1. Definition of a Venture Capital (VC) Fund

A Venture Capital (VC) Fund in the cryptocurrency industry refers to a collective investment vehicle that channels capital into early-stage blockchain and cryptocurrency startups with high growth potential. In return for the investment, these funds acquire equity stakes or ownership interests in the projects. Crypto VC funds bring more than just capital to the table—they offer mentorship, industry connections, and strategic guidance, helping startups scale and succeed in a fast-moving and volatile market.

2. How Crypto VC Funds Operate?

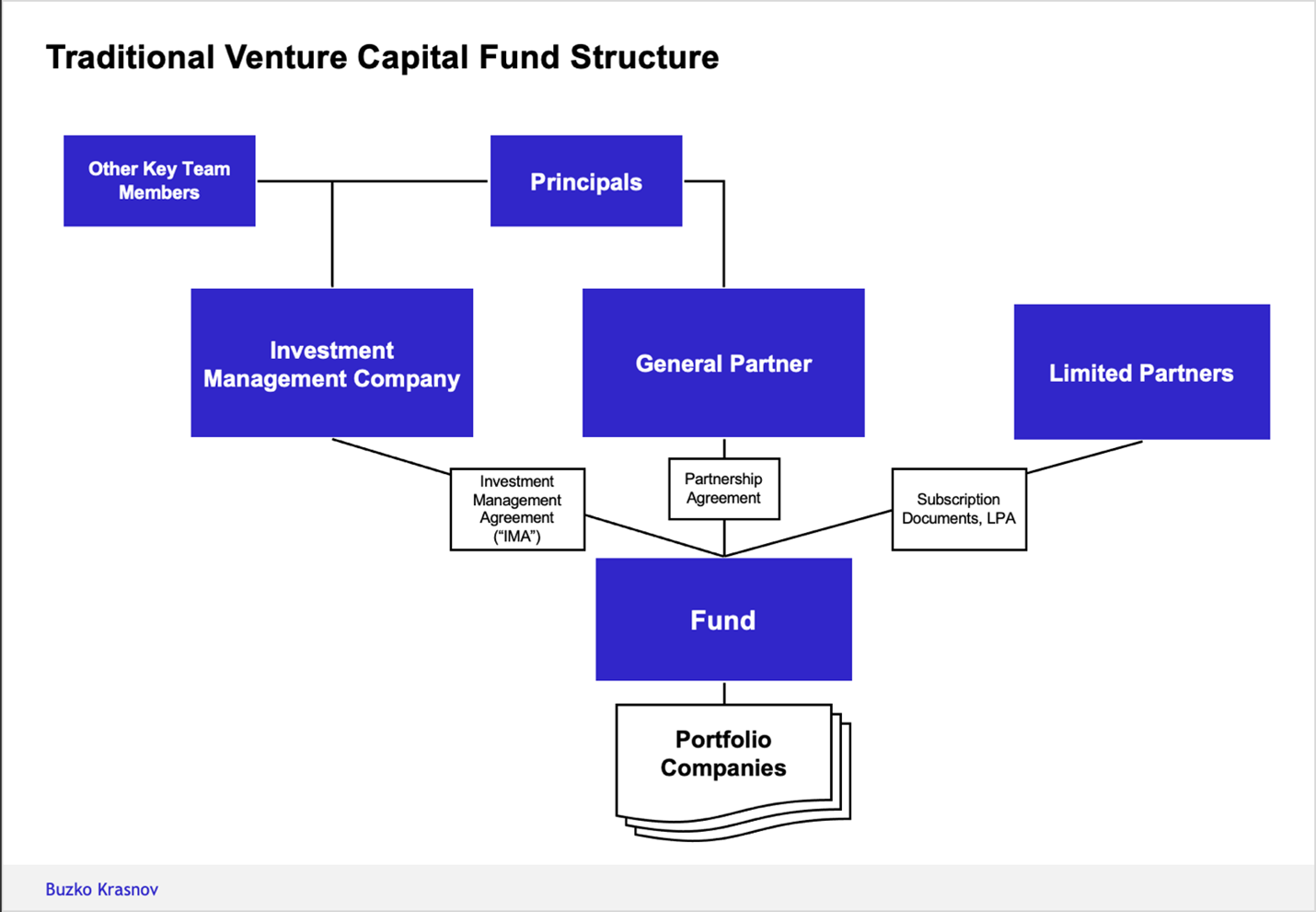

Crypto VC funds operate by raising capital from limited partners such as institutional investors, high-net-worth individuals, and sometimes corporate investors. These funds are typically managed by experienced fund managers who specialize in the cryptocurrency and blockchain sectors.

The fund managers then allocate the raised capital across a diversified portfolio of promising crypto projects and startups. Their role extends beyond mere financial investment, as they actively engage in the growth of the portfolio companies, offering valuable insights, strategic advice, and introductions to potential partners, clients, and other investors.

3. The Role of VC Funds in the Crypto Industry

Venture capital funds are drawn to the cryptocurrency space due to its immense potential to disrupt various industries, ranging from finance and banking to supply chains and governance. Blockchain technology, which underpins cryptocurrencies, has the ability to solve complex problems such as decentralization, security, transparency, and efficiency. This vast transformative potential makes the crypto industry an attractive area for high-risk, high-reward investments.

VC funds are instrumental in the growth and success of the cryptocurrency ecosystem. Many of the breakthrough projects and leading companies in the space were seeded by venture capital funding.

By providing financial backing and strategic support, VC funds enable startups to grow quickly, launch innovative products, and enter new markets. This early support helps ensure that promising projects move from the ideation phase to market, where they can potentially become industry leaders.

4. Stages of Venture Capital Funding

Stage 0: Pre-Seed Funding (The Idea Stage)

At this early stage, the company is in its formative phase, usually working on an idea or building an initial prototype. The funding raised is typically modest, often sourced from personal savings, family, friends, or angel investors. The goal is to prove the concept’s viability and develop an early version of the product.

Example: A team with a new blockchain application idea raises a small amount of capital from personal sources to develop an initial prototype and test its market feasibility.

Stage 1: Seed Capital (The MVP Stage)

Once the Minimum Viable Product (MVP) is developed, the startup enters the seed funding stage. The funding at this stage is higher than in the pre-seed phase, often raised from angel investors, seed funds, or accelerators. The primary goal at this stage is to refine the product, gather early user feedback, and confirm market demand.

Example: A blockchain startup with a decentralized finance (DeFi) platform secures seed funding to enhance its technology and build its user base.

Series A: Startup Capital (The Growth Stage)

In Series A funding, the startup usually has an established product with initial users and is beginning to generate revenue. This stage is crucial for scaling up operations and refining business models. The funds raised are typically in the range of several million dollars.

Example: A blockchain company with a growing user base raises Series A funding to expand its team, improve its platform’s features, and capture a larger market share.

Series B: Growth Stage (The Expansion Stage)

Series B funding is sought by more mature startups that have a proven product and business model. At this stage, the focus is on accelerating growth, such as hiring key talent, expanding into new markets, or enhancing product development. The funds raised are typically larger, ranging from tens of millions of dollars.

Example: A cryptocurrency exchange platform raises Series B funding to scale internationally, improve security, and broaden its range of supported assets.

Series C and Beyond: Expansion Stage (The Scaling Stage)

Series C and later-stage rounds are focused on expansion, scaling, or preparing for an IPO. Companies at this stage are looking for substantial funding—often hundreds of millions of dollars—to execute large-scale moves, such as acquisitions, market dominance, or preparing for a public listing.

Example: A leading cryptocurrency company raises a Series C round to acquire competitors or diversify its operations, setting the stage for a potential IPO.

5. Innovative Funding Methods: SAFTs and Token Vesting

-

Simple Agreement for Future Tokens (SAFT)

A Simple Agreement for Future Tokens (SAFT) is an investment contract used by cryptocurrency firms to raise capital. Under this structure, investors provide capital to a blockchain project in exchange for the promise of tokens to be issued at a later date, once the project is operational. This method allows crypto projects to raise funds before their tokens are fully developed or launched.

Token vesting refers to a mechanism in which tokens are gradually released to stakeholders (such as founders, employees, or investors) over a predetermined period. A typical vesting schedule might release a certain percentage of tokens over months or years, ensuring that stakeholders remain committed to the project long-term.

-

Benefits of SAFTs and Token Vesting

Both SAFTs and token vesting mechanisms provide blockchain startups with greater flexibility in raising capital. For investors, these methods offer a form of participation that can potentially yield substantial returns. At the same time, they reduce the risks of premature token releases and align the interests of all parties involved in the project.

6. Key Considerations for Investors

- Evaluating a VC Fund in Crypto

When evaluating a crypto VC fund, investors should look at several factors: the fund’s historical performance, its investment focus, the experience and track record of its management team, and its risk management strategies. It’s also important to understand the fund's approach to diversifying its investments across different crypto projects and the level of expertise in the blockchain space.

- The Risks and Rewards of Investing in Crypto VC Funds

Investing in crypto VC funds presents both significant risks and rewards. The cryptocurrency market is volatile and unpredictable, and even well-funded startups can fail due to market fluctuations, technological challenges, or regulatory changes. However, for investors willing to navigate these risks, the potential for high returns is significant, especially with early investments in transformative projects.

7. Conclusion

Venture capital funds are critical to the growth and success of the crypto ecosystem. They provide the funding and support necessary for startups to scale and innovate in the blockchain space. With the introduction of innovative funding mechanisms like SAFTs and token vesting, the landscape for both investors and startups is evolving rapidly. Tools like Nuant are further enhancing the management and decision-making process, making it easier for VC funds to navigate the complexities of the crypto world. For investors, this represents an exciting opportunity to participate in the next wave of innovation and growth in the blockchain and cryptocurrency industries.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)