1. What are Real-World Assets (RWAs)?

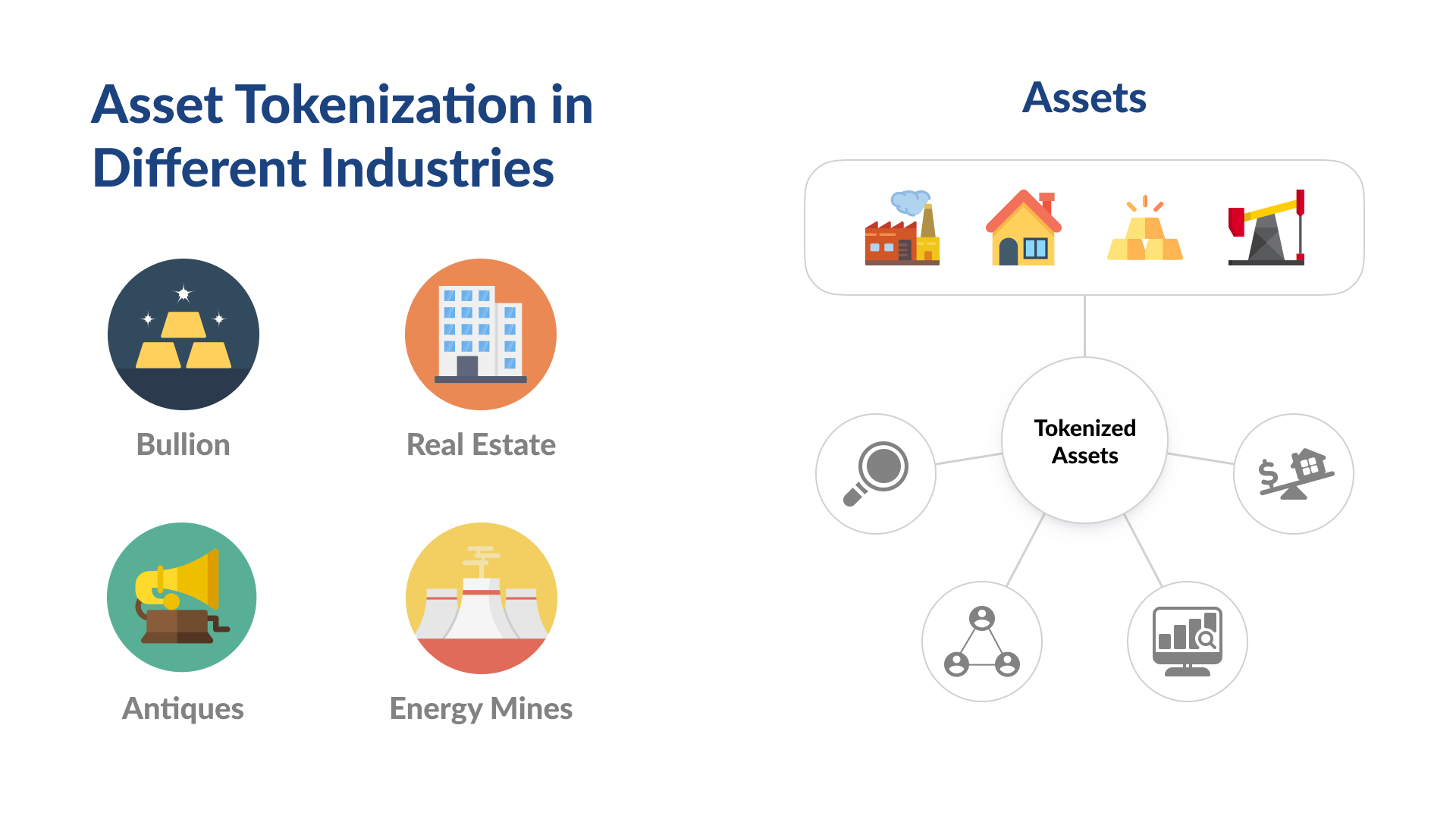

Real-World Assets (RWAs) refer to assets that have intrinsic value and exist in the physical world. These can include a wide range of items, such as:

-

Real Estate: Properties and land

-

Commodities: Gold, oil, agricultural products, etc.

-

Bonds and Equities: Traditional financial assets like stocks and debt instruments

-

Machinery and Equipment: Industrial assets and other physical property

In blockchain technology, RWAs are represented by digital tokens that serve as a blockchain-based version of these physical assets. Tokenizing RWAs enables these traditionally illiquid assets to be traded, owned, and transferred more easily within the digital ecosystem.

2. The tokenization process

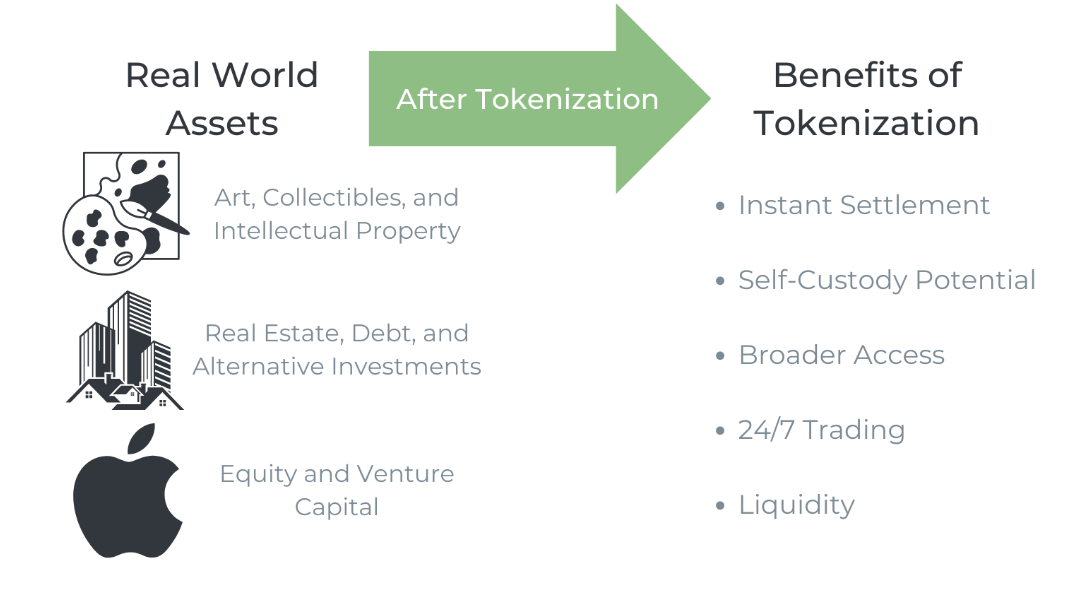

Tokenization is the process of converting tangible or intangible assets into digital tokens, which can be stored, transferred, or traded on a blockchain. In the case of RWAs, this means converting real estate, artwork, commodities, or even intellectual property into digital assets that can be accessed on-chain. The primary goal of tokenization is to fractionalize these assets, making them more accessible to a wider audience by dividing them into smaller, affordable units.

By tokenizing RWAs, investors can purchase fractions of high-value assets, like real estate, that would otherwise be out of their reach. This process not only democratizes asset ownership but also provides greater liquidity and accessibility to a broader range of investors.

3. Key benefits of tokenizing Real-World Assets

Tokenizing real-world assets offers several distinct advantages:

-

Enhanced Liquidity: Traditional assets like real estate or rare commodities are often difficult to trade and lack liquidity. By converting them into tokens, they can be traded on blockchain platforms 24/7, offering continuous liquidity and enabling investors to buy or sell at any time.

-

Transparency: Blockchain technology ensures that every transaction is recorded on a transparent, immutable ledger. This reduces the possibility of fraud and increases trust among investors, as they can independently verify the ownership and history of assets.

-

Fractional Ownership: Tokenization allows for fractional ownership of high-value assets. Investors can own a percentage of an asset, making it easier for individuals to invest in traditionally expensive markets such as real estate, fine art, or private equity.

-

Cost Reduction: Tokenization can streamline asset management by reducing the need for intermediaries, such as brokers and lawyers, as well as minimizing paperwork and legal fees. This helps lower the overall costs of asset transactions.

-

Accessibility: Tokenized RWAs can be accessed globally by anyone with an internet connection, broadening the potential investor base. This makes it easier for individuals who may have been excluded from traditional investment opportunities to participate in global markets.

4. Challenges in Tokenizing Real-World Assets

While tokenization presents significant benefits, it also comes with several challenges:

-

Regulatory Concerns: Since tokenized RWAs involve both digital and physical assets, they must comply with various regulations that differ by jurisdiction. Regulatory clarity is essential to ensure that tokenized assets are recognized as legitimate financial products in different markets.

-

Security Risks: Digital assets are susceptible to hacking and fraud. Secure custody solutions, encryption, and other advanced security measures are necessary to protect tokenized RWAs from cyber threats.

-

Custody and Physical Asset Management: For tokenized RWAs to maintain their value, the physical asset they represent must be securely stored and managed. Whether it's a piece of real estate or a gold bar, ensuring the proper custody of the underlying asset is crucial for the token's credibility and value.

-

Market Liquidity: Tokenized RWAs need sufficient market demand and liquidity for successful trading. Without a solid market foundation, tokenized assets may struggle to gain traction and achieve the desired level of liquidity.

5. RWAs in Decentralized Finance (DeFi)

One of the most promising applications of tokenized RWAs is in Decentralized Finance (DeFi). DeFi platforms use blockchain technology to create decentralized financial systems that are open, transparent, and operate without traditional intermediaries. Tokenizing RWAs can bring significant advantages to the DeFi ecosystem:

-

Bridging Traditional and Digital Finance: While DeFi has largely been based on digital assets like cryptocurrencies, tokenizing RWAs allows for the inclusion of traditional assets in the blockchain ecosystem, greatly expanding the scope and value of DeFi platforms.

-

Increased Liquidity: DeFi platforms can provide global access to tokenized RWAs, significantly increasing market liquidity for traditionally illiquid assets such as real estate, commodities, and bonds.

-

Innovative Financial Products: Tokenized RWAs open the door for novel financial products. For example, MakerDAO, one of the largest DeFi protocols, uses tokenized RWAs as collateral for its stablecoin DAI. This allows for the creation of a new type of stable asset that blends traditional finance with decentralized technologies.

As of December 2023, the total value locked (TVL) in tokenized RWAs in the DeFi ecosystem was approximately $5 billion, according to DefiLlama. This growing segment of the market showcases the increasing acceptance and adoption of RWAs within DeFi.

By integrating tokenized RWAs into the DeFi space, blockchain technology can create a more inclusive financial system with fewer barriers to entry, more transparent asset management, and lower systemic risks. In turn, this could lead to a more equitable and decentralized global financial market.

7. Conclusion

Tokenization of Real-World Assets (RWAs) offers a transformative opportunity to integrate physical assets into the digital financial ecosystem. By enabling fractional ownership, enhancing liquidity, and improving transparency, tokenization is democratizing access to high-value assets and paving the way for new financial products.

However, challenges such as regulatory compliance, security, and custody management must be addressed for tokenized RWAs to realize their full potential. As the DeFi ecosystem continues to grow and mature, tokenized RWAs will play an increasingly important role in shaping the future of global finance.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)