1. What is APY?

.jpg)

APY, or Annual Percentage Yield, is a percentage that represents the real rate of return on an investment or savings account, taking into account the effect of compounding interest over a year. Unlike APR (Annual Percentage Rate), which reflects the simple interest rate without considering compounding, APY shows you how much your investment grows over time when interest is added back into the account, which then earns additional interest.

In short, APY helps you understand how much interest you would earn on a deposit or investment over a year, accounting for the impact of interest being compounded (daily, monthly, or yearly).

2. Key Features of APY

2.1. Compounding Interest

One of the most important elements of APY is compounding. Compounding refers to the process where the interest earned on an investment is added to the principal balance, and future interest payments are then based on this new balance. The more frequently interest compounds, the higher the APY will be.

For example, if you have a savings account with 5% APY, you’re not just earning 5% of your initial deposit over the year. You’re earning interest on the interest that’s already been added to your account.

2.2. Calculation of APY

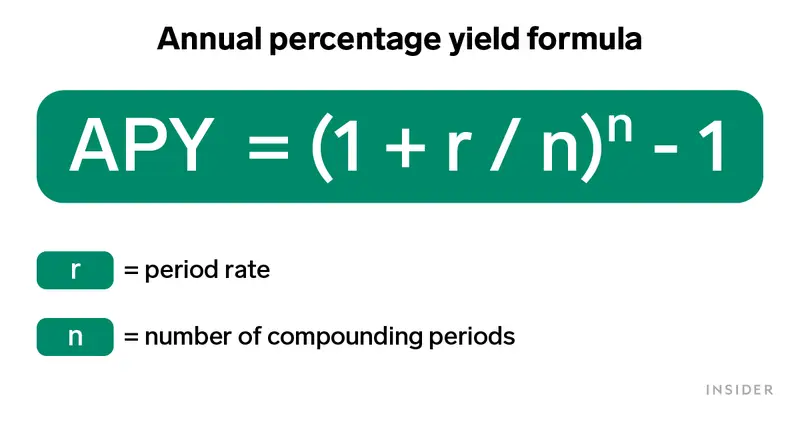

APY is calculated using the following formula:

Where:

-

r is the annual interest rate (expressed as a decimal).

-

n is the number of times the interest is compounded per year.

This formula shows how the frequency of compounding affects the overall yield. The more often interest is compounded, the higher the APY will be, even with the same interest rate.

2.3. Time Period

APY is always calculated on an annual basis, meaning it reflects how much interest you could earn in one year, assuming you leave your money invested for the full year and continue earning interest without withdrawing funds.

3. Types of APY

There are various types of APY, depending on the investment or savings product you're looking at. Let’s break down some of the most common types:

3.1. Traditional Savings Accounts

Traditional savings accounts typically offer APY on deposits, where interest is compounded daily, monthly, or quarterly. The APY on these accounts can vary, but they are usually low in comparison to other types of investments.

3.2. High-Yield Savings Accounts

High-yield savings accounts often offer a higher APY than traditional savings accounts. These accounts may also have additional features, like online-only banking, which allow them to offer better rates. The APY in high-yield accounts can range anywhere from 0.5% to 3%, depending on market conditions.

3.3. Certificates of Deposit (CDs)

Certificates of Deposit (CDs) are time deposits offered by banks with a fixed interest rate. The APY on a CD is usually higher than on a regular savings account but comes with the requirement that the money stays locked up for a fixed period (ranging from a few months to several years).

3.4. Cryptocurrency Savings and Staking

In the cryptocurrency space, staking and yield farming are popular methods of earning interest, and these often offer APYs that are much higher than traditional savings accounts. However, these products come with increased risks. Crypto savings accounts or staking platforms may offer APYs ranging from 5% to over 100%, depending on the assets involved and the platform’s risk level.

3.5. DeFi Platforms

DeFi (Decentralized Finance) platforms, especially in the cryptocurrency world, offer liquidity mining and staking services where users provide liquidity to decentralized exchanges (DEXs) or platforms in exchange for rewards. These platforms often offer APYs that far exceed traditional banks, but the risks involved are also considerably higher due to market volatility and potential smart contract bugs.

4. Factors affecting APY

While APY is useful for measuring returns, there are several factors that can influence its value, including:

4.1. Interest Rate

The primary determinant of APY is the interest rate itself. A higher interest rate means a higher potential return, assuming other factors remain constant.

4.2. Compounding Frequency

As mentioned earlier, the frequency of compounding is crucial in determining the overall yield. Daily compounding will yield a higher APY than monthly compounding, even with the same interest rate.

4.3. Risk

Risk plays an important role in APY, particularly in the case of investments like stocks, bonds, and cryptocurrencies. Higher-risk investments typically offer higher APYs to attract investors, but they also carry the potential for loss. Conversely, low-risk savings accounts and CDs offer lower APYs but are considered safer.

4.4. Inflation

Inflation erodes the purchasing power of money over time, which can affect the real value of your returns. Even if an investment offers a high APY, inflation may reduce its effectiveness in growing your wealth.

5. APY vs. APR: Key Differences

Although APY and APR (Annual Percentage Rate) both represent the rate of return on an investment, they are not the same thing. Here's a quick comparison:

| Feature | APY | APR |

| Interest Calculation | Includes compounding interest | Does not account for compounding |

| Use Case | Used for savings, investments, and loans | Typically used for loans and credit cards |

| Purpose | Shows the real return after compounding | Reflects the simple interest cost |

While APY helps investors understand the true return on their investments, APR is used to show the cost of borrowing or lending without considering the effects of compounding.

6. Why is APY Important?

- Comparison Tool

APY is an invaluable tool for comparing different investment or savings products. By understanding the APY offered by various accounts or investments, you can easily evaluate which option provides the best return for your money.

- Transparency

APY allows for greater transparency when it comes to the returns of an investment or savings product. It clearly shows you how much you can expect to earn over the course of a year, making it easier to plan your finances.

- Long-Term Growth

For long-term investors, understanding how APY works is essential. With the power of compounding, even small differences in APY can lead to significantly higher returns over time.

7. Risks and Considerations

.jpg)

- Market Volatility

Higher APYs often come with higher risks, especially in the crypto space. Volatile markets can cause significant fluctuations in returns, and you may not earn as much as you initially anticipated.

- Fees and Penalties

Some financial products, such as CDs or savings accounts, may impose fees or penalties for early withdrawal. These can significantly reduce your effective APY if you withdraw your funds before the term expires.

- Inflation Impact

It’s important to factor in inflation when evaluating APY. If inflation rates are higher than the APY offered by an investment, your real return could be negative.

Conclusion

APY is an essential metric for evaluating financial products and understanding the true return on your investments. By taking compounding into account, APY provides a more accurate picture of how much you can expect to earn over time, compared to APR. Whether you're saving for the short term, investing for long-term growth, or exploring DeFi opportunities, understanding how APY works will help you make smarter financial decisions.

When choosing an investment or savings account, always compare APYs, consider the risk involved, and factor in the compounding frequency. By doing so, you'll be better equipped to maximize your returns and achieve your financial goals.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)