1. What is Volume in the Cryptocurrency Market?

In the cryptocurrency market (crypto), Volume typically refers to the total amount of cryptocurrency units traded within a specific time period. The unit of volume is usually the cryptocurrency itself, such as Bitcoin, Ethereum or another cryptocurrency.

For example, let's say you're looking at Bitcoin's price chart on an exchange, and you're interested in the volume.

-

Day 1:

- Bitcoin's price rises from $40,000 to $42,000 during the day.

- Volume on Day 1 is 100,000 BTC.

-

Day 2:

- Bitcoin's price drops from $42,000 to $41,000 during the day.

- Volume on Day 2 is 120,000 BTC.

-

Day 3:

- Bitcoin's price increases from $41,000 to $43,000 during the day.

- Volume on Day 3 is 150,000 BTC.

In this example, you can observe Bitcoin's price volatility each day while also tracking the volume.

On Day 1, both price and volume increase, which could represent growing interest and participation from the investment community.

On Day 2, despite the price drop, the volume rises, which might indicate some investors selling due to concerns about further price declines.

On Day 3, both price and volume increase again, showing continued interest that might lead to further price rises.

Volume is a crucial indicator and is commonly used to assess market strength and liquidity. High liquidity is often associated with high volume, which helps reduce slippage and makes trading more predictable.

Investors and market watchers frequently monitor volume to gauge the level of interest and participation in a particular cryptocurrency. A sudden spike in volume may indicate significant market interest, potentially causing sharp price fluctuations. Conversely, low volume can create an unstable and unpredictable market environment.

2. The Significance of Volume in the Cryptocurrency Market

Liquidity

Volume determines an asset's liquidity. In other words, it indicates how easily and quickly an asset can be bought or sold at the current market price. High volume and liquidity stabilize an asset's price and minimize frequent price volatility.

Market Trends

Volume is a key indicator for understanding market trends. Price movements accompanied by high volume suggest the start of a strong trend. Conversely, if low volume follows a price movement, it suggests that the trend is weak. Additionally, high volume in a rising trend indicates strong buyer interest, pushing asset prices higher. But if high volume accompanies a downward trend, it indicates increased selling pressure and reduced buyer interest. The relationship between volume and trends helps traders identify optimal entry and exit points for a trade.

Market Strength

Volume confirms market movements. If a large volume accompanies a price movement in any direction, the movement may be strong. However, if the movement comes with low volume, it may be weak, and a correction might follow.

Accumulation

Volume provides traders with an easy way to recognize market accumulation. If there is a volume spike without a significant price change, it may indicate accumulation. This means that investors, especially high-net-worth ones, are gradually buying up an asset in large quantities. Therefore, a price rise can be expected after the accumulation phase.

Market Reversal

A decrease in volume despite a price movement in one direction may indicate a reversal or price correction. A price rise with low volume could signal diminishing buying pressure and an impending price drop. Conversely, a price decrease with low volume suggests weakening selling pressure and a potential price increase.

However, investors should not rely solely on volume to predict market reversals. It is essential to confirm the reversal with other technical indicators.

3. What Does Volume Indicate?

What Does High Volume Mean?

Based on the summary above, high volume usually correlates with strong buyer interest and potential price increases. In other words, in a market with high volume, an asset typically changes hands quickly and easily.

However, volume can occur in both directions. High volume is often a clear sign of the beginning or peak of a bear market, where there is strong selling pressure as traders anticipate a price drop. As mentioned earlier, volume should not be the sole indicator used to predict market trends.

What Does Low Volume Mean?

In contrast to high volume, a market with low volume shows declining buyer interest, making asset exchanges more difficult under such conditions. Low volume indicates a lack of liquidity and declining prices.

Assets with low volume often have limited supply and are highly volatile, as their prices can be easily manipulated. For example, a buyer could purchase a low-volume asset at a higher price to attempt to push the price up and create a fake uptrend before selling it to unsuspecting investors.

Low-volume markets are also unfavorable for sellers, as low demand forces them to sell at prices below their buying cost.

4. How to Use Volume Effectively in Crypto Trading?

4.1. Confirm Price Trends

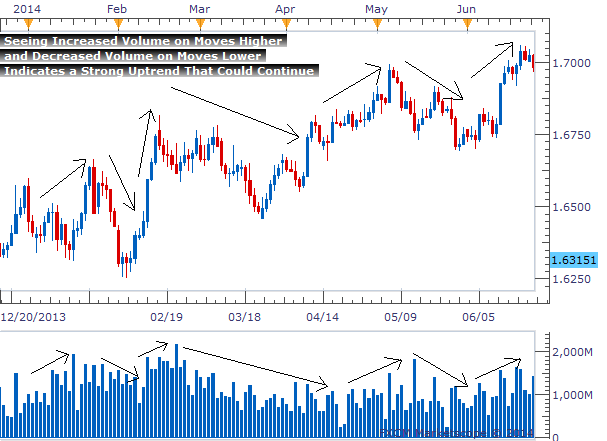

Volume plays a crucial role in confirming price trends. When volume increases or decreases in line with price trends, it shows that a new trend is forming:

-

In an uptrend: Volume usually increases when prices rise and decreases when prices fall. If volume rises as prices rise, this strengthens the uptrend. On the other hand, if volume decreases as prices rise, it may indicate that the upward momentum is weakening, and the trend may reverse.

-

In a downtrend: Volume typically increases as prices fall and decreases as prices rise. If volume increases as prices fall, the downtrend is confirmed. If volume decreases while prices fall, it may signal that the downtrend is losing momentum.

4.2. Confirm Trend Reversals

A sudden spike in volume may indicate that buying or selling pressure has reached its peak, leading to a potential trend reversal:

-

In an uptrend: When volume peaks and then declines, while selling volume increases, buying pressure may be exhausted, and prices could soon peak and reverse downward.

-

In a downtrend: When volume peaks and then declines, while buying volume increases, selling pressure may be exhausted, and prices could soon bottom out and reverse upward.

Price-volume divergence is also an important signal, indicating the likelihood of a trend reversal.

4.3. Confirm Support and Resistance

Volume helps confirm support and resistance levels:

-

Strong support and resistance: When prices reach support or resistance levels with high volume, this usually indicates the likelihood of a price reversal or the formation of a peak or bottom.

-

Low volume: If prices reach support or resistance but don't react strongly, low volume may suggest that the support or resistance level could be broken.

4.4. Confirm Breakouts of Support and Resistance

Volume also helps confirm the success of breakouts:

-

Successful breakout: When prices break through a support or resistance level with a significant volume spike, it usually signals a successful breakout.

-

False breakout: If prices break through a support or resistance level but the volume is low compared to previous trading sessions, this may be a false breakout.

By analyzing volume charts, you can clearly distinguish between false and successful breakouts, helping you accurately identify trends and adjust your trading strategy accordingly.

5. Notes for Investors

Analyzing volume in the cryptocurrency market helps investors and analysts gain deeper insights into market interest and activity. Here are some important points to consider when analyzing volume in the cryptocurrency market:

Key Considerations for Reading Volume:

-

Agreement and Disagreement:

Agreement: When both price and volume increase, this signals agreement. Investors are moving in the same direction, and the trend is likely to continue.

Disagreement: If the price increases but the volume decreases, this might signal disagreement, indicating potential concerns about the strength of the upward trend.

-

Comparing Volume with Price:

Comparing the price chart with the volume chart helps identify the relationship between the two. A price increase accompanied by high volume can be a strong signal.

-

Checking Peaks and Troughs:

When the price hits new highs or lows, analyzing the volume can help confirm the strength or weakness of the trend.

-

Correlation with Other Indicators:

Combining volume analysis with other indicators like RSI, MACD can provide a more comprehensive view of market strength.

In conclusion, analyzing volume in the cryptocurrency market requires a comprehensive approach, combining multiple factors to make informed decisions. Market conditions can vary, so investors need to be confident and understand the specific market context they are observing.

6. FAQs

Q1: Can volume be manipulated in the crypto market?

Yes, volume can be manipulated in the crypto market. Some organizations or individuals may create fake volume by making large transactions to temporarily increase or decrease prices to attract investor attention. To avoid being influenced by such manipulation, combine volume with other technical analyses and monitor the consensus across various indicators.

Q2: How should I use volume in long-term trading strategies?

In long-term trading strategies, volume helps confirm the strength of trends and long-term entry or exit points. Monitoring volume along with long-term indicators like moving averages can help identify major trends and key support/resistance levels. Volume can also help detect major reversals or shifts in market sentiment over a longer time frame.

7. Conclusion

In summary, volume is not just a number frequently appearing on charts, but a powerful tool that helps investors better understand the dynamics of the cryptocurrency market. When applied correctly, analyzing volume can provide insights into market agreement or disagreement, the strength of trends, and changes in market sentiment. Wise investors will combine volume analysis with other indicators, creating a comprehensive and accurate trading strategy in the challenging cryptocurrency market.

Read more:

English

English Tiếng Việt

Tiếng Việt

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)