1. What is CoinAnk?

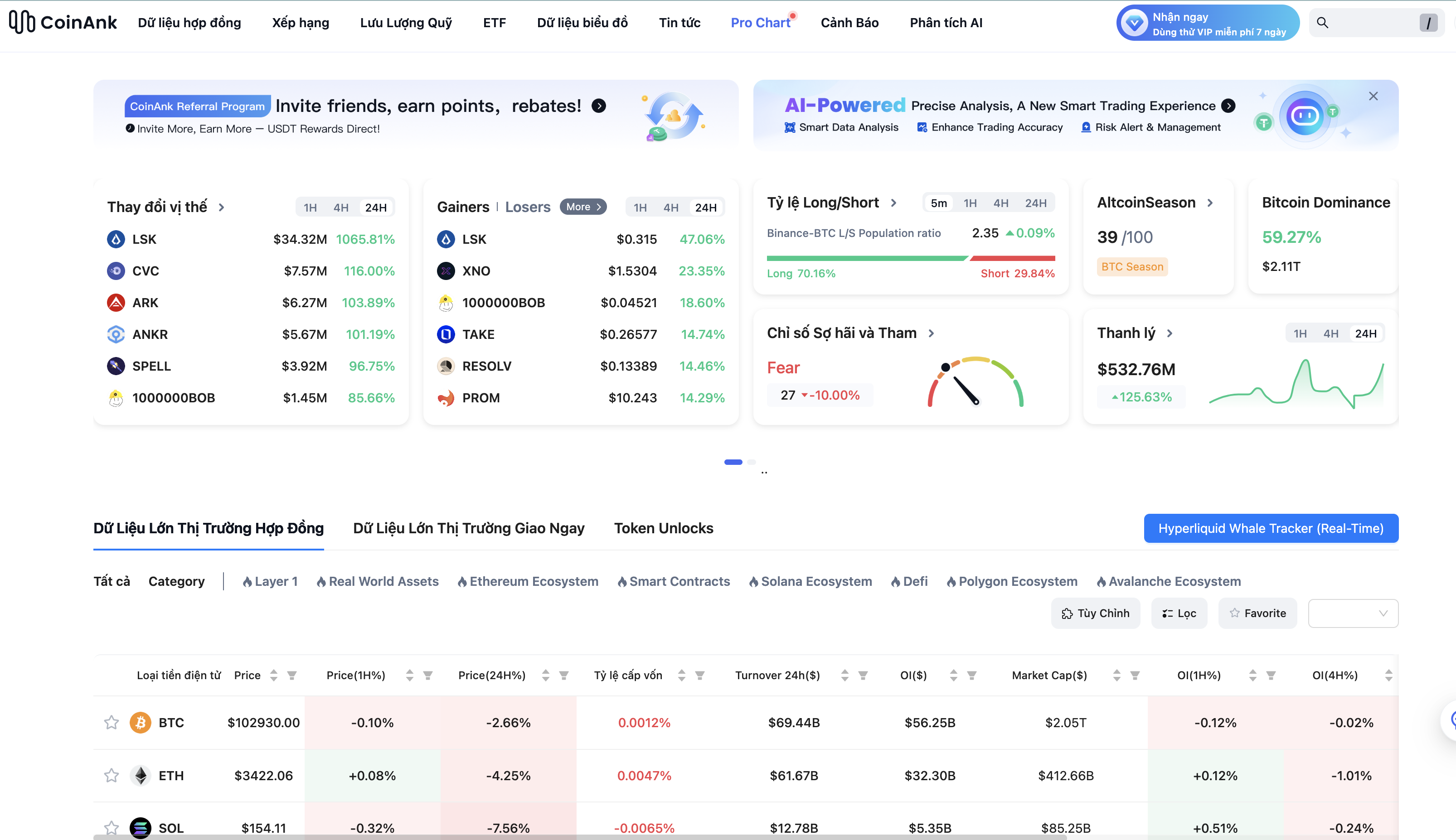

CoinAnk is a cryptocurrency analytics platform designed to provide traders with essential data related to cryptocurrency derivatives. It offers a variety of metrics that can be used to understand market movements, including liquidation heatmaps, open interest, funding rates, and order‑book depth. The platform's tools cater to traders who are primarily involved in futures and other derivative markets, making it a powerful tool for anyone looking to trade cryptocurrencies with advanced strategies.

CoinAnk helps traders identify liquidation points, monitor open interest, and analyze market pressure to make data‑driven decisions in real time.

2. Key Features of CoinAnk

In a CoinAnk crypto analysis, evaluating the platform’s key features is vital. Below are the most valuable tools that CoinAnk offers to traders:

- Liquidation Heatmap & Liquidation Map: One of CoinAnk's standout features is its liquidation heatmap, which helps traders predict price levels where large liquidations are likely to occur. Liquidations can lead to cascading market moves, so understanding where these are likely to happen is crucial for managing risk. CoinAnk’s liquidation heatmap offers real‑time data on price levels with potential large‑scale liquidations, helping traders anticipate sharp market movements.

- Funding Rates & Derivatives Metrics: CoinAnk also provides real‑time funding rates across various exchanges, such as Binance, Bybit, and OKX. This data allows traders to gauge the market’s short‑term sentiment, whether it’s bullish or bearish based on funding rate movements.

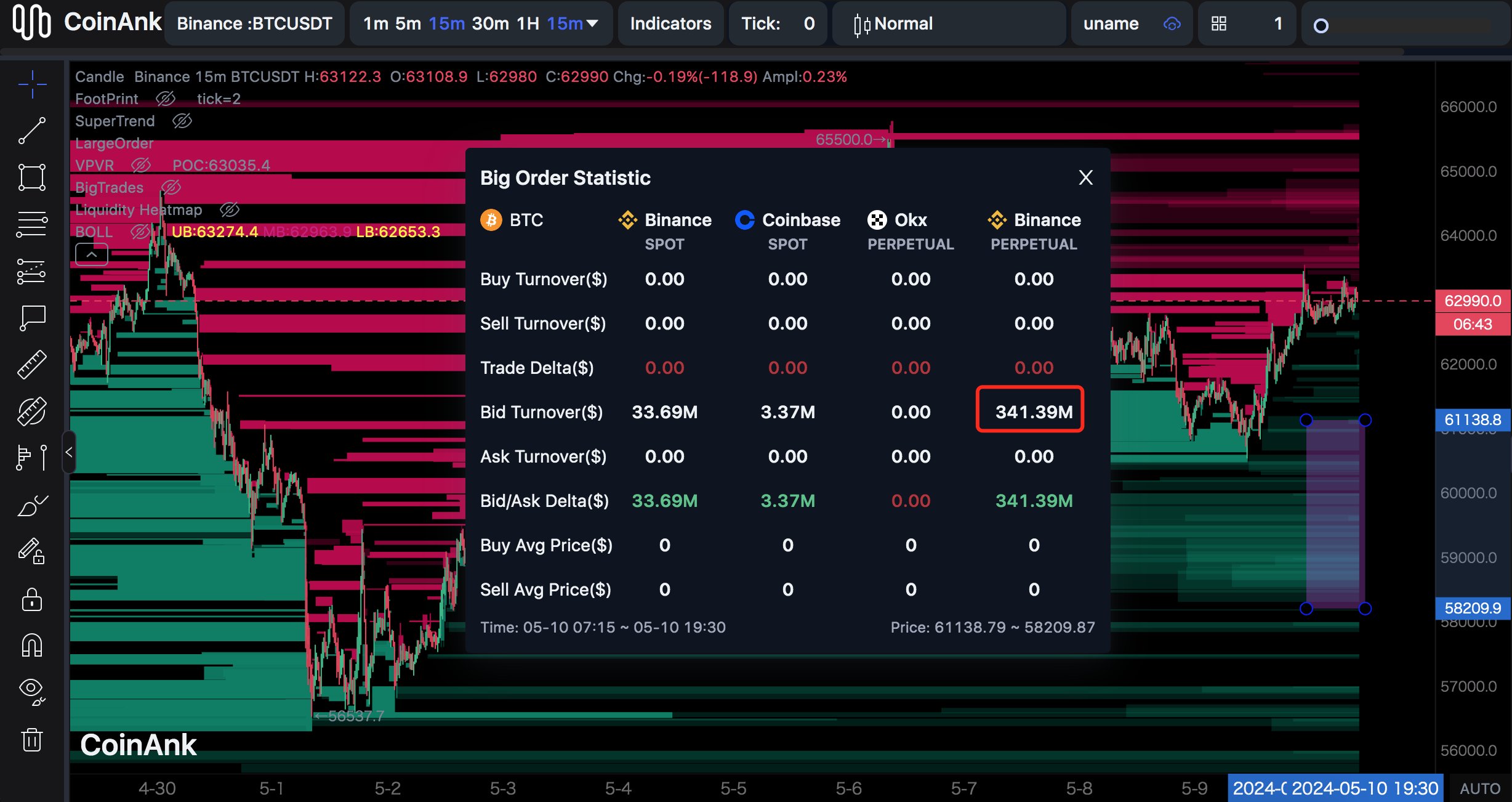

- Order Book Depth & Order Flow Analytics: Another important feature of CoinAnk is its order book depth charts. These charts display the imbalance between buy and sell orders, helping traders identify potential market movements based on large trades. The platform also offers order flow footprints, which give traders insight into how large positions are placed and executed in real time.

- AI‑Driven Smart Analysis: CoinAnk's AI module enhances the platform by offering AI‑driven trend analysis. This tool processes complex K‑line charts and provides intuitive, easy‑to‑understand summaries. While not foolproof, it can offer traders quick insights that help them make faster decisions.

3. Strengths of CoinAnk Crypto Analysis

Based on a thorough analysis, CoinAnk stands out in several areas:

-

Comprehensive data set: The platform offers a rich set of metrics not just for spot trading but specifically for derivatives, which is a rarity among many crypto analytics platforms.

-

Real‑time visualizations: Tools like the liquidation heatmap and order‑book depth chart make it easier to understand market trends visually, aiding in quicker decision‑making.

-

Cross‑exchange data aggregation: With data collected from multiple major exchanges, CoinAnk provides traders with a holistic view of the market.

-

AI‑assisted analysis: CoinAnk's AI features give traders a quick snapshot of potential market movements, which can be helpful for traders who don't have the time to manually analyze every chart.

These features make CoinAnk a robust tool for active and professional cryptocurrency traders looking to manage risk and maximize profits.

4. Limitations of CoinAnk

However, no platform is without its flaws. In our CoinAnk crypto analysis, we should also highlight a few considerations before using the platform:

-

Derivative focus: CoinAnk’s tools are primarily designed for derivatives traders, which means spot traders might find fewer relevant metrics for their strategies.

-

AI limitations: The AI analysis, while useful, is not guaranteed to always be accurate, and traders should not rely solely on it.

-

Data latency and gaps: There may be instances where data is slightly delayed or unavailable from certain exchanges. Traders must cross-check information from other sources if needed.

-

Subscription fees: Some advanced tools are only available on higher subscription tiers, which may limit access for some users.

These limitations don't necessarily detract from the platform’s value but should be kept in mind when deciding whether it fits your trading style.

5. How to Use CoinAnk in Your Trading Strategy

CoinAnk can be integrated into an effective trading strategy by following these steps:

-

Pre‑trade filtering: Use funding rates to gauge market sentiment before entering trades. A funding rate higher than 0.01% may indicate a bearish market, while lower than ‑0.01% suggests bullish pressure.

-

Identify liquidation zones: Use the liquidation heatmap to find potential price levels for cascading liquidations.

-

Monitor order‑book depth: Look for imbalances in buy and sell orders to anticipate potential price movements.

-

AI assistance: Leverage AI‑generated trend analysis for a second opinion when evaluating market conditions.

-

Risk management: Always manage risk with stop‑loss orders, particularly in highly volatile markets.

By incorporating these steps, you can leverage CoinAnk’s data and tools to make more informed and strategic trading decisions.

6. Conclusion

In conclusion, CoinAnk crypto analysis reveals that the platform is a highly useful tool for traders focused on cryptocurrency derivatives. With its comprehensive set of data, real‑time visualizations, and AI‑driven analysis, CoinAnk offers valuable insights that can help you stay ahead in the competitive world of crypto trading.

Read more:

- Sonic - The first L2 gaming platform on Solana successfully raised 16 million USD

- Ethereum vs Solana: Comprehensive comparison of top blockchain platforms in 2024

- What is Solayer? Overview of new restaking platform on Solana

Tiếng Việt

Tiếng Việt