1. Learn about crypto exchanges

If you're new to investing in crypto, you might be wondering, "Where should I buy and sell cryptocurrencies? Can I easily withdraw my funds to ensure their safety?" You should know that trading crypto is similar to trading stocks; all activities take place through cryptocurrency exchanges.

These exchanges store and manage your assets. Therefore, the first step when you want to invest in crypto is to know which exchanges are available and which ones are reputable.

Let's get started right away.

1.1. What is a crypto exchange?

A cryptocurrency exchange is where buying and selling of various cryptocurrencies (often referred to as digital currencies) take place. Currently, there are over 800 exchanges of various sizes in the market.

These exchanges can be centralized, meaning they are controlled by intermediary organizations (similar to banks), or decentralized, where they operate without centralized control. Each cryptocurrency exchange has its own mechanisms and regulations governing how you can buy and sell cryptocurrencies.

As a newcomer to the market, you'll typically start by trading on 1 or 2 exchanges (it's not necessary to use too many exchanges). Therefore, choosing a reputable exchange where you can safely deposit funds and trade with confidence is crucial.

1.2. The role of crypto exchanges

As mentioned, cryptocurrency exchanges serve as the marketplace for buying and selling digital currencies, akin to a "shopping center" in the crypto market.

Whether you want to buy or sell any coin, you need to go through a cryptocurrency exchange. While it's possible to engage in direct peer-to-peer transactions (also known as OTC trading), the risk of fraud or financial loss is higher when dealing with untrusted parties.

On a cryptocurrency exchange, investment opportunities are available for everyone. Whether you are a large investor with substantial capital or a newcomer with limited funds, there are cryptocurrencies suitable for every individual's needs and strategies. You can invest in high market cap cryptocurrencies like Bitcoin or Ethereum, as well as those with lower market caps. Each person's income potential varies depending on their investment approach and the profit potential of the cryptocurrency they choose, but fundamentally, the exchange is where investment opportunities are presented to you.

1.3. Types of crypto exchanges

Currently, there are two common types of cryptocurrency exchanges that investors can consider.

CEX (Centralized Exchange):

A centralized exchange, often referred to as CEX, is managed and operated by a specific organization or company. To use this type of exchange, you deposit funds into it, and the entire management of your assets is handled by the exchange.

This model operates similarly to a bank. You entrust your assets to a third party (the centralized exchange) for protection and storage. The exchange monitors and executes transactions and stores your assets securely.

Examples of centralized exchanges include Binance, Huobi, OKX, Coinbase, and others.

For newcomers entering the crypto market, centralized exchanges are suitable because they are user-friendly and offer 24/7 support in case of any issues.

DEX (Decentralized Exchange):

A decentralized exchange, often known as DEX, operates without the need for an intermediary organization/company to store and manage customer assets. Instead, users trade directly through an automated process (peer-to-peer network) based on blockchain technology.

Therefore, when trading on a decentralized exchange, you manage your assets and all your trading activities independently. This mechanism enhances security because it mitigates the risk of hacks or the exchange going bankrupt and ceasing operations.

Examples of decentralized exchanges include Pancakeswap, Uniswap, SerumDEX, among others.

However, decentralized exchanges may not be suitable for beginners due to their complexity in usage (requiring specific knowledge of the crypto market and tools like personal wallets). Additionally, DEX platforms often have limitations on support functions such as margin trading and stop-loss compared to CEX platforms.

2. How to choose a reputable trading exchange?

To select a reputable crypto exchange, you need to know the criteria for evaluating the credibility of crypto exchanges. Below are some criteria to help you assess and choose a reliable exchange for yourself.

2.1. High liquidity on the trading exchange

This is the first important factor when you want to choose a crypto exchange to participate in trading. Simply put, liquidity refers to the ease of buying or selling an asset on the market without significantly affecting its price stability.

You should choose exchanges with high liquidity because it ensures you can buy and sell coins quickly without needing to accept lower prices or wait for trades to be matched.

If you buy a coin with low liquidity, it can be very difficult to sell because there are few buyers. Also, if the coin price increases but liquidity is low, you may struggle to realize your profits.

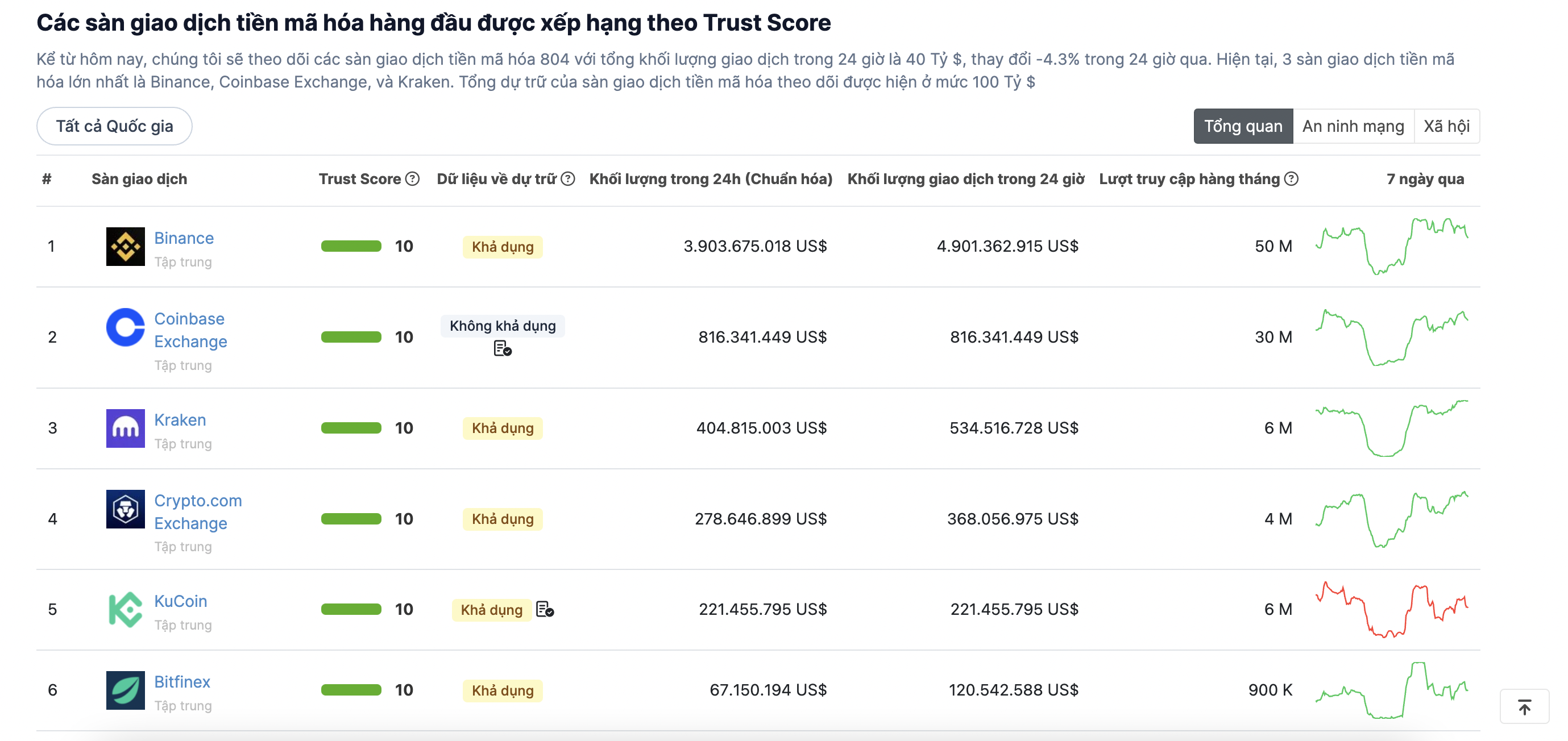

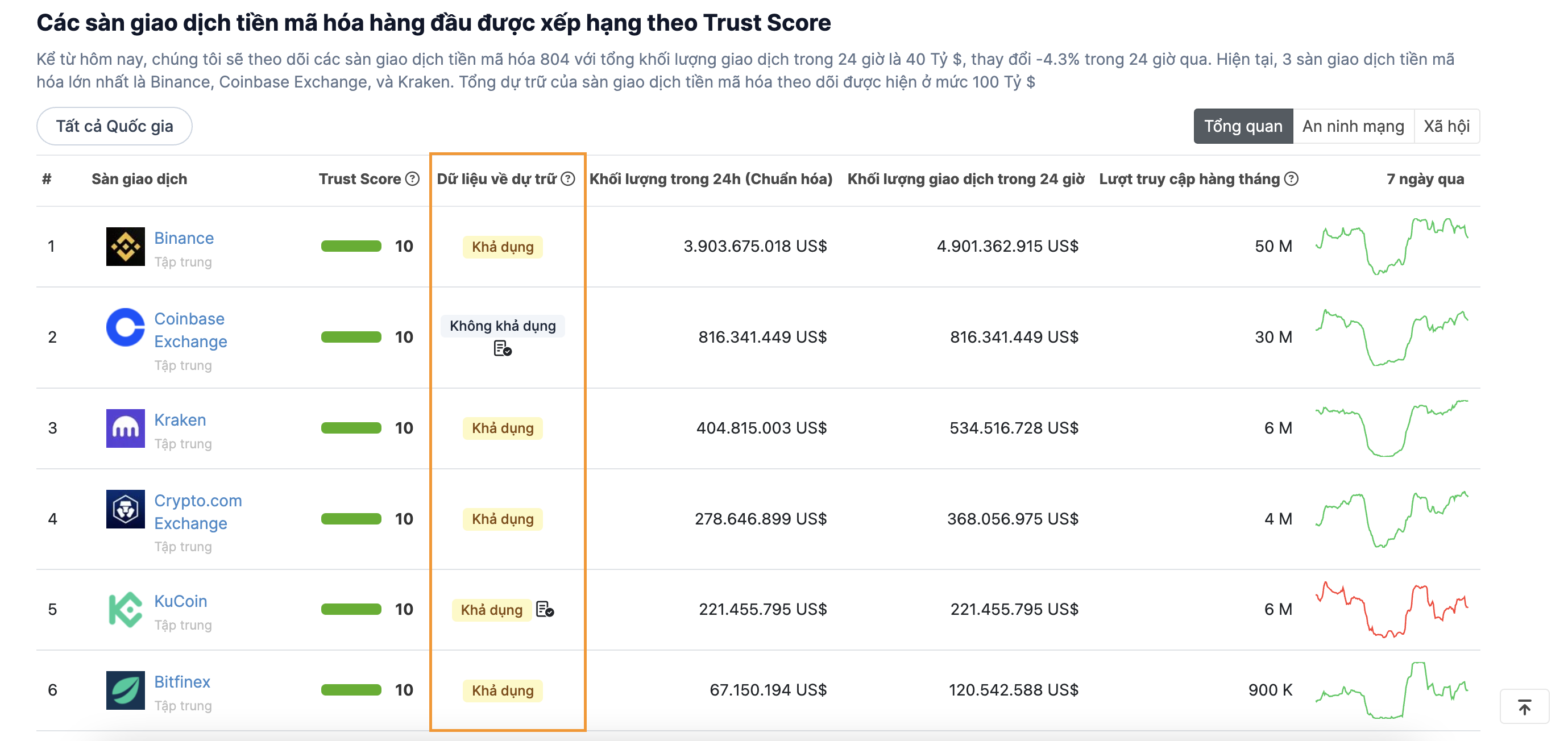

The most clear factor affecting liquidity is the trading volume on the exchange (usually over a 24-hour period). You can check the trading volume to determine liquidity on exchanges through specialized statistical websites such as Coingecko, CoinMarketCap, TradingView, and others.

⇒ High trading volume indicates that the exchange is widely followed and facilitates continuous buying and selling of cryptocurrencies.

2.2. Transparency in holding users' funds

Currently, in the crypto space, centralized exchanges often lack transparency regarding how they hold and utilize users' assets on the platform. This lack of transparency has eroded trust among users.

To address this issue, many exchanges have started disclosing the list of wallets they use to store users' assets. This list is known as Proof of Reserve (PoR), pioneered by Binance.

You can directly verify Proof of Reserve (PoR) on the exchange's platform or access reserve data statistics on websites like Coingecko.

⇒ Exchanges have published PoR can demonstrate transparency in their use of user funds on the platform. Therefore, this can be used to determine that the exchange is reputable.

2.3. Quick support ability

During the process of investment trading, many individuals encounter difficulties and often need assistance. A trading platform that offers professional, high-quality support services can make your trading activities smoother.

The ability to provide support also reflects the professionalism and credibility of a crypto exchange among traders.

⇒ You should choose exchanges that offer support teams consisting of Vietnamese representatives to receive timely advice and answers to your questions.

2.4. Transaction fees

Exchanges themselves charge fees based on each user's transaction. Whenever you place an order and it is successfully executed, you will incur a fee. Naturally, these fees vary between exchanges and can also differ depending on the scale of your transactions. Typically, larger trading volumes result in lower fees, and vice versa.

However, most exchanges generally follow a common fee structure known as the maker-taker model (maker - order creator, taker - order executor). Below is a table summarizing transaction fees on popular crypto exchanges.

CEX Spot Trading Fees

| Maker Fee | Taker Fee | |

|---|---|---|

| Bybit | 0,10% | 0,10% |

| Binance | 0,10% | 0,10% |

| Gate.io | 0,20% | 0,20% |

| KuCoin | 0,10% | 0,10% |

| OKX | 0,08% | 0,10% |

| Huobi | 0,20% | 0,20% |

| Coinbase | 0,40% | 0,60% |

| MEXC | 0,20% | 0,20% |

Futures Trading Fees on CEX

| Maker Fee | Taker Fee | |

|---|---|---|

| Bybit | 0,02% | 0,055% |

| Binance | 0,02% | 0,04% |

| Gate.io | 0,015% | 0,05% |

| KuCoin | 0,02% | 0,06% |

| OKX | 0,02% | 0,05% |

| Huobi | 0,02% | 0,05% |

| Coinbase | 0,40% | 0,60% |

| MEXC | 0,02% | 0,06% |

=> An optimal exchange for engaging in cryptocurrency trading is characterized by low fees offered to its users.

3. Review of 5 popular crypto exchanges for newbies

If there are too many criteria to evaluate and you still haven't found the right exchange for yourself, below is a detailed review of 5 popular exchanges suitable for beginners.

3.1. Binance

If you've been in the crypto market for some time, you've likely heard of "Binance."

Binance is a cryptocurrency exchange established in 2017 and rapidly became the largest exchange in the crypto market in just three years. It's trusted by many investors and is considered one of the most reputable and secure exchanges today, holding licenses from multiple governments.

I will share details about this exchange from the perspective of a cryptocurrency trader buying and selling various cryptocurrencies.

Advantages:

- Binance offers low trading fees using a Maker/Taker fee structure along with various fee types based on trading volume and Binance Coin (BNB) balance in users' wallets. Generally, Binance reduces fees for traders with higher trading volumes to encourage large transactions on its platform.

- The interface is simple and user-friendly, making it easy for beginners to access Binance's services through the app. Additionally, each feature on Binance provides detailed step-by-step instructions for first-time users upon accessing the service.

- Support for P2P trading is another key feature of Binance, allowing direct trading between users to buy and sell cryptocurrencies without transferring funds into the exchange wallet. You can use fiat currencies like VND, USD, etc., for various transaction methods such as bank transfers, Momo wallet, ZaloPay, etc.

- Security is prioritized on Binance, being the first exchange to publish Proof of Reserves (PoR). Binance also operates the Secure Asset Fund for Users (SAFU) to reimburse users in case of losses due to exchange hacks. Transaction confirmation on Binance is rigorous, requiring two-factor authentication setup and verification services for messages, Gmail, etc.

Disadvantages:

- Customer Support Service:Due to its large user base, Binance's complaint handling process can be relatively slow. To expedite this process, users are advised to access the Binance Vietnam group and present their issues to the admin team for quicker support resolution.

- Target of Attacks: Being one of the world's largest cryptocurrency exchanges, Binance frequently becomes a target for hacker attacks. This has led to multiple security incidents. For instance, there have been three notable attacks resulting in the loss of 96 BTC the first time, 7,074 BTC the second time, and 1 SYS equivalent to 96 BTC the third time. The security of assets on the exchange remains a significant concern for users.

- Frequent Legal Troubles: Binance often faces allegations from the SEC regarding issues such as "misleading investors," channeling user funds into CZ's (Binance's founder) personal funds, and inflating trading volumes. These allegations raise significant user concerns about using the platform's services.

3.2. Bybit

Bybit is a cryptocurrency derivatives exchange offering over 100 assets and futures contracts. Established in 2018 by Ben Zhou, it is headquartered in Dubai, United Arab Emirates, and registered in the British Virgin Islands (BVI).

Bybit has experienced rapid growth, managing over 5 million users globally and gaining quick trust within the cryptocurrency community. It has risen to become the second-largest crypto exchange by trading volume, following Binance.

Advantages:

- Support for numerous new tokens, catering to varied user demands.

- High liquidity with large trading volumes, exceeding nearly $2 billion USD daily.

- Regularly organizes trading competitions to incentivize traders.

- Attractive Affiliate Program for earning commission.

- No KYC identity verification required to start trading.

- Low trading fees, with a Taker Fee of 0.0750% and Maker Fee of 0.0250%.

- Mobile applications available on both iOS and Android with a user-friendly interface.

- 24/7 support including Vietnamese language support on Telegram community.

- Reliable security measures using cold wallets and fast coin withdrawal approval times.

- Diverse order types and no issues with errors or lag on mobile apps.

- Convenient OTC and P2P trading services.

- High leverage up to 100x, with flexible adjustments even after opening positions

Disadvantages:

- Bybit is relatively younger compared to other exchanges like Binance. Additionally, I haven't come across any significant drawbacks from Bybit so far. I'll keep you updated if anything changes.

3.3. OKX

OKX, formerly known as OKEx, is a leading centralized cryptocurrency exchange (CEX) offering services related to spot trading, derivatives, and staking.

Advantages:

- OKX ranks in the top 3 on CoinGecko's list, following only Binance and Bybit, showcasing its credibility and large trading volume.

- Supports fee-free P2P trading.

- Offers copy trading and bot trading features for users on the platform.

Disadvantages:

- It can be a complex platform for beginners due to various cryptocurrency trading options.

- The tiered fee structure sometimes adds complexity.

- OKX user accounts have been targeted by hackers in the past.

3.4. HTX (Huobi)

HTX is one of the leading exchanges by daily transaction volume, with billions of USD traded daily, ranking among the top 5 cryptocurrency exchanges according to CoinMarketCap.

Established in 2013, HTX initially originated in China. However, due to China's policy banning cryptocurrency transactions, Huobi relocated its headquarters to Seychelles, an island nation comprising 115 islands in the Indian Ocean.

Advantages:

-

HTX offers a quick KYC process: One of HTX's advantages is its fast user verification (KYC) process. This is particularly beneficial for newcomers to cryptocurrency trading. Users at all levels can trade without KYC for limited transactions. You can deposit $1000 without verification. However, withdrawals may be limited to 0.006 BTC within 24 hours, enhancing security.

-

High security measures: HTX stores customer funds in multi-signature cold wallets and maintains a Security Reserve Fund with 20,000 BTC established to reimburse funds in case of security incidents. This reassures users that they have the opportunity to recover any lost funds. Fortunately, HTX has never had to tap into this Security Reserve Fund, as they are one of the few exchanges that have never fallen victim to a successful hack, alongside SwissBorg and Kraken.

-

Diverse support for fiat withdrawals and P2P trading: HTX supports various fiat withdrawal options and facilitates peer-to-peer trading.

Disadvantages:

- Trading fees not the lowest: Compared to Binance, trading fees on HTX are slightly higher in some aspects. Overall, HTX's trading fees are considered average not high, but not the lowest among exchanges currently.

- Customer support service not yet satisfactory, with long response times.

- Services provided on the mobile app are fewer compared to the website.

- Direct deposit and withdrawal services in Vietnamese Dong (VNĐ) are frequently under maintenance, so transactions often need to go through the P2P market.

- Higher trading fees if you do not own HT tokens on the exchange.

3.5. Kucoin

KuCoin is a cryptocurrency exchange based in Singapore. This platform allows you to buy, sell, trade, and participate in other profit-generating activities such as lending, earn, stake, etc. It also features a trading bot function specifically designed to help you earn passive income without needing to actively monitor the market.

Advantages

- KuCoin exchange does not charge fees for depositing cryptocurrencies. However, fees apply when depositing fiat currencies through standard methods like Visa or Mastercard.

- For regular users on KuCoin, the standard trading fee is 0.1%. However, holding a certain amount of KCS tokens in the exchange wallet qualifies users for reduced trading fees.

- KuCoin provides relatively good customer support, promptly addressing issues or difficulties that users may encounter while using the platform.

Disadvantages:

-

Limited network support for deposits/withdrawals: Depositing or withdrawing tokens through KuCoin is quite limited because the exchange supports fewer networks compared to Binance.

-

Security: KuCoin has experienced a significant hack amounting to nearly $300 million, marking one of the largest cryptocurrency hacks ever recorded. The hack occurred in 2020, totaling around $275 million, but the exchange managed to recover $240 million through its efforts. This was a hot wallet hack (a type of wallet accessed through apps or websites), and a North Korean hacker group named Lazarus Group was accused of the incident.

-

Processing time for P2P deposits/withdrawals on KuCoin is generally fast if you choose reputable partners. However, depositing via Visa, Mastercard, PayPal, etc., incurs high transaction fees and longer waiting times.

-

The exchange also lists very new and obscure coins from small-scale projects. This can make investors feel uncertain about the exchange's reliability.

4. Conclusion

When considering all cryptocurrency exchanges to use, it's important to understand that each exchange has its own advantages and disadvantages. This diversity underscores the richness of today's crypto market. It's crucial to carefully weigh your options and conduct thorough research before selecting an exchange that fits your needs and investment goals. Always remember to maintain caution and ensure the security of your personal information when entering the world of cryptocurrency trading.

Read more:

English

English Tiếng Việt

Tiếng Việt