.jpg)

1. What is DefiLlama?

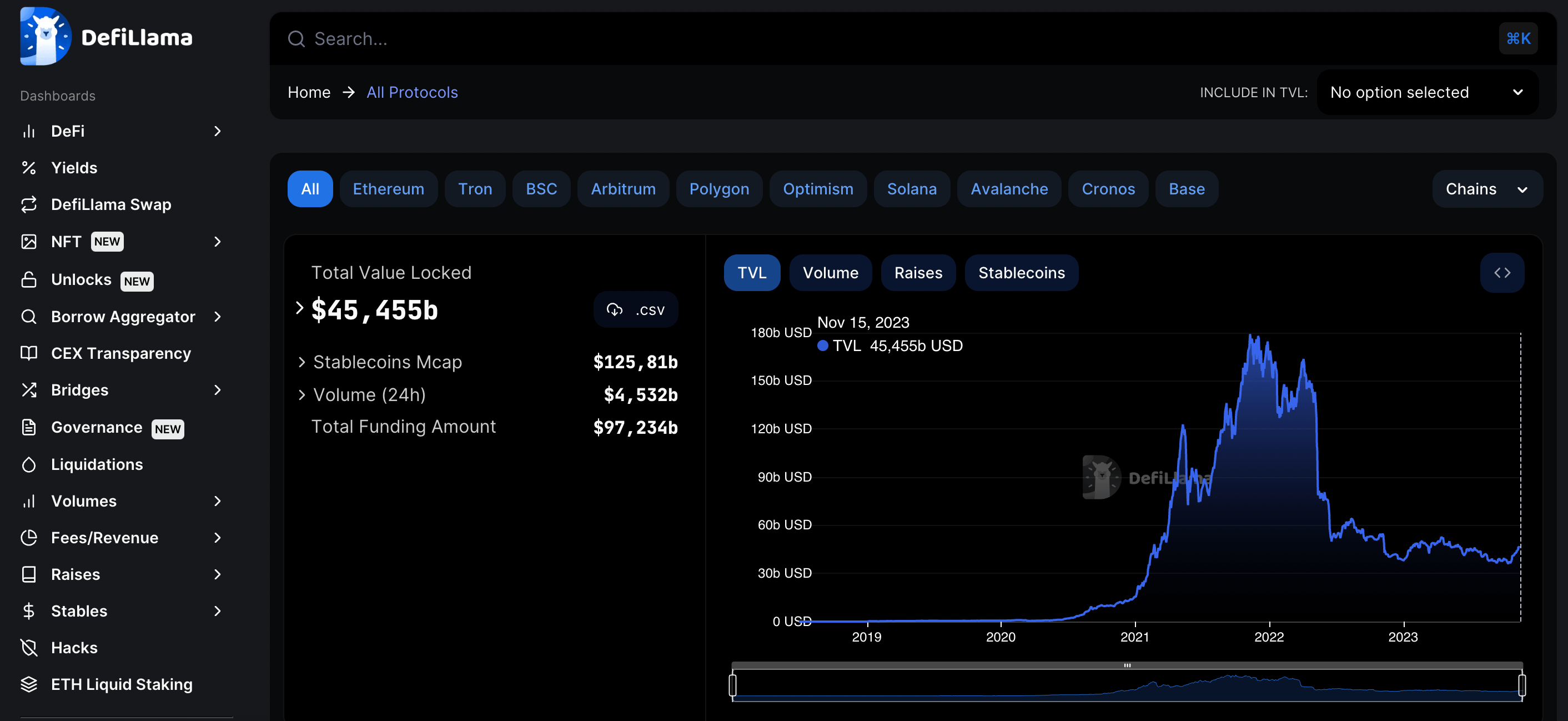

DefiLlama is a website that aggregates information and data related to DeFi on blockchain networks including Ethereum, Solana, Near, Avalanche, BSC, Arbitrum, Optimism, and more.

DefiLlama provides users with an overview of activities surrounding decentralized applications built on various blockchains and ecosystems. Through DefiLlama, newcomers can gain a clearer picture of the DeFi market.

Notably,DefiLlama provides information on "Total Value Locked" (TVL), a key factor in DeFi. TVL represents a certain amount of money deposited on blockchains in the form of LP tokens or collateral. TVL helps users understand the flow of funds into ecosystems and applications, enabling them to make informed investment decisions.

In addition, DefiLlama provides data to track and analyze the following factors:

- Decentralized applications (dApps)

- Blockchain networks

- Oracles

- Forks

- Stablecoins

- Bridges

- Protocols

- Airdrop

- NFTs

2. Characteristics of DefiLlama

2.1. Advantages

-

The statistics are aggregated on the homepage of DefiLlama and are provided for free.

-

DefiLlama offers comprehensive information related to blockchain activities in general and dApps in particular.

-

It compares TVL metrics and the level of DeFi market activity across different blockchains.

-

The interface is user-friendly and easy to navigate.

2.2. Disadvantages

- Some information is updated slowly and may be inaccurate (such as TVL or transaction volume).

- There are quite a few new metrics and terms that require users to continuously update their knowledge and learn more.

3. Guide to using DefiLlama

3.1. Retrieve data on DeFi

3.1.1. Overview

When you visit the DefiLlama website, you will see the interface at the Overview section. Some of the information displayed here includes:

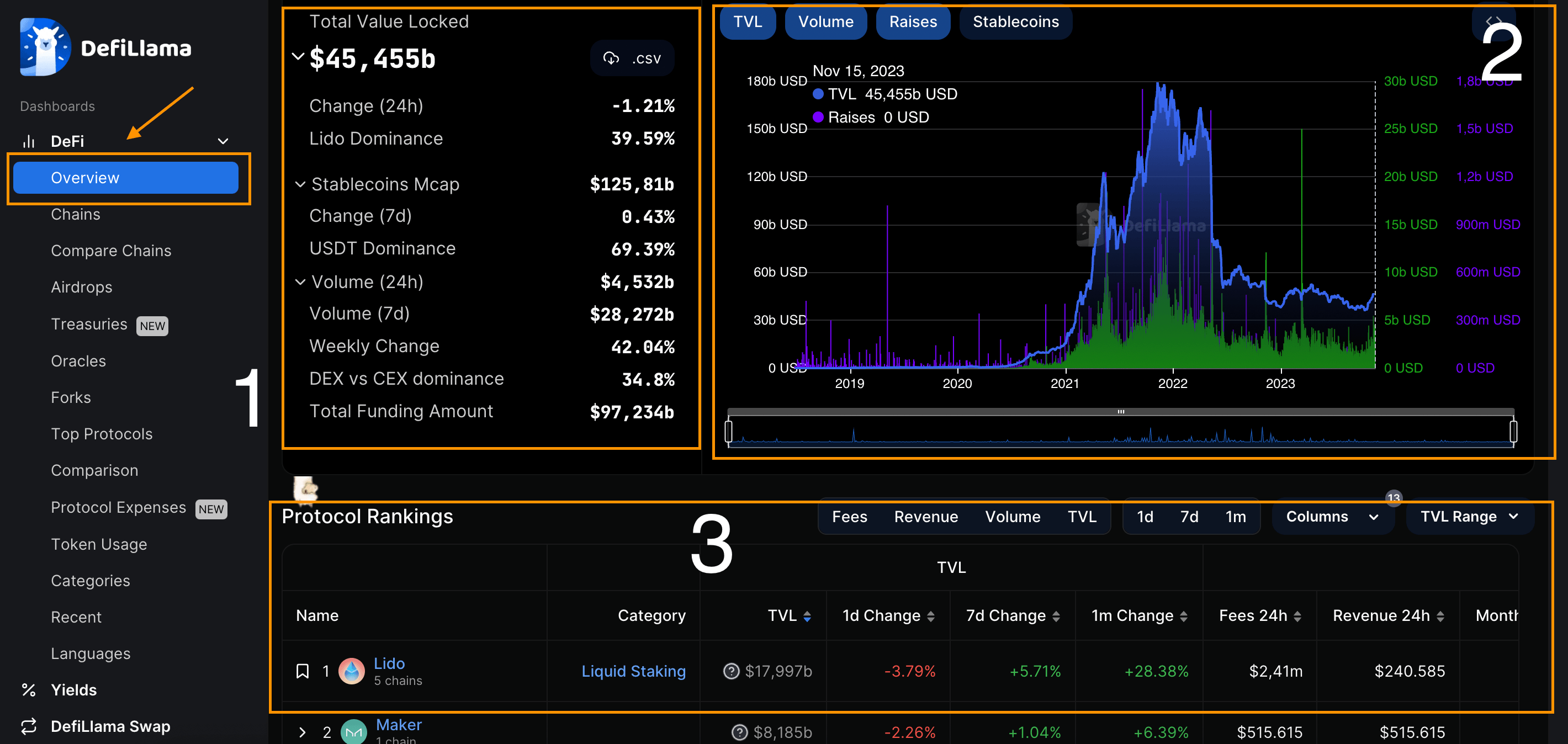

Area 1

- Total Value Locked (TVL): This is a metric that shows the total amount of money locked in a DeFi protocol.

- Change (24h): The percentage increase (+) or decrease (-) in TVL over the past 24 hours.

- Dominance: The dominance ratio of a DeFi platform compared to the entire market. For example, in the TVL ranking, Lido Finance is leading. The Lido Dominance metric accounts for

- approximately 39.59% of the TVL in the DeFi market.

- Stablecoins Mcap: The market capitalization of the entire stablecoin market.

- Volume (24h): The trading volume of the entire DeFi market in the past 24 hours.

Area 2

-

The chart area shows the fluctuations of TVL, Volume, Raises, and Stablecoins for the entire market.

Area 3

-

TVL Rankings: The TVL ranking table lists DeFi applications in descending order based on their Total Value Locked across various blockchain ecosystems.

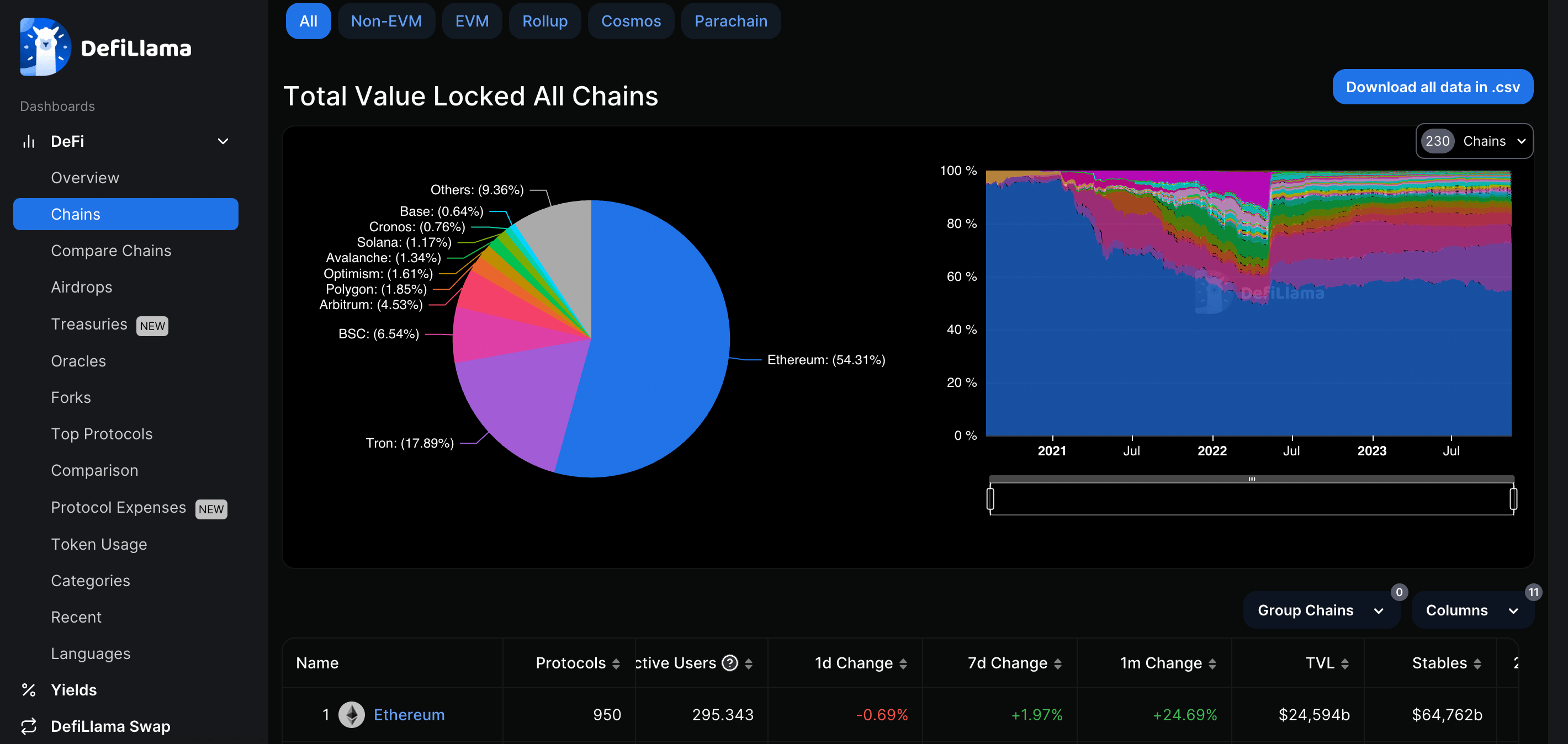

3.1.2. Chains

The "Chains" option on DefiLlama allows users to track TVL across entire blockchain ecosystems. This enables users to see which ecosystems are attracting capital flows, helping them formulate appropriate investment allocation strategies.

-

Left Chart: The percentage of TVL share held by each ecosystem in the market. For example, in the chart, Ethereum holds the highest share (54.31%).

-

Right Chart: The growth of TVL across the entire DeFi market and its correlation with ecosystem growth.

-

Bottom Table: A specific breakdown of TVL statistics for each ecosystem, arranged in descending order.

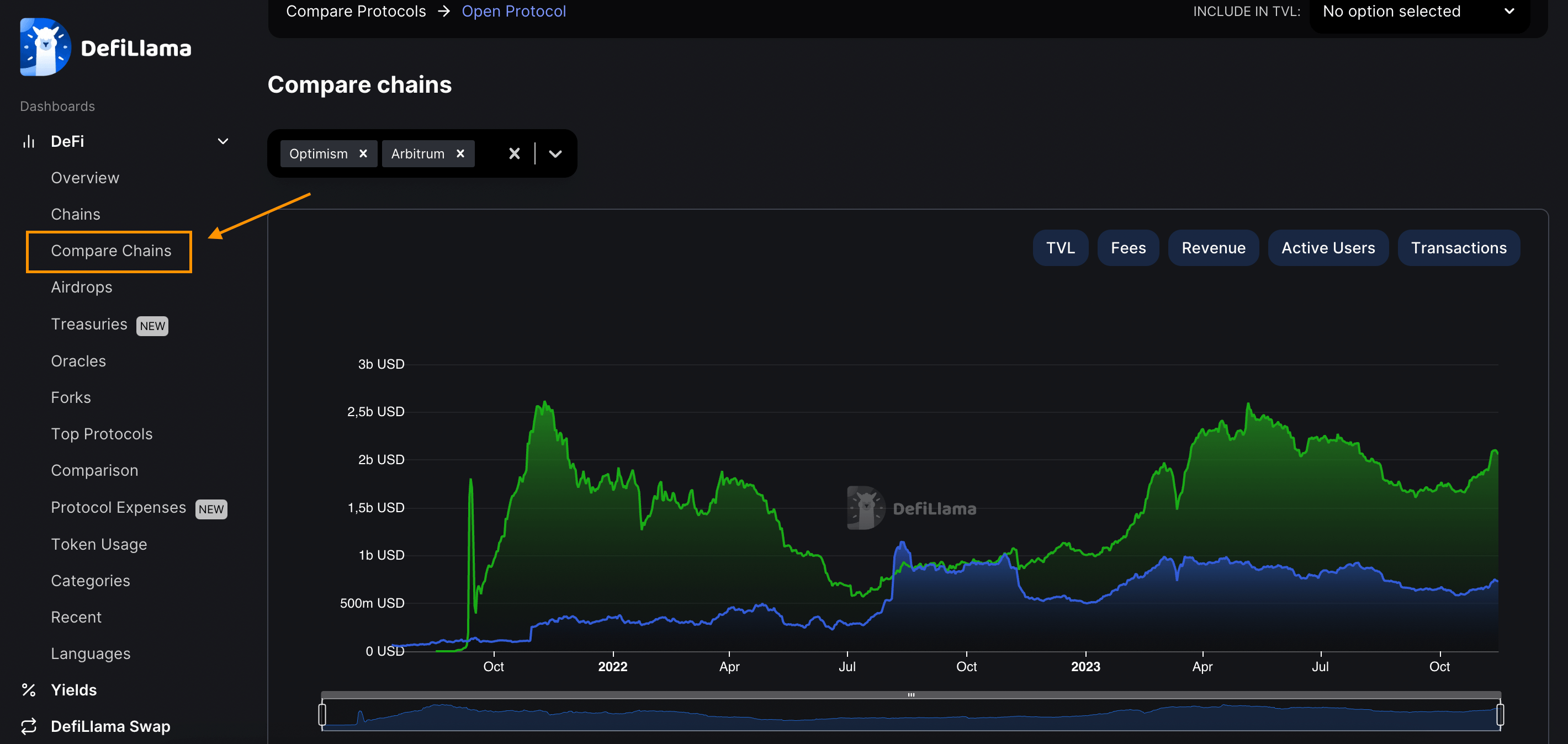

3.1.3. Compare Chains

This feature allows users to compare two or more blockchain ecosystems with each other based on metrics including:

- TVL: Total Value Locked - The total value of assets locked within a network or protocol.

- Fees: Transaction fees on the network.

- Revenue: Income generated on the network.

- Active Users: Number of regular users.

- Transactions: Number of transactions conducted on the network.

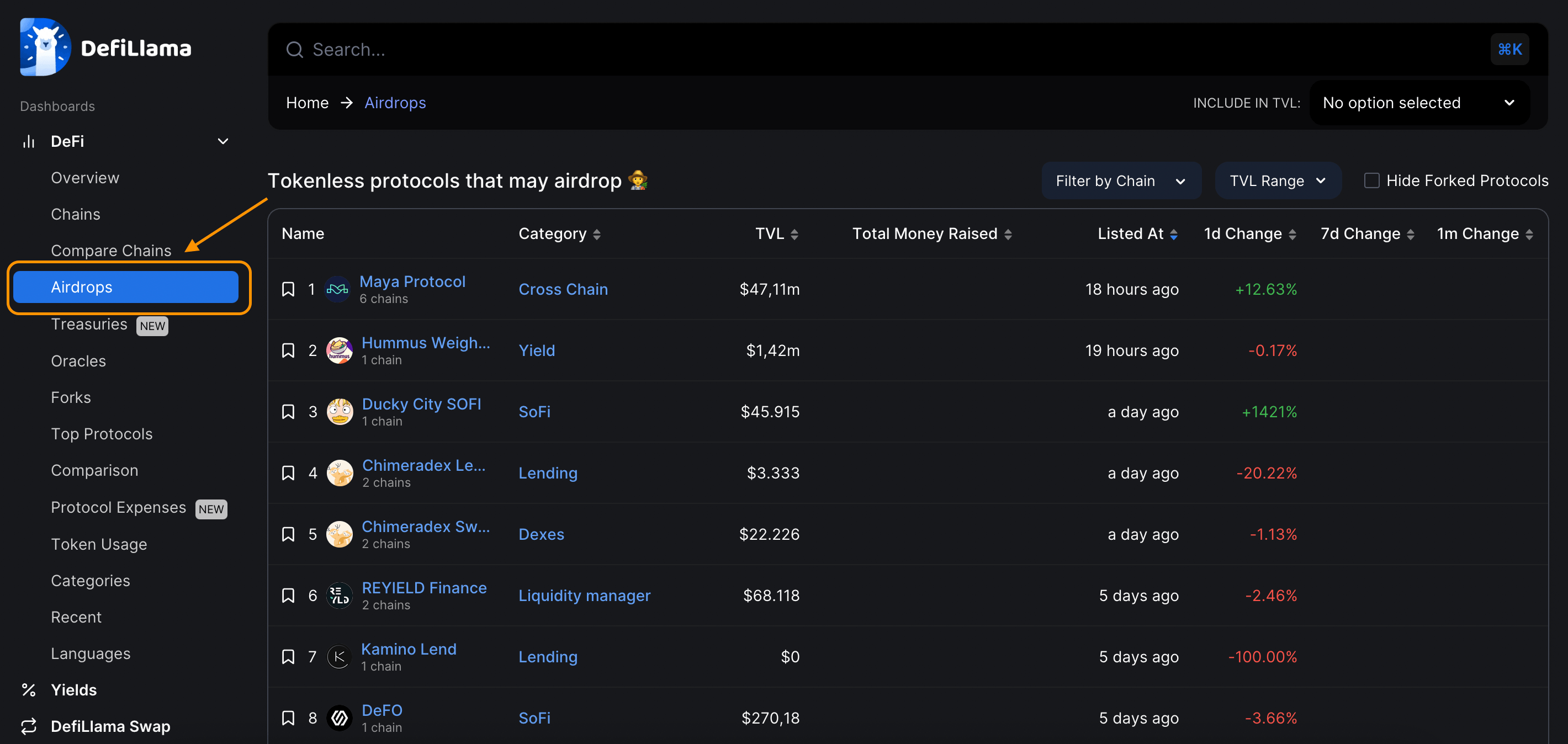

3.1.4. Airdrops

DefiLlama compiles information on pre-launch projects with potential for participating in airdrops, making it a valuable reference channel for users. It's important to note that participating in airdrops can be time-consuming and effort-intensive, with no guarantee of receiving tokens from the project. Therefore, researching and carefully selecting projects to participate in for airdrops is crucial.

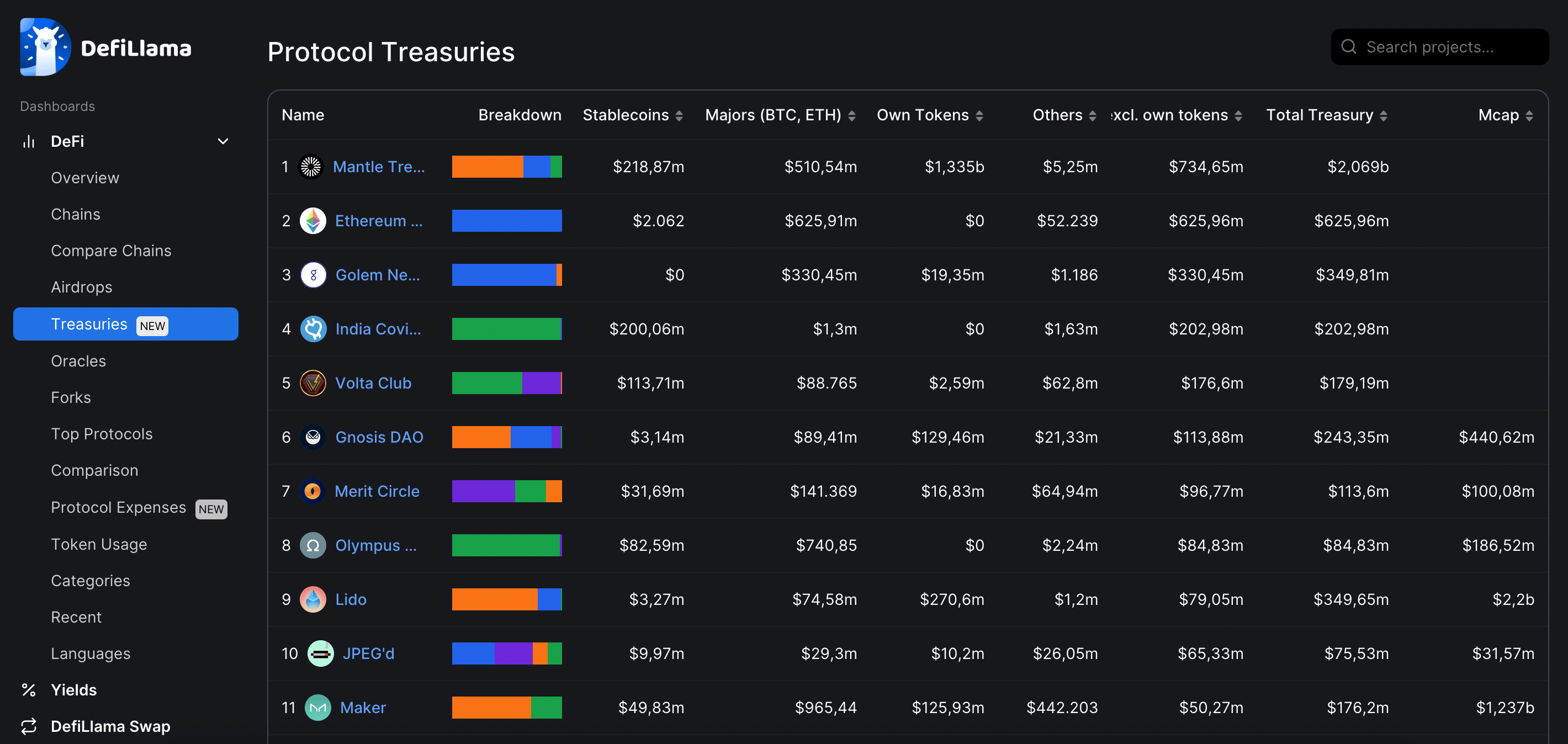

3.1.5. Treasuries

"Treasuries" is a new feature released by DefiLlama that helps users understand information related to assets within DeFi protocols.

The statistics compiled within Treasuries include:

- Stablecoins: Number of stablecoins in the Treasury

- Majors: Number of BTC and ETH in the Treasury

- Own Tokens: Number of protocol governance tokens in the Treasury

- Others: Other altcoins in the Treasury

- Total excl. own tokens: Total assets excluding Own Tokens

- Total Treasury: Total assets in the Treasury

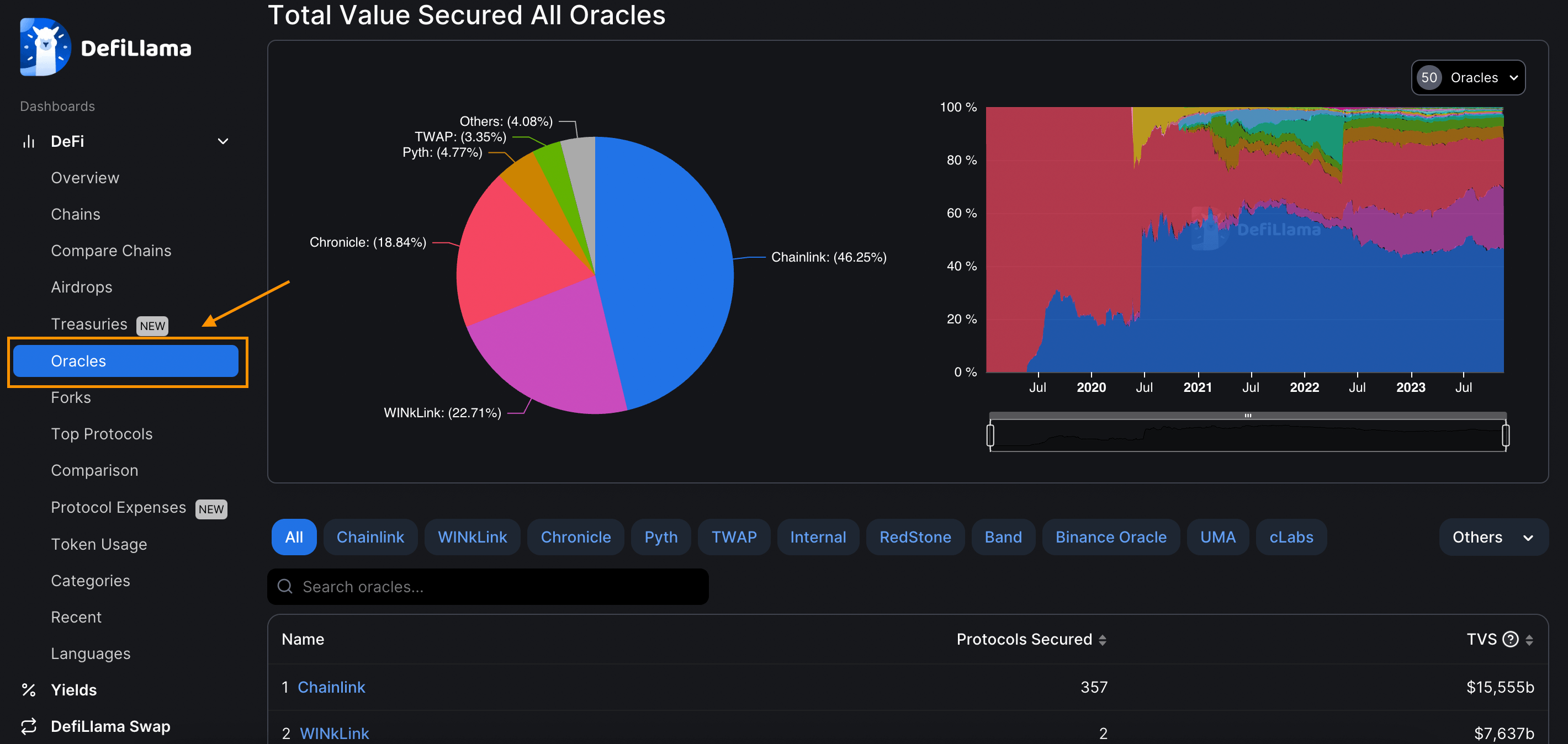

3.1.6. Oracles

Oracles are an indispensable component of the DeFi ecosystem. DefiLlama aggregates TVL data for all projects involved in the Oracle sector.

3.1.7. Forks

Forks represent improved versions of original software and are often reused for development purposes. Therefore, copying existing applications to create Forks has become popular among developer communities. In many cases, these Forks can achieve higher TVL compared to the original applications.

DefiLlama compiles the types of assets present in protocols forked from original projects like Uniswap v2, Compound, AAVE, and others.

3.1.8. Top Protocols

DefiLlama ranks the top protocols in the DeFi market corresponding to each ecosystem.

For example, you can check the top protocols on the Ethereum network in specific categories such as:

- Liquid Staking: Lido Finance

- CDP: MakerDAO

- Lending: AAVE V3

- RWA: Maker RWA

- Dexes: Uniswap V3

- Yield: Convex Finance

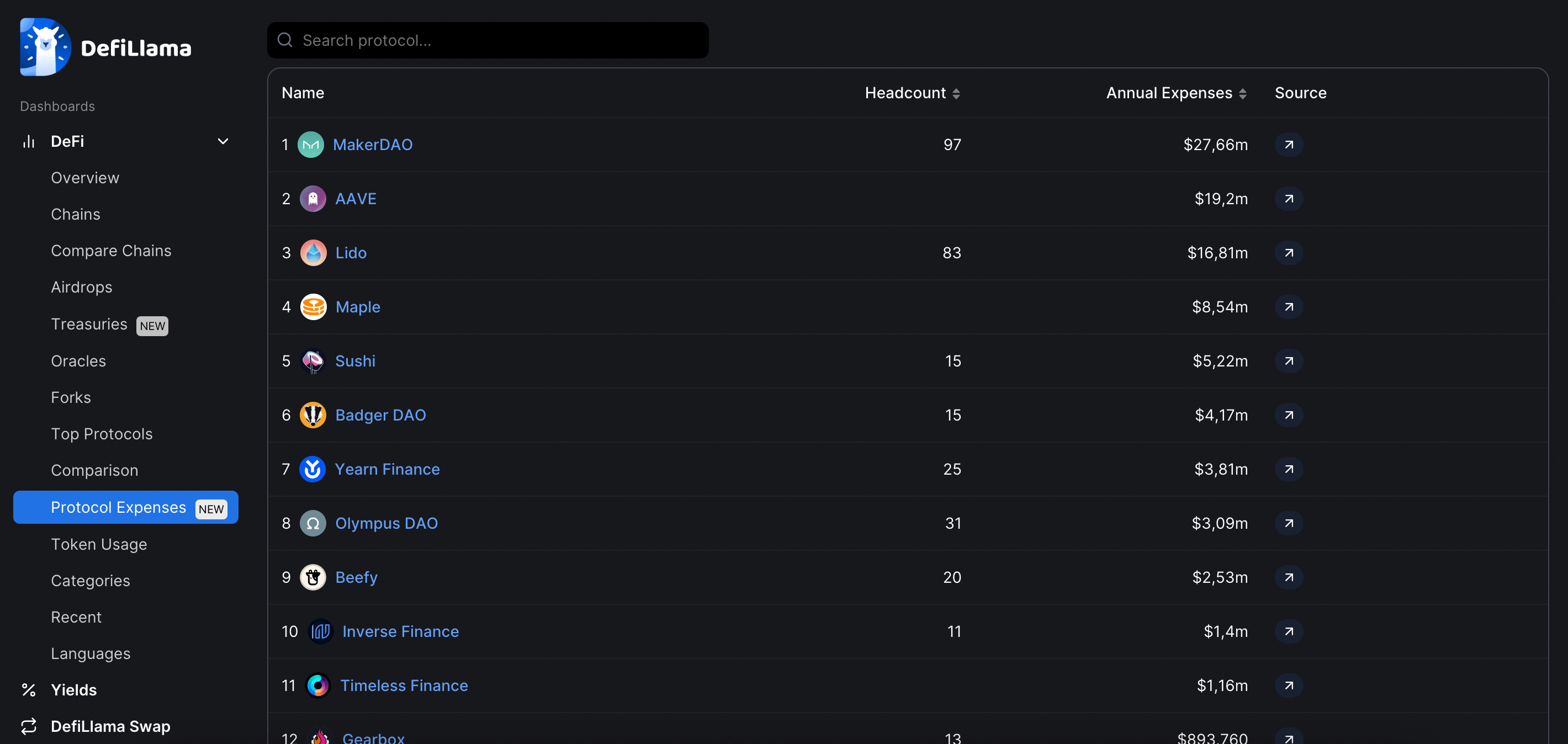

3.1.9. Protocol Expenses

This is a feature provided by DefiLlama that helps users track the operating costs of a DeFi protocol annually.

3.1.10. Token Usage

This feature helps users track the quantity and value of tokens used within DeFi protocols.

Additionally, DefiLlama also aggregates information based on filters such as Categories, Recent, and Languages.

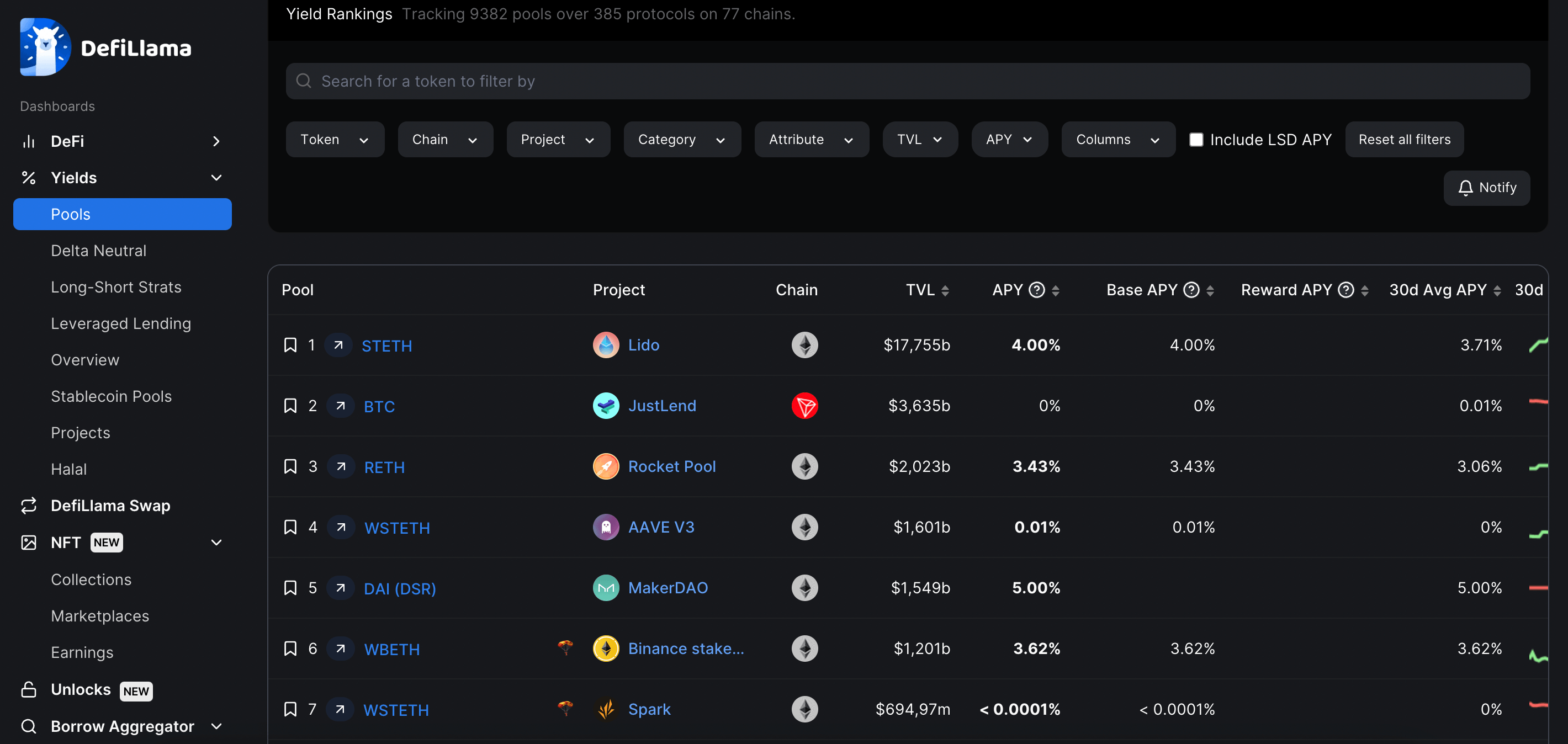

3.2. Look up data on Yields

Yield farming is an investment strategy in the decentralized finance (DeFi) world, where users provide their assets to platforms to earn profits.

Participants in yield farming typically receive rewards or profits in the form of tokens from liquidity provisioning activities and transactions. This is a way to capitalize on high-profit opportunities while contributing to the development of the DeFi ecosystem.

Filters provided in Yields by DefiLlama include:

-

Pools: Statistics on smart contracts where users deposit assets the most.

-

Leveraged Lending: Platforms in the lending space that utilize leverage.

-

Overview: Summary of APY (Annual Percentage Yield) across protocols in the DeFi market.

-

Stablecoin Pools: Ranking of major stablecoins in the market.

-

Projects: Ranking table of Yield Farming projects from highest to lowest.

-

Halal: Statistics on the amount of real assets in derivative products.

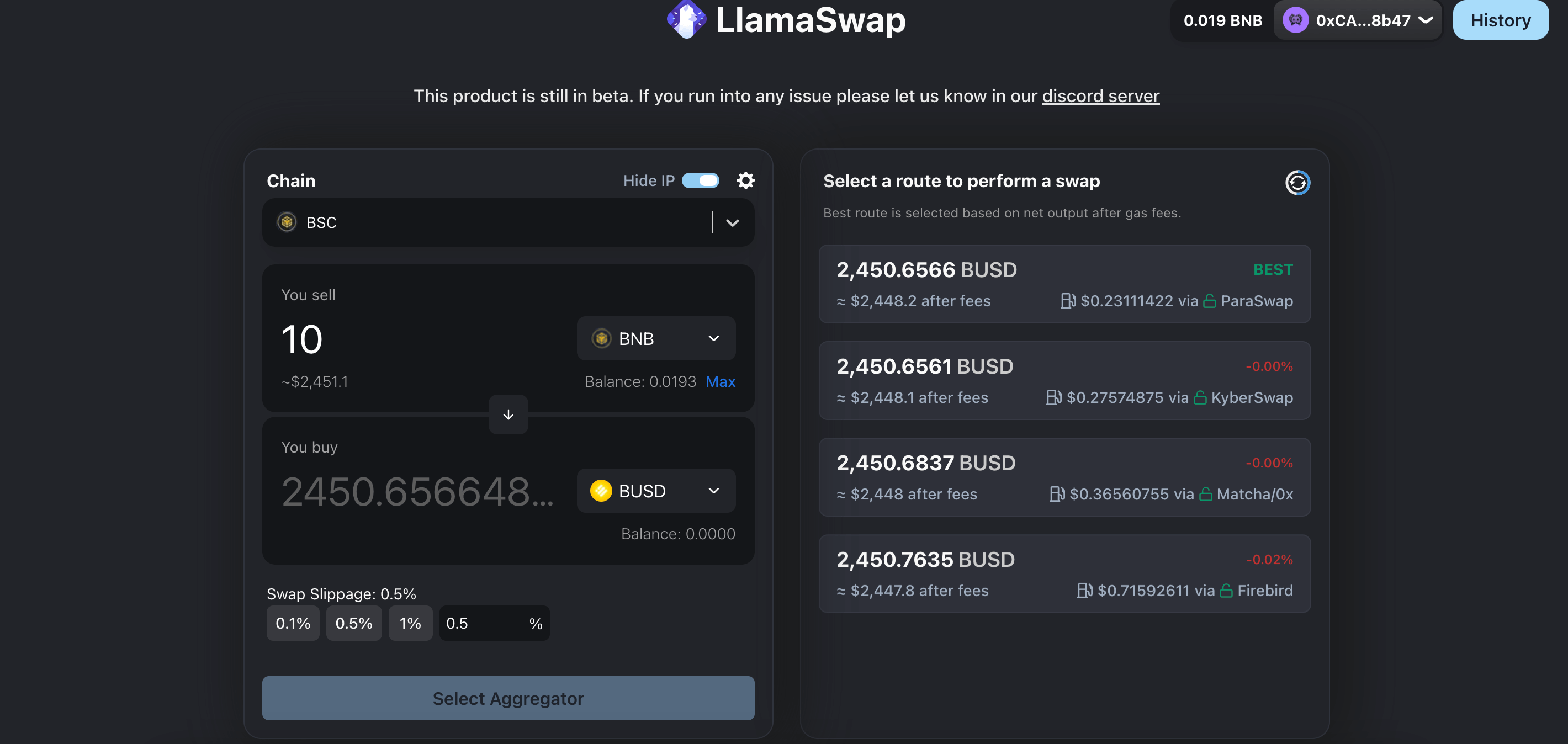

3.3. DefiLlama Swap

DefiLlama Swap is a liquidity aggregator for decentralized exchanges, supporting users in converting assets across blockchain networks such as Ethereum, BSC, Polygon, Arbitrum, etc., with zero fees.

This product is currently in the testing phase (Beta).

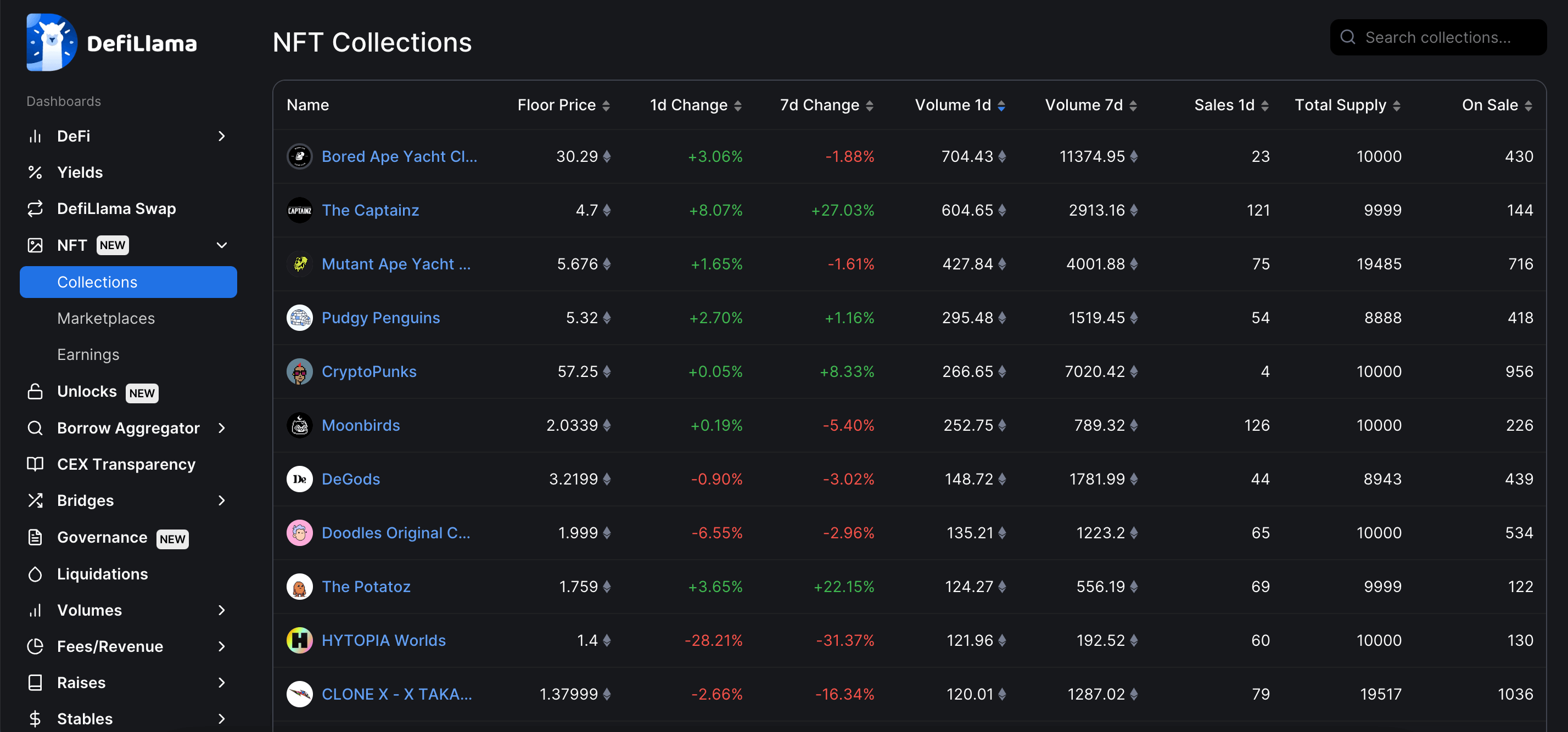

3.4. NFT

Similarly to DeFi, DefiLlama also aggregates data related to the NFT market into categories such as NFT collections and NFT marketplaces. Here's a detailed guide on how you can track NFT-related metrics on DefiLlama:

3.4.1. Collections

Here is a table summarizing information about NFT collections in the market based on various metrics:

- Floor Price: The lowest price of NFTs available for sale.

- 1d Change: Price change percentage of NFTs in the last 1 day.

- 7d Change: Price change percentage of NFTs in the last 7 days.

- Volume 1d: Trading volume of NFTs in USD or native token in the last 1 day.

- Volume 7d: Trading volume of NFTs in USD or native token in the last 7 days.

- Sale 1d: Number of NFTs sold in the last 1 day.

- Total Supply: Total number of NFTs in the entire collection.

- On Sale: Number of NFTs currently listed for sale on the market.

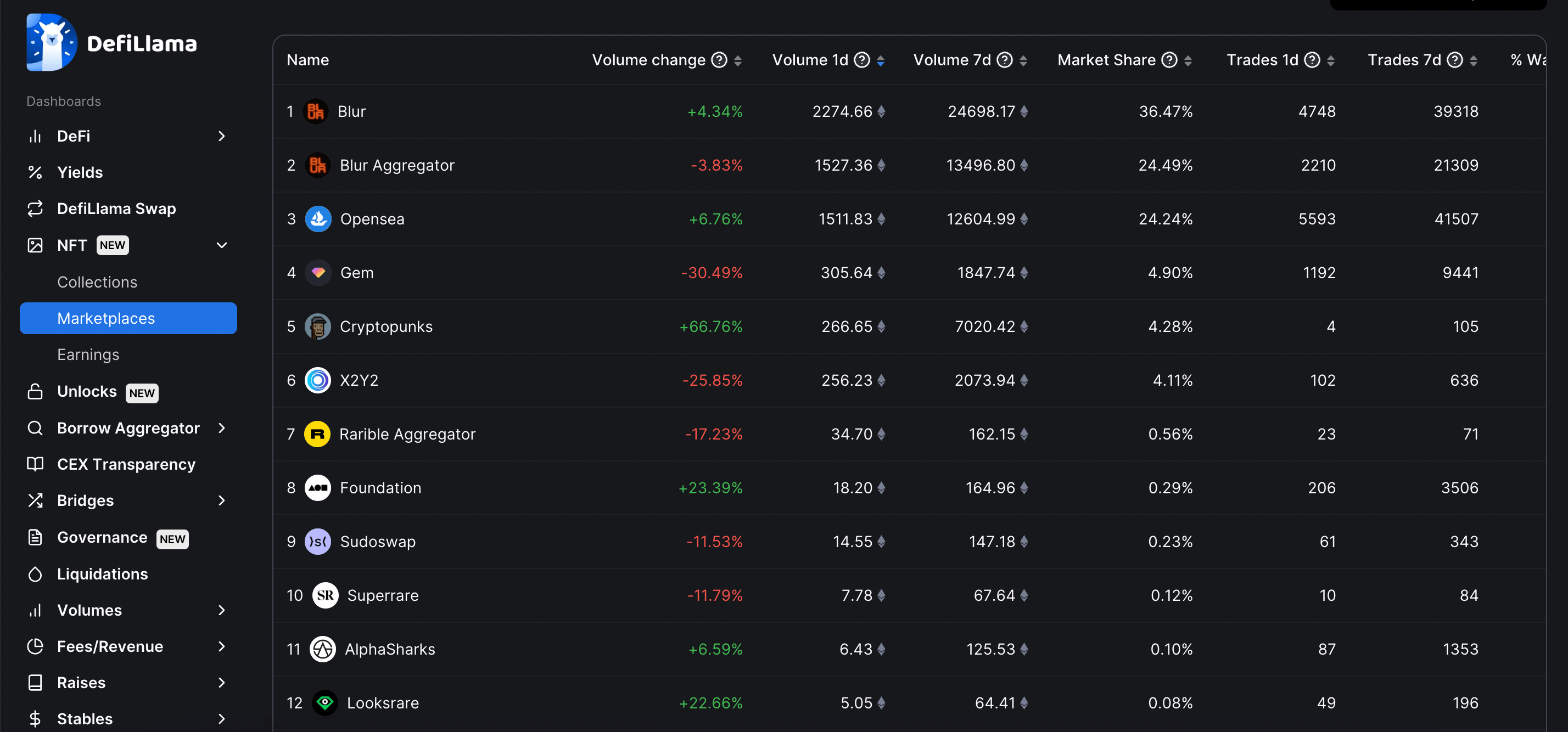

3.4.2. Marketplace

DefiLlama aggregates and ranks NFT marketplaces across various blockchain networks, sorting them from highest to lowest based on market share.

For example, in the image below, Blur holds the top position with over 60% market share, followed by Opensa with more than 24% market share in the NFT trading marketplace.

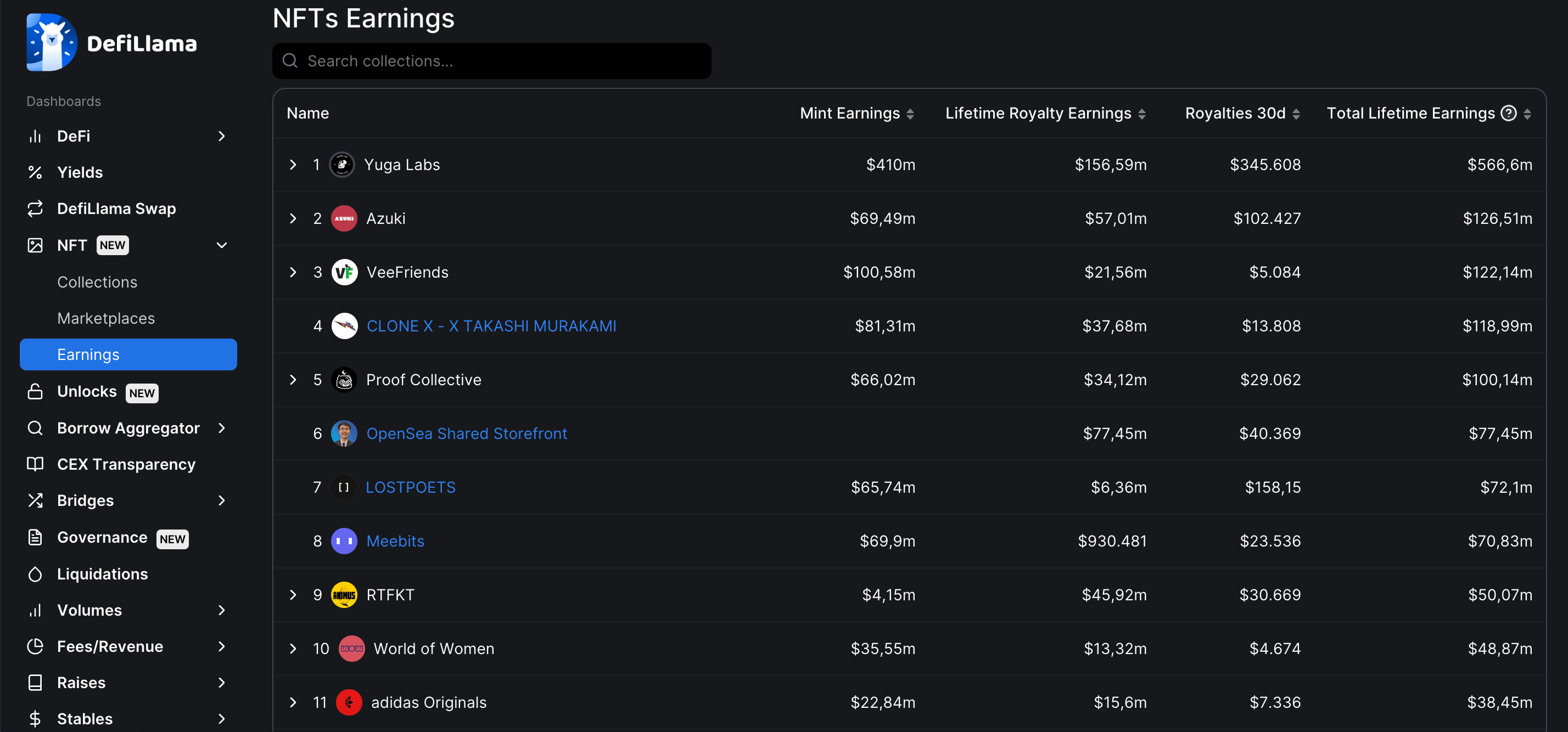

3.4.3. Earnings

Here are the categories for aggregating the total amount received by each project or NFT issuer:

- Mint Earnings: Money earned from minting (creating) NFTs.

- Lifetime Royalty Earnings: Fees paid by users for the use of NFTs over their lifetime.

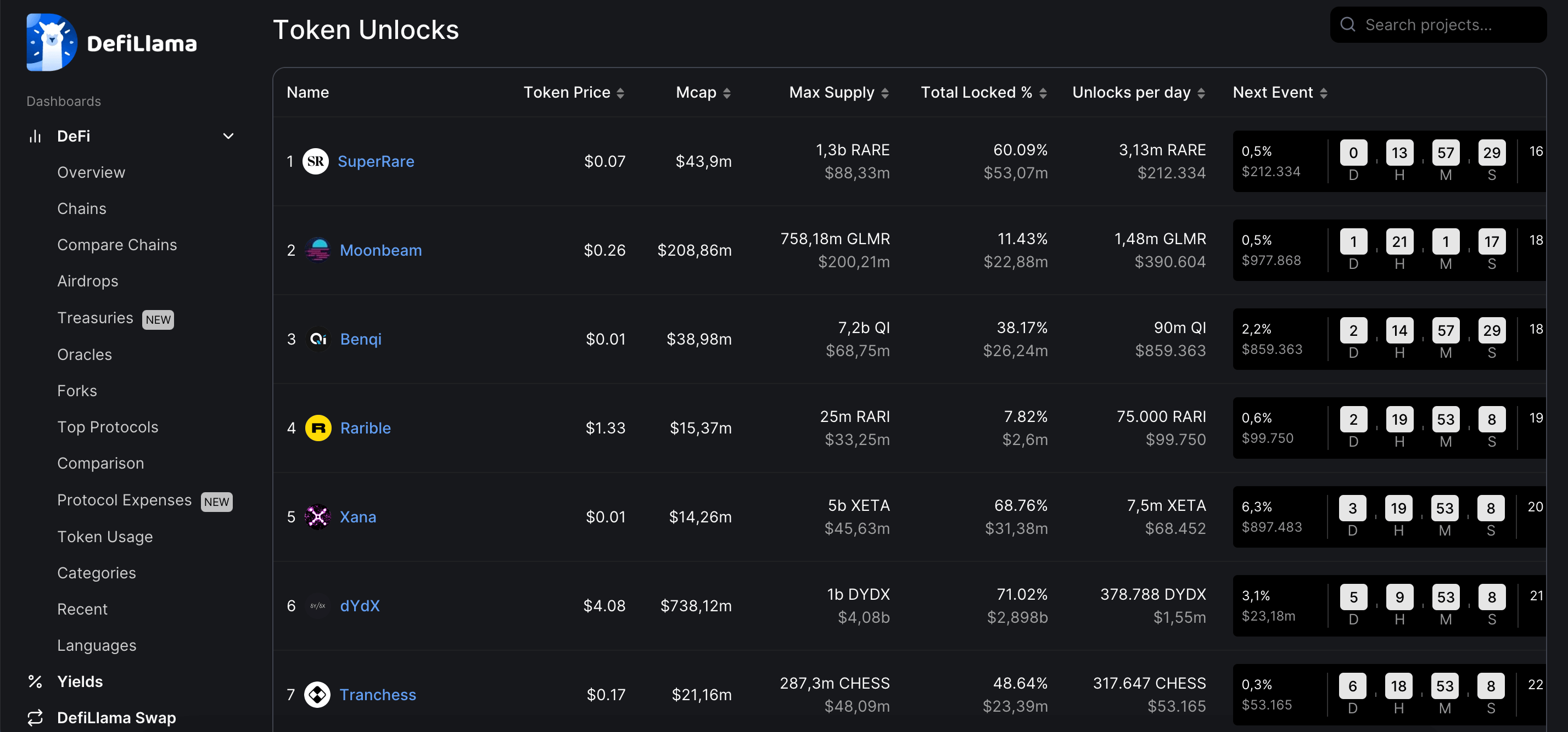

3.5. Look up data about the Token Unlock schedule

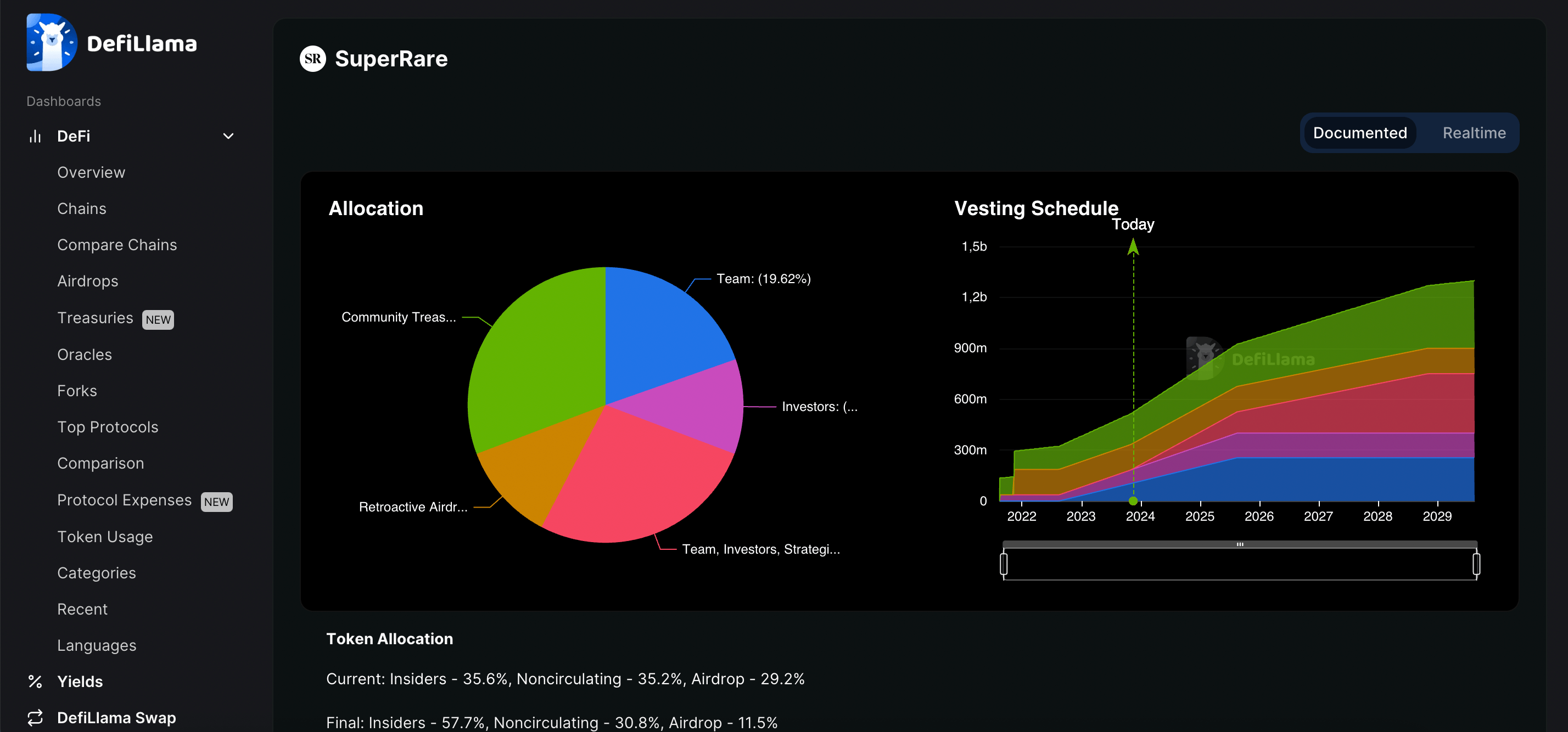

The "Unlock token" is the activity of unlocking and distributing tokens of a project into circulation. DefiLlama tracks the schedule of token unlocks for various projects down to the second, enabling users to easily monitor the timeline of token unlocking events for each project. This feature helps users stay informed about when tokens become available for trading or other uses after being unlocked according to the project's schedule.

When you click into each project detail, you will find specific information about token allocation and vesting schedules. This includes details about how tokens are distributed and the timeline for vesting, which outlines how tokens are released over time according to the project's schedule.

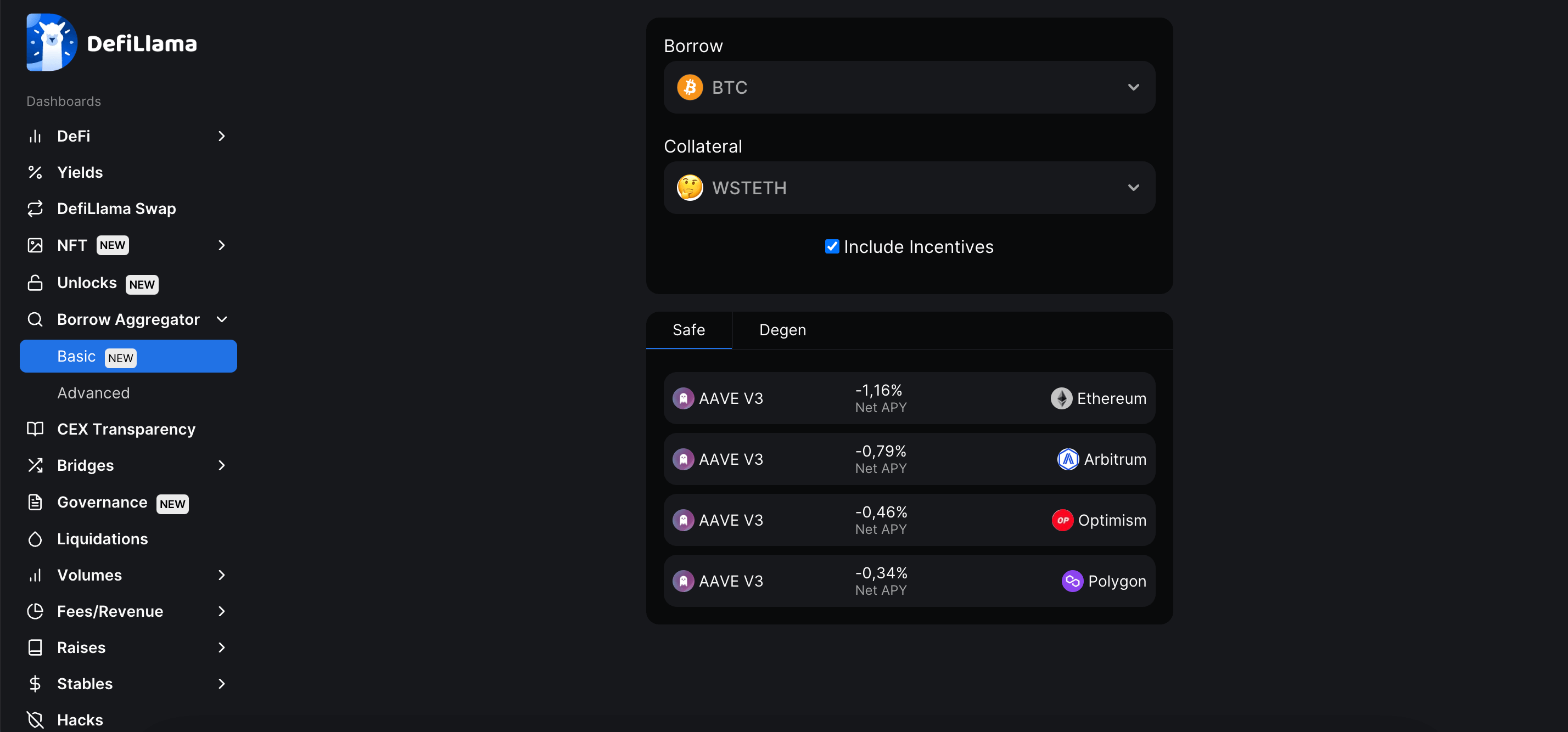

3.6. Look up data about Borrow Aggregator

A Borrow Aggregator is a tool that aggregates borrowing activities, allowing you to select the cryptocurrency you want to collateralize (CDP) and the cryptocurrency you want to borrow. DefiLlama aggregates lending protocols and provides users with suggestions for optimizing profit on borrowing and lending platforms.

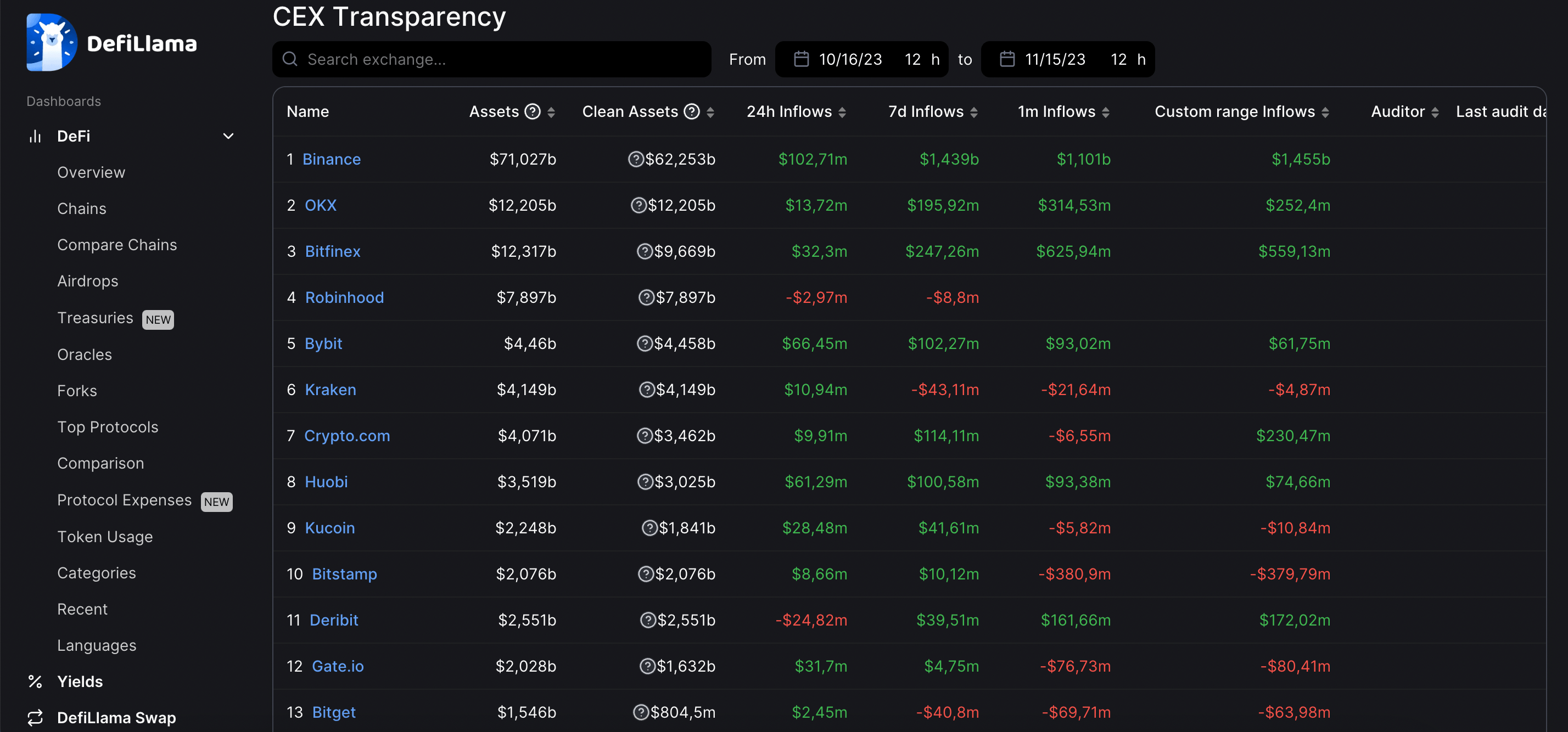

3.7. Look up data about CEX Transparency

This is a feature for tracking and monitoring the transparency of centralized exchanges such as Binance, OKX, Bybit, etc. DefiLlama consolidates data related to the assets held by these exchanges and the flow of funds in and out over a specific period of time.

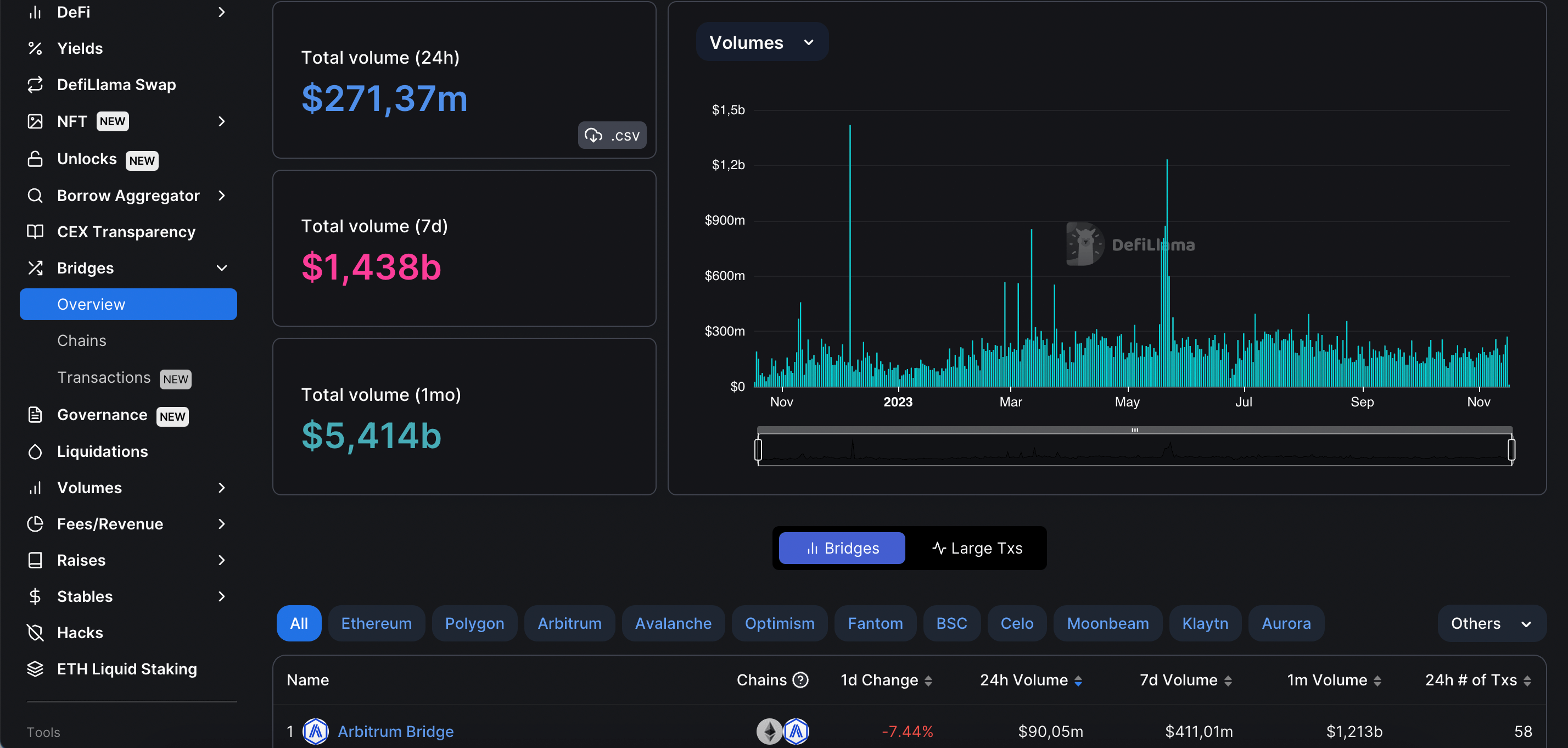

3.8. Look up data about Bridge

Bridges are connectors that facilitate asset transfers between different blockchain networks. DefiLlama provides comprehensive market statistics for bridges based on three criteria: market overview, network, and transaction volume.

- Overview

Statistics of trading volumes across all bridges and ranking of bridges in descending order based on trading volume.

- Chain

Statistics of assets transferred between blockchains via bridges.

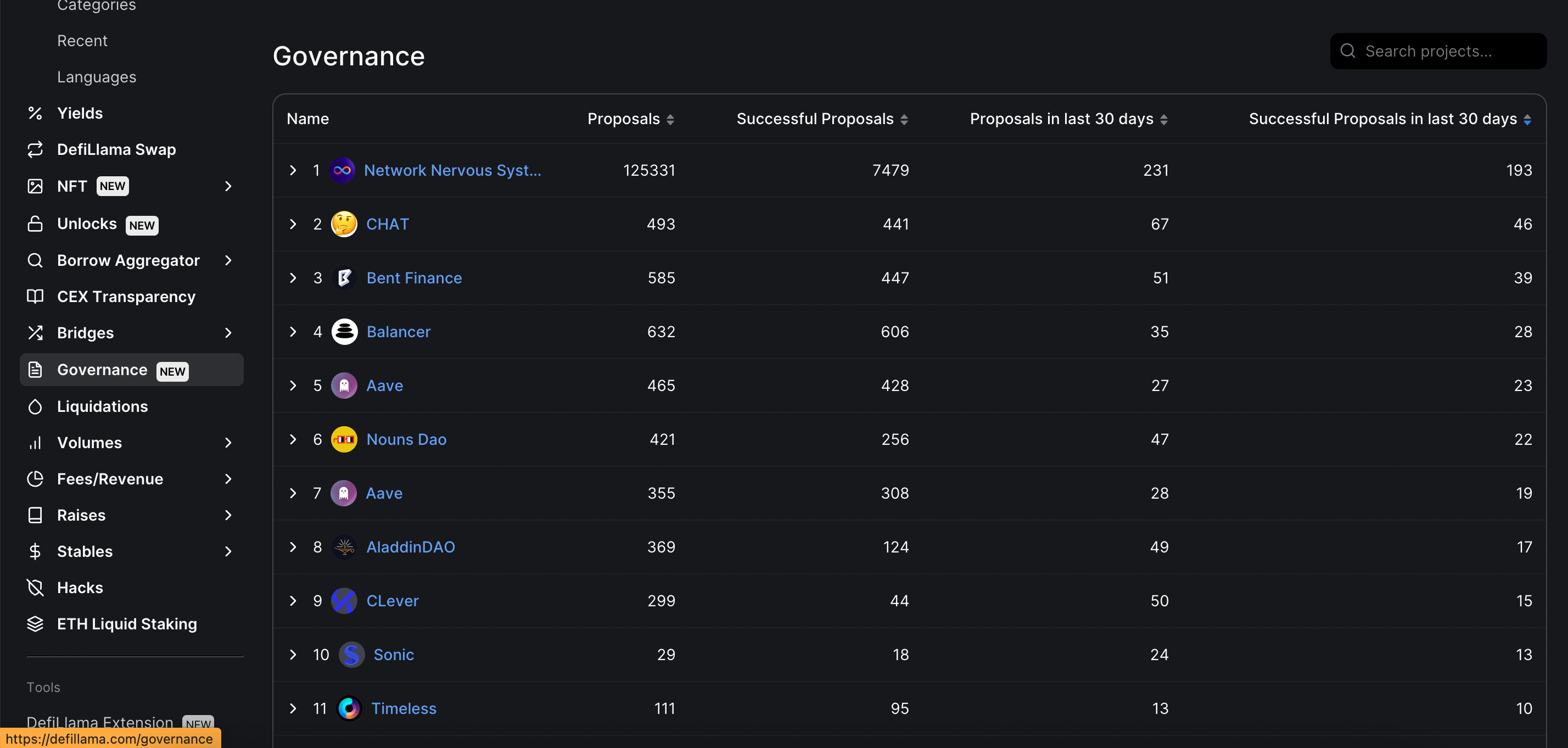

3.9. Look up data about Governance

This is a feature developed by DefiLlama to track activities occurring on decentralized autonomous organizations (DAOs), with metrics such as:

- Proposals: the number of proposals related to governance activities on the network.

- Successful Proposals: the number of proposals successfully implemented.

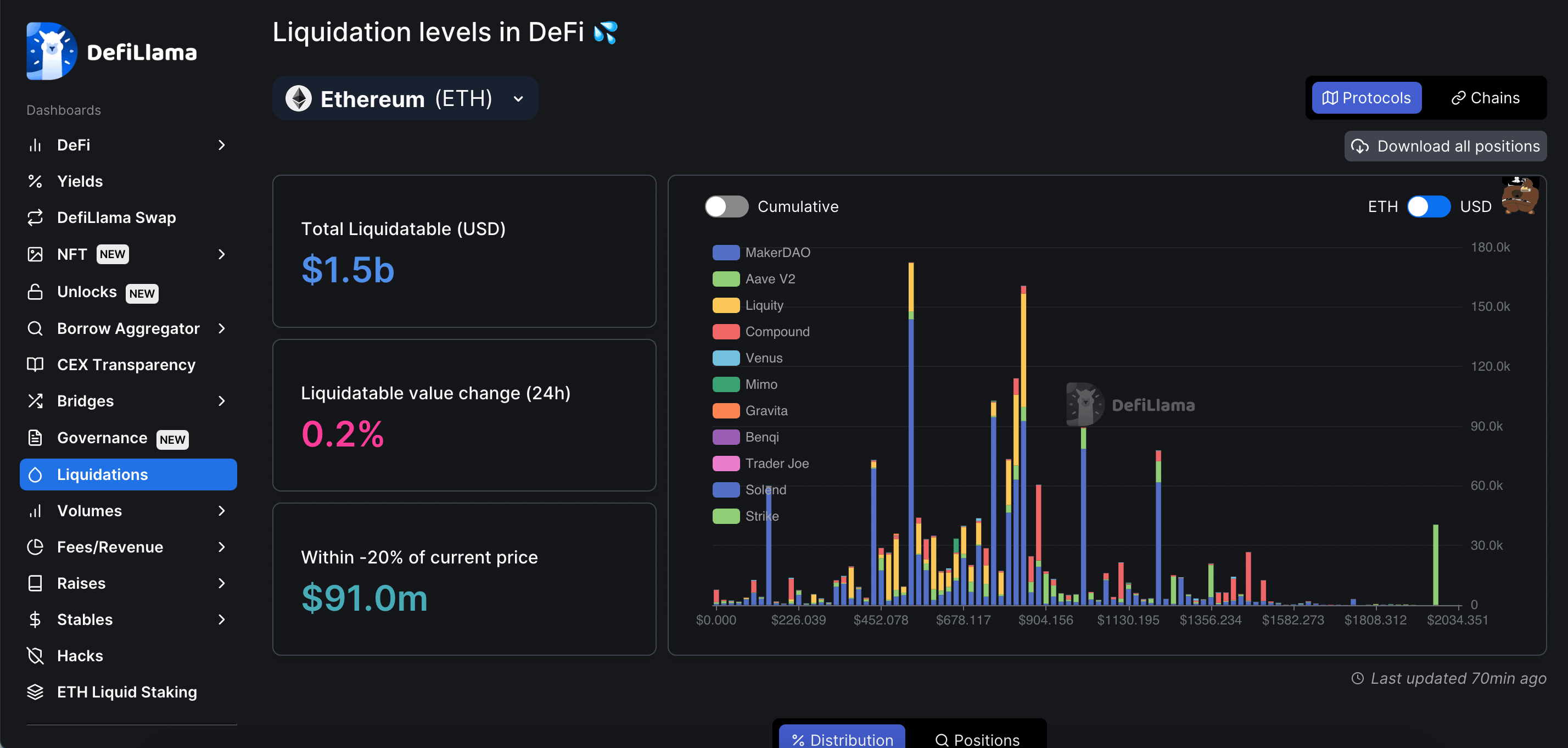

3.10. Look up data about Liquidations

Liquidations are the number of assets that are forcibly sold or "liquidated" on lending and borrowing platforms within the DeFi market.

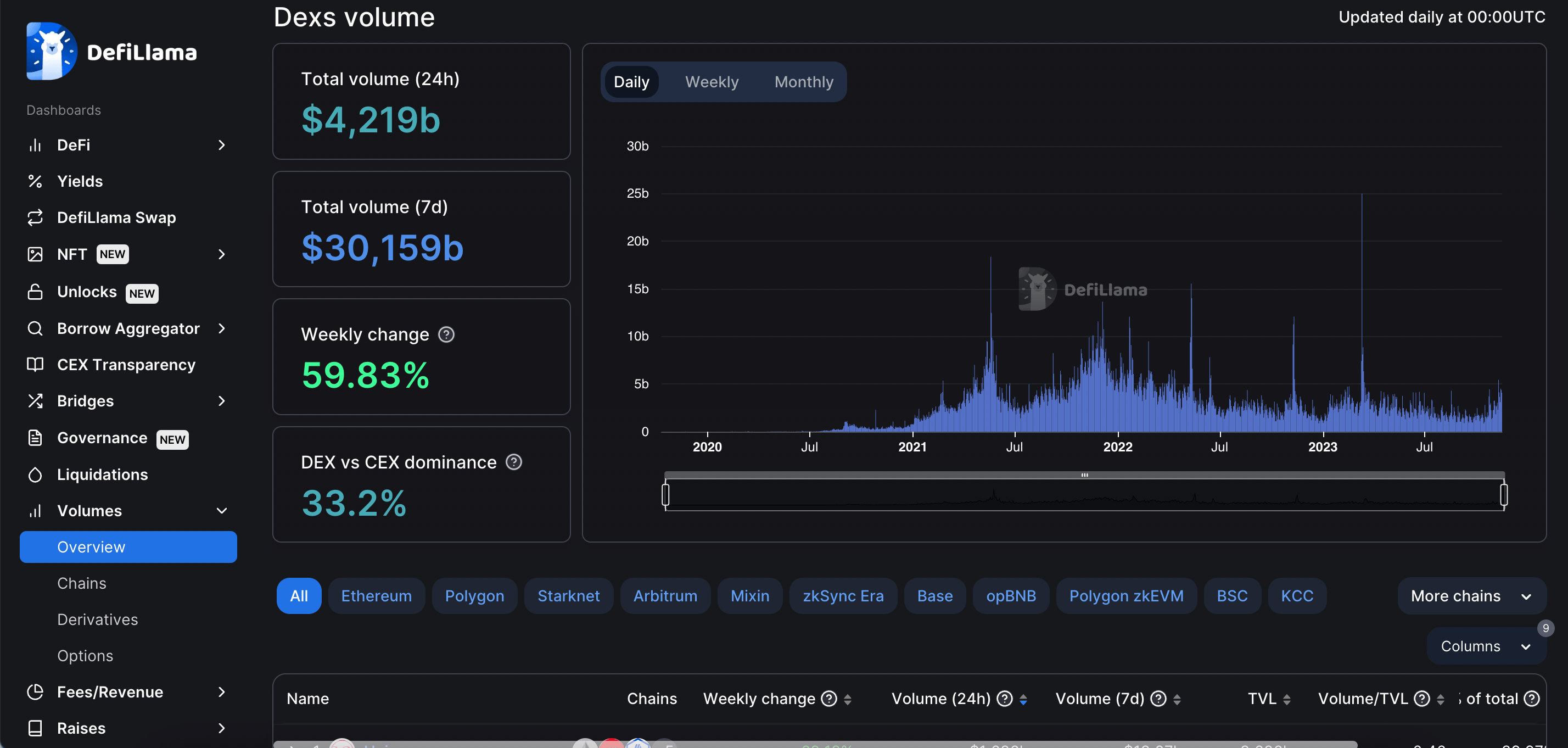

3.11. Look up data about Volumes

Volumes refer to the trading activity across the entire blockchain network among various types of platforms such as DEXs, CEXs, Lending & Borrowing, Yield Farming, etc.

On DefiLlama, the relevant statistics related to trading volumes are summarized as follows:

- Overview

Overview of trading volumes on DEX platforms and ranking the exchanges in descending order based on trading volume.

- Chains

Statistics of trading volumes across DEXs (Decentralized Exchanges) within the entire blockchain network.

- Derivatives

Statistics on trading volumes across Derivatives protocols and aggregated detailed information for each protocol, sorted in descending order based on trading volume.

- Options

Statistics of trading volumes for Options protocols and comprehensive details for each protocol, arranged in descending order based on trading volume.

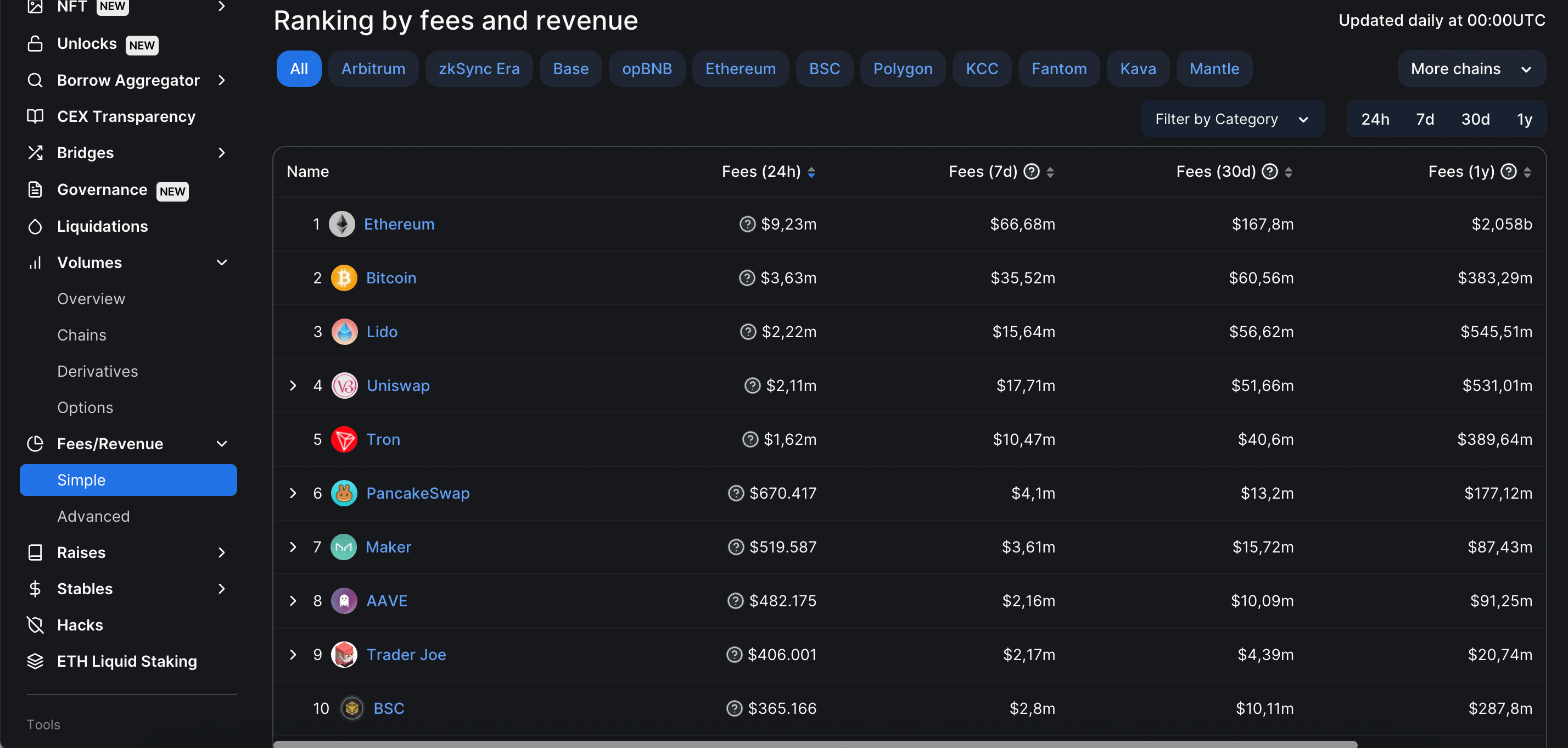

3.12. Look up data about Fee and Revenue

DefiLlama compiles data on revenue and fees of DeFi protocols and blockchain networks. These fees represent the costs users incur when utilizing services on DeFi protocols and networks.

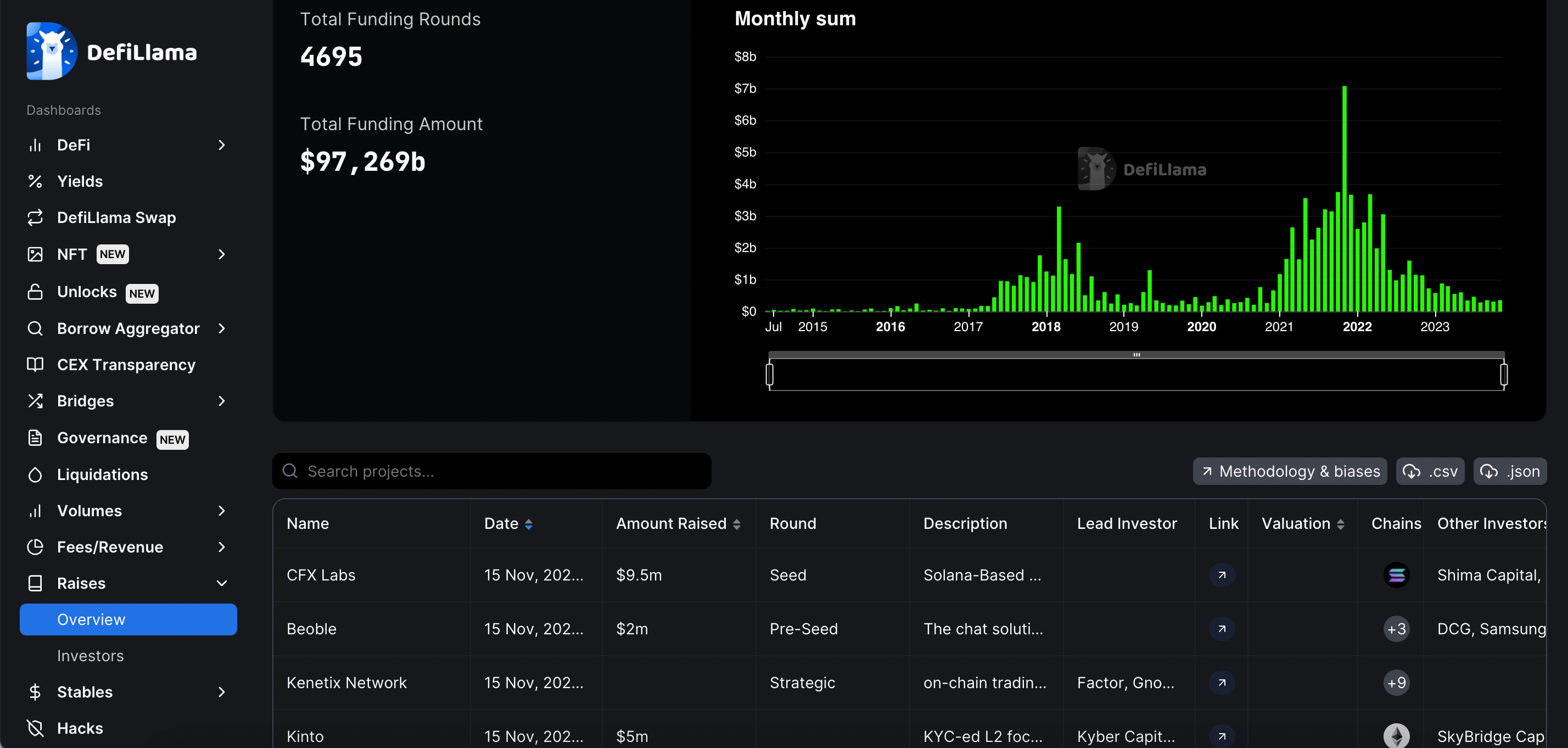

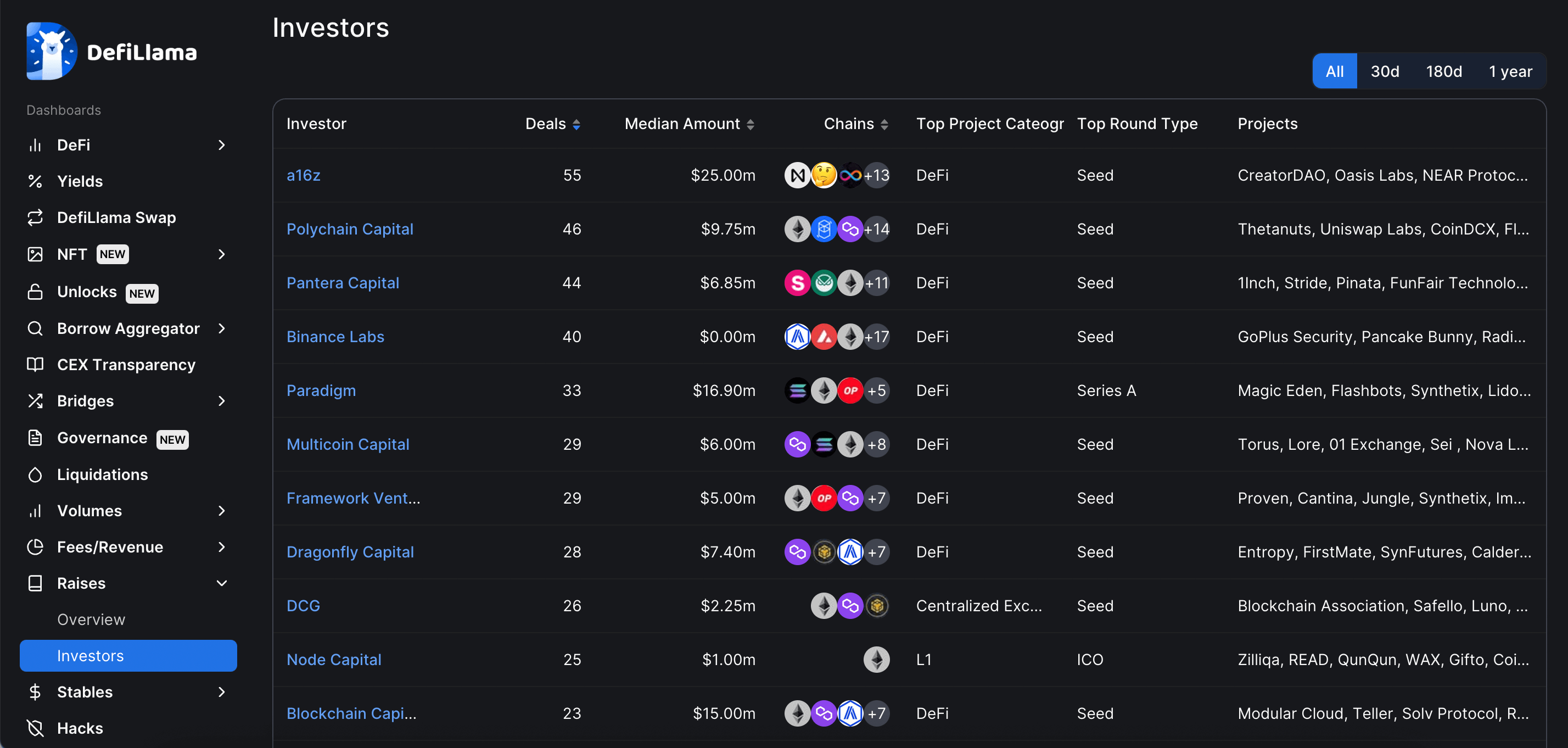

3.13. Statistics on raised Capital in the DeFi Market

You can track fundraising rounds happening in the market and the amount of money projects have raised from investors.

In the "Investor" section, you can check statistics about existing investment funds in the crypto market, the number of investment projects, average investment capital, ecosystems, and preferred portfolios of the funds. This allows individuals to reference for their own investment portfolios.

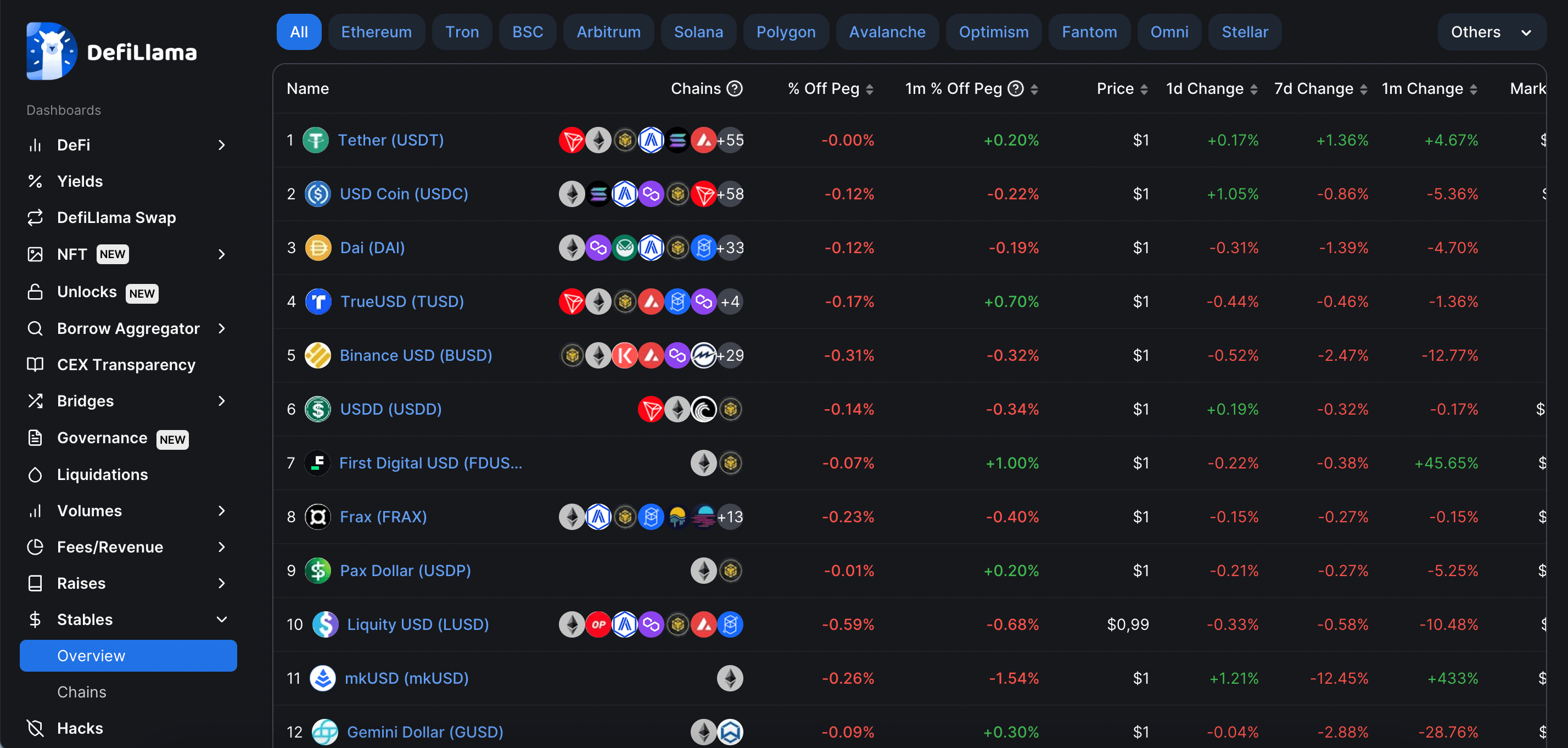

3.14. Look up data about Stables

DefiLlama provides information on the overall Stablecoin market, a crucial niche within DeFi. Stablecoins serve as primary means of payment for services within DeFi. Here, users can track data related to:

-

Total Stablecoins Market Cap: Total market capitalization of stablecoins.

-

Change (7d): Change over the past 7 days.

-

USDT Dominance: Dominance index of USDT.

-

![Thống kê thị trường stablecoin trên DefiLlama]()

Stablecoin market statistics on DefiLlama

Additionally, scrolling down the page, you will find a ranking table of current stablecoins in the market, sorted from top to bottom based on market capitalization (market cap).

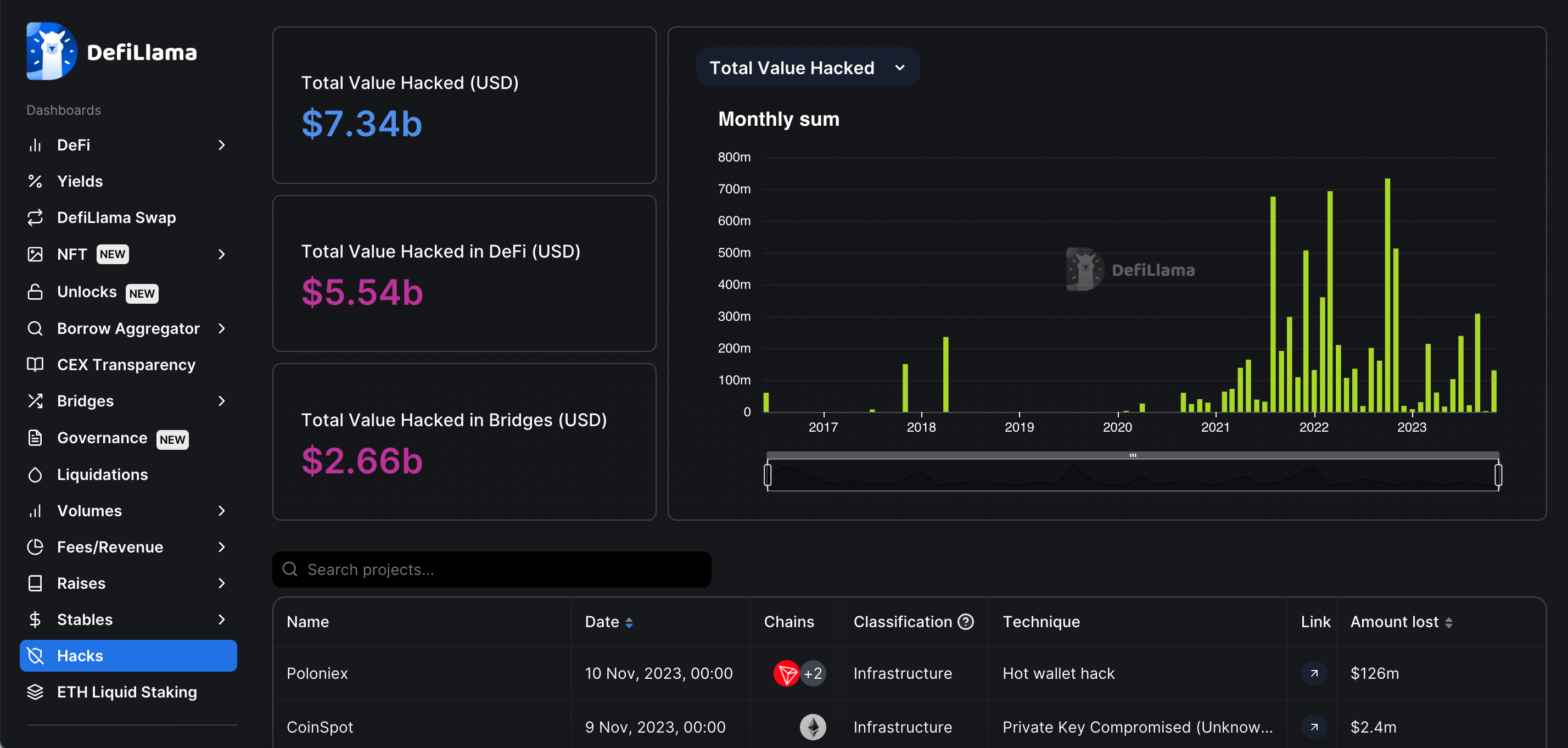

3.15. Look up information about DeFi hacks

DeFi is often a hub for hacks stemming from different causes, with some incidents involving sums as high as hundreds of millions of USD. You can look up information about these hacks on DefiLlama.

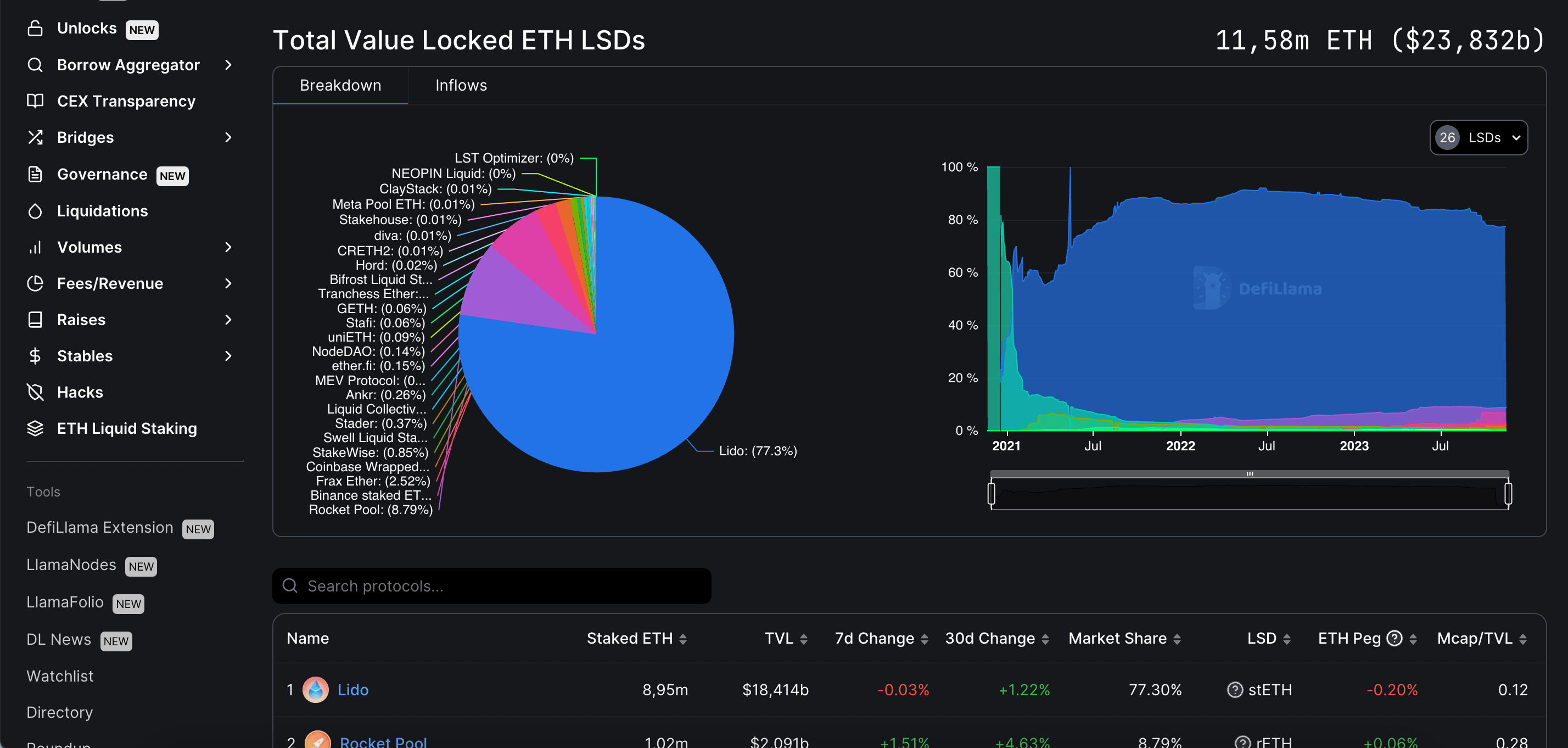

3.16. ETH Liquid Staking

Liquid Staking (or staked tokens) is a method that allows users to participate in blockchain staking projects without needing to hold tokens for a fixed period that cannot be used during that time.

Instead, users can exchange their tokens for a "wrapped token" version (e.g., staked ETH or staked SOL) and continue using these tokens to participate in other activities within the DeFi ecosystem.

On DefiLlama, users can monitor the following metrics related to Liquid Staking:

- Total amount of ETH locked in LSD protocols

- A list of LSD protocols in the market is compiled based on the amount of ETH locked, TVL, market share, type of LST token, ..

4. Conclusion

It's clear that DefiLlama is one of the leading and most comprehensive data aggregation platforms in the DeFi market. The project continuously upgrades its tools with the goal of becoming the largest aggregator of Total Value Locked (TVL) data in DeFi. This detailed guide aims to provide readers with a comprehensive understanding of the metrics and how to track data on DefiLlama, hoping it will be useful for users.

Read more:

English

English Tiếng Việt

Tiếng Việt