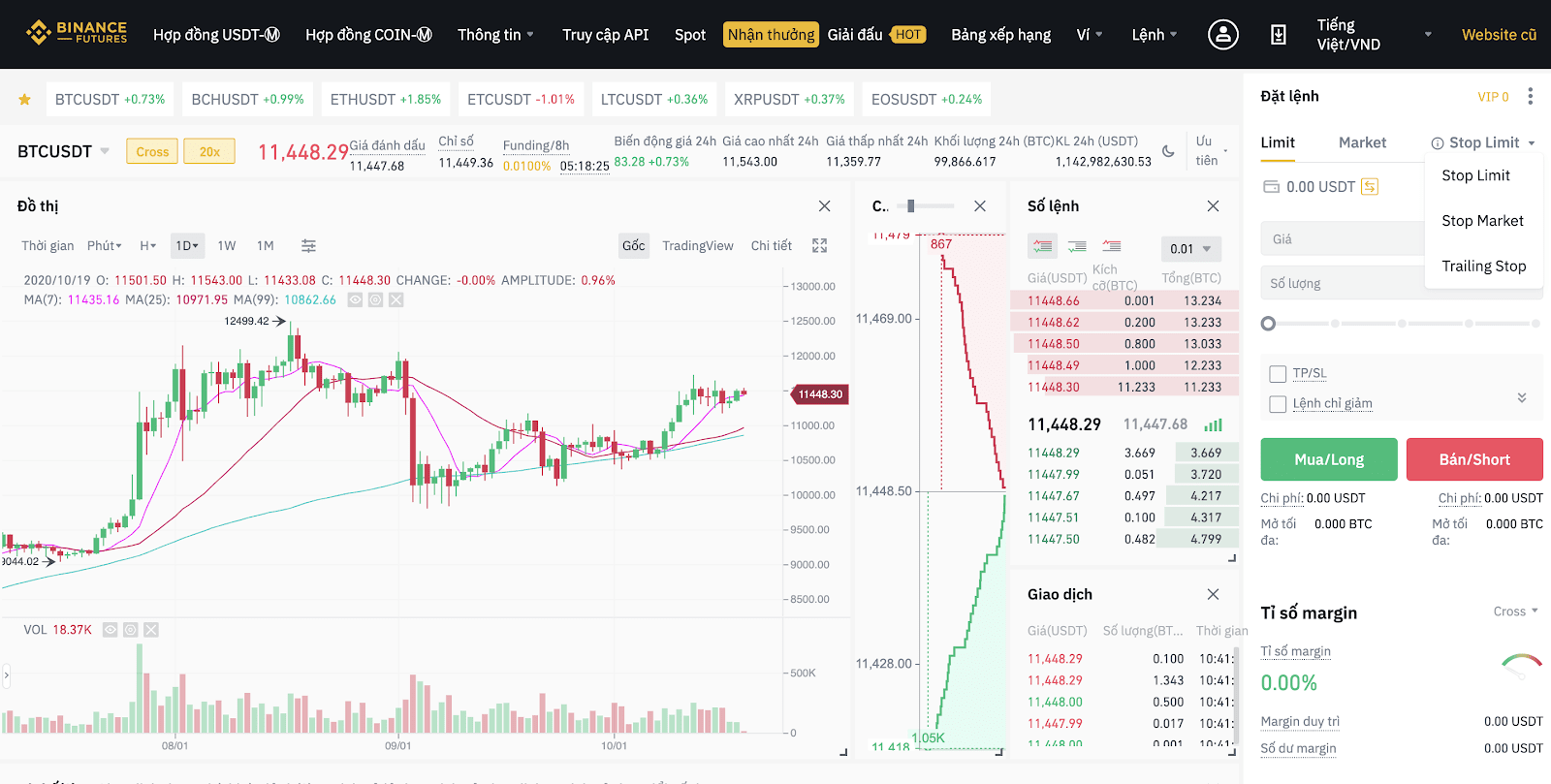

To take advantage of the Stop-Limit order, the first step is to ensure that you have an account on an exchange that supports this type of order. In this example, we will use the BTC/USDT trading pair on Binance to illustrate.

Once you have logged into your Binance account, go to the "Trade" section and select the Stop-Limit order as shown in the illustration below to start your trading process.

Next, when you have selected the Stop-Limit order, the display interface will appear as shown below. To place the order, you need to fill in all the required information in this interface.

- Stop: The price at which your stop-limit order will be triggered.

- Limit: The actual execution price of the limit order after the Stop price is triggered.

- Quantity: The amount of BTC you want to buy or sell.

- Total: The total value of your order.

After that, check the order details in the Open Orders section.

7. Important Notes for Investors When Using Stop-Limit Orders

When using a Stop-Limit order, investors should note the following points to optimize effectiveness and avoid risks:

-

Understand how it works: A Stop-Limit order combines a Stop order (activating a buy/sell order when the price reaches a certain level) and a Limit order (limiting the selling/buying price). The order will only be executed when the price reaches the Stop Price, and it will then match if the price reaches or exceeds the set Limit price. This means that your order may not be matched if the price moves too quickly beyond the Limit price.

-

Choose appropriate Stop and Limit prices: The Stop Price should be set at a price where you want to trigger the order. The Limit Price can be lower (for sell orders) or higher (for buy orders) than the Stop Price to increase the likelihood of order matching. If the Limit price is too close to the Stop price, the order may not match if the price moves quickly and surpasses both levels.

-

Be cautious in highly volatile markets: In highly volatile markets, the price can move quickly past both the Stop and Limit levels, resulting in the order not being matched. This is especially dangerous if you are using a Stop-Limit order to cut losses.

-

Monitor continuously when placing orders: A Stop-Limit order is not always guaranteed to be executed. Investors need to regularly monitor the market to ensure that their strategy is not affected by unfilled orders.

-

Set the Stop price away from the current price: If you set the Stop Price too close to the current price, the order may be triggered prematurely due to short-term market fluctuations, causing the order not to achieve the desired target.

-

Use Stop-Limit orders in conjunction with other strategies: A Stop-Limit order should be part of an overall risk management strategy, combined with other tools such as Market, Limit, or Stop Loss orders to ensure effective capital management.

8. FAQs

Q1: When should I use a Stop-Limit order?

A Stop-Limit order is suitable when you want to control the execution price of the order, especially in highly volatile market conditions. It is used to protect profits or limit losses, but only if you are willing to accept the risk of the order not being matched if the price exceeds the limit.

Q2: Can I place a Stop-Limit order for both buying and selling?

Yes, a Stop-Limit order can be used for both buy and sell orders. With a sell order, the Stop-Limit helps you exit a position when the price decreases. With a buy order, it helps you enter when the price rises to the Stop Price and matches at the Limit price.

Q3: Can a Stop-Limit order replace a regular Limit order?

A Stop-Limit order can be used instead of a regular Limit order when you want to control the execution price but need the additional feature of matching the order only after the price reaches the Stop level. This provides more flexibility than a regular Limit order.

9. Conclusion

In summary, the Stop-Limit order is an important tool in an investor's trading strategy, helping them control risk and execute trading strategies flexibly. By using Stop-Limit orders, investors can set target stop prices and goal prices to optimize profits and minimize risk exposure. Understanding how to use this type of order on exchanges is key to an effective and safe investment strategy.

Read more:

English

English Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)