1. What is a Spot Bitcoin ETF?

A Spot Bitcoin Exchange-Traded Fund (ETF) is an investment product that allows investors to gain exposure to Bitcoin's price movements without directly owning the cryptocurrency. These ETFs hold actual Bitcoin in secure digital vaults, making it easier for traditional investors to access the cryptocurrency market. By purchasing shares of a Spot Bitcoin ETF, investors can indirectly invest in Bitcoin through their brokerage accounts, similar to how they would invest in stocks or traditional ETFs.

2. How Spot Bitcoin ETFs work?

Spot Bitcoin ETFs are a type of exchange-traded product (ETP) that directly hold Bitcoin as the underlying asset. Here’s a step-by-step breakdown of how they function:

-

Purchase of Bitcoin: The ETF purchases Bitcoin from holders or authorized exchanges. These Bitcoins are then stored in a digital wallet, often using multiple layers of security, such as cold storage (offline) to protect against hacking risks.

-

Issuance of ETF Shares: The ETF issues shares corresponding to the number of Bitcoins it holds. Each share represents a portion of the Bitcoin held by the fund, and these shares are traded on traditional stock exchanges like NASDAQ.

-

Price Tracking: The price of the ETF shares mirrors the market value of Bitcoin as closely as possible. This is typically achieved by rebalancing the ETF to reflect the performance of a Bitcoin reference rate, such as the CME CF Bitcoin Reference Rate.

-

Liquidity and Market Efficiency: The market is kept efficient by market makers who continuously buy and sell ETF shares. This ensures that investors can easily buy or sell their shares at market prices, which reflect the current value of Bitcoin.

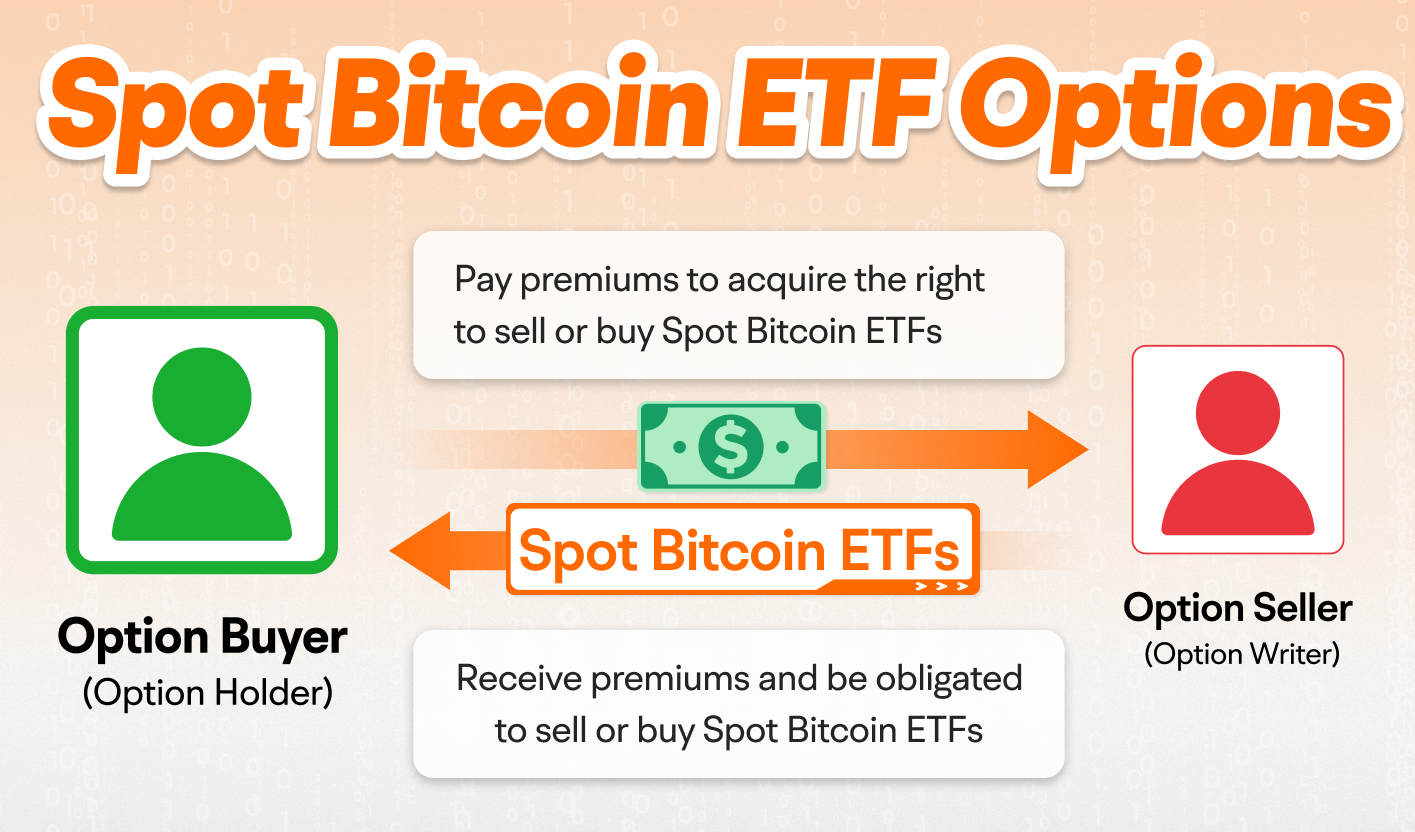

3. Spot Bitcoin ETF Options

Until recently, investors could only speculate on Bitcoin’s price movements through Bitcoin futures contracts. However, with the approval of Spot Bitcoin ETFs, it’s now possible for investors to purchase shares that directly represent Bitcoin itself.

In October 2024, the SEC approved several exchanges, such as Cboe and the New York Stock Exchange, to allow options trading on various Spot Bitcoin ETFs like Fidelity Wise Origin Bitcoin Fund (FBTC), ARK 21Shares Bitcoin ETF (ARKB), and Grayscale Bitcoin Trust (GBTC). This means that investors can now use options contracts to speculate on the price of Bitcoin ETFs, further expanding the investment opportunities in this space.

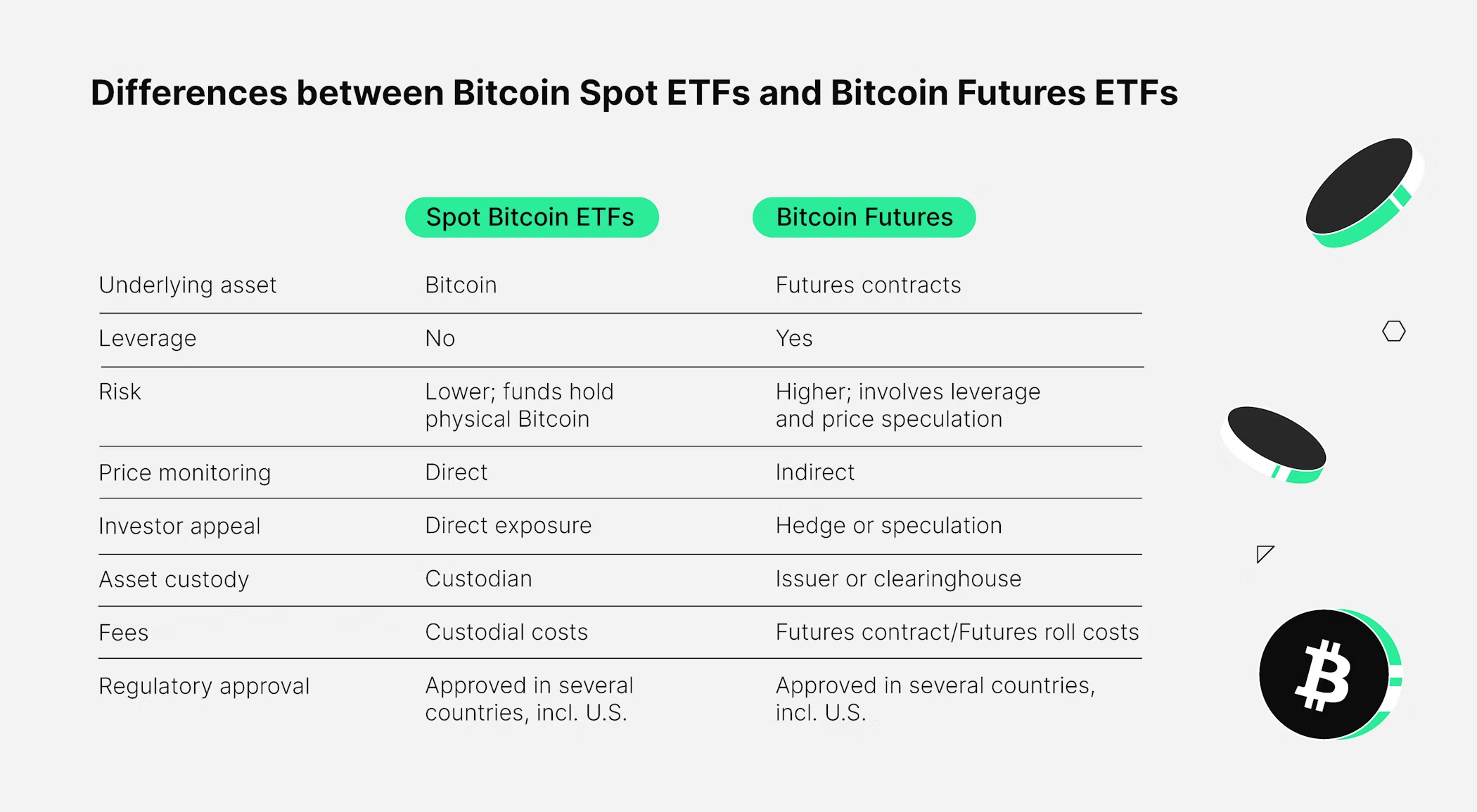

4. Spot Bitcoin ETFs vs. Other Bitcoin ETFs

There are two main types of Bitcoin ETFs: Spot Bitcoin ETFs and Bitcoin Futures ETFs. Here’s how they differ:

| Attribute | Spot Bitcoin ETFs | Bitcoin Futures ETFs |

| Underlying Asset | Actual Bitcoin | Bitcoin futures contracts |

| Price Tracking | Direct (based on actual Bitcoin) | Indirect (based on Bitcoin futures) |

| Asset Custody | Secure custody of Bitcoin | No direct custody of Bitcoin |

| Investor Simplicity | Higher: direct exposure | Lower: indirect exposure |

| Transparency | Higher: actual Bitcoins held | Lower: dependent on futures |

| Regulatory Framework | Established | Established |

5. Advantages and Disadvantages of Spot Bitcoin ETFs

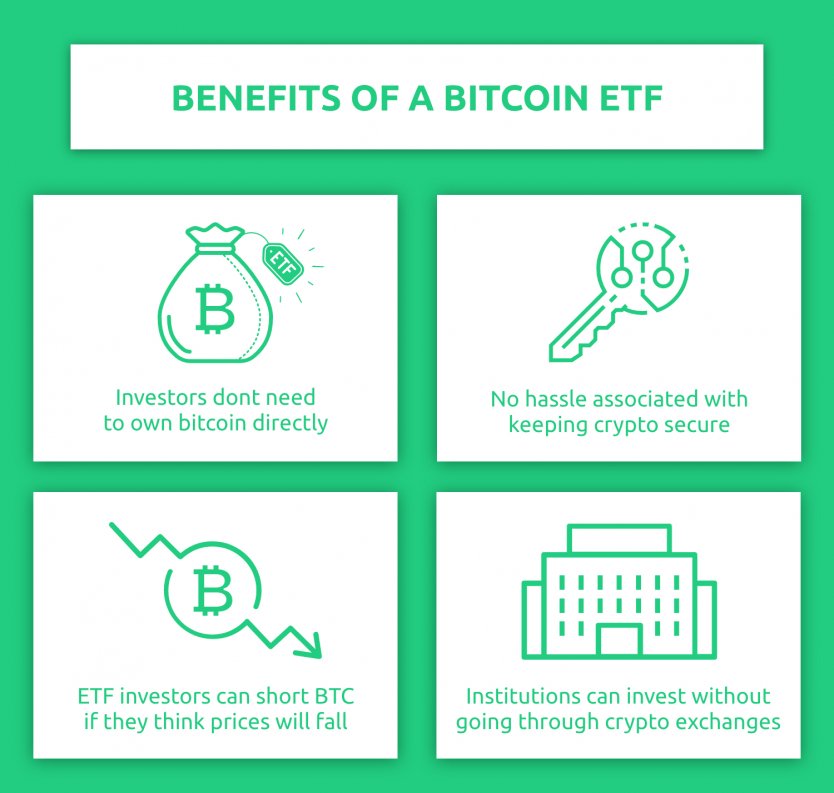

5.1 Advantages

-

Convenience: Spot Bitcoin ETFs eliminate the technical challenges of managing a cryptocurrency wallet, navigating exchanges, or dealing with private keys. Investors can easily trade the ETF like any other stock or ETF, using their traditional brokerage accounts.

-

Liquidity: Spot Bitcoin ETFs provide greater liquidity compared to cryptocurrency exchanges. Since they are traded on traditional stock exchanges, buying and selling is seamless and efficient, with prices reflecting the current value of Bitcoin.

-

Regulatory Oversight: Spot Bitcoin ETFs are subject to regulations, offering protection against risks such as fraud and market manipulation. This provides more security compared to dealing with unregulated cryptocurrency exchanges.

-

Tax Implications: In certain jurisdictions, Spot Bitcoin ETFs may offer favorable tax treatment compared to holding Bitcoin directly. The established tax framework for ETFs makes it easier for investors to predict their tax obligations.

5.2 Disadvantages

-

Crypto Volatility: Bitcoin remains highly volatile, and despite the benefits of holding the cryptocurrency in an ETF, investors are still exposed to Bitcoin’s price fluctuations.

-

Regulatory Uncertainty: The regulatory landscape for cryptocurrencies is still evolving. While Bitcoin ETFs are subject to existing regulations, future regulations could impact the performance of the ETFs or create new compliance challenges.

-

Management Fees: Spot Bitcoin ETFs charge management fees to cover operational costs, including Bitcoin storage and custody fees. These fees can be higher than those for traditional equity ETFs, potentially eating into investor returns over time.

-

Tracking Error: While Spot Bitcoin ETFs aim to mirror Bitcoin’s price, there may be discrepancies between the ETF’s share price and the actual price of Bitcoin. These tracking errors can occur because the ETF may not always rebalance perfectly to match Bitcoin’s price.

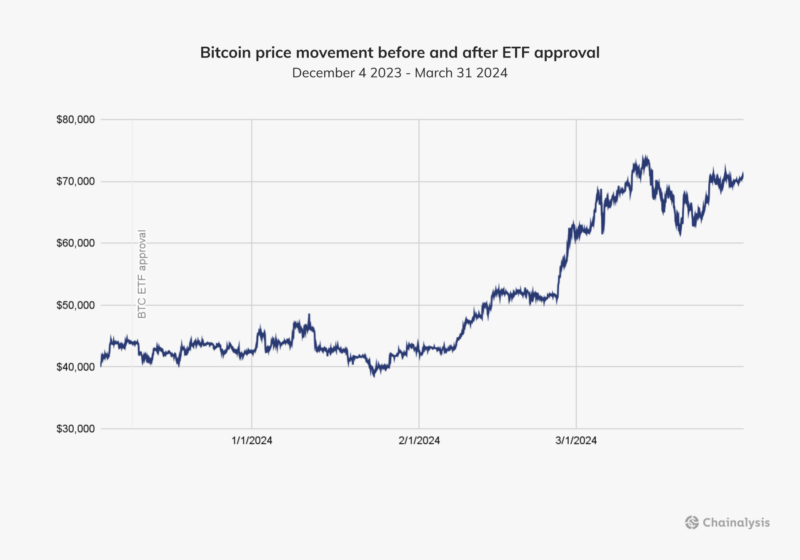

6. Impact of Spot Bitcoin ETFs on the Price of Bitcoin

While Spot Bitcoin ETFs do not directly affect the price of Bitcoin, they can influence its price indirectly through several key mechanisms:

-

Increased Adoption

The launch of Spot Bitcoin ETFs attracted significant investment from mainstream investors who previously faced barriers to directly investing in Bitcoin. With Spot Bitcoin ETFs, investors can gain exposure to Bitcoin through traditional brokerage accounts, making it easier for institutional and retail investors to participate. As demand for these ETFs rose, it resulted in increased capital inflows into Bitcoin, leading to temporary upward pressure on Bitcoin’s price.

-

Market Validation

The approval and launch of Spot Bitcoin ETFs provided further legitimacy to Bitcoin in the eyes of traditional investors and financial institutions. This perceived validation from regulators, particularly the U.S. Securities and Exchange Commission (SEC), helped to solidify Bitcoin's place in the broader financial ecosystem. Increased confidence from mainstream investors helped boost demand for Bitcoin, pushing its price higher.

-

Trading Activity

The creation of Spot Bitcoin ETFs opened new trading avenues for hedge funds, day traders, and other speculative investors. The active trading of these ETFs likely led to increased trading volume and volatility in the broader Bitcoin market, amplifying Bitcoin’s price fluctuations. The more frequent and accessible trading of Bitcoin via ETFs likely contributed to higher market liquidity and price volatility.

-

Reduced Premiums

Prior to the approval of Spot Bitcoin ETFs, institutional investors often paid a premium to gain exposure to Bitcoin via grayscale products or Bitcoin trusts. The introduction of Spot Bitcoin ETFs, which directly hold Bitcoin, has the potential to reduce these premiums. With more efficient pricing through these ETFs, institutional investors no longer need to pay inflated prices for Bitcoin exposure, which can help reduce the premium often seen in the market.

7. Conclusion

Spot Bitcoin ETFs provide a convenient, regulated way for investors to gain exposure to Bitcoin’s price movements without the need to directly manage the cryptocurrency. They offer several advantages, including simplicity, liquidity, and regulatory protection. However, they also come with risks such as volatility, regulatory uncertainty, and management fees. For those looking for a more direct way to invest in Bitcoin without dealing with the complexities of owning and storing the asset, Spot Bitcoin ETFs are an attractive alternative.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)