1. What Is DCA in Crypto?

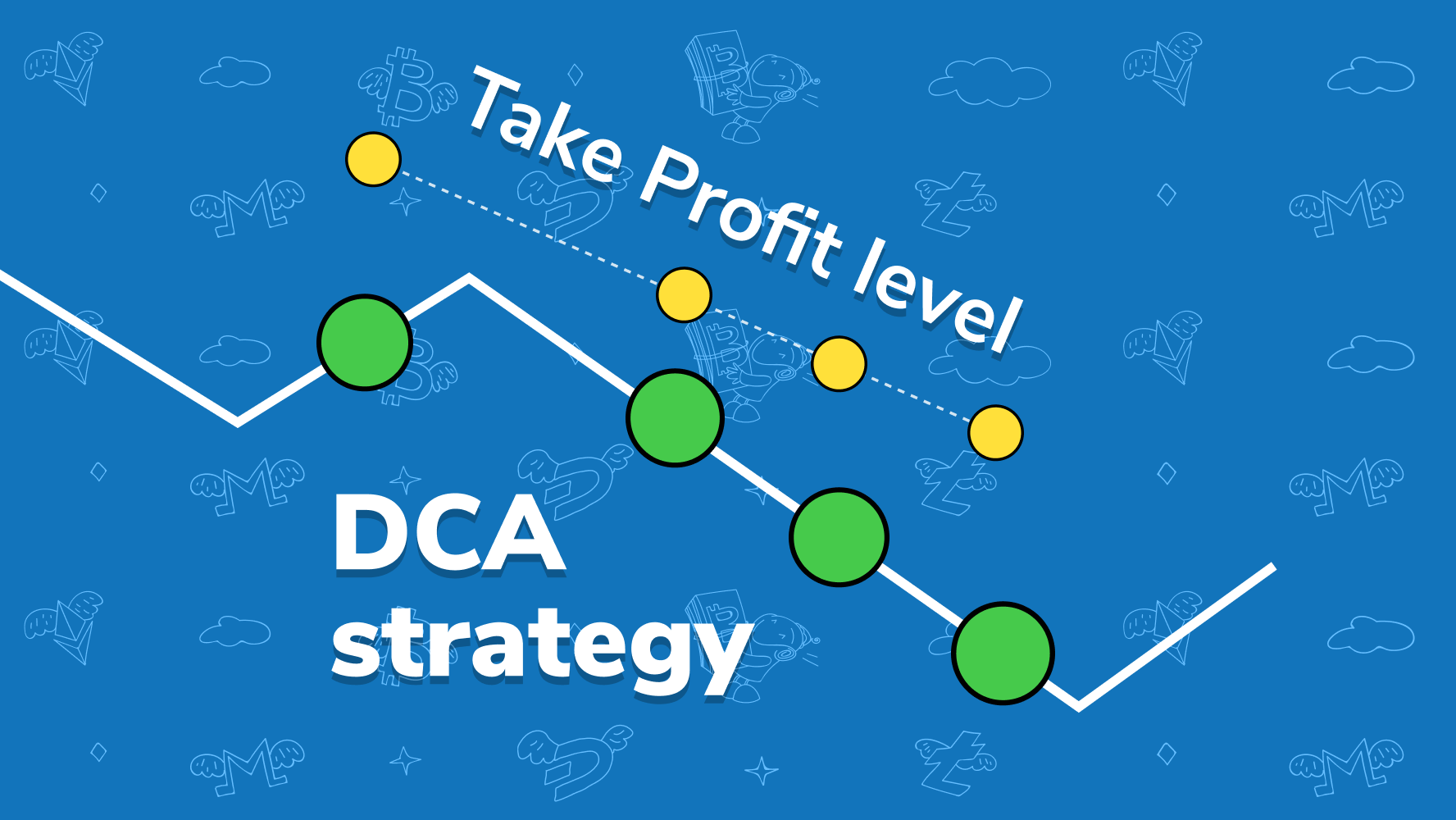

Dollar-Cost Averaging (DCA) is a strategy where you invest a fixed amount of money in a cryptocurrency at regular intervals, regardless of its price. The concept is simple: rather than trying to predict when the price of a cryptocurrency will rise or fall, you consistently invest the same amount of money at set times (daily, weekly, or monthly).

For instance, if you decide to invest $100 in Bitcoin every week, you will buy Bitcoin no matter if its price is high or low. Over time, this approach helps smooth out the fluctuations in the market, so you don’t risk buying all your crypto at a high price.

By spreading out your purchases, you lower the chances of buying at the wrong time—avoiding market highs and benefiting from dips in the market. Over the long run, this leads to a more balanced average cost per unit of cryptocurrency.

2. How does DCA in crypto work?

The core concept of DCA involves buying a fixed dollar amount of a cryptocurrency on a regular basis, regardless of market conditions. Here’s how it works step-by-step:

-

Choose Your Investment Amount: Decide how much you want to invest each time. This could be as little as $10 or as much as $1,000, depending on your budget and financial goals.

-

Pick a Cryptocurrency: You can apply DCA to any cryptocurrency you believe in. Bitcoin and Ethereum are popular choices, but you can use this strategy for altcoins as well.

-

Set Up a Regular Interval: Choose how often you want to make your purchases. For example, you might choose to invest $100 in Bitcoin every week, or $500 every month.

-

Automate Your Investments: Many crypto exchanges and platforms (like Coinbase, Gemini and Binance) offer features that allow you to automate your DCA strategy. This means you don’t need to manually place buy orders each time. The platform will handle it for you.

3. Benefits of Dollar-Cost Averaging in Crypto

_(1).png)

There are several advantages to using DCA as an investment strategy in the crypto market:

3.1 Mitigates Volatility

Cryptocurrency markets are extremely volatile, with prices often fluctuating wildly. This can make it challenging to time your buys. DCA helps smooth out the effects of market volatility, ensuring you don’t invest all your money at a high price during a bull market or a market peak. By purchasing crypto at regular intervals, you reduce the impact of short-term price swings.

3.2 No Need to Time the Market

Timing the market—predicting when to buy low and sell high—is incredibly difficult, even for professional investors. With DCA, you don’t need to worry about making those decisions. You set up your plan and stick to it, ensuring that you invest regularly without stressing over market conditions.

3.3 Reduces Emotional Investing

Crypto markets often prompt emotional decision-making. When the market is booming, many investors may be tempted to buy in, driven by FOMO (Fear of Missing Out). Conversely, during market dips, panic can lead to selling prematurely. DCA helps remove emotion from investing by sticking to a predetermined plan. You invest the same amount regardless of market conditions, making the process more objective and less influenced by emotion.

3.4 Simplicity and Discipline

DCA offers a structured approach to investing. It takes the complexity out of crypto trading and ensures that you stay disciplined in building your portfolio over time. You don’t have to track the market constantly or attempt to make precise predictions—your investment happens automatically.

4. Cons of Dollar-Cost Averaging

Market Tends to Rise Over Time

One of the primary disadvantages of dollar-cost averaging (DCA) is that it can underperform when the market is rising consistently. Since this strategy involves investing smaller amounts of money over a longer period, it may miss out on the potential growth that comes with a lump-sum investment made earlier.

For example, if you invest $10,000 at the beginning of a 10-year period in a stock that grows at 10% annually, you would end up with significantly more by the end of the period than if you had invested in smaller portions each year. With DCA, your total return might be $7,531.17, while investing the lump sum would result in $15,937.42. However, in situations where the market experiences downturns early on, the lump-sum investor risks larger losses compared to the DCA investor, who spreads the risk over time.

Not a Substitute for Good Investment Choices

Dollar-cost averaging does not shield you from poor investment decisions. It is not a foolproof strategy and does not eliminate the need for careful research. If you invest steadily in an underperforming or bad investment, the DCA method will only contribute to your losses over time. DCA assumes you are regularly investing in a portfolio that remains suitable, but it doesn’t adapt to new insights or changing conditions.

For example, if you learn that a company is making a strategic acquisition that will likely increase its earnings, you might decide to increase your investment in that company. However, DCA doesn’t offer the flexibility to make such adjustments based on new information. Instead, it follows a passive approach that doesn't respond dynamically to shifts in the market or the investment landscape.

5. Example of DCA in Crypto

Let’s say Joe decides to invest $100 in Bitcoin every week for a year. Over time, Bitcoin’s price fluctuates from $50,000 to $40,000 and back up to $60,000. Here’s how DCA would work in Joe’s case:

-

Week 1: Bitcoin is priced at $50,000, Joe buys 0.002 BTC.

-

Week 2: Bitcoin drops to $40,000, Joe buys 0.0025 BTC.

-

Week 3: Bitcoin rises to $60,000, Joe buys 0.00167 BTC.

After 12 weeks, Joe has purchased Bitcoin at different prices, averaging out the highs and lows. Instead of risking buying a large sum all at once, DCA ensures that Joe pays an average price, reducing the risk of purchasing at a market peak.

6. Who should use DCA for crypto?

DCA is ideal for:

-

Beginners: Those new to cryptocurrency investing can use DCA to avoid the stress of market timing and the pressure of making emotional decisions.

-

Long-Term Investors: DCA is well-suited for people who believe in the long-term growth potential of cryptocurrencies but don’t want to actively trade.

-

Risk-Averse Investors: If you’re hesitant about market fluctuations but still want to participate in crypto, DCA is a more conservative approach.

However, DCA may not be ideal for:

-

Active Traders: If you’re an experienced trader who prefers to make large, strategic moves based on market analysis, DCA may not align with your approach.

-

Those Seeking Quick Gains: DCA is a long-term strategy and may not provide immediate results, making it unsuitable for investors looking for fast returns.

7. Conclusion

Dollar-Cost Averaging (DCA) is a valuable strategy for cryptocurrency investors who want to mitigate risks associated with market volatility, avoid emotional decision-making, and invest consistently over time. By automating your purchases and committing to a set schedule, you can gradually build your crypto portfolio without stressing about market timing.

For new investors, DCA offers a simple, low-risk way to enter the volatile world of cryptocurrency. While it may not provide the immediate rewards that come with market timing, over the long term, it can help you accumulate assets and build wealth steadily. With the crypto market continuing to mature, DCA could be the best strategy for long-term, stress-free crypto investing.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)