1. What is Spot Trading?

Spot trading refers to the act of buying or selling a financial asset or commodity for immediate delivery. In a spot trade, the transaction is settled "on the spot," meaning the exchange of assets typically happens within a short period—usually two business days or less.

The main appeal of spot trading is its simplicity and transparency. Unlike derivatives trading (such as futures or options), spot trading involves the direct exchange of assets without the use of complex contracts or leverage. This makes it an ideal option for beginners who are just starting to explore the world of trading.

1.1 Spot Market vs. Derivatives Market

The spot market is the market where spot trading occurs. In contrast, the derivatives market involves trading contracts that derive their value from underlying assets like stocks, cryptocurrencies, or commodities. While spot trading involves the immediate exchange of actual assets, derivatives trading involves contracts that settle at a future date.

1.2 How Spot Trading Works

When you execute a spot trade, you buy or sell an asset (such as Bitcoin, Ethereum, or a stock) at the current market price. The asset is delivered immediately, and the transaction is completed almost instantly. You’ll typically pay for the asset upfront and receive it in your account right away.

For example, in cryptocurrency spot trading, you might buy Bitcoin at the current price, and the Bitcoin will appear in your wallet immediately after the purchase is completed.

2. Key Features of Spot Trading

There are several features that distinguish spot trading from other types of trading:

2.1 Immediate Settlement

In spot trading, the exchange of assets is done immediately. This ensures that once a trade is executed, you own the asset (or have received the payment for the asset you sold) without delay.

2.2 No Leverage

Spot trading does not involve borrowing funds to trade larger amounts than you have in your account (which is common in margin or leveraged trading). This means that you are only able to trade with the funds you currently hold, reducing the risk of large losses.

2.3 No Expiry Dates

Unlike futures contracts, which have an expiration date, spot trades are settled instantly, with no need to worry about contract expiry. This makes it much simpler for traders to enter and exit trades as needed.

2.4 Transparent Pricing

In spot trading, prices are determined by the current market conditions, ensuring that you are always trading at fair market value. The price of the asset is directly influenced by supply and demand factors in the spot market.

3. Spot Trading vs. Other Types of Trading

While spot trading is popular, it’s essential to understand how it compares to other types of trading. Here’s a comparison between spot trading and other common trading methods:

3.1 Spot Trading vs. Futures Trading

-

Spot Trading: Involves immediate purchase or sale of assets at the current market price with no future settlement date.

-

Futures Trading: Involves contracts that specify the purchase or sale of assets at a predetermined price at a future date.

Spot trading is more accessible to beginners due to its simplicity, while futures trading is better suited for advanced traders seeking to speculate on price movements over time.

3.2 Spot Trading vs. Margin Trading

-

Spot Trading: Requires the trader to only use the funds they have in their account.

-

Margin Trading: Allows traders to borrow funds to trade larger positions than they can afford, using their assets as collateral.

Margin trading involves higher risk because you can lose more than your initial investment, while spot trading is lower-risk because you only lose what you invest.

4. How to Get Started with Spot Trading

Spot trading is one of the easiest forms of trading to get into, and with a little guidance, even beginners can quickly learn how to execute successful trades. Here’s a more in-depth breakdown of the process:

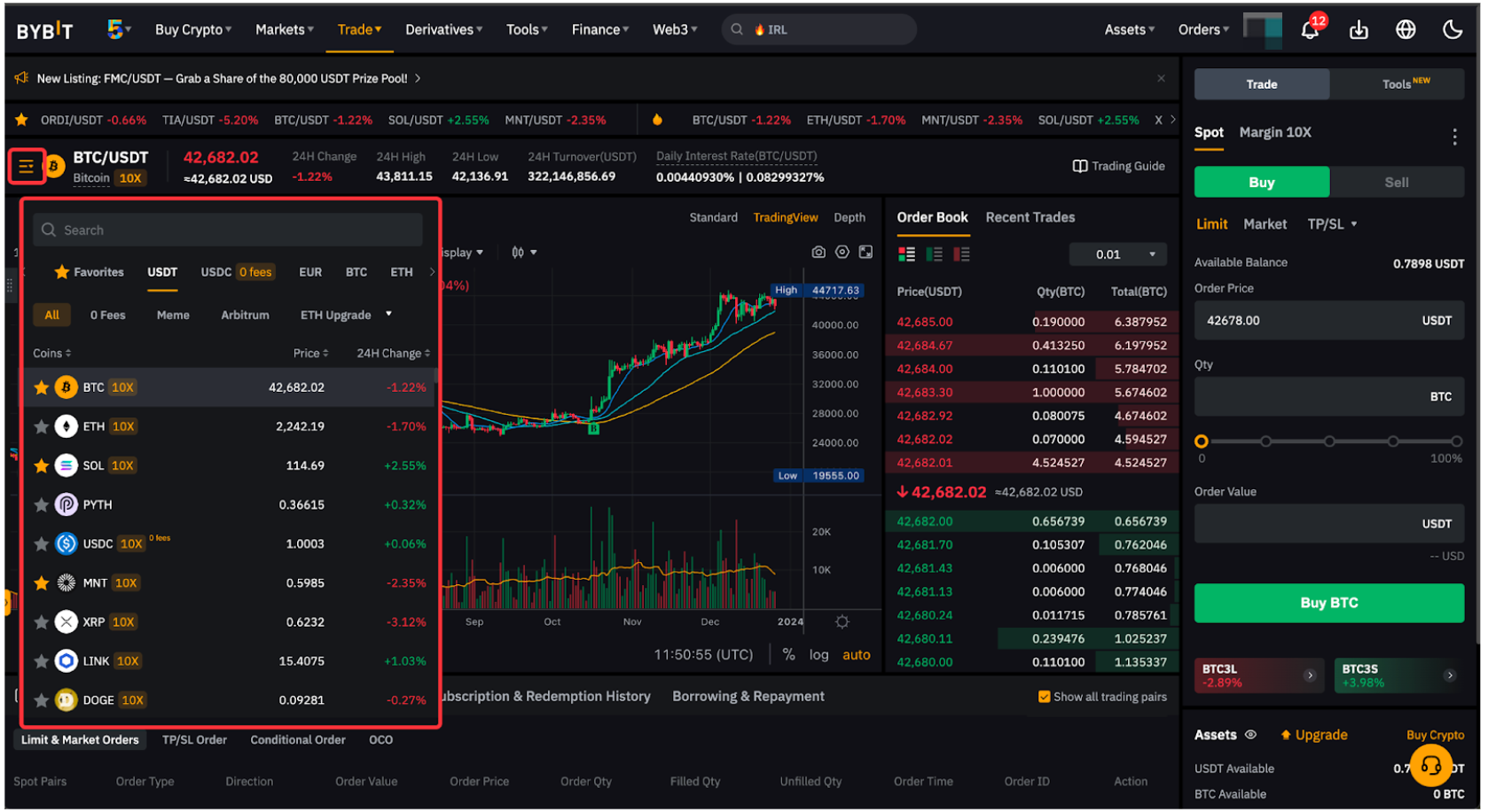

4.1 Choose a Reliable Trading Platform

The first step to beginning spot trading is selecting a trustworthy and reliable platform. The platform you choose should offer the tools and features that best suit your trading needs. Here are some critical factors to consider when choosing a trading platform:

-

Security: Make sure the platform has strong security protocols in place to protect your assets. Look for platforms that use two-factor authentication (2FA), encryption, and cold storage for cryptocurrencies.

-

Liquidity: A platform with high liquidity means there is a lot of buying and selling activity, which is crucial for ensuring that your trades are executed at a fair market price without delays.

-

Ease of Use: As a beginner, you should choose a platform with a user-friendly interface. Platforms with easy-to-navigate dashboards, well-organized markets, and simple order types will make the process smoother.

-

Fees: Always check the trading fees associated with the platform. Some exchanges have higher fees than others, which can erode your profits over time. It's important to compare trading fees, withdrawal fees, and deposit fees.

-

Assets Supported: Ensure that the platform supports the assets you want to trade, such as Bitcoin, Ethereum, or altcoins. Most platforms allow trading in multiple cryptocurrencies and other assets like stocks or commodities.

Some popular platforms for spot trading include:

-

Coinbase

-

Kraken

-

Gemini

-

eToro (for stocks and commodities)

4.2 Create an Account

Once you’ve chosen a platform, the next step is to create an account. Most platforms will require you to go through the following steps:

-

Sign Up: Provide basic personal information such as your name, email address, and password.

-

Verify Your Identity: Due to regulatory requirements, many platforms require you to complete a Know Your Customer (KYC) process. This may involve uploading a government-issued ID and proof of address to verify your identity.

-

Set Up Two-Factor Authentication (2FA): For added security, enable two-factor authentication. This will require a second form of verification (usually a code sent to your phone) to complete logins or withdrawals.

4.3 Deposit Funds

Before you can start trading, you'll need to deposit funds into your account. Here’s how you can go about it:

-

Choose Your Deposit Method: Most platforms accept various deposit methods, such as:

-

Bank Transfers: Typically the most cost-effective method for larger deposits.

-

Credit/Debit Cards: Quick but may come with higher fees.

-

Cryptocurrency Transfers: If you already hold cryptocurrency, you can transfer it directly into your spot trading account.

-

Deposit Fees: Be aware that some deposit methods may come with fees. For example, credit card payments may incur processing fees.

-

Deposit Time: Bank transfers may take a few business days, while cryptocurrency transfers are typically completed within minutes.

-

Fiat or Crypto? Decide whether you’re depositing fiat currency (such as USD, EUR) or cryptocurrency. If you're new to cryptocurrency trading, depositing fiat and then converting it to crypto might be the easiest option.

4.4 Select Your Assets

Once your funds are deposited, you can select the assets you wish to trade. Spot trading allows you to buy or sell any asset available on the platform, from cryptocurrencies like Bitcoin and Ethereum to commodities like gold or oil, or stocks in companies.

Here are some important points to consider when selecting your assets:

-

Market Research: Don’t just pick assets on a whim. Research the market trends and fundamental aspects of the assets you're interested in. For cryptocurrencies, this includes understanding the technology behind the token, its use cases, and its market sentiment.

-

Diversification: If you are a beginner, avoid putting all your funds into one asset. Diversification helps to spread the risk across different assets, making your portfolio more resilient to price swings.

-

Liquidity: Opt for assets with higher liquidity as they tend to have smaller spreads (the difference between the buying and selling price), which is essential for minimizing your trading costs.

4.5 Place Your First Spot Trade

Now that you’ve selected your asset and have funds available, you can execute your first spot trade. Here’s how to go about it:

-

Choose Buy or Sell: Decide whether you want to buy or sell the asset. If you believe the asset's price will rise, you'll want to buy. If you think the price will fall, you'll sell the asset.

-

Enter the Trade Amount: Input the amount of the asset you want to buy or sell. You can often choose to trade either a specific quantity or value (e.g., 1 BTC or $500 worth of Bitcoin).

-

Set Stop-Loss or Take-Profit Orders: These are risk management tools that can help you minimize losses or lock in profits. A stop-loss order automatically sells the asset if the price drops below a certain threshold, while a take-profit order will sell the asset once it hits a specific target price.

-

Review the Order: Double-check your trade details (asset, amount, price, etc.) before executing the order. In spot trading, the transaction will typically be executed immediately at the current market price.

-

Confirm and Execute the Order: After reviewing, confirm the trade, and the platform will execute it immediately. The asset will be bought or sold at the current market price and transferred to your account or wallet.

4.6 Monitor Your Trades

After placing your trades, it’s important to monitor them regularly to ensure that you're on track to meet your investment goals. Here are some strategies for keeping tabs on your trades:

-

Price Alerts: Set up price alerts so you’re notified when an asset reaches a specific price point. This helps you act quickly without having to constantly monitor the markets.

-

Market Trends: Track market trends and news that could influence the price of the asset you're trading. For example, cryptocurrency prices are often affected by regulatory news, technological advancements, or market sentiment.

-

Portfolio Management: Regularly assess your portfolio’s performance and consider rebalancing it if certain assets are outperforming others. Rebalancing helps keep your risk levels in check.

5. Tips for successful Spot Trading

While spot trading is relatively straightforward, it's important to develop strategies and good habits to be successful in the long run. Here are some tips for beginners:

Do Your Research

Before entering any trade, make sure you’ve done thorough research on the asset you plan to buy or sell. Look for news, historical price patterns, market trends, and overall sentiment around the asset. Knowledge is key to making informed decisions.

Start Small

As a beginner, start with small trades to minimize your risk. This allows you to gain experience without risking too much capital. Once you’re more comfortable, you can start increasing the size of your trades.

Have a Trading Plan

Develop a clear trading plan that outlines your goals, risk tolerance, and entry/exit points for each trade. A trading plan helps you stay disciplined and avoid making impulsive decisions based on emotions.

Use Risk Management Strategies

Always use stop-loss and take-profit orders to manage risk. These tools can automatically close your position when it reaches a certain level, protecting you from significant losses or locking in profits at a predefined price.

Be Patient and Avoid Overtrading

Spot trading can be tempting due to the fast-paced nature of the market, but overtrading can lead to mistakes and unnecessary fees. Be patient, and wait for the right opportunities. It's essential to only trade when you have a strong conviction about the market direction.

6.Conclusion

Spot trading is an excellent way for beginners to enter the world of trading, providing a simple and straightforward method to exchange assets at current market prices. Its transparency, low risk, and immediate ownership make it an ideal starting point for those new to the financial markets.

As you gain experience and knowledge, you can explore more advanced trading strategies, but spot trading remains an essential foundation for understanding the basics of buying and selling assets in the markets.

By following the steps outlined in this guide and being mindful of the tips and common mistakes, you’ll be well on your way to becoming a successful spot trader.

Read more:

English

English Tiếng Việt

Tiếng Việt.png)