1. What is Bullish?

"Bullish" refers to a positive outlook regarding price increases. In the context of the cryptocurrency market, a "bullish" investor is one who believes that a specific cryptocurrency or NFT will increase in value. This confidence is often observed when the market is experiencing growth and profits are being realized.

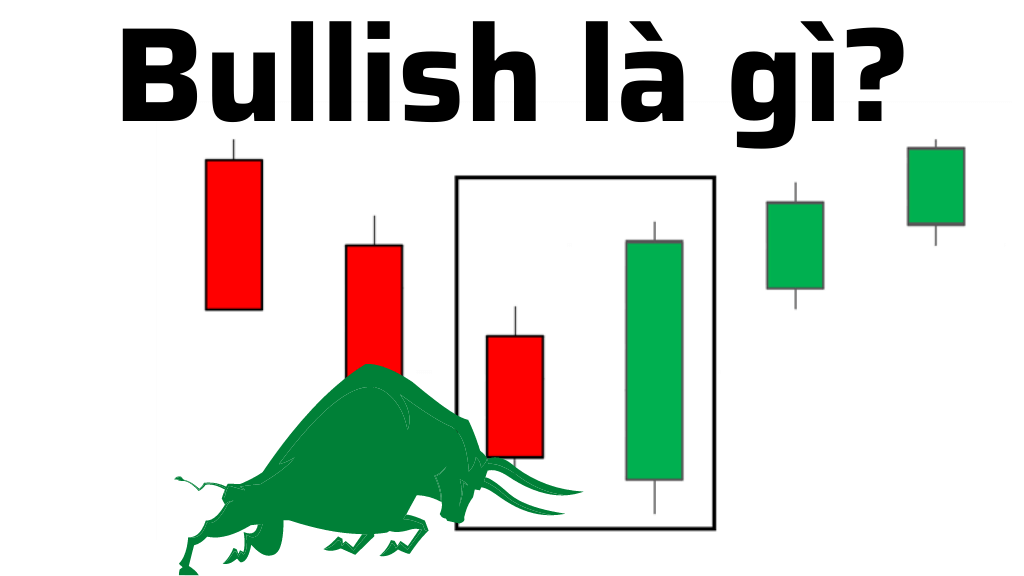

For those new to crypto, think of bullish as a bull pushing up from below, symbolizing strength and growth.

When someone says "the market is bullish," they imply that there is a positive trend, and many investors believe that the price of a coin will rise. This is usually accompanied by optimism about future prospects and can encourage people to buy in to benefit from the anticipated price increase.

The bullish state is often described with terms like "rising prices," "growth," or "market optimism." In contrast, "bearish" is the opposite state, reflecting concerns about price declines in the future.

Short-Term Bullish:

Short-term bullish refers to a positive market condition over a brief period, usually from a few days to a few weeks. During this time, a coin’s price tends to rise. Short-term bullish investors often believe that there are short-term factors driving the price up and want to capitalize on this temporary price increase.

For example, a major event such as the launch of an important update or positive news from a major partner could cause a coin's price to rise temporarily.

Long-Term Bullish:

Long-term bullish refers to a positive market outlook extending over a longer period, typically from several months to many years. In this case, investors believe in the potential for growth and value increase of a cryptocurrency over the long term.

Factors supporting long-term bullishness may include community consensus on the coin’s technology, expansion and application prospects, or even changes in blockchain infrastructure.

In summary, "short-term bullish" usually relates to short-term fluctuations, while "long-term bullish" reflects confidence in the potential and sustainable development of a cryptocurrency over a longer period.

2. Signs of a Bullish Market

There are several indicators that investors and market analysts use to identify a bullish market. Here are some common signs:

-

Continuous Price Increase: The price of an asset steadily increases over a prolonged period without significant drops.

-

Increased Trading Volume: When prices rise along with increasing trading volume, this could indicate a strong upward trend.

-

Large Inflows of Capital: Major projects, investment funds, or reputable individuals start investing in the market.

-

Golden Cross: A "Golden Cross" occurs when the short-term moving average (e.g., 50-day) crosses above the long-term moving average (e.g., 200-day). This is often a positive market signal.

-

Increased Relative Strength Index (RSI): An RSI above 70 typically indicates that an asset is "overbought," but in a bullish market, this can persist for some time without undue concern.

-

Positive News: Positive events, such as new developments, major partnerships, or widespread technology adoption, can boost market sentiment.

-

Increased Market Participation: A significant rise in the number of market participants can indicate increased interest and confidence from the investment community.

Remember, no single indicator is foolproof, and using multiple indicators together is usually the best approach for assessing market conditions.

3. Technical Analysis in a Bullish Market

Technical analysis in a bullish market involves evaluating and predicting price behavior when the market is experiencing positive trends. Here are some key methods and factors in technical analysis during a bullish trend:

-

Moving Averages: Continuous price increases are often confirmed when prices are above short-term moving averages, such as the 50-day moving average. The strength of the bullish trend can be assessed through long-term moving averages, like the 200-day moving average.

-

Buy/Sell Signals: Certain buy/sell signals, such as the "Golden Cross" (short-term moving average crossing above long-term moving average), can confirm a bullish trend.

-

Relative Strength Index (RSI): An RSI above 70 usually indicates an "overbought" condition, but in a bullish market, it may remain high for extended periods.

-

Divergence and Convergence: Convergence between price and indicators like MACD can be a strong sign of a stable bullish trend. Divergence should be monitored for potential changes in market momentum.

-

Trading Volume: Increased trading volume can confirm the strength of the upward trend.

-

Candlestick Patterns: Candlestick patterns such as "Bullish Engulfing" or "Hammer" can provide positive signals in a bullish market.

In a bullish market, using multiple technical tools and indicators together often helps investors get a comprehensive view and confirm positive signs.

4. Effective Trading Strategies in a Bullish Market

Trading in a bullish market requires a flexible strategy and awareness of risks. As an intelligent investor, you should develop a strategy to capitalize on the opportunities. Here are some suggested strategies for trading in a bullish market:

-

Entry Strategy: Determine entry points based on technical signals like trend lines, price patterns, or indicators like RSI. You may consider buying after recent price corrections to "buy the dip."

-

Stop Loss Orders: Set a stop loss below your entry point to manage risk. Choose the stop loss level based on technical support or a fixed percentage of your total investment.

-

Take Profit Orders: Set a price level to take profits, based on your assessment of potential price increases and support or resistance levels. Profit-taking levels could be set at significant historical price points or based on a risk/reward ratio.

-

Confirm Technical Signals: Combine technical signals (e.g., "Golden Cross") with fundamental factors (e.g., new product launches) to increase the probability of success.

-

Avoid FOMO: Managing the Fear of Missing Out (FOMO) is crucial in a bullish market. FOMO is the emotional pressure to buy assets simply out of fear of missing an opportunity. During rising prices, investors might be tempted to make large purchases, but this can lead to difficulties when prices peak and decline. To succeed, establish a solid plan to avoid FOMO. If you detect this mindset, pausing trading can be a wise choice, especially during volatile market conditions.

5. Conclusion

While a bullish market presents significant opportunities, an investor’s success depends not only on optimism but also on a smart trading strategy. Understanding bullish trends is crucial, but combining this knowledge with a flexible strategy and risk management is key to truly benefiting from the market's advantages.

Read More:

English

English Tiếng Việt

Tiếng Việt