1. What is Spot?

Spot trading in the cryptocurrency market involves the immediate exchange of digital assets with instant settlement and transfer at the time of the transaction.

Unlike futures or options contracts, spot trading has no expiration date. This means you buy or sell cryptocurrencies at the current market price and receive the assets directly into your wallet immediately.

Spot trading occurs on the spot market, where transactions are executed based on current market prices. Learn more about the Spot Market here

2. The operation of Spot trading

When you participate in spot trading, you're purchasing or selling cryptocurrencies at their current market price.

For instance, if you buy Bitcoin (BTC) through spot trading, you receive BTC directly into your wallet based on the current exchange rate. This means spot trading necessitates settling the entire transaction amount immediately upon buying or selling.

Unlike margin or futures trading, spot trading does not involve leveraging and requires full payment of the transaction value upfront.

3. Benefits of Spot trading?

Spot trading offers numerous benefits to investors. Firstly, its transparency allows investors to easily track the real-time value of the cryptocurrencies they hold, as these values are reflected instantly in the market. This clarity provides users with a clear and accurate view of their assets without worrying about price fluctuations in the future.

Moreover, spot trading is straightforward and intuitive, making it particularly suitable for newcomers to the crypto market. Buying and selling directly at current prices helps users understand and execute transactions easily, without having to deal with complex factors such as leverage or futures.

One of the biggest advantages of spot trading is the ability for investors to purchase tokens at the moment of the transaction, enhancing timeliness and avoiding missing out on advantageous positions.

4. Risks to be aware of

Despite its simplicity and transparency, spot trading in cryptocurrencies comes with risks that investors need to be aware of. The cryptocurrency market is known for its high volatility, which means that asset values can change rapidly. Investors should prepare mentally and have contingency plans to deal with sudden market fluctuations.

Additionally, security is always a critical concern in cryptocurrency trading. Storing cryptocurrencies on exchanges should be done with caution to mitigate the risk of hacking. Investors should employ security measures such as two-factor authentication (2FA) and choose reputable exchanges to minimize these risks.

5. Điểm khác biệt của Spot với Futures/Margin

| Khía cạnh | Spot | ||

| Định nghĩa | Immediate buying and selling of cryptocurrencies at current market prices. | Agreement to buy/sell a specific amount of cryptocurrency at a predetermined future date and price. | Trading where investors borrow additional funds to increase their buying power for cryptocurrencies. |

| Đòn Bẩy | No leverage used. | Leverage commonly used. | Leverage used. |

| Rủi Ro | Low risk due to no leverage used. | High risk due to leverage, especially in volatile markets. | High risk due to leverage, potentially leading to significant losses. |

| Thanh Toán | Full payment required at the time of transaction. | Payment can be deferred to a future date. | Requires borrowed capital with interest payments and maintaining margin levels. |

| Đơn Giản | Simple and intuitive, suitable for beginners. | More complex, suitable for experienced traders. | More complex and higher risk, suitable for experienced traders. |

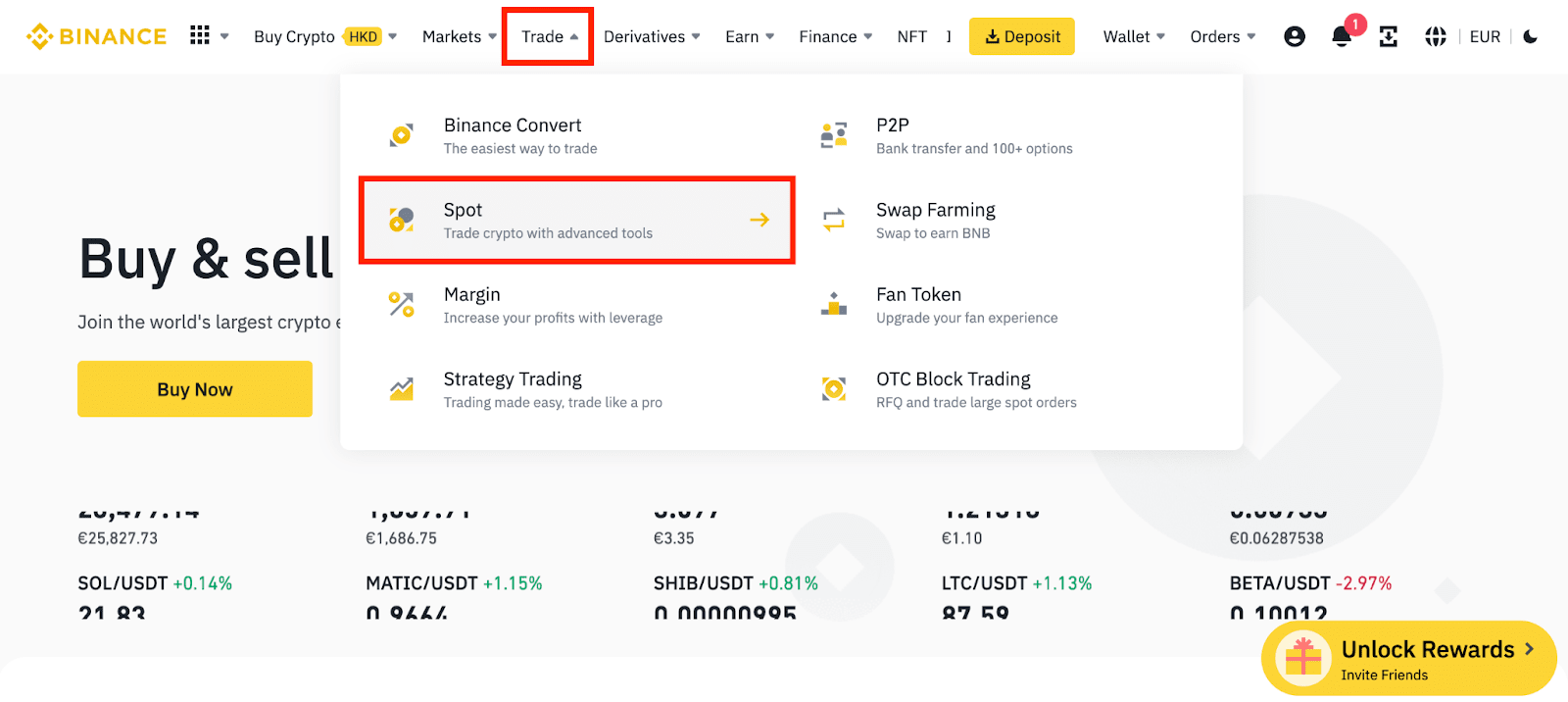

6. Exchanges Supporting Spot Trading

Currently, most cryptocurrency exchanges support spot trading, with prominent examples including Binance, Bybit, and OKX. Binance, one of the world's largest cryptocurrency exchanges, offers spot trading services for hundreds of different cryptocurrencies. Coinbase, a well-known and reputable exchange, particularly popular in the United States, provides spot trading for major cryptocurrencies like Bitcoin, Ethereum, and Litecoin. Kraken also offers spot trading services with various cryptocurrency pairs, known for its high security standards and reasonable trading fees.

7. Conclusion

Spot trading in crypto is a simple and effective method for buying and selling cryptocurrencies at current market prices. Understanding spot trading and comparing it with other types of trading such as futures and margin allows investors to make informed decisions in trading, optimizing profits and minimizing risks. If you're new to the cryptocurrency market, spot trading is an excellent choice to start with.

Read more:

Tiếng Việt

Tiếng Việt